Oct 29, 2018

“Rumors of my death have been greatly exaggerated.” — Mark Twain

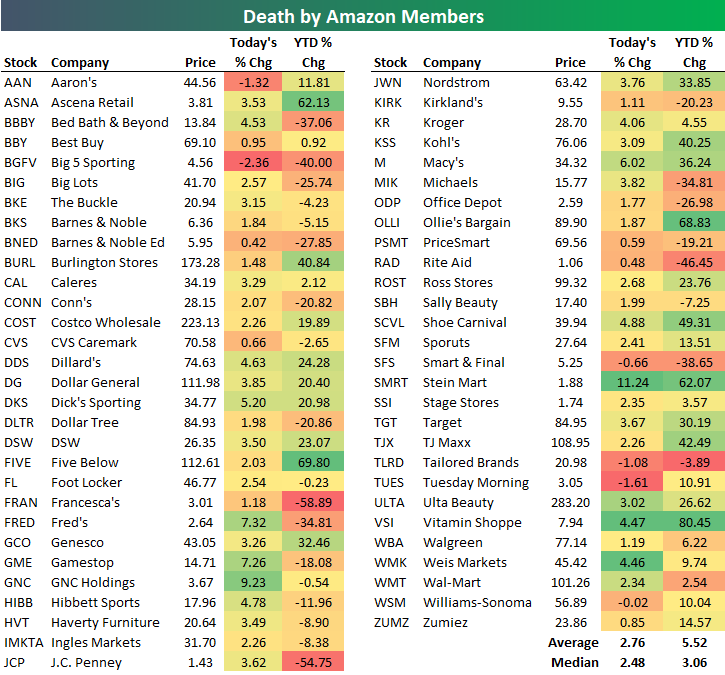

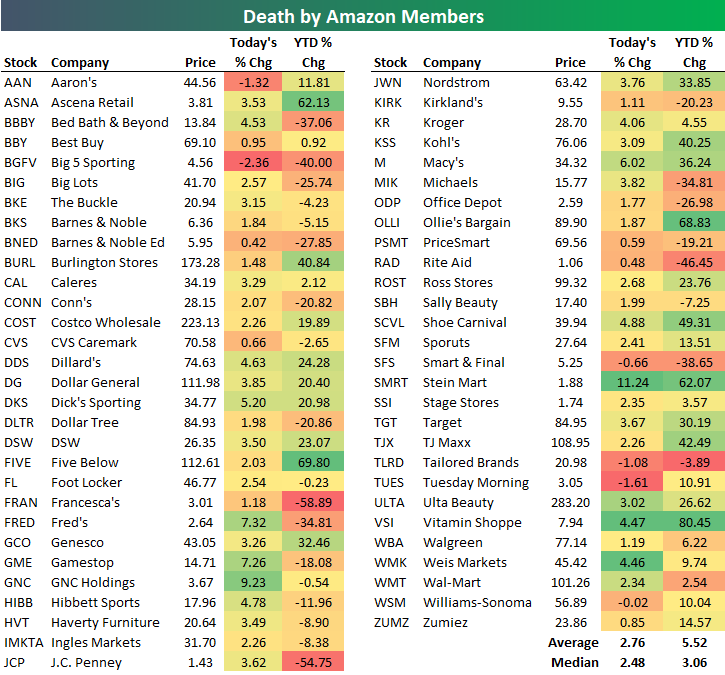

Traditional brick and mortar retailers are soaring today with the average stock in our Death by Amazon index up 2.76% on the day. As shown below, around half of these retailers are up 3-5% on the day with just a handful in the red.

As brick-and-mortar retailers see buying, Amazon.com (AMZN) has seen another wave of selling today with a drop of more than 4.5% as of mid-afternoon. This is on the heels of AMZN’s 7.82% drop on Friday after the company missed revenue estimates and lowered guidance for the second quarter in a row.

The chart for AMZN is really breaking down. After trading in a tight uptrend channel from October 2017 through August 2018, the stock is currently in free-fall in what appears to be a straight path towards $1,500/share. What’s remarkable is that even after the stock’s 23.6% decline from its highs, it’s still up 34% year-to-date!

