B.I.G. Tips – Fed Easing Cycles

