ISM Services Sigh of Relief

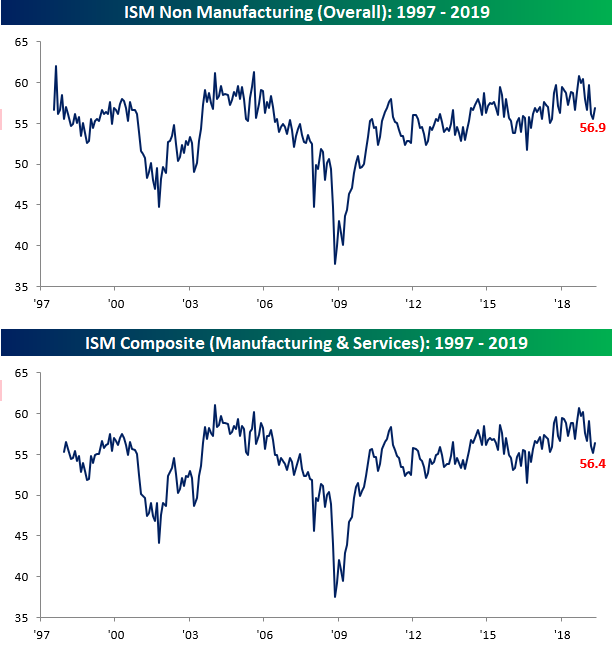

After the weakest ADP Private Payrolls report (in terms of the actual reading and relative to expectations) in close to a decade earlier this morning, investor anxiety heading into the ISM Services report for May was understandably high. While economists were expecting the headline index to decline slightly from 55.5 down to 55.4, it actually saw a modest increase rising to 56.9. On a combined basis and accounting for each sector’s share of the overall economy, the May ISM Composite PMI rose from 55.2 up to 56.4.

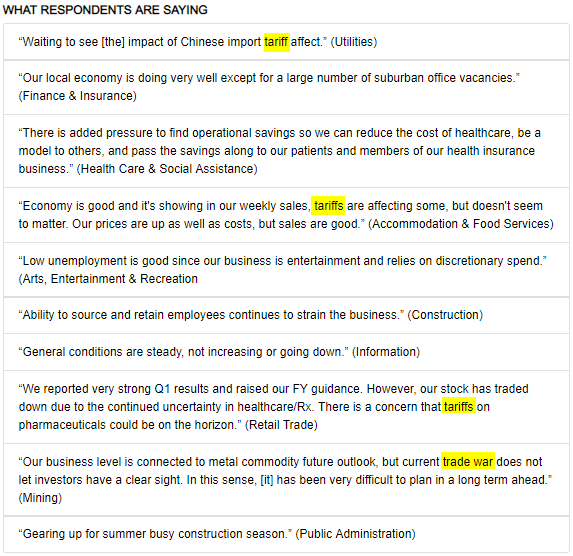

As you might recall, tariffs were a major issue in the commentary section of the ISM Manufacturing report, and while they were also an issue in the commentary section of the Services report, it wasn’t as prevalent. As shown in the graphic below, the issue only showed up in four of the ten comments, and in one of them it was saying that the issue of tariffs “doesn’t seem to matter.”

