Bespoke CNBC Appearance (4/9/19)

Bespoke co-founder Paul Hickey appeared on CNBC’s Squawk Box on Tuesday (4/9) to discuss markets heading into earnings season. To view the segment, click on the image below.

Start a two-week free trial to Bespoke Premium to access our individual stock research and much more.

Bespoke’s Global Macro Dashboard — 4/10/19

Bespoke’s Global Macro Dashboard is a high-level summary of 22 major economies from around the world. For each country, we provide charts of local equity market prices, relative performance versus global equities, price to earnings ratios, dividend yields, economic growth, unemployment, retail sales and industrial production growth, inflation, money supply, spot FX performance versus the dollar, policy rate, and ten year local government bond yield interest rates. The report is intended as a tool for both reference and idea generation. It’s clients’ first stop for basic background info on how a given economy is performing, and what issues are driving the narrative for that economy. The dashboard helps you get up to speed on and keep track of the basics for the most important economies around the world, informing starting points for further research and risk management. It’s published weekly every Wednesday at the Bespoke Institutional membership level.

You can access our Global Macro Dashboard by starting a 14-day free trial to Bespoke Institutional now!

Trend Analyzer – 4/10/19 – Overbought Oil

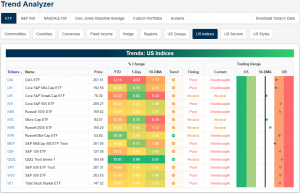

Given yesterday’s declines, the Dow (DIA) has now turned negative on the week. It is also now underperforming on a YTD basis versus all the other major index ETFs. Fortunately, it is the only ETF to have moved into negative territory for the last five trading days. Granted, the others’ returns are nothing stellar as there is no ETF to have edged out a gain of more than 1%.

Turning to overbought and oversold levels as seen in our Trend Analyzer, yesterday’s declines only led to a single ETF, the Russell 2000 (IWM) which we discussed in last night’s Closer, falling back into neutral from overbought. There are still eleven others that are still overbought and fairly close to being 2 standard deviations or more above their 50-DMA. From its strong run, the Nasdaq is the most overbought as it currently sits the most extended above the 50-DMA.

Start a two-week free trial to Bespoke Premium to access our Trend Analyzer tool in addition to other interactive features.

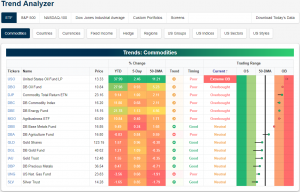

Turning to commodities, Crude Oil (USO) has been the only one to see any sort of substantial move in the past week. Even with a decline yesterday, USO is up 2.46% in the past week and a substantial 37.99% YTD! This huge rally comes with the caveat that the asset has become extended above its 50-DMA. At yesterday’s close, USO settled 11.21% above the 50-DMA and remaining in extreme overbought levels.

Morning Lineup – Here Comes Earnings Season!

We’ve just published today’s Morning Lineup featuring all the news and market indicators you need to know ahead of the trading day. To view the full Morning Lineup, start a two-week free trial to Bespoke Premium.

Here’s a snippet from today’s report:

As noted in our B.I.G. Tips report yesterday, while it starts off slowly, earnings season kicks off this week as the big banks start to report earnings on Friday and early next week. In this report, we provide a breakdown of how analyst sentiment is stacking up heading into the reporting period and how that bodes for equities. If you haven’t seen it yet, make sure you do!

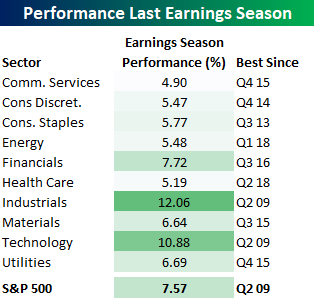

Given the equity market’s strong performance during the last earnings season, it’s going to be hard to get a repeat performance. That doesn’t mean returns can’t be positive, but if you are expecting anything resembling the last earnings season, you’re being way too greedy. The table below shows the performance of the S&P 500 and each sector during the Q4 earnings season (1/11—2/22) and how that performance ranked versus prior quarters. With a gain of 7.57%, the S&P 500’s performance was the best earnings season showing since the Q2 2009 reporting period. Industrials and Technology were the same with a gain of 10.9%. Other sectors with notable performance relative to recent history included Consumer Staples (best since Q3 2013) and Consumer Discretionary (best since Q4 2014).

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.

The Closer — Russell Can’t Hold Its 200-DMA, Crop Review, JOLTS — 4/9/19

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we cover how the Russell once again failed to hold above the 200-DMA. We draw an ominous parallel to another instance that the index has acted this way in the past. Staying on the topic of the Russell 2000, we show why the high share of unprofitable companies in the index may not necessarily be a call for concern. Moving onto commodities, using today’s USDA monthly crop data, we show the impressive trend of growth in agriculture’s productivity. We finish with a note on today’s JOLTS report which missed estimates but still remains strong relative to the labor force.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

B.I.G. Tips – Let the Earnings Season Begin!

Earnings season kicks off this week as some of the major banks are set to report Q1 earnings. JP Morgan (JPM), PNC, and Wells Fargo (WFC) will all report Friday morning, and then Citi (C) and Goldman (GS) will report Monday morning. Outside of the big banks, the only other reports of note this week are Delta (DAL) on Wednesday morning, Bed Bath & Beyond (BBBY) on Wednesday afternoon, and Rite Aid (RAD) Thursday morning. Things don’t really start to pick up, though, until next week, and the peak reporting day will be on 4/25 when 64 companies in the S&P 500 are set to report.

Given the equity market’s strong performance during the last earnings season, it’s going to be hard to get a repeat performance. That doesn’t mean returns can’t be positive, but if you are expecting anything resembling the last earnings season, you’re being way too greedy. The table below shows the performance of the S&P 500 and each sector during the Q4 earnings season (1/11—2/22) and how that performance ranked versus prior quarters. With a gain of 7.57%, the S&P 500’s performance was the best earnings season showing since the Q2 2009 reporting period. Industrials and Technology were the same with a gain of 10.9%. Other sectors with notable performance relative to recent history included Consumer Staples (best since Q3 2013) and Consumer Discretionary (best since Q4 2014).

To gain access to the full report which provides a detailed look at how the S&P 500 and individual sectors have performed during prior earnings season based analyst sentiment heading into the period, please start a two-week free trial to our Bespoke Premium package now. Here’s a breakdown of the products you’ll receive.

Apple (AAPL) Hot Streaks

Ever since the WWDC event in late March, which was widely panned by many of the company’s critics, Apple (AAPL) has been on an absolute tear. In the last ten trading days, the stock has risen 8.12%, and if it holds on to today’s gains it will be the first ten-day winning streak for the stock since October 2010! As shown in the chart below, since the launch of the iPod in 2001, this would only be the stock’s fourth streak of ten or more days of gains in a row.

Start a two-week free trial to Bespoke Premium to access our individual stock research and much more.

Additionally, if Apple’s winning streak keeps up in tomorrow’s trading, it will be the stock’s second-longest such streak ever. The only one longer was back in 2003 when it had a 12-day winning streak. Regardless of what happens tomorrow, looking further out the stock typically hits some rough waters over the short term before righting the ship. Following similar streaks, AAPL saw declines in the following week and month on both an average and median basis. Three months out things improve a bit, and six months to one year out, returns have been positive across the board with considerable gains. All in all, with the stock also now extremely overbought (>2 standard deviations from the 50-DMA), some type of short-term mean reversion is increasingly likely.