We’ve just released our weekly Sector Snapshot report (see a sample here) for Bespoke Premium and Bespoke Institutional members. Please log-in here to view the report if you’re already a member. If you’re not yet a subscriber and would like to see the report, please start a 14-day trial to Bespoke Premium now.

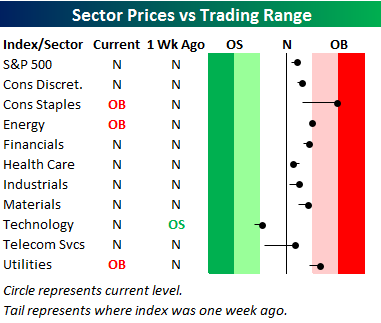

Below is our trading range screen for the ten S&P 500 sectors, which is always included in the weekly Sector Snapshot. The screen allows you to quickly see which sectors have upside or downside momentum, and which sectors may be too extended to the upside or downside. For each sector, the dot shows where it is currently trading within its range, while the tail end shows where it was trading one week ago. The black vertical “N” line represents each sector’s 50-day moving average, and moves into the red or green zone are considered overbought or oversold. The darker the shading, the more extreme the reading.

As shown, last week at this time, nine sectors were in neutral territory along with the S&P 500 as a whole, while one sector — Technology — was oversold. Most sectors have experienced very little movement within their ranges over the last week, but Telecom and Consumer Staples are two big standouts to the upside. Consumer Staples moved from neutral to overbought, while Telecom moved from just above oversold territory to above its 50-day moving average. Health Care is the only sector that has moved lower within its range.

To see our full Sector Snapshot with additional commentary plus six pages of charts that include analysis of valuations, breadth, technicals, and relative strength, start a 14-day free trial to our Bespoke Premium package now. Here’s a breakdown of the products you’ll receive.