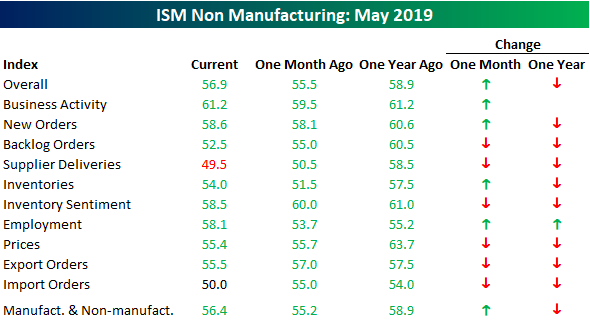

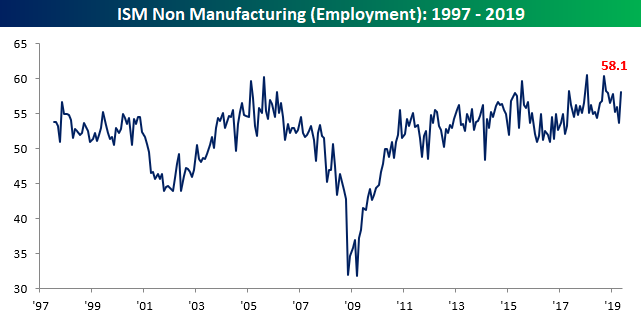

While the headline reading of the ISM Services report showed a m/m increase, breadth in this month’s report wasn’t particularly strong. Of the index’s ten subcomponents, six showed m/m declines in May and eight showed y/y declines. One positive outlier, though, was Employment, which increased from 53.7 up to 58.1. It figures that on the same day we saw the weakest ADP Private Payrolls report in nearly a decade, that we would also see the largest m/m increase in the Employment component of the ISM Services report in two years. Really clears things up! Start a two-week free trial to Bespoke Institutional to access all of our research and interactive tools.

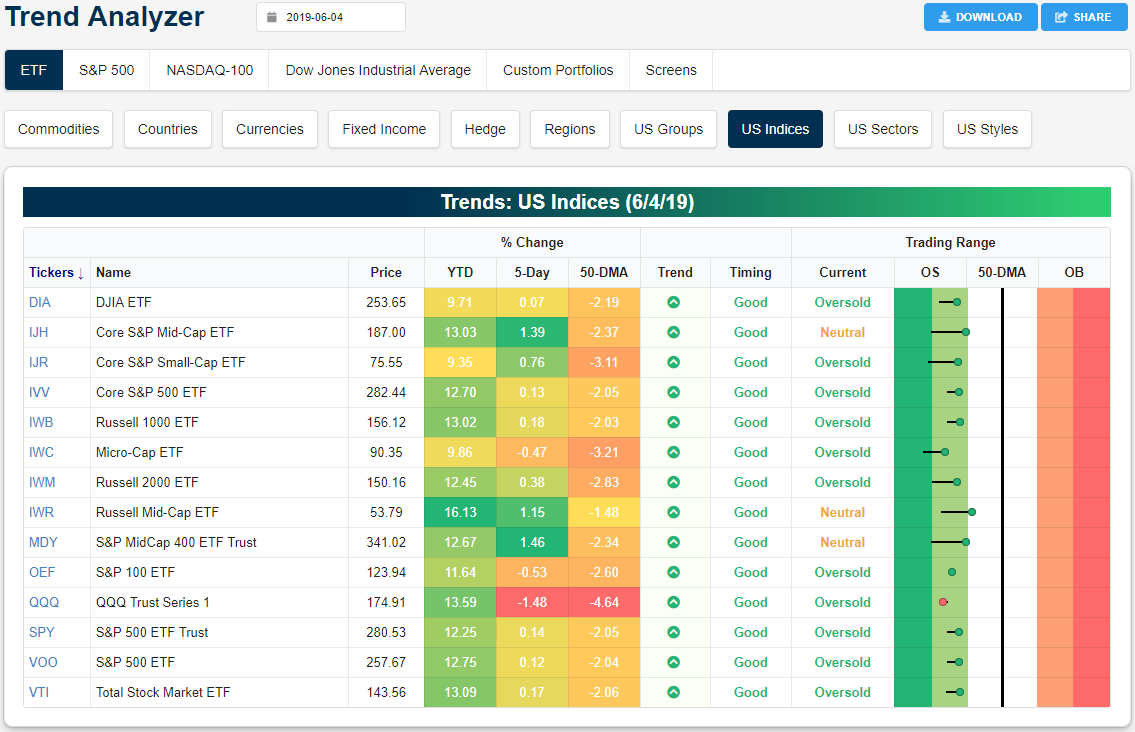

Trend Analyzer – 6/5/19 – Goodbye Oversold?

