While we don’t ever suggest that investors should base their trading solely on the calendar, there is evidence that the market and many stocks do indeed follow seasonal patterns. This makes our S&P 500 Stock Seasonality report a useful addition to every investor’s toolbox. Using the last ten years worth of price data, our Stock Seasonality report looks at the average returns for the S&P 500, its eleven sectors, and its 500 individual stocks. In the report, we highlight the five stocks in each sector that have historically been the best and worst performers over the next two weeks. For each stock, we also include information such as average returns, the percent of time each stock or sector is positive/outperforms the S&P 500, and its historical performance over the next two weeks for each of the last ten years. The Stock Seasonality report is published on a weekly basis on Mondays, and it is available to all Bespoke Premium and Bespoke Institutional subscribers.

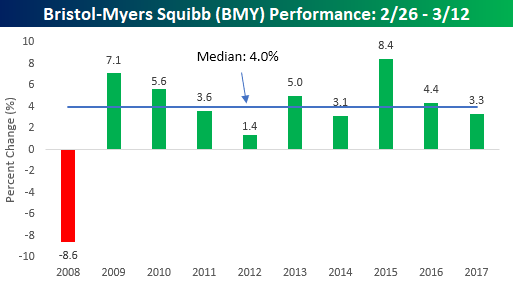

This week’s stock that we have chosen to highlight is Bristol-Myers Squibb (BMY). BMY typically doesn’t trade in as wide a range as other stocks in the market, but in the upcoming two-week period it has been remarkably consistent. BMY hasn’t traded down during the upcoming two-week period since 2008. Overall, the stock’s median gain during this period is a gain of 4.0%.

For active traders, our Stock Seasonality report is an excellent tool to help keep track of the best and worst times of year for the overall market, sectors and individual stocks. To see the report, sign up for a monthly Bespoke Premium membership now!