Bespoke CNBC Appearance (6/20/17)

Bespoke co-founder Paul Hickey appeared on CNBC’s Power Lunch on Monday (6/20) to talk about Bespoke’s Death By Amazon Index. To view the segment, please click on the image below.

Bespoke co-founder Paul Hickey appeared on CNBC’s Power Lunch on Monday (6/20) to talk about Bespoke’s Death By Amazon Index. To view the segment, please click on the image below.

Death By Amazon is a term we coined years ago to describe how Amazon was single-handedly destroying the margins, businesses, and ultimately prospects of traditional retailers as consumers transitioned from bricks to clicks. Like any pandemic, it started out small and with little fanfare in just books, but then Amazon made the jump to electronics, general merchandise, clothing, and just about every other sector in retailing. For many products that seemed un-Amazonable five years ago, Amazon is now the first place people turn. Even in the entertainment space, Amazon is barreling in. The slide below from a presentation Scott Galloway made in April shows that Amazon is forecasted to spend more on content this year than NBC, ABC, or HBO!

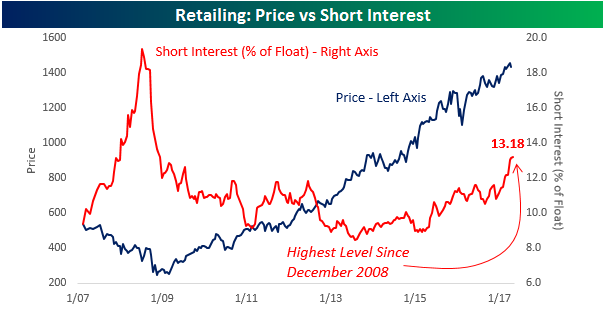

As Amazon infects all things retail, investors are piling in on the short side betting against traditional retailers. In this week’s latest update to short interest data, the average level of short interest in retail stocks (as a percentage of float) reached the highest level it has been since the depths of the last recession. All this is based in large part on fears that Amazon will continue to move into the space of traditional retailers and further marginalize them.

Things got a lot more real this morning when Amazon announced that it was acquiring Whole Foods for just under $14 billion, and a collective “Oh Sh%$!” was uttered in the headquarters of every other retailer across the country. The reaction in their stocks was immediate. For starters, Amazon saw its market cap increase by 3%, which translates almost exactly to what it is paying for Whole Foods. Outside of these two companies, though, they are dropping like flies. Of the 54 companies that make up our Death By Amazon (DBA) Index, the average decline as of Friday morning was nearly 3%, and the destruction in market cap has been significant. Check out the table below. Seven companies that make up our DBA index have lost at least half a billion dollars in market cap today alone. Leading the way lower, Wal-Mart has lost more than $12 billion, or $2 billion more than the entire market cap of Whole Foods before the deal was announced! In total, the seven companies shown have shed nearly $30 billion in market cap. Earlier this month, some started to think it was safe to get back in the water of retail after stories surfaced that the Nordstrom family was looking to take its namesake company private, but Uncle Jeff quickly put the kibosh on that idea today.

Start a two-week free trial to Bespoke’s research platform to read more.

The S&P 500 is up nearly 7% year-to-date, but the average stock in the index is up just 5.70%. This means the largest stocks in the cap-weighted index are outperforming the smallest names. Even still, two-thirds of the stocks in the S&P are up year-to-date, while 35% of stocks are up more than 10%. Seventy stocks are up more than 20%, while just 25 are up more than 30%.

Below is a list of the 30 best performing S&P 500 stocks year-to-date. As shown, Vertex Pharma (VRTX) is up the most with a gain of 55%, followed by Activision Blizzard (ATVI), Arconic (ARNC), CSX and Lam Research (LRCX). Wynn Resorts (WYNN) — a Bespoke Model Portfolio name — ranks 7th best with a gain of 40.8%, while Adobe (ADBE) — another Bespoke Model Portfolio name — ranks 18th with a gain of 31.7%. Apple (AAPL) ranks just behind ADBE at 31.68%. As the largest stock in the world with a market cap of just under $800 billion, Apple’s gain this year has been a huge contributor to the cap-weighted S&P 500. Another mega-cap Tech name that’s up more than 30% YTD is Facebook (FB). Coach (COH) may be the most surprising name on the list in the 29th spot given the pain that Retail stocks have gone through. But remember, since Coach is a retailer that has its own brand, it’s not part of our Death By Amazon (DBA) index of retailers that rely mostly on third party brands. That’s where the real pain is.

If you’re not yet a Bespoke Premium member, start a 14-day free trial to gain access to our Death By Amazon index as well as our model stock portfolios.

You can find a number of Death By Amazon index members on the list of worst performing S&P 500 stocks year-to-date, however. Remember, to be part of Bespoke’s DBA index, you have to be a retailer that relies mostly on third party brands. See if you can spot a few of them on the list of 2017’s biggest S&P 500 losers:

The major exchanges released short interest figures for the end of April after the close on Tuesday, and while overall levels of short interest didn’t see much in the way of major changes, the number of heavily shorted stocks continues to expand as 61 stocks in the S&P 1500 now have more than a quarter of their float sold short. In the interest of space, the table below lists the 20 stocks in the S&P 1500 with the highest levels of short interest as a percentage of float. As shown in the table, these stocks have been performing admirably so far in May with an average gain of 5.32% and a median gain of 4.03%. The big winner on the list has been World Acceptance (WRLD) which has rallied over 57%, helped in large part by a positive earnings report on Tuesday.

Another trend in the semi-monthly short interest figures over the last few months has been the strong presence of retail-related stocks. As shown in the chart, short interest as a percentage of float for the group is currently over 13% and at its highest level since the Financial Crisis. Obviously, with Death By Amazon, sentiment towards the retail sector is tilted to the negative side, and while our longer term view towards brick and mortar retail is negative, nothing moves in a straight line. There will be times when sentiment gets too extreme and the sector will rally.

Another trend in the semi-monthly short interest figures over the last few months has been the strong presence of retail-related stocks. As shown in the chart, short interest as a percentage of float for the group is currently over 13% and at its highest level since the Financial Crisis. Obviously, with Death By Amazon, sentiment towards the retail sector is tilted to the negative side, and while our longer term view towards brick and mortar retail is negative, nothing moves in a straight line. There will be times when sentiment gets too extreme and the sector will rally.

One example of this shows up in the most recent short interest data. As shown, seven of the twenty stocks highlighted are retailers, ranging from RH with over 45% of its float sold short to JC Penney (JCP) which has close to 38% of its float sold short. In terms of performance, though, six of the seven stocks highlighted are up so far in May with an average gain of 7%. With some of these companies starting to report results that weren’t quite as bad as the market expected, the group is catching a break.

For full access to our market analysis that is second to none, start a 14-day free trial to our Bespoke Institutional research platform.