Bespoke Brunch Reads: 3/31/19

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium for 3 months for just $95 with our 2019 Annual Outlook special offer.

Extinction

The Day The Dinosaurs Died by Douglas Preston (The New Yorker)

A little-known PhD candidate has found a remarkable fossil bed in the Dakotas, yielding evidence of what happened on the literal day that an asteroid buried itself into the Earth’s crust just north of the modern Yucatan peninsula. [Link]

The Worst Disease Ever Recorded by Ed Yong (The Atlantic)

The world’s deadliest disease is found among amphibians: Batrachochytrium dendrobatidis eats away the skin of frogs and gives them heart attacks, devouring hundreds of species. [Link]

Kids

At $50,000 a Year, the Road to Yale Starts at Age 5 by Suzanne Woolley and Katya Kazakina (Bloomberg)

A look inside the extreme competition for spots in schools that promise a path into elite colleges within the New York City private education system. [Link; soft paywall, auto-playing video]

Experts warn of rapid rise in ‘Tommy John’ surgeries among child athletes by Cristina Corbin (Fox News)

60% of surgeries designed to repair the ulnar collateral ligament in patients’ elbows are found among teenagers, with over-use of the body in high pressure, year-round competitive sports programs to blame. [Link; auto-playing video]

ACA

Health Insurance Exchanges 2019 Open Enrollment Report (CMS)

This week the agency responsible for management of health care exchanges set up under the Affordable Care Act reported 2019 enrollment was down about 3.4% (amidst an effort to reduce enrolment by suppressing outreach efforts) with premiums down about 2.5% pre-tax credit, and 2.3% lower after tax credit. Roughly 87% received assistance for premiums, versus 85% last year. [Link]

Justice Department now says courts should strike the entire ACA by Sam Baker (Axios)

The Trump Administration’s Justice Department is arguing in federal courts that the entire ACA should be struck down: not just the more limited pre-existing conditions coverage requirements that are roundly opposed by Republicans in general but the rest of the law as well, sparking a new threat to health care coverage expansion achieved during the Obama administration. [Link]

Industry Recaps

Battery Power’s Latest Plunge in Costs Threatens Coal, Gas (BloombergNEF)

A staggering review of the plunging cost of installation for industrial-scale power generation. Benchmark prices for lithium-ion battery storage has fallen 35% since the first half of 2018 while offshore wind prices are down 24%. [Link]

The State of Fashion 2019 (McKinsey & Company)

Interesting for investors, businesses, and consumers who focus on the world of fashion, this comprehensive review summarizes trends and economics across the industry. [Link; 108 page PDF]

Long Reads

Harry Kane Wants To Conquer The Premier League…Then The NFL by Bruce Schoenfeld (ESPN)

A profile of Tottenham’s Harry Kane – one of the highest-valued strikers in European soccer – and his fascination with the NFL. [Link]

The mobster in our midst by Zak Keefer (Indianapolis Star)

Where better to hide out from the mob (after putting one of their men, your own father, behind bars) than Indianapolis? The story of John Franzese Jr. and how he left the witness protection program to tell it. [Link]

Economics

Why Are Economists So Bad at Forecasting Recessions? by Simon Kennedy and Peter Coy (Bloomberg)

Using an annual decline in GDP as the benchmark, there have been 469 recessions around the world since 1988. IMF economists only successfully predicted 4 of those. [Link; soft paywall]

Independent but Not Indifferent: Partisan Bias in Monetary Policy at the Fed by Williams Robert Clark and Vincent Arel-Bundock (SSRN)

An empirical investigation of political bias at the Fed. The authors show evidence that interest rates decline before elections when Republicans control the White House, rise when Democrats do, are more responsive to inflation when Democrats are in power, and are more responsive to the output gap when Republicans are in power. [Link]

California

$1,000,000 home for sale highlights San Francisco’s wild real estate market by Aarthi Swaminathan (Yahoo! Finance)

Fixer-uppers in San Francisco are a bit different than the rest of the country. That’s why a tiny bungalow in the middle of the city is listed for $1mm. [Link]

Who keeps buying California’s scarce water? Saudi Arabia by Lauren Markham (The Guardian)

Relatively scarce water resources in California’s central valley are being used to grow fodder for cows in Saudi Arabia, part of a chain of agricultural investments made around the world to assure that Saudi Arabian livestock get their dinner. [Link]

Lodging

American consumers spent more on Airbnb than on Hilton last year by Rani Molla (Recode)

US revenues for AirBnB surpassed those of Hilton in 2018, accounting for 20% of the US lodging market as the company continues to expand. [Link]

Data

Oil Traders Are Now Watching Workers’ Phones to Spot Problems at Refineries by Aaron Clark (Bloomberg)

Using geolocation data from cell phones, researchers are able to track the number of phones – and therefore the number of outside workers – refineries, giving them an edge on estimating shutdown times. [Link]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!

