The Closer — Eurozone Macro, Consumer Credit, Import and Export Prices — 5/14/19

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we review the Eurozone’s economic surprised over the past few months while real yields are setting up in a bear flag pattern. We also highlight copper’s weakness. Then we turn to today’s release from the New York Fed to take an in-depth look at the debt of the American consumer. We finish with a look at today’s release of Import and Export Price Indices.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

Small Businesses Still Confident

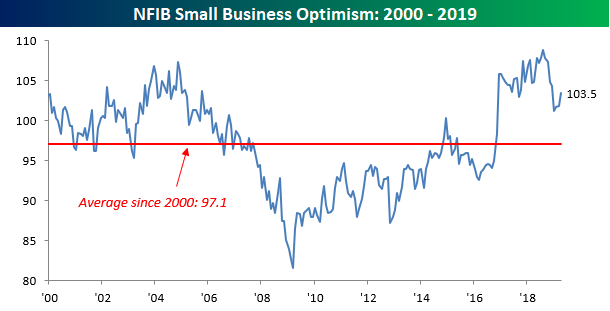

Trade wars. What trade wars? While markets are freaking out about the latest tweets from the President related to trade tensions with China, small business owners are grinding away and becoming increasingly confident after sentiment took a hit late last year and earlier this year due in part to the government shutdown and tighter Fed. In this month’s report from the NFIB, overall sentiment came in at a level of 103.5 compared to expectations for a reading of 102.0 and last month’s reading of 101.8. We’re still quite a ways from the cycle high of 108.8 reached last August, but also still comfortably above the historical average reading of 97.1. In the words of the NFIB, “Overall, the Index remains at a historically very strong level, consistent with solid growth, keeping the economy at full employment. There is no recession in sight this year.”

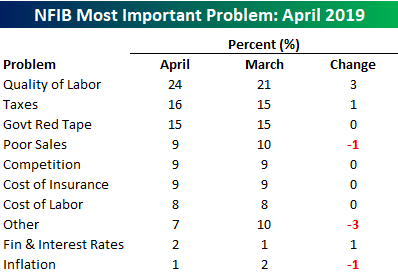

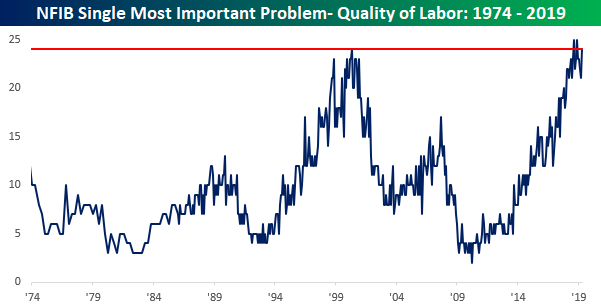

In each month’s report, one area we like to focus on is the section of the report where small business owners are asked what the single most important problem they face is. In this month’s survey, Labor Quality continued to top the list with nearly a quarter of respondents saying they are having difficulty finding qualified workers. That’s up from 21% last month and isn’t far off the record high of 25% we saw in August and November of 2018. As shown in the chart below, there have only been three other months in the history of this report where either as large or a larger percentage of small business owners cited Labor Quality as the biggest problem. The first was in May 2000, while the other two were in the second half of 2018.

Strangely enough, while Labor Quality is a big issue, the cost of labor has been much less problematic as just 8% of small business owners cited it as their most important problem. That’s unchanged from March and is right in the range of where it has been for the last two years. That’s a positive from an inflation perspective as wages play such a large role in prices and with just 1% of small business owners citing inflation as their biggest problem, they don’t seem particularly worried about the prospect of rising prices. Start a two-week free trial to Bespoke Institutional to access all of our research and interactive investor tools.

