Jan 27, 2017

Shares of Sears Holdings (SHLD) have been in free-fall the last three days, falling a staggering 23% during that span. This week’s decline is only a continuation of a longer-term decline where the stock has lost over half of its value in the last six months. The reason behind the most recent leg lower in the stock stems from a ratings downgrade from Fitch where there the agency said that, “although Sears has been able to fund its continued cash shortfalls through planned asset monetization, and additional financings, a meaningful business turnaround in fiscal 2017 is critical given the continued reduction of its asset base.” In other words, unless business picks up for Sears, it is going to run out of assets to fund its liabilities.

Shares of Sears Holdings (SHLD) have been in free-fall the last three days, falling a staggering 23% during that span. This week’s decline is only a continuation of a longer-term decline where the stock has lost over half of its value in the last six months. The reason behind the most recent leg lower in the stock stems from a ratings downgrade from Fitch where there the agency said that, “although Sears has been able to fund its continued cash shortfalls through planned asset monetization, and additional financings, a meaningful business turnaround in fiscal 2017 is critical given the continued reduction of its asset base.” In other words, unless business picks up for Sears, it is going to run out of assets to fund its liabilities.

The history of Sears is really a fascinating case study of how technology has upended the retail landscape. Whereas over a century ago, Sears completely altered the retail landscape with its famous catalog, today companies like Sears are being upended by technology and online sales. Back in the late 1800s, when the country was much more agrarian in nature, farmers had just one option to purchase their goods and supplies – the local general store. With zero competition, the owner of the store was a price maker and could, within reason, charge whatever he wanted for whatever he decided to sell. The customer basically had no choice as to selection or price. When the Sears catalog was first introduced, it completely upended the retail landscape by introducing uniform prices and a wider selection of merchandise (sound familiar).

With the success of the catalog business, Sears began to diversify its product offerings as well as its distribution by opening retail stores in cities and towns around the country. The company saw massive growth and success over a period that spanned decades, and in the early 1970s finished building the Sears Tower, which was at the time of its completion the world’s largest skyscraper. Sears was literally on top of the world! Nothing lasts forever, though, and looking back, the 1970s were probably the peak for Sears. Sales from the catalog started to decline as the concept became stale, and in the 1990s the company stopped publishing it. Then ten years later Sears was purchased by Kmart, another once famous retailer that was losing its relevance. While the combined company saw some success in its stock price after the merger, most of the period as a combined company has been negative for shareholders.

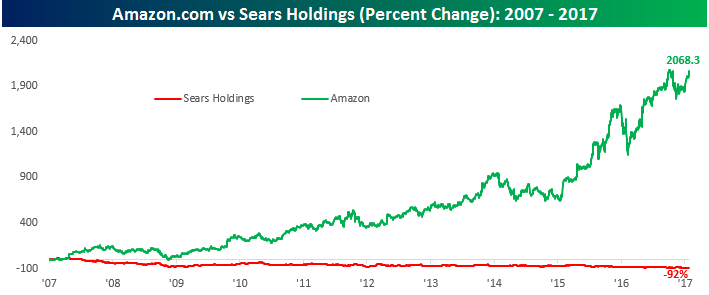

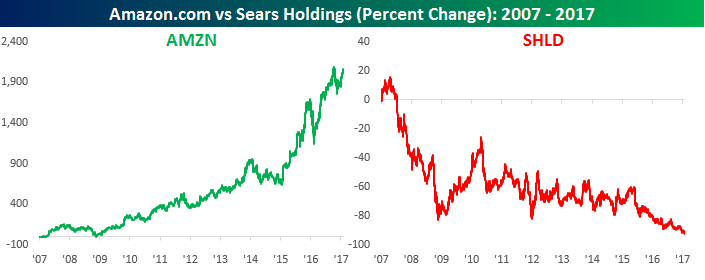

The experience of Sears really provides a perfect example of the ‘bricks to clicks’ trend we first highlighted several years ago in our Death By Amazon index. Like Sears over a century ago, starting with books, Amazon came into the traditional retail environment and completely transformed it. Numbers don’t lie, and the stock performance of Sears and Amazon.com over the last decade illustrates how traditional retail’s pain (in this case Sears) has been Amazon’s gain. Over that span, shares of AMZN are up over 2,000% while SHLD is down over 90%!

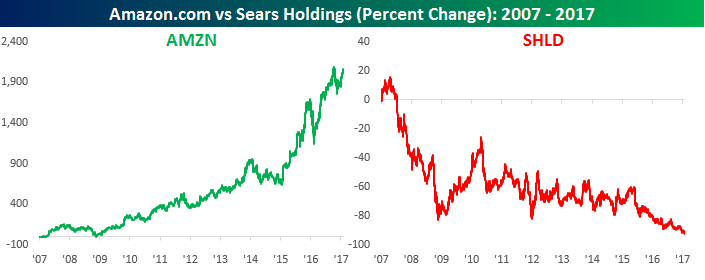

In fact, the chart above doesn’t even do justice to the disparity in the performance of the two stocks, because AMZN’s return has been so positive and SHLD’s has been so negative. Below we show the performance of both stocks on separate charts. Just to get back to where it was ten years ago, Sears would have to rally more than 1,300%. There’s probably a good chance that ten years from now Sears will no longer be around, but as ancient as the company now seems, it was once the Amazon of its day.