Equities’ massive rally in yesterday’s session was exactly what the major index ETFs needed to work off the extreme oversold levels they have been sitting in or around for the past week. Currently, none of these ETFs are sitting at extreme levels, though, 11 are still oversold. For most, these oversold levels are actually teetering on neutral after yesterday’s 2%+ rally! The three mid-cap ETFs have actually moved into neutral territory. All three of these have outperformed in the past week with gains well over 1%. No other index ETF comes close to these gains. On the other end of the spectrum, the Nasdaq (QQQ) is still sitting 1.48% lower than 5 days ago and is the only one of the group to be more oversold than it was last week (as seen through the red dot, rather than green, in the Trading Range section of the Trend Analyzer). Start a two-week free trial to Bespoke Institutional to access our Trend Analyzer, Chart Scanner and much more.

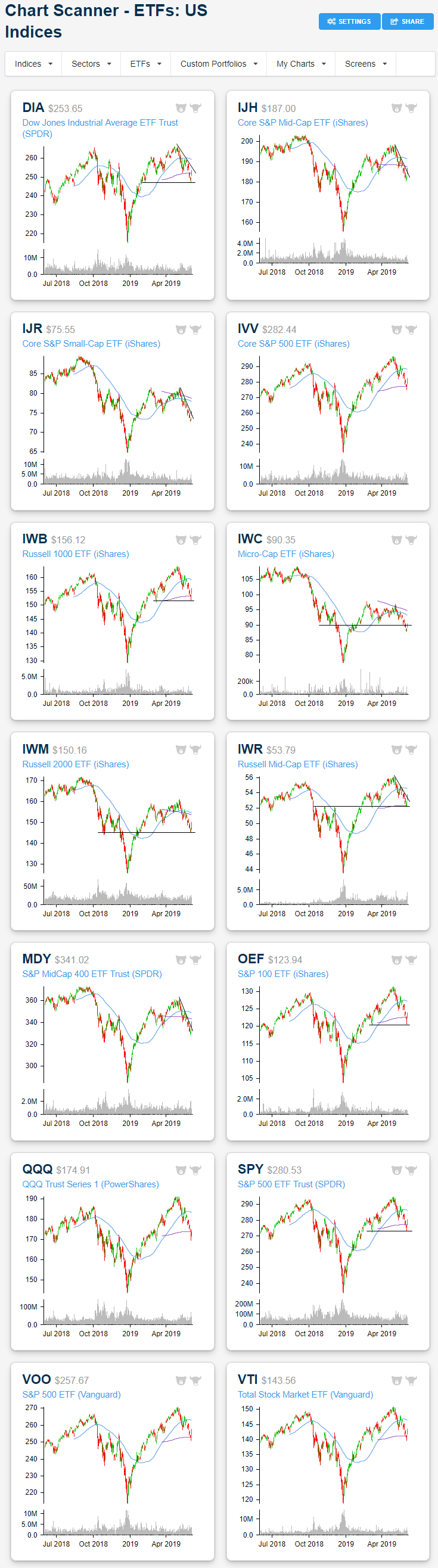

Using our Chart Scanner tool to pan through the charts of these same ETFs, most of the major indices are still sitting in short-term downtrends, though, yesterday’s surge helped to lift some slightly above the downtrend lines or at least to the top of these downtrend channels. Another interesting technical point to make: over the past few sessions, several of these ETFs including the Total Stock Market ETF (VTI), the S&P 500 (SPY and VOO), Nasdaq (QQQ), Russell Mid Cap (IWR), Russell 1000 (IWB), and S&P 100 (OEF) have found support around lows from a pullback earlier in the year when the market ran up to prior resistance at last year’s highs before the sharp December sell-off. Some like IWR and IWB have also found support at their moving averages. Others like the Core S&P Mid-Cap (IJH), the Core S&P Small Cap (IJR), and the Micro-Cap ETF (IWC) have fallen through these levels recently and now sit at the lower end of the range from last fall.