Bespoke Stock Scores — 5/14/19

Chart of the Day: Tariffs Terrifying Retail

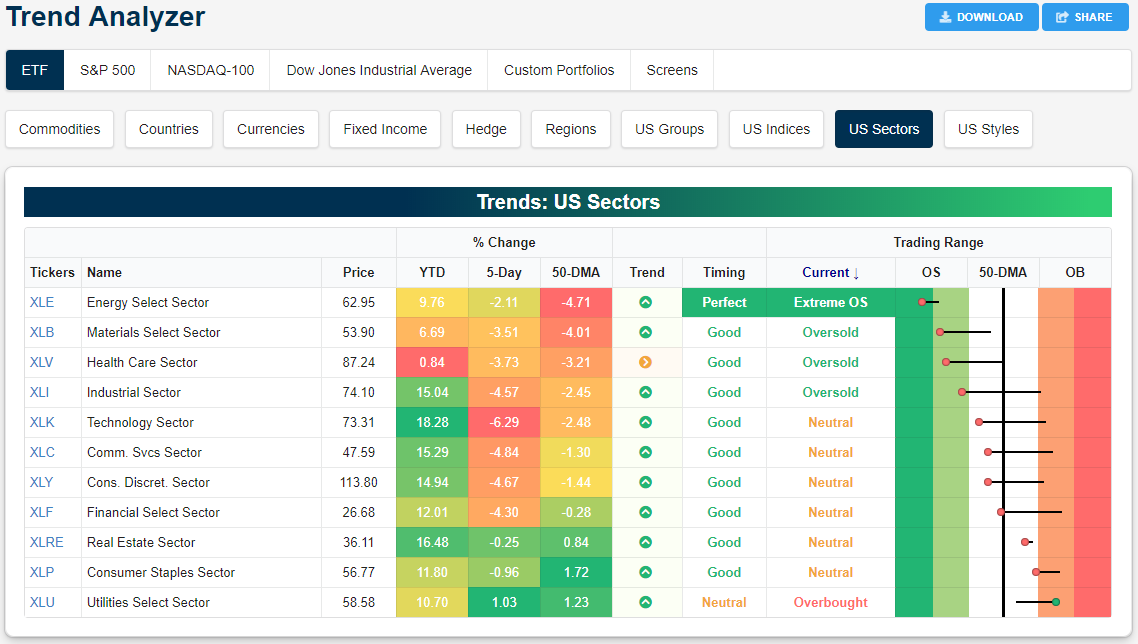

Trend Analyzer – 5/14/19 – Oversold Shift

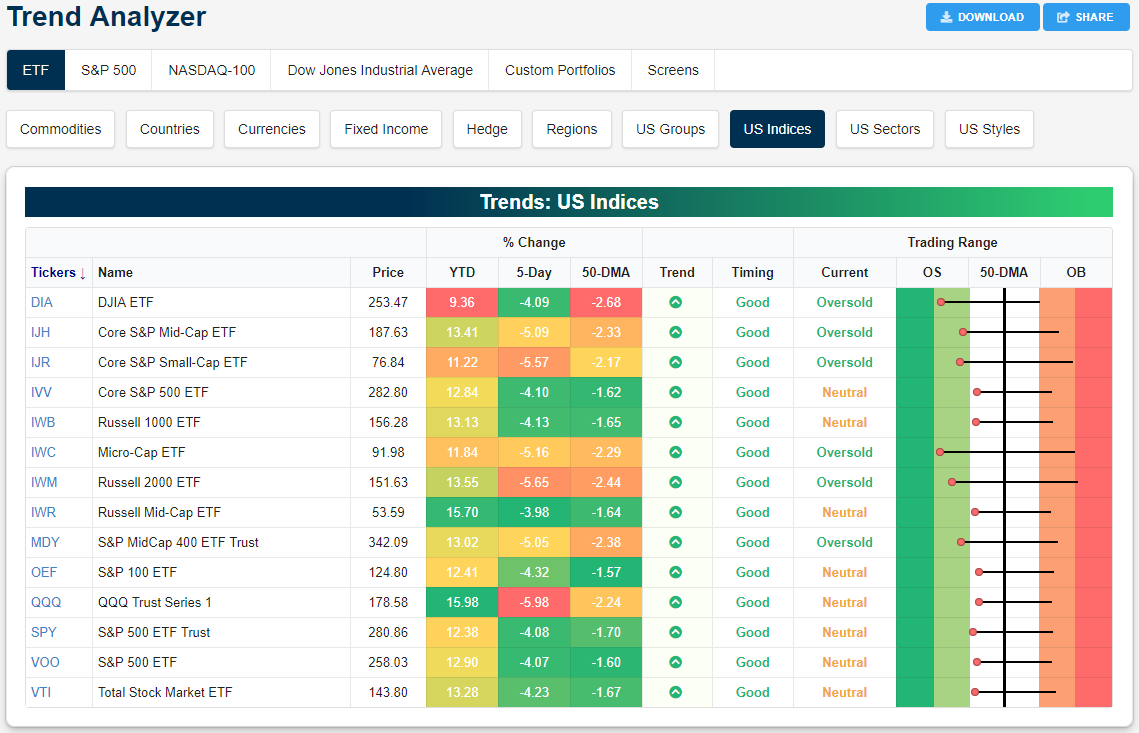

Tacking onto the past week’s losses, yesterday was the first decline of over 2% in more than five months for the S&P 500 (SPY). Currently, every major index ETF has now declined over 4% in the past five days. Small caps and mid caps, in particular, have gotten hit hard as each one has fallen over 5%. Meanwhile, the Nasdaq (QQQ) has more dramatically underperformed, currently sitting just under 6% below where it was last week at this time. QQQ has still outperformed all other major index ETFs on a year to date basis, though. There is also no longer any major index ETF sitting above the 50-DMA. Whereas last week the group was entirely overbought, they head into trading today at either oversold levels or neutral and on the cusp of oversold. As seen through the long tails across each name in our Trend Analyzer, the movement towards this lower end of the ETFs’ trading ranges has been rapid. But this pullback provides a good timing opportunity considering each one is still in an uptrend over the past six months. Start a two-week free trial to Bespoke Institutional to access our Trend Analyzer and much more.

Like the broader market, declines can be seen across the eleven sectors as only Utilities (XLU) has managed to edge out a gain over the past week. XLU is now up just over 1% and is also the only sector ETF to sit in overbought territory. Other defensives like Real Estate (XLRE) and Consumer Staples (XLP), while not positive, have held up better than their peers. These two have only seen declines of less than 1% versus losses upwards of 6.29% from Technology (XLK). Despite XLK’s steep declines in the past week, it actually has yet to push into oversold territory. Along with six other sectors, XLK is in neutral territory, but similar to most other sectors, XLK has fallen below its 50-DMA. Only XLRE, XLP, and XLU have managed to hold above their respective 50-DMAs. Some have fallen far enough below the 50-DMA to now sit in oversold territory, with Energy (XLE) doing so to an extreme degree. This is in part due to volatile oil prices over the past few days. The silver lining once again is that each of these (except for the overbought XLU) have good timing scores and XLE actually has a perfect timing rating.

Bespoke Morning Lineup – Hoping for a Turnaround