The Bespoke Report — Good, Bad, Or Ugly?

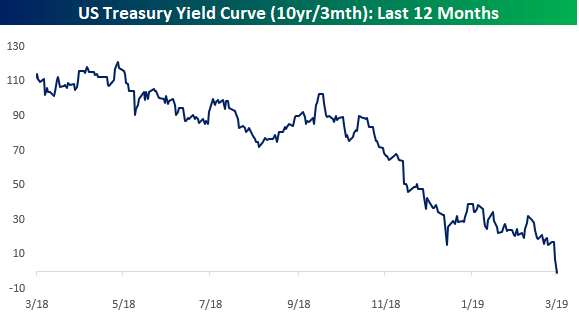

Stocks have basically held the line this week despite huge moves in interest rates and an ongoing rough run for global economic data. Curve inversion has many forecasting a recession, and we’ve seen a number of recent data releases that make us much more nervous about that outcome than we have been in almost a decade. On the other hand, the pivot to dovishness from global central banks, the relatively modest size and scale of yield curve inversion, some nascent signs of bottoming in global growth, and the nature of the plunge in interest rates are all reasons to not panic. Besides, despite all of the negativity US stocks have held up admirably well, and markets that trend higher on bad news are generally regarded as strong, rather than weak. In short, the outlook could be Good, Bad, or Ugly…depending how you read the tea leaves!

In addition to markets, we take a look at central bank policy, the recession outlook in the US, and weak economic data around the world this week. We cover everything you need to know as an investor in this week’s Bespoke Report newsletter. To read the Bespoke Report and access everything else Bespoke’s research platform has to offer, start a two-week free trial to one of our three membership levels. You won’t be disappointed!

The Closer: End of Week Charts — 3/29/19

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke clients, we recap weekly price action in major asset classes, update economic surprise index data for major economies, chart the weekly Commitment of Traders report from the CFTC, and provide our normal nightly update on ETF performance, volume and price movers, and the Bespoke Market Timing Model. We also take a look at the trend in various developed market FX markets.

The Closer is one of our most popular reports, and you can sign up for a free trial below to see it!

See tonight’s Closer by starting a two-week free trial to Bespoke Institutional now!

A Strange Trip With Some Strange Leaders

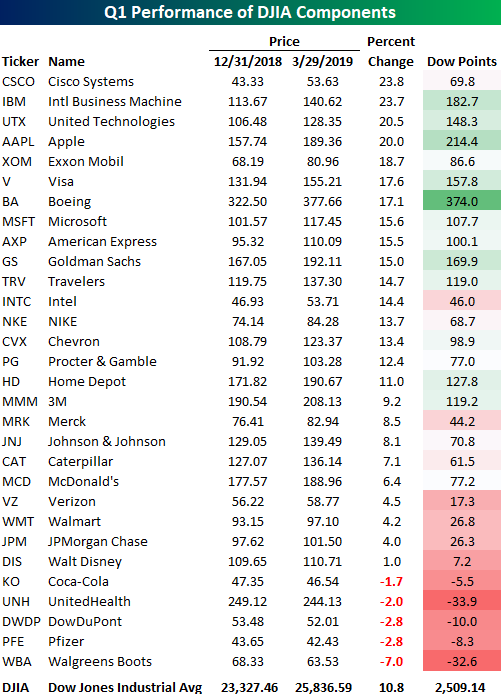

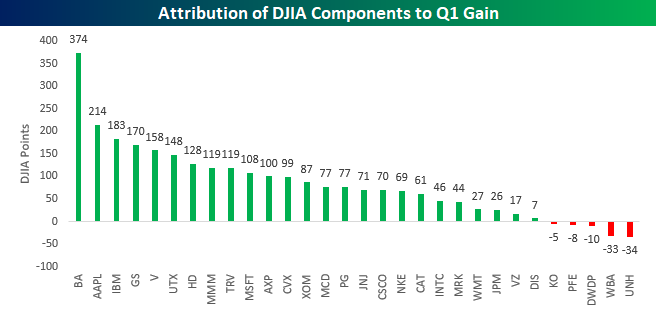

With sentiment where it was at the end of last year following the Q4 rout in equities, it’s safe to say that not a lot of investors were expecting double-digit gains in the first quarter. That’s exactly what we have seen in US equities, though, as the major averages are all up over 10% YTD heading into the final hours of the quarter. While the Dow has lagged many of its peer indices this year, it too is still on pace to finish Q1 with a gain of just over 10%.