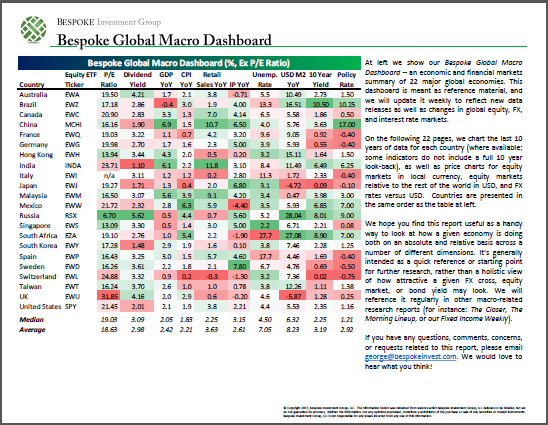

Bespoke’s Global Macro Dashboard — 6/5/19

Bespoke’s Global Macro Dashboard is a high-level summary of 22 major economies from around the world. For each country, we provide charts of local equity market prices, relative performance versus global equities, price to earnings ratios, dividend yields, economic growth, unemployment, retail sales and industrial production growth, inflation, money supply, spot FX performance versus the dollar, policy rate, and ten year local government bond yield interest rates. The report is intended as a tool for both reference and idea generation. It’s clients’ first stop for basic background info on how a given economy is performing, and what issues are driving the narrative for that economy. The dashboard helps you get up to speed on and keep track of the basics for the most important economies around the world, informing starting points for further research and risk management. It’s published weekly every Wednesday at the Bespoke Institutional membership level.

You can access our Global Macro Dashboard by starting a 14-day free trial to Bespoke Institutional now!

Ambarella (AMBA) Up 9% on Earnings Triple Play

Chip-maker Ambarella (AMBA) is trading up 9% after reporting an earnings triple play after the close of trading last night. An earnings triple play occurs when a stock beats consensus EPS estimates, beats revenue estimates, and raises forward guidance. While EPS beat by 7 cents ($0.01 vs. -$0.07 est.), revenues managed to just barely beat by $180,000 ($47.2 million vs. $47.02 estimates). But…a beat is a beat.

Ambarella is certainly in the sweet spot of the semiconductor space it seems. The company was only founded 15 years ago in 2004, but its low-power/high def chips are key for tech products like video security, advanced driver assistance systems, fully autonomous driving, and robotics.

Bespoke Institutional subscribers have access to our popular Earnings Explorer tool. One of the sections of the tool allows you to search for individual stocks to see historical earnings results for the company. Below is a snapshot of AMBA pulled directly from the Earnings Explorer. As shown, AMBA has historically beaten EPS estimates 100% of the time since it went public in 2012. This quarter’s EPS beat was the company’s 27th in a row! Talk about consistency. In terms of sales, the company has a 96% beat rate, which means it has only missed sales estimates once in twenty-seven quarterly reports.

While AMBA has no problem beating EPS and sales estimates, it lowers guidance quite often. In just the last ten quarters, AMBA has lowered guidance eight times. Prior to this quarter, AMBA had lowered guidance for five quarters in a row. That’s what makes this quarter’s report so impressive. Instead of lowering guidance as the company usually does, it raised guidance this time around. This is only the second time that the company has raised guidance on a quarterly report since it went public. As highlighted in the table below, the last time AMBA raised guidance on November 30th, 2017, it opened higher by 8.5% and then continued to trade higher by another 5.3% from the open to the close. Its full-day change that day was +14.3%. Again, AMBA is set to gap higher at the open this morning by about 9%. Will the same trend of intraday buying that happened the last time AMBA raised guidance occur once again today? We’ll find out soon enough. Start a two-week free trial to Bespoke Institutional to unlock our Earnings Explorer tool and much more.

Morning Lineup – ADP.U.

The bulls are out again this morning, but an ADP Private Payrolls that simply stinks has dampened the mood. While economists were expecting the headline reading to come in at 185K, the actual reading was just 27K. That was the weakest monthly print since March 2010 and the third weakest report relative to expectations since at least 2006.

