We’ve just released our weekly Sector Snapshot report (see a sample here) for Bespoke Premium and Bespoke Institutional members. Please log-in here to view the report if you’re already a member. If you’re not yet a subscriber and would like to see the report, please start a 14-day trial to Bespoke Premium now.

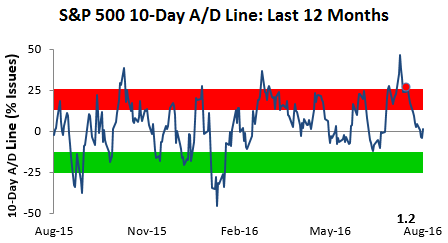

Below is one of the many charts included in this week’s Sector Snapshot, which shows the 10-day advance/decline line for the S&P 500. This reading measures the average number of daily advancers minus decliners over a rolling 10-trading day period, and it’s an important breadth indicator to follow. When this reading hits extremes in either direction, it’s usually a sign that a turning point is near. As shown, at the moment, the S&P’s 10-day advance/decline line is as neutral as it gets. This means the market has plenty of room to run in either direction before getting too extended (to either the upside or downside) again.

To see our full Sector Snapshot with additional commentary plus six pages of charts that include analysis of valuations, breadth, technicals, and relative strength, start a 14-day free trial to our Bespoke Premium package now. Here’s a breakdown of the products you’ll receive.