In the table below, we show how each of the 30 components in the DJIA have performed on a YTD basis as well as how much they have contributed to the index’s total gains. Remember, the DJIA is a price-weighted index, so the sole determinant of a stock’s weight in the index is its price. Looking at the table, you’re likely not the only one doing a double-take at the two stocks that top the list of best performers in the index so far this year. That’s right, Cisco (CSCO) and IBM have been the index’s two top performers in 2019 with gains of nearly 24%. Behind these two stocks, United Technologies (UTX) and Apple (AAPL) are the only two other stocks that are up 20% or more. To the downside, just five stocks in the DJIA are in the red on a YTD basis. Leading the way lower, Walgreens Boots (WBA), the newest stock in the index, has declined over 7%, but none of the four other stocks are down more than 3%.

Because the DJIA is price-weighted, the best-performing stocks in the index haven’t been the biggest contributors to the YTD gains. The chart below shows how many points each stock in the index has contributed to the YTD gains. Looking at things this way, you may be surprised to see that Boeing (BA) still tops the list. With its 17% YTD gain and very high share price, BA has contributed 374 points to the DJIA’s upside this year, beating out the next closest component (AAPL) by 160 points! All else being equal, BA could fall another 23 points (6.0%) and it would still be the largest contributor to the DJIA’s YTD gains.

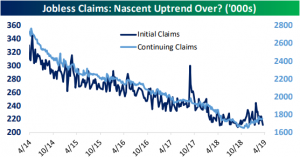

Eyes on Jobless Claims Indices

As we discussed in last night’s Closer and a blog post yesterday, weekly initial jobless claims moved back to 211K, the lowest in over two months and a pretty healthy print. While initial claims have been fairly volatile and more recent prints have been reassuring that recent highs are not a new trend, continuing claims have more steadily been working their way higher.

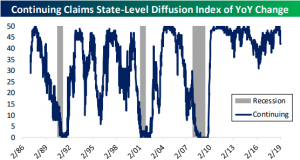

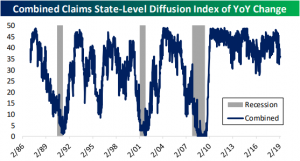

We made a diffusion index of the 50 states using this data to get a better idea of the health of these labor market indicators. In these indices, higher readings indicate more state-level claims falling, while lower numbers indicate more state-level increases. The index for continuing claims continues to appear fairly healthy. The index number has fallen, meaning an increasing number of states have been seeing increases in jobless claims, but this is far outweighed by states still seeing declines.

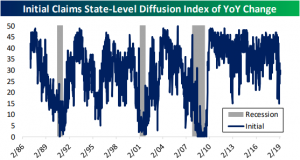

The diffusion index for initial claims, like the headline numbers, are telling a different story. On January 19th, the index had fallen as low as 15 which was the weakest reading since 2012. More recently, though, the number has been stronger, coming in at 28 this week; down from 30 last week.

Averaging the two, the current reading is 36. Overall that is neither a strong or weak number, but it is still in stronger shape than the past several years lows in 2016. All in all, while claims have improved in the past few weeks and are not flashing recessionary signs, they should continue to be watched for signs of further deterioration.

Shanghai Rips Into Quarter End

Equities around the world have been looking to close out the quarter on a positive note, and China was no exception. With trade US and Chinese trade negotiators reportedly making progress in the always on the horizon trade deal, the Shanghai Composite ripped 3.2% higher in the last trading day of the quarter and nearly erasing all of the week’s prior losses. For the entire quarter, the index finished up just a hair shy of 24%, putting it at the top of the list in terms of major international stock market returns. While Chinese stocks finished the quarter strong, it is important to point out that during this consolidation phase the index has been in for the last several weeks, it has made a couple of lower highs. Ideally, we would like to see some follow-through next week from this Friday’s rally to break that string.

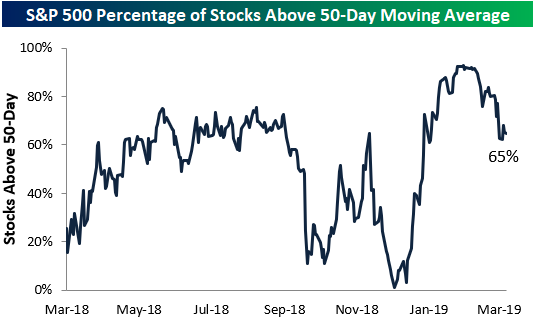

One factor working in favor of Chinese equities is solid breadth. The chart below compares the performance of the Shanghai Composite to its cumulative A/D line over the last twelve months. Ever since late last year, breadth has been leading price to the upside. It started with a positive divergence in late 2018 when prices made a new low (red line) but breadth (blue line) hung in there and has continued right up through the middle of the month when the cumulative A/D line made a new high. As long as that trend continues to play out, Chinese stocks should continue their leadership.

