Nov 28, 2017

If there’s one area of the market that investors couldn’t be more bearish on, it’s the multi-line retailers. With Amazon eating their lunch, consumers changing the way they spend money (choosing experiences over stuff), and an overall bloated retail footprint, multi-line retailers have faced a perfect storm and their stocks have reacted accordingly. With all the negative headwinds, short-sellers have been piling on the group. At the end of 2016, average short interest as a percentage of float for the group was an already high 14.3%, but through the course of the year, short interest levels ballooned to more than 25%. Shorting retail stocks has become one of the consensus trades of 2017. The trade has become so consensus, in fact, that ProShares imitated (to put it kindly) our Death by Amazon Index and created an ETF that increases in price when the stocks of traditional brick and mortar retailers decline.

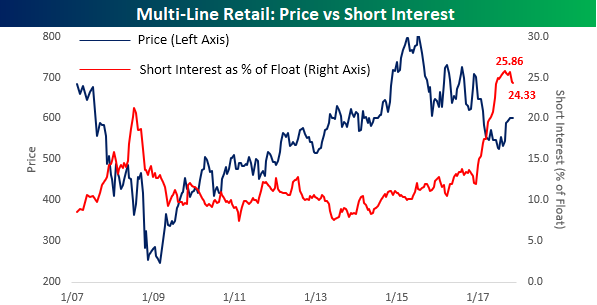

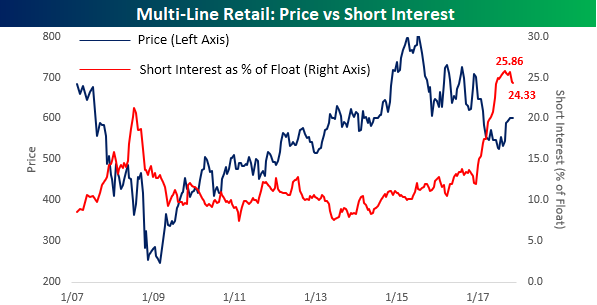

In recent weeks, however, we have begun to see some easing in the pressure by short sellers towards traditional brick and mortar retailers. The chart below compares the S&P 500 Multi-Line Retail Index to the average short interest (as a percentage of float) of multi-line retailers in the S&P 1500. While the average SIPF level of stocks in the group peaked at 25.86% at the end of August, in four of the last five short interest reports, the average has declined. Granted, it’s not much of a drop and it has coincided with a rally in the stocks, but it’s the first time we have seen such consistent declines in short interest for the group all year.

Nov 21, 2017

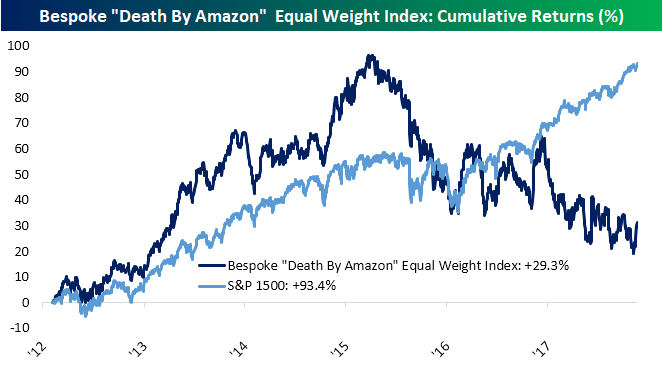

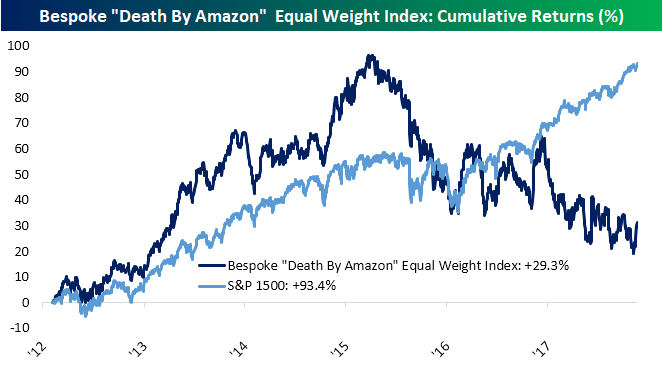

Awful. Simply put, the word awful sums up the year for investors with ties to stocks in the retail sector not named Amazon.com (AMZN), Home Depot (HD), or a handful of other companies. It hasn’t been just 2017 either. As shown in our Death By Amazon Index (DBA) below, the retail sector has been in a tailspin for over two and a half years now. Since 2012, the index has rallied 29.3%, which is less than a third of the S&P 500’s 93.4% gain. More recently, though, things have been even worse. Since its peak in Spring 2015, the DBA index has lost more than a third of its value, and in just 2017 alone, it is down 15% in a year where the S&P 500 is up 15%! Not good.

