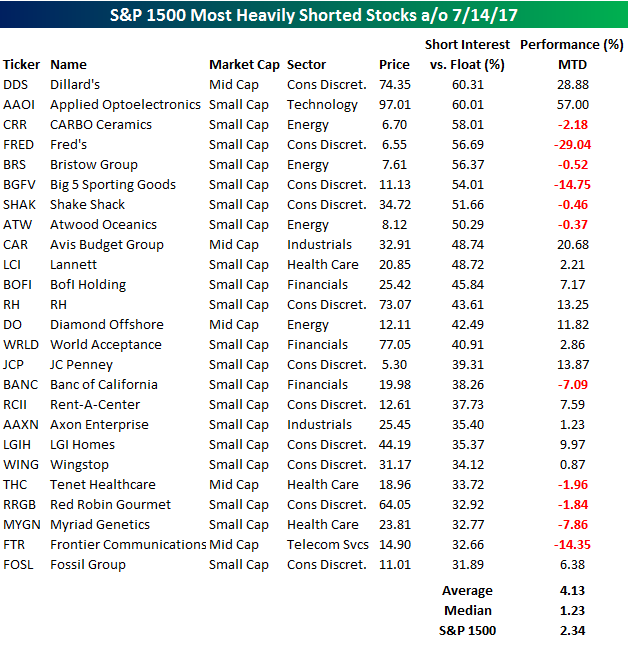

Short interest figures for the middle of July were released after the close on Tuesday, so we have just updated our regular report on short interest trends for the market, sectors, and individual stocks for clients. Below we wanted to quickly highlight the stocks with the highest levels of short interest as a percentage of float. The list below shows the 25 stocks in the S&P 1500 that have the highest short interest as a percentage of float (SIPF). Through early Wednesday, the 25 stocks listed below were up an average of 4.13% (median: 1.23%) compared to a gain of 2.34% for the S&P 1500.

One thing that stands out on the list is that the two stocks in the S&P 1500 with the highest short interest as a percent of float have also been the two best-performing stocks on the list. As shown, Dillard’s (DDS) has 60.3% of its float sold short and has seen its stock rally 28.9% since the start of July. Likewise, shares of Applied Optoelectronics (AAOI) also have more than 60% of their float sold short and its shares have rallied 57% this month! To the downside, the two worst performing stocks on the list are retailers Fred’s (FRED) and Big 5 Sporting Goods (BGFV) which have declined 29% and 15%, respectively. One characteristic of the list that should surprise nobody is that a large percentage of the stocks listed are involved in the retail space. With Amazon.com (AMZN) continuing to steal share from traditional brick and mortar retailers, these stocks are among the most hated stocks in the world and their short interest figures reflect that

For a more detailed look at short interest data on a regular basis, sign up for a monthly Bespoke Premium membership now!