Chart of the Day: Retail Sales Flashing Yellow

Fixed Income Weekly – 4/3/19

Searching for ways to better understand the fixed income space or looking for actionable ideals in this asset class? Bespoke’s Fixed Income Weekly provides an update on rates and credit every Wednesday. We start off with a fresh piece of analysis driven by what’s in the headlines or driving the market in a given week. We then provide charts of how US Treasury futures and rates are trading, before moving on to a summary of recent fixed income ETF performance, short-term interest rates including money market funds, and a trade idea. We summarize changes and recent developments for a variety of yield curves (UST, bund, Eurodollar, US breakeven inflation and Bespoke’s Global Yield Curve) before finishing with a review of recent UST yield curve changes, spread changes for major credit products and international bonds, and 1 year return profiles for a cross section of the fixed income world.

In this week’s report we discuss the signals being sent by the term structure of the Brent crude curve.

Our Fixed Income Weekly helps investors stay on top of fixed income markets and gain new perspective on the developments in interest rates. You can sign up for a Bespoke research trial below to see this week’s report and everything else Bespoke publishes free for the next two weeks!

Click here and start a 14-day free trial to Bespoke Institutional to see our newest Fixed Income Weekly now!

Services Sector Disappoints

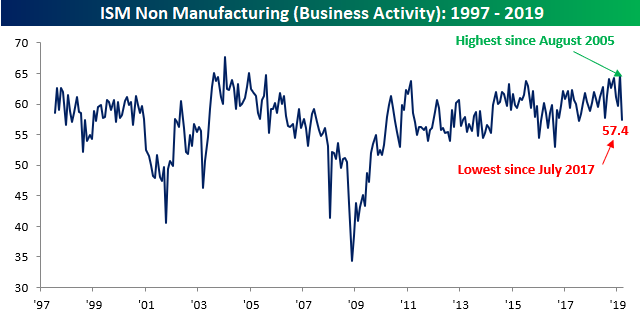

After a number of global PMIs for the services sector came in better than expected overnight and this morning, the ISM Services (non-manufacturing) report for March disappointed, coming in at a level of 56.1 compared to expectations for a reading of 57.9 and last month’s reading of 59.7. Not only was this month’s report weaker than expected, but it was also the lowest reading since July 2017. On a combined basis and accounting for each sector’s share of the total economy, the ISM for March came in at 56.0 versus last month’s reading of 59.1. This combined reading was the lowest print seen since August 2017. Start a two-week free trial to Bespoke Premium to access our interactive research portal. You won’t be disappointed!

The table below breaks down this month’s report by each of its subcomponents and shows their m/m and y/y changes. Despite the large drop on a m/m basis, more components actually saw increases (5) in March versus declines (4). The biggest gainer was Prices Paid, followed by Inventory Sentiment and Import Orders. On the downside, the declines were larger and the biggest ones were Business Activity and New Orders. On a y/y basis, breadth was considerably weaker as Inventory Sentiment was the only component that increased.

There has been a lot of inconsistency in economic data lately and one of the prime examples has been in the Retail Sales data from the last three months. Retail Sales isn’t the only example, though. Take a look at the chart of Business Activity below. In last month’s report, Business Activity rose to 64.7, which was the highest reading since August 2005. This month, however, the index for Business Activity dropped to 57.4, which was the lowest level since July 2017. In other words, Business Activity went from a 13+ year high to a 52-week low in the span of a month!

B.I.G. Tips — Uptrending Nasdaq 100 Stocks With “Good” Timing

Log-in here if you’re a member with access to our B.I.G. Tips reports.

Twelve stocks in the Nasdaq 100 are currently rated as “uptrending” with “good” or “perfect” timing based on our proprietary “Trend” and “Timing” algorithms. These algos analyze the price action of every stock on a daily basis. It’s not a perfect algo just yet, but it is a great starting point for finding new opportunities or monitoring an existing portfolio. In our new Tools section, you can pull up trend and timing ratings with our Trend Analyzer, and you can also see the trend and timing scores for individual stocks or ETFs when you search for them in our Search bar. Here’s an example using Alphabet (GOOGL). If you’d like to build a custom portfolio of stocks and/or ETFs to monitor, simply head to our Custom Portfolios section and get started.