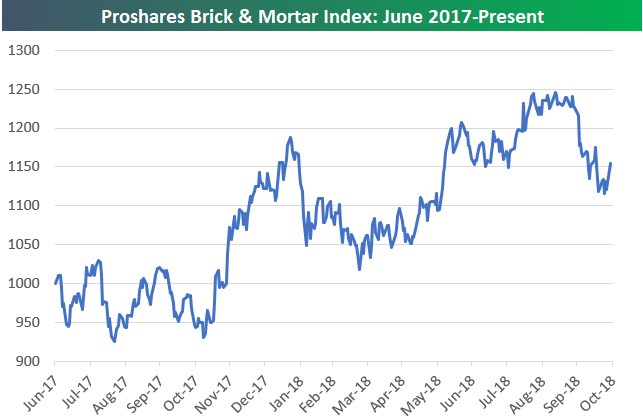

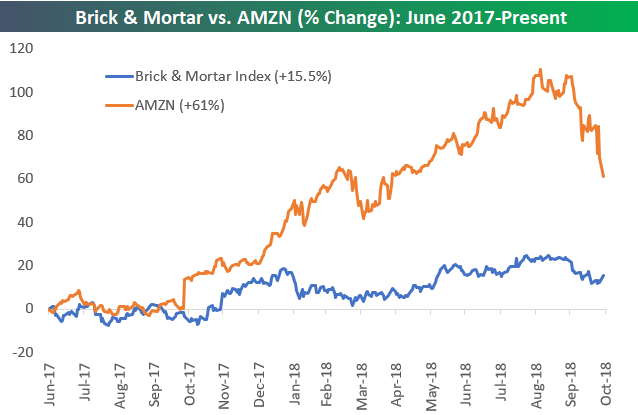

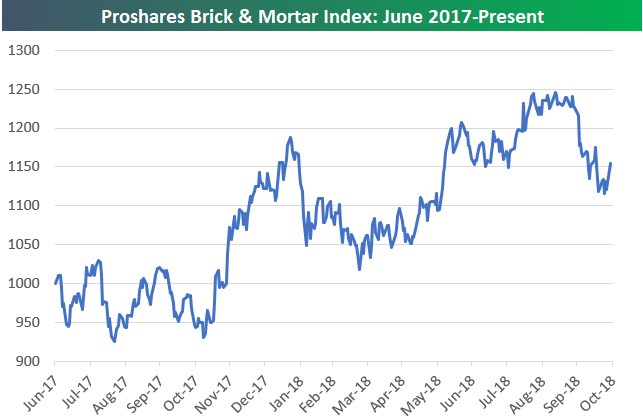

The chart for the Proshares Brick & Mortar index (which was created years after we formed the Death by Amazon index) has fallen a bit from its highs, but it still looks much more constructive than AMZN’s chart at this point, especially with today’s big bounce.

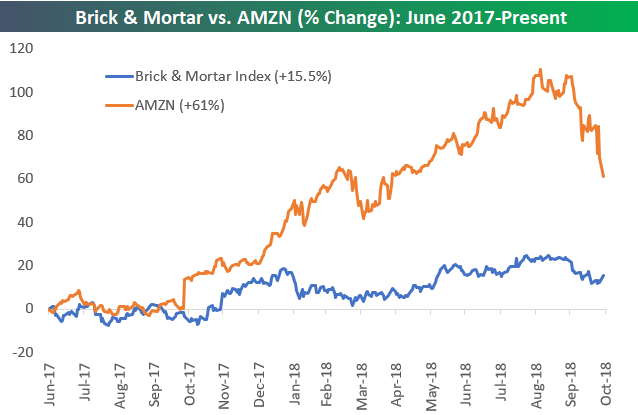

Since the Proshares Brick & Mortar index began back in June 2017, AMZN still holds a commanding lead on it. AMZN is up 61% versus a gain of 15.5% for Brick & Mortar. However, the fact that Brick & Mortar is in the green at all over the last 16 months is the real story. From mid-2015 through mid-2017, traditional retailers most at risk of online were slammed, but they’ve actually been performing quite well recently.