Global equity markets are attempting to rally back from the plunge yesterday thanks to trade headlines. The bounce appears to be mostly a function of the same kind of headlines, if not even more speculative in nature, but the move higher has been pretty consistent with Europe up 1% and US equities poised to gap up by about 63 bps. The market continues to be dominated by trade-related headlines, but at some point soon, tweets and headlines just aren’t going to cut it, and investors are going to demand concrete results.

We’ve just published today’s Morning Lineup featuring all the news and market indicators you need to know ahead of the trading day.

The list of oversold stocks is really starting to pile up. Through yesterday’s close, 18.6% of stocks in the S&P 500 were at short-term overbought levels while 38% were oversold. That net reading of 19.4% is the most negative reading since January 7th.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.

The Closer — Oil Volatility, Fastenal Sales, Inflation Expectations — 5/13/19

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we begin with a recap of oil’s volatile session as well as LYFT and UBER’s rough trading. We then review the theory that equity markets are more prone to sudden and sharp drops. Next, we look at Fastenal (FAST) monthly sales which are a good proxy for the broad economy. We finish with a deep look at the New York Fed’s consumer expectations survey on inflation.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

B.I.G. Tips – CAT Sales Trying to Stabilize

Chart of the Day: TGIM

S&P 500 Performance Following 1%+ Lower Opens

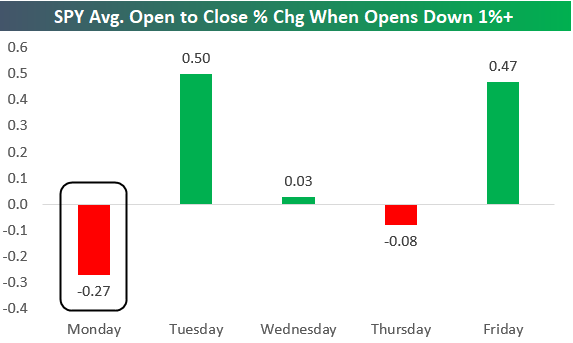

The S&P 500 SPY ETF opened lower by more than 1% this Monday morning after no progress was made between the US and China on trade. When SPY opens down 1% or more, how does the ETF typically perform during regular trading hours from the open to the close? Since 1993 when SPY began trading, the ETF has averaged a decline of 0.27% from the open to the close when it opens down 1%+ on a Monday morning. As shown in the chart below, Monday is the worst day of the week for a 1%+ open lower.

When SPY has opened down 1%+ on Tuesdays or Fridays, it has actually bounced back very nicely throughout the trading day with an average open to close change of ~0.50%. On Wednesdays and Thursdays, the open to close change is basically flat following a 1%+ gap down.

Based on historical price action, big opens lower on a Monday typically see continued selling throughout the trading day, while Tuesdays and Fridays see buyers step in. Start a two-week free trial to Bespoke Institutional to access our thought-provoking investment research and all of our interactive investor tools.