A stock will receive an “uptrend” rating if its price has made a series of higher highs and higher lows over the last six months. In terms of timing, anything that is trading overbought or extremely overbought will be considered “neutral” at best and “bad” in extreme scenarios. Before adding to or buying a new position, we’d prefer to wait for downside mean reversion to occur if the stock is trading at extremely overbought levels. A stock that is trending higher but trading inside of its “normal” trading range will have a “good” timing score — meaning it’s okay to enter the position. If a stock is uptrending but has moved to oversold territory, it becomes even more attractive from a timing perspective. In these instances, though, you’ll sometimes find that our algo doesn’t quite capture a stock that has just recently broken down, so that’s why it’s important to add in the ‘human touch’ and pull up a price chart for each individual name you’re interested in using the Search bar.

To continue reading and see which Nasdaq 100 stocks are currently in an uptrend with “good” timing scores, you’ll need to start a two-week free trial to Bespoke Premium. CLICK HERE to start your free trial now.

Trend Analyzer – 4/3/19 – Micro-Gains in Micro-Caps

After what was pretty much a flat day yesterday, there is one more major index ETF (MDY) that has shifted back to neutral from overbought territory. While most small-cap ETFs have seen lesser gains than their large-cap peers, the Micro-Cap (IWC) has continued to underperform in dramatic fashion gaining only 0.77% in the past week.

One trend that has been noticeable in the charts is the underperformance of small caps since March. While large caps were consolidating and are now breaking out to new highs, their small and mid-cap peers were making lower lows and are now just breaking out of short-term downtrends.

Overbought Regional ETFs

As shown in the Trend Analyzer snapshot below, all but one of the regional ETFs that we track are trading overbought at the moment, with the Latin America 40 (ILF) the lone holdout. ILF is actually still below its 50-day moving average, so it has a ways to go to catch up with the rest of the group. Europe Hedged (HEDJ), MSCI All Country Asia ex Japan (AAXJ), and FTSE Emerging Markets (VWO) are the most extended above their 50-DMAs. Start a two-week free trial to Bespoke Premium to access our interactive research portal. You won’t be disappointed!

Bespoke’s Global Macro Dashboard — 4/3/19

Bespoke’s Global Macro Dashboard is a high-level summary of 22 major economies from around the world. For each country, we provide charts of local equity market prices, relative performance versus global equities, price to earnings ratios, dividend yields, economic growth, unemployment, retail sales and industrial production growth, inflation, money supply, spot FX performance versus the dollar, policy rate, and ten year local government bond yield interest rates. The report is intended as a tool for both reference and idea generation. It’s clients’ first stop for basic background info on how a given economy is performing, and what issues are driving the narrative for that economy. The dashboard helps you get up to speed on and keep track of the basics for the most important economies around the world, informing starting points for further research and risk management. It’s published weekly every Wednesday at the Bespoke Institutional membership level.

You can access our Global Macro Dashboard by starting a 14-day free trial to Bespoke Institutional now!

Morning Lineup – Worldwide Rally

We’ve just published today’s Morning Lineup featuring all the news and market indicators you need to know ahead of the trading day. To view the full Morning Lineup, start a two-week free trial to Bespoke Premium.

Here’s a snippet from today’s report:

Just about anywhere you look around the globe this morning, the picture is the same. Equities are rallying and breaking above intermediate-term resistance levels in the process. US futures are indicating a higher open this morning on positive sentiment related to the never-ending US-China soap opera, but globally sentiment is improved as economic data showed encouraging improvement/stabilization. One negative economic data point just released, though, was the ADP Private Payrolls report which showed weaker than expected job gains in March (129K vs 175K estimate). So far, there has been little reaction from the market to the report.