Jul 16, 2018

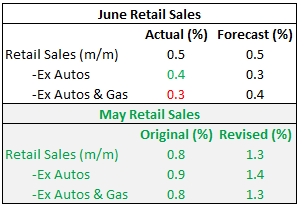

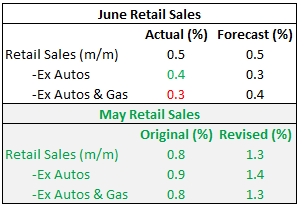

When it comes to the June Retail Sales report, it has historically been pretty weak relative to expectations. Since the expansion began in 2009, there have only been three better than expected June reports out of nine. Even worse, heading into today’s report, five out of the last six June Retail Sales reports were weaker than expected. Based on that record, the fact that today’s report for June was inline with expectations at the headline level is almost considered a win! Ex Autos, the report was even stronger than expected, while Ex Autos & Gas, it was weaker. So there was a little of everything. What was really impressive about the June report was the half percentage point upside revisions to May (see table to right). The last time the report had a larger upside revision to the initial report was almost a year ago last August.

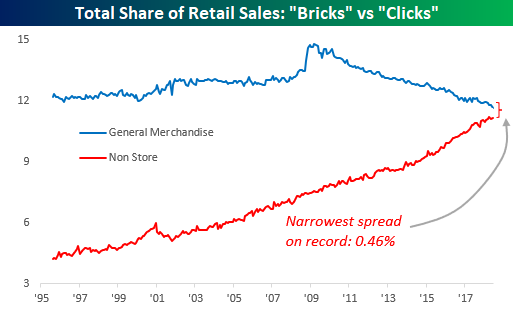

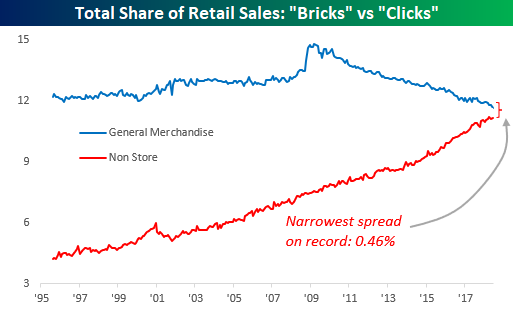

Another interesting trend involving this month’s report was the ongoing shift from “Bricks to Clicks” and “Death By Amazon” which we have been highlighting for years now. Following June’s report, we are increasingly reaching the point where Online’s share of total sales will overtake the General Merchandise category, as the spread of less than 0.5% between the two sector’s shares was the narrowest on record. That’s quite a difference from 20 years ago when General Merchandise was at 12% and Online was under 5%.

In a just-published report for Premium and Institutional clients, we provided a complete analysis of this month’s Retail Sales reports and how recent shifts have impacted overall trends. To unlock this report, sign up for a Bespoke Premium trial membership now!

Dec 10, 2017

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

Economic Research

A prince not a pauper: the truth behind the UK’s current account deficit by Stephen Burgess and Rachana Stanbhogue (BoE Bank Underground)

An argument that rather than incurring new liabilities, the UK’s current account deficit is a spending-down of accumulated national wealth. [Link]

Putting a Value on the Ecosystem Services Provided by Forests in the Eastern United States: Case Studies on Natural Capital and Conservation by Dan Kraus and Brian DePratto (The Nature Conservancy)

An attempt to demonstrate the economic value of forests across the East Coast of the United States, with a range of values per acre and methodology for how biological resources were assigned financial worth. [Link; 29 pages]

Tax Reform and the Trade Balance by Brad W. Setser (Council on Foreign Relations)

A rundown on likely macroeconomic account impacts from tax reform, focusing on the shifts in foreign taxation that will drive a re-alignment of the current account including the trade balance. [Link]

Retail

Long Online/Short Stores ETF (ProShares)

Just in time for a huge rally in traditional retail stores over the last few weeks, ProShares has created a custom index of traditional retailers to short and online retailers to be long, similar to Bespoke’s Death By Amazon index (link to more information). [Link]

Judge bars Starbucks from closing 77 failing Teavana stores by Lisa Fickenscher (NYP)

Starbucks has been ordered to keep stores open under the theory that closing them is a bigger burden on their landlord (Simon Property Group) than it is on Starbucks to keep the stores open. [Link]

Consumer

Want a Vintage Metallica T-Shirt? That’ll be $1,000 by Jacob Gallagher (WSJ)