In the last two weeks, though, retail stocks have been attempting to bounce ahead of the holiday season. Investors seem to be in the “bargain hunting” mood. Can it last? In our latest B.I.G. Tips report, we look at the recent rally in retail to put the gains in perspective too see if the recent gains are likely to last or fall by the wayside. For anyone interested in the retail sector, this report is a must-read. To see the report, sign up for a monthly Bespoke Premium membership now!

Sep 14, 2017

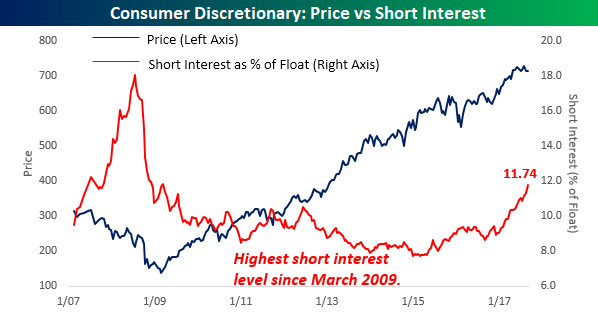

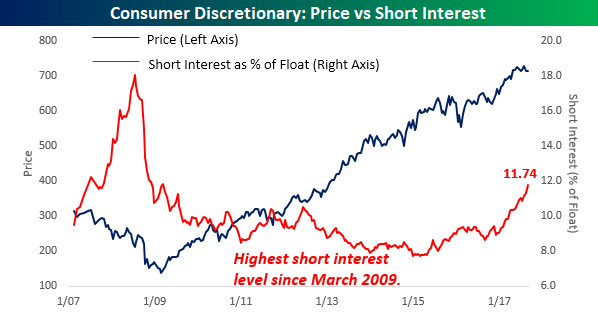

Short interest figures for the end of August were released on Tuesday, and as far as the overall trends were concerned, let’s just say that investors were quite nervous heading into what has historically been the stock market’s worst performing month. To see our complete analysis of the recent results, sign up for Bespoke Premium or Bespoke Institutional now. One sector where investors are particularly negative these days is in the Consumer Discretionary sector. Through the end of August, the average stock in the S&P 500 had 11.7% of its float sold short. That’s the highest average short interest reading since March 2009! Think about that for a minute — investors haven’t been this negative towards the Consumer Discretionary sector since the very beginning of the bull market!

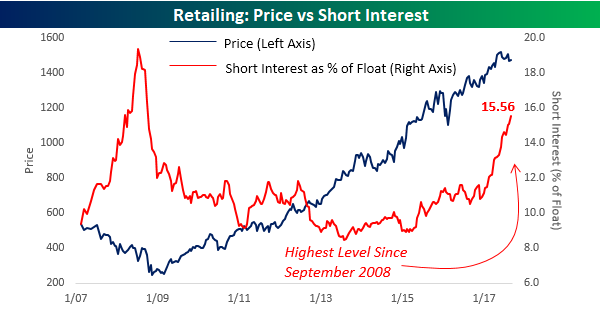

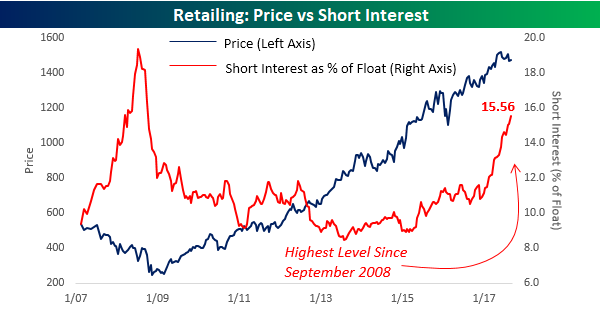

The main culprit behind the high levels of short interest has been in the Retailing group, where average short interest levels currently stand at 15.6%. That’s the highest level for this Industry Group since September 2008 when Lehman went bankrupt!

Gain access to 1 month of any of Bespoke’s membership levels for $1!

The reason for the negative sentiment towards retail stocks is obviously the “Death by Amazon” trade as well as the shift in consumer preferences towards experiences over products. Nowhere is this more evident than in the short interest levels of Multi-Line retailers. Here, short interest levels have gone ‘hockey stick,’ surging from an already high level of 12% at the end of last year to an absurdly high level of 25.2% as of the end of September. That kind of surge in such a short period of time is the type of move we saw in banks and brokerage stocks during the height of the financial crisis.