We’ve just released our weekly Sector Snapshot report (see a sample here) for Bespoke Premium and Bespoke Institutional members. Please log-in here to view the report if you’re already a member. If you’re not yet a subscriber and would like to see the report, please start a 14-day trial to Bespoke Premium now.

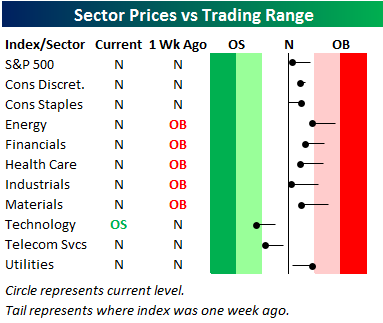

Below is our trading range screen for the ten S&P 500 sectors, which is always included in the weekly Sector Snapshot. The screen allows you to quickly see which sectors have upside or downside momentum, and which sectors may be too extended to the upside or downside. For each sector, the dot shows where it is currently trading within its range, while the tail end shows where it was trading one week ago. The black vertical “N” line represents each sector’s 50-day moving average, and moves into the red or green zone are considered overbought or oversold. The darker the shading, the more extreme the reading.

As shown, last week at this time there were five sectors in overbought territory and zero sectors in oversold territory. As of the close today, there are no longer any sectors in overbought territory and one sector — Technology — is oversold. We’ve clearly seen a slow drift lower for equities over the last couple weeks. As of now the trend can still be categorized as “mean reversion,” but if the S&P can’t hold its 50-day in the coming days, it will be a different story.

To see our full Sector Snapshot with additional commentary plus six pages of charts that include analysis of valuations, breadth, technicals, and relative strength, start a 14-day free trial to our Bespoke Premium package now. Here’s a breakdown of the products you’ll receive.