Vintage t-shirts from across the musical spectrum are flying off the shelves of stores that specialize in digging up old tour merch for a new generation. [Link; paywall]

Design (Motiv)

A new fitness tracker that’s fully waterproof, lasts days without a charge, and is worn around…your finger. [Link]

Injustice

Nothing Protects Black Women From Dying in Pregnancy and Childbirth by Nina Martin and Renee Montagne (ProPublica)

A heartbreaking story about the post-partum death of a CDC researcher which serves as an example of the horrific inequality in mothers’ mortality in the United States. [Link]

Millions Are Hounded for Debt They Don’t Owe. One Victim Fought Back, With a Vengeance by Zeke Faux (Bloomberg)

Debt collectors are hounding consumers for payments on debts they never incurred, but one man they chose to threaten over an invented balance decided to fight back. [Link]

History

Napoleon was the Best General Ever, and the Math Proves it. by Ethan Arsht (Towards Data Science)

Using methods that will be familiar to any hard-core baseball fan, Arsht ranks generals and attempts to determine how well they performed relative to the typical general. [Link]

The Conflict in Jerusalem Is Distinctly Modern. Here’s the History. by Mona Boshnaq, Sewell Chan, Irit Pazner Garshowitz, and Gaia Tripoli (NYT)

Background on the history of Jerusalem, helpful in the context of President Trump’s decision to move the US embassy to that city this week. [Link; soft paywall]

Finance

Private equity investors are paying through the nose for midsize companies by Matthew C. Klein (FTAV)

An update on the P/E market, which looks a little bit excessive these days given huge war chests and extreme valuations. [Link; registration required]

Bloomberg’s rising terminal count signals hope for the beleaguered bond trader by John Detrixhe (Quartz)

After recording only its second subscriber count decline in history last year, Bloomberg’s terminal business saw its customer count rise in 2017. [Link]

Cuisine

I Made My Shed the Top Rated Restaurant On TripAdvisor by Oobah Butler (Vice)

In a frankly hilarious stunt, a journalist listed their shed as a restaurant then gamed TripAdvisor to make it the highest ranked restaurant in all of London. [Link]

Crypto

This Mining Company Soared 159% After Saying It’s Buying a Crypto Firm by Camila Russo (Bloomberg)

All a company needs to do these days is change a part of its name to something bitcoin-related. [Link; auto-playing video]

There’s an $814 Million Mystery Near the Heart of the Biggest Bitcoin Exchange by Matthew Leising (Bloomberg)

In any investing fad there is inevitably fraud, and it looks like the combination of tether and the crypto exchange Bitfinex are gunning for the poll position in the blockchain’s tally. [Link; auto-playing video]

SEC Targets Initial Coin Offering ‘Scam’ by Paul Vigna (WSJ)

The first enforcement action against an initial coin offering has been dropped by the SEC, and it could be important in setting precedent for how ICOs are handled by US regulators. [Link; paywall]

Bitcoin miner: ‘I haven’t paid for heat in three years’ by Krystal Hu (Yahoo Finance)

A North Carolina man who mines bitcoins hasn’t needed to turn on his heat thanks to the huge volume of heat thrown off by CPUs on rigs he uses to mine. [Link; auto-playing video]

A Bitcoin Frenzy Like No Other Is Gripping South Korea by Kyungji Cho, Yuji Nakamura , and Narae Kim (Bloomberg)

Roughly 21% of trading in bitcoin globally takes place in Korean won, and thousands of speculators in the relatively small country have piled in to the surge. [Link; auto-playing video]

Meet CryptoKitties, the $100,000 digital beanie babies epitomizing the cryptocurrency mania by Evelyn Cheng (CNBC)

An explainer on the strangest fad you’ll read about this weekend. [Link; auto-playing video]

Have a great Sunday!

Nov 29, 2017

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we look at the massive rotation that has hit US equity markets this week. One area of the market that has seen huge buying interest recently is retail. Below is a list of our Death By Amazon index members. For each stock, we show its year-to-date percentage change along with its percentage change this week. On average, Death By Amazon stocks are down 15% year-to-date, but they’re up 8.2% this week. That’s a massive move. Of the 62 stocks in the index, 19 are up more than 10% on the week.

We discuss this week’s rotation in more detail in tonight’s Closer.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!