Outside of the US, the World Bank lowered its global growth forecast down by 0.3 percentage points to 2.6% and said that risks to the global economy are firmly on the downside. On a similar note, the IMF lowered its growth forecasts for China slightly just as the May Services PMI for that country came in lower than expected. In Europe, Services PMI data was slightly better than expected coming in at a level of 52.9 compared to expectations of 52.5. Even if the economic outlook is cloudy, investors have been encouraged by the belief that the Fed is ready to act if needed. Whether the market and FOMC are both on the same page with regards to what “needed” means, though, is up for debate, but more data like this morning’s ADP report will likely move the FOMC closer to acting.

Please click the link below to read today’s Bespoke Morning Lineup for our take on what the rates markets are pricing, a recap of services sector PMIs, and just as important the latest data on Semiconductor sales.

As mentioned above, the ADP Private Payrolls report just came in weaker than expected, missing consensus expectations by over 150K. Using our Economic Indicator Database, we found that this month’s report was the weakest relative to expectations since January 2009 and just the third time since 2006 that the report has missed expectations by more than 100K.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.

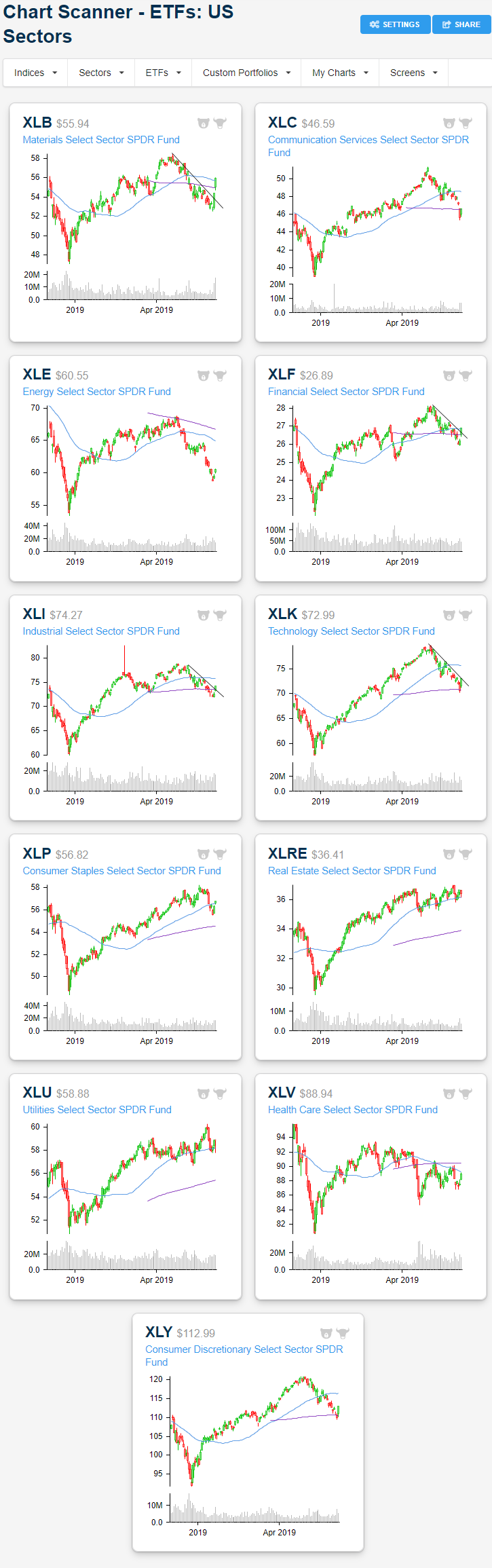

Equities Bounce Back Across Sectors

Equities roared back to life in Tuesday’s session as the major indices regained all of Monday’s losses and then some with the S&P 500 seeing its second strongest day of the year. Breadth was pretty strong among sectors as all but one, Real Estate (XLRE), finished the day higher. The Technology Sector (XLK) rose the most, surging 3.34%. This is only one day after a rout of tech giants (like Alphabet (GOOGL) and Apple (AAPL) in response to government investigations) dragged on XLK to finish the day just below the 200-DMA. Names like Facebook (FB) similarly dragged on the Communication Services sector (XLC) for the same reasons, but these losses were mostly made up for on Tuesday. Semis were a major factor in Tuesday’s tech rally as names like Advanced Micro Devices (AMD) and Nvidia (NVDA) rose as much as 7%. Materials (XLB) were the second best performing sector of the day as breadth in the sector was very strong with DowDuPont (DD) being the only S&P 500 Materials stock to be lower at Tuesday’s close. After gapping up to just above the 200-DMA, XLB rose further taking out the 50-DMA and finishing the day 2.81% higher. In addition to taking out the moving averages, XLB also broke out of its recent short term downtrend in dramatic fashion. Industrials (XLI) similarly saw a break out of its downtrend. Other cyclicals, the Financial Sector (XLF) and Consumer Discretionary (XLY), also performed well with both rising 2.71%. XLF’s chart has a similar pattern to XLB with Tuesday’s opening price sitting at the 200-DMA and finishing above the 50-DMA while also breaking out of its downtrend.

