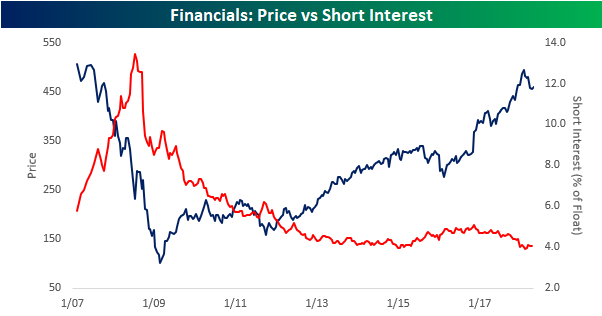

Short interest figures for the middle of April were released after the close on Tuesday, so we have just updated our regular report on short interest trends for the market, sectors, and individual stocks for clients. Below we wanted to quickly highlight two charts that caught our eye. With the S&P 500 trading at or close to correction levels, it shouldn’t come as a surprise that we have seen short interest levels pick up a bit, but two sectors where investors appear to have little concern is in the Financials and Materials sectors. The charts below are pulled from our regular update on trends in short interest, and they compare the average short interest level (as a percentage of float) of stocks in the sector to its price going back to 2007.

For both sectors, not only are average short interest levels right near their lowest levels of the last year, but they are also right near their lowest levels in over a decade. For these sectors, at least, investors don’t seem all that concerned. While there are valid reasons to be positive on the prospects for either sector, one would think investors would be showing a little bit more concern.

For a more detailed look at short interest data on a regular basis, sign up for a monthly Bespoke Premium membership now!