Sep 24, 2021

This week’s Bespoke Report newsletter is now available for members.

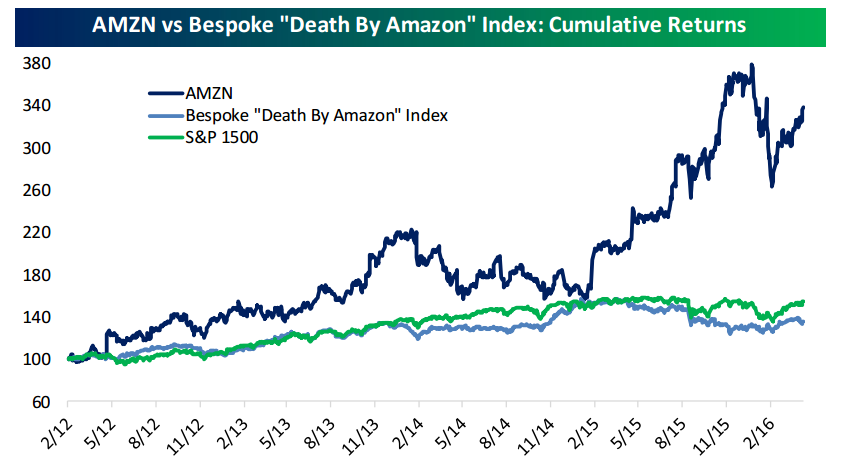

Whether you look at the earnings outlook, macroeconomic data, or the policy backdrop, we’ve reached a turning point in the trends that have defined the recovery from the COVID recession. We discuss all in detail in the latest edition of The Bespoke Report along with analysis of inflation and the ten year yield, cryptocurrencies, an update on our Death By Amazon and Amazon Survivors indices, events in China this week, housing market data this week, analysis of the Federal Reserves Q2 Flow of Funds report, and more.

To read this week’s full Bespoke Report newsletter and access everything else Bespoke’s research platform has to offer, start a two-week trial to one of our three membership levels.

Oct 27, 2019

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium for 3 months for just $95 with our 2019 Annual Outlook special offer.

Changes And Stasis

Apple Pay Overtakes Starbucks as Top Mobile Payment App in the US (eMarketer)

Mobile payments leader Starbucks has been surpassed by Apple Pay, which now was more than 30mm US users accounting for 47% of total users who use proximity payment services. [Link]

‘Death by Amazon’ Was a False Alarm for Walmart and Some Other Retailers by Daren Fonda (Barron’s)

Bespoke’s own Death By Amazon index shows that traditional retailers have been having a great year despite the rise of the e-commerce giant. [Link]

Why the Gasoline Car to the EV is Like the Horse to the Car by Vitaliy Katsenelson (Contrarian Edge)

Part of an 11-part series on Tesla and related topics, this essay argues that internal combustion engines’ decline is a critical shift akin to the end of horses and rise of the automobile. [Link]

Hollywood

The Latest in Security for Hollywood Homeowners: “Laser Systems in Every Single Project” by Alexandria Abramian (The Hollywood Reporter)

Higher incidence of robberies and burglaries have the stars of the silver screen thinking more about their security and some of the results live up to the same over-the-top approach that celebrities bring to other kinds of consumption. [Link]

The One Where Apple Tried to Buy Its Way Into Hollywood by Lucas Shaw and Mark Gurman (Bloomberg)

A detailed look at the story of Apple’s entry into the world of streaming, powered by an ocean of cash and a need to bolster services revenues, a risky play given the history of what makes winners in Hollywood. [Link; soft paywall]

Food

An Undeserved Gift by Shane Mitchell (The Bitter Southerner)

The delicious oral history of okra, a key ingredient in the cuisine of the south that was part of the massive Columbian Exchange; the vegetable goes back so far into that history that nobody can when or how specifically it made its way from Africa to the Gulf Coast. [Link]

Popeyes Will Hire More Staff to Deal With Return of Hit Sandwich by Leslie Patton (Bloomberg)

In early November, the chicken joint will resume its offering of chicken sandwiches which proved so staggeringly popular over the course of the summer, and it’s hiring extra workers to do so. [Link; soft paywall, auto-playing video]

Online ordering boom gives rise to virtual restaurants by Alexandra Olson (AP)