While cyclicals were bid up, defensives underperformed. The Consumer Staples sector was the best performing of the defensives as it rose 0.91%. Utilities (XLU) also managed to finish in the green, but it only rose 8.5 bps. Granted, Utilities finished well off of the day’s lows. Intraday, the sector had briefly dipped all the way below the 50-DMA. Finally, as previously mentioned, Real Estate (XLRE) was the only sector to move lower on the day, finishing down 0.55%. Similar to XLU, Real Estate finished off of the day’s lows near the 50-DMA. Start a two-week free trial to Bespoke Institutional to access our interactive Chart Scanner tool and much more.

The Closer – Unsustainable Surge, Fed vs Market, EM Rally, Auto Results – 6/4/19

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we review the internals of today’s surge in equity prices and evaluate how sustainable this rally could be given breadth and price action in credit markets. Next, we provide our analysis of how the disconnect between the market and the Fed in regards to rate cuts in the near future. We then update our Bespoke EMFX Index which has popped higher. We finish with a look at the bounce in automakers and today’s Factory Orders release.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

B.I.G. Tips – Treasury Yields Coming Off Extremes

We’ve just published a B.I.G. Tips report that discusses the recent plunge in 10-year yields and provides a look at how stocks and bonds have followed through in similar periods where the yield in the 10-year reached extremely low levels. To put the recent move in perspective, levels like Monday’s have only been recorded on thirteen prior days in the last 30 years! To read this report and access all of our other reports, start a two-week free trial to Bespoke Premium!

Severe Off-Season Earnings Weakness

Using our Earnings Explorer tool, we did a quick check today on how companies that have reported during this “off-season” have done. There have been 141 earnings reports since May 17th when the first quarter reporting period ended. Of these 141 reports, 71% reported stronger than expected EPS, while 62% reported stronger than expected sales. Only 6% have raised forward guidance while 11% have lowered guidance.

In terms of how company share prices have reacted to their reports this off-season, it has essentially been a bloodbath. The average stock that has reported has fallen 1.31% on its earnings reaction day, which is the first trading day following its earnings report. (For companies that report in the morning, its earnings reaction day is that trading day. For companies that report after the close, its earnings reaction day is the next trading day.)

Our rolling 3-month beat rate charts still show downtrends. While the bottom-line EPS beat rate remains nearly 3 points above its historical average, the top-line sales beat rate has recently dipped slightly below its average.

You can track the performance of individual stocks in reaction to earnings using our Earnings Explorer tool, but below is a list we pulled that shows the worst performing stocks in reaction to earnings since the “off-season” began on May 17th. Twenty-two of the 141 stocks that have reported this off-season have fallen more than 10% on their earnings reaction days. The list is littered with retailers like J. Jill (JILL), Canada Goose (GOOS), Abercrombie & Fitch (ANF), Foot Locker (FL), Kohl’s (KSS), Lowe’s (LOW), Urban Outfitters (URBN), and Nodstrom (JWN). Start a two-week free trial to Bespoke Institutional to unlock our Earnings Explorer tool and much more.