The perfect way to illustrate the global nature of the rally is through a chart of the Bloomberg World Index. After breaking down below support just under 240 last fall, that level was poised to act as resistance on the way up. In its first test of that level last week, the Bloomberg World Index pulled back a bit, but it quickly regained its composure and bounced back above that level in this morning’s trade. There’s no arguing the fact that markets are overbought in the short term (a topic we cover in this morning report), but as long as these resistance turned support levels hold, bulls have the momentum.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.

The Closer — Late Buyers, Backwardation, Auto Sales Around The World — 4/2/19

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we go over the lack of late day buying while crude oil has moved further into backwardation. We also note that amidst all the interest rate chaos and weak economic data, the VIX is falling to new lows. Moving on to macro data, we begin with a look at the February data on manufacturers’ new orders, sales, and inventories. We compare this hard data to the soft data seen in our Five Fed Manufacturing Index. We finish with an update on global autos sales.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

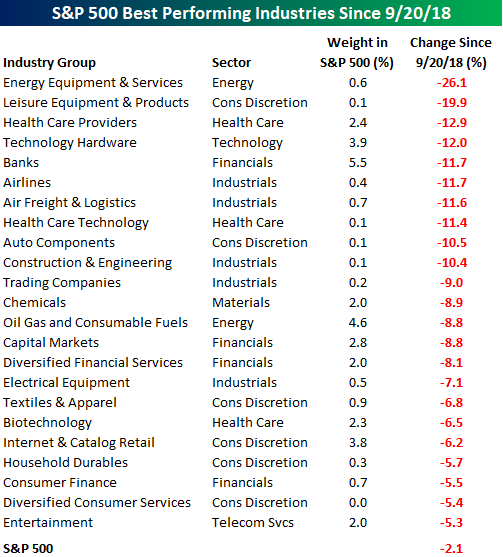

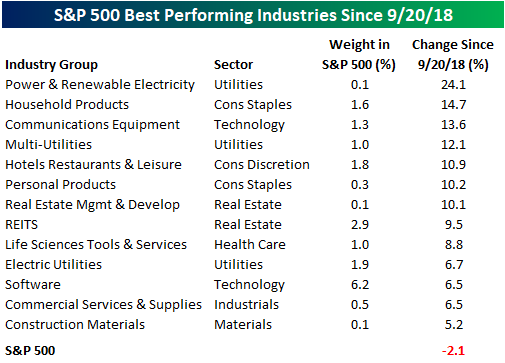

Best and Worst S&P 500 Industries Since 09/20 Peak

After all the ups and downs – or more accurately, downs and then ups in the market over the last six months, the S&P 500 is now just over 2% from its all-time closing high on 9/20. As you might expect, though, not all groups have seen the same moves over that time. During this span, a number of Industries in the S&P 500 have done very well while even more have fared poorly. In the tables below, we highlight the best and worst performing Industries since 9/20/18 along with their current weighting in the S&P 500.

First the bad news. On the downside, over a third of S&P 500 Industries are still down 5% or more from their closing levels on 9/20, and ten of those are down over 10%. The worst performers on the list include Energy Equipment, which has lost over a quarter of its value, and Leisure Equipment, which is down nearly 20%. Thankfully for the market, both of these Industries have rather small weightings in the index. The same, however, can’t be said for Health Care Providers, Technology Hardware, and Banks, which all have weightings ranging from 2.4% to 5.5% and together account for 11.8% of the entire index. In terms of sector representation, Consumer Discretionary, Industrials, and Financials are all well represented. The same is true for Energy as both Industries in the sector are on the list.

Shifting to the good news, seven Industries in the S&P 500 have bucked the trend and are up over 10% since the market peaked back on 9/20. Leading the way higher, Power and Renewable Electricity is up nearly 25%, but unfortunately, even after the move it still only accounts for just 0.1% of the entire index. Behind Power and Renewables, though, the next four Industries all have weightings of 1% or more. The biggest contributor to the upside on the list has been Software as it has risen 6.5% and accounts for 6.2% of the entire S&P 500. Start a two-week free trial to Bespoke Premium to access our interactive research portal. You won’t be disappointed!