Commercial kitchens are sharing space and workers in order to offer precisely tailored menus designed for takeout that appeals to users of Grubhub, DoorDash, and Uber Eats. [Link]

Politics

The Student Vote Is Surging. So Are Efforts to Suppress It. by Michael Wines (NYT)

College student voting rates doubled from 2014 to 2018, as young people increasingly turn out in opposition to the GOP; the response has been to restrict voting by students. [Link]

A multi-millionaire set out to counter Dominion. Now he’s the state’s biggest campaign donor. by Ned Oliver (Virginia Mercury)

When a Charlottesville-based hedge fund manager Michael Bills ran the numbers, he realized he could buy more influence with state lawmakers than the local utility, so he did. This is both an amusing and slightly horrifying story about how basically (and legally) corrupt many lawmakers have become. [Link]

Democrats Seek Insider Trading Probe After ‘Trump Chaos’ Article by Ben Bain and Matt Robinson (Yahoo!/Bloomberg)

Bespoke’s Macro Strategist George Pearkes gave a convincing debunking of the conspiracy theory that insiders were moving around S&P 500 futures ahead of Presidential tirades (link), but apparently that wasn’t enough for some Democratic lawmakers who want more details; those details will inevitably disappoint the tinfoil hat crowd. [Link]

Baseball

A century after Black Sox, baseball cheating goes high-tech by Ben Nuckols (San Diego Union-Tribune)

While nobody can accuse modern players or whole teams of throwing the World Series, there’s still plenty of evidence that more modest acts of cheating are commonplace. [Link]

Why Baseball in D.C. Finally Worked by Brian Costa and Jared Diamond (WSJ)

A story of how the Washington Nationals finally broke through after spending years in purgatory north of the border in Montreal. [Link; paywall]

Romanophilia

Mark Zuckerberg’s fascination with Augustus Caesar might explain the Facebook CEO’s haircut by Mary Mesenzahl (Business Insider)

Facebook CEO Mark Zuckerberg is a fan of Augustus Caesar, the princeps (“first citizen”) who helped transition Rome from a semi-republic to a full empire, and his weird haircut is one example of that appreciation. [Link]

Aerospace

How Boeing’s 737 MAX Troubles Are Affecting the Economy by Matthew C. Klein (Barron’s)

Boeing’s manufacturing operations are so large that the halt in sales (and orders) for just one of their models (the infamous 737-MAX) is having a very measurable impact on government economic statistics. [Link; paywall]

Executive Efforts

How to retire by 40 by Jamie Powell (FTAV)

An amusing set of tips for those who want to cut their working lives in half. [Link; registration required]

Inside Ken Fisher’s Private Kingdom, Where Hardball Culture Reels in Billions by Sabrina Willmer (Bloomberg)

Cold calls by the hundreds, more than $100bn in AUM, and direct mail in industrial quantities: inside the sprawling empire that is Fisher Investments. [Link; soft paywall, auto-playing video]

Halloween Horrors

Scariest haunted house in U.S. requires 40-page waiver, doctor’s note, safe word (WGN9)

If you’re willing to get a physical, sign a book-length waiver, and watch a two hour training video you are allowed to try the scariest attraction in America. If you can get through it without using your safe word, you’ll get a $20,000 reward. [Link]

The Times Square Sbarro Is Closed by Chris Crowley (Grub Street)

An iconic – and somewhat laughable – figure in Times Square, the Sbarro pizza is being closed after opening 23 years ago. [Link]

Social Media

Online Influencers Tell You What to Buy, Advertisers Wonder Who’s Listening by Suzanne Kapner and Sharon Terlep (WSJ)

Quantifying the benefit of advertising spending that is funneled through “influencers” gets complicated, leading to significant questions about how much value they provide. [Link; paywall]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!

Shares of Sears Holdings (SHLD) have been in free-fall the last three days, falling a staggering 23% during that span. This week’s decline is only a continuation of a longer-term decline where the stock has lost over half of its value in the last six months. The reason behind the most recent leg lower in the stock stems from a ratings downgrade from Fitch where there the agency said that, “although Sears has been able to fund its continued cash shortfalls through planned asset monetization, and additional financings, a meaningful business turnaround in fiscal 2017 is critical given the continued reduction of its asset base.” In other words, unless business picks up for Sears, it is going to run out of assets to fund its liabilities.

Shares of Sears Holdings (SHLD) have been in free-fall the last three days, falling a staggering 23% during that span. This week’s decline is only a continuation of a longer-term decline where the stock has lost over half of its value in the last six months. The reason behind the most recent leg lower in the stock stems from a ratings downgrade from Fitch where there the agency said that, “although Sears has been able to fund its continued cash shortfalls through planned asset monetization, and additional financings, a meaningful business turnaround in fiscal 2017 is critical given the continued reduction of its asset base.” In other words, unless business picks up for Sears, it is going to run out of assets to fund its liabilities.