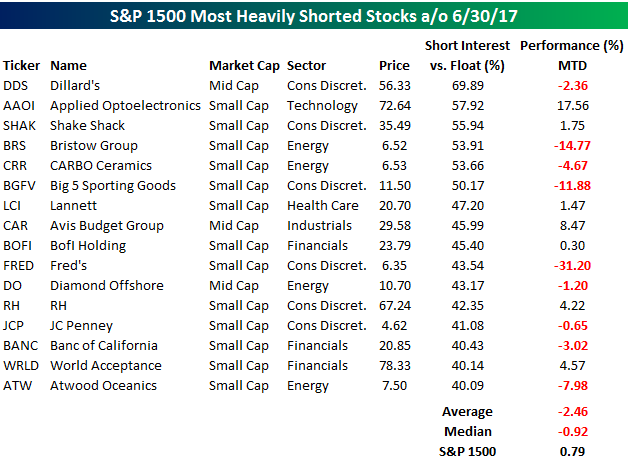

Short interest figures for the end of June were released after the close on Wednesday, so we have just updated our regular report on short interest trends for the market, sectors, and individual stocks for clients. Below we wanted to quickly highlight the stocks with the highest levels of short interest as a percentage of float. Through the end of June, there were 16 stocks in the S&P 1500 that had more than 40% of their free-floating shares sold short. Through Wednesday’s close, the stocks on this list were down an average of 2.46% (median: -0.92%) month to date compared to a gain of 0.79% for the S&P 1500 as a whole. So, in the first half of the month at least, the most heavily shorted stocks are underperforming by a wide margin.

One stock that isn’t lagging the market, though, is Applied Optoelectronics (AAOI). Through Wednesday, the stock was up over 17% in July, and that doesn’t even include Thursday’s 6% gain after the company raised guidance below the open. The only other stock listed that is up more than 5% this July is Avis Budget (CAR). On the downside, shares of retailer Fred’s (FRED) are down over 30% in July, helicopter transportation provider Bristow Group (BRS) is down 14%, while Big 5 Sporting Goods (BGFV) is down 12%.

For a more detailed look at short interest data on a regular basis, sign up for a monthly Bespoke Premium membership now!