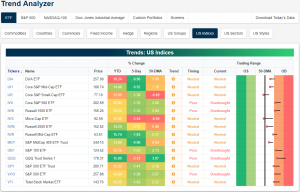

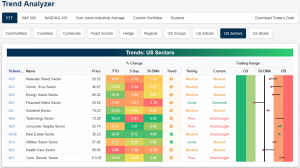

Trend Analyzer – 3/29/19 – Mixed End

We are capping off the quarter with a somewhat mixed picture as seen through our Trend Analyzer tool. There are currently five overbought ETFs while the remaining nine are neutral. Every ETF has seen a bit of mean reversion in the past week as seen through the long tails in the trading range section. Whereas many were firmly or—in the case of the Nasdaq (QQQ)—extremely overbought not long ago, about half are now teetering between overbought and neutral. Others are more firmly neutral with the Core S&P Small Cap (IJR) and Micro Cap (IWC) actually both moving below their respective 50-DMAs. Additionally, not a single ETF has managed to work its way into the green this past week as almost every index ETF has declined 1% or more as the hit from last Friday still lingers. Headed into today’s trading, the Micro-Cap (IWC) has seen the worst of the selling with a decline of 2.54% over the past five days. Coming off of the strongest overbought levels of the major indices, the Nasdaq (QQQ) has similarly been hit hard falling 2.33% in the past week. Meanwhile, Mid-Caps have actually held up relatively well. The Core S&P Mid Cap (IJH) and S&P MidCap 400 (MDY) are both down less than 1%, while their peer, the Russell Mid Cap (IWR), has only shed 1.05%.

Turning to individual sectors, only Real Estate (XLRE) and Consumer Staples (XLP) are up in the past week with gains of 0.72% and 1.07%, respectively. They have also become the most overbought sectors. Consumer Discretionary (XLY) is also still pretty elevated but has pulled back slightly this week. Meanwhile, Health Care (XLV) has taken quite the hit falling from overbought territory to below its 50-DMA. Similarly, after falling below the 50-DMA, Financials (XLF) have gotten pretty oversold, although it has rebounded in the last couple of days.

Morning Lineup – In Like a Bear, Out Like a Bull

We’ve just published today’s Morning Lineup featuring all the news and market indicators you need to know ahead of the trading day. To view the full Morning Lineup, start a two-week free trial to Bespoke Premium.

It’s the last day of the quarter and investors around the world are looking to end it on a bullish note. With the S&P 500 on pace for its best first quarter of the year since 1998, it may be hard to remember that the year didn’t start out on nearly that optimistic of a note. In fact, after a big decline of over 2% on the second trading day of 2019 (thanks to an Apple warning), the S&P 500 was off to its worst start of a year since 2000 and just the fifth year in its history that it was down more than 2% two trading days into the year. For all the strength in equities this quarter, though, they haven’t held a candle to crude oil which is up over 30% this year for its best quarter since Q2 2009!

Please click the link below to read today’s Bespoke Morning Lineup.

We highlighted the massive relative performance gap between the Technology sector and the Transports in last week’s Bespoke Report, and if you are a fan of Dow Theory, the underperformance of the Transports has been a source for concern. This week, the Transports put a small dent, or better yet, scratch into that streak of underperformance.

The chart below shows the relative strength of the Technology sector and the Transports relative to the S&P 500 (rising lines indicate outperformance versus the S&P 500). Beginning in late January, the two really started to diverge from each other, but this week have started to close what has been, and still is, an enormous gap between the two.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.

The Closer — Credit Still Trending Wider, Five Fed, Claims Diffusion — 3/28/19

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we begin with a look at the multi-year trend of widening credit spreads while dollar and rate volatility has fallen; mirroring that of stocks and WTI. We also observe the lackluster performance of green energy stocks before giving the full picture of our Five Fed Manufacturing Composite with the addition of today’s Kansas City Fed’s data. To finish, expanding on an earlier blog post, we created a diffusion index of state-level jobless claims. The index shows a bit of a contrast between Initial and Continuing Jobless Claims.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

Bespoke’s Sector Snapshot — 3/28/19

We’ve just released our weekly Sector Snapshot report (see a sample here) for Bespoke Premium and Bespoke Institutional members. Please log-in here to view the report if you’re already a member. If you’re not yet a subscriber and would like to see the report, please start a two-week free trial to Bespoke Premium now.

In this week’s Sector Snapshot, we discuss mean reversion to close the quarter for the S&P 500, and we look at weakening relative strength for Health Care and Financials. Please click the thumbnail image below to read this week’s report.

To gain access to the report, please start a two-week free trial to our Bespoke Premium package now. Here’s a breakdown of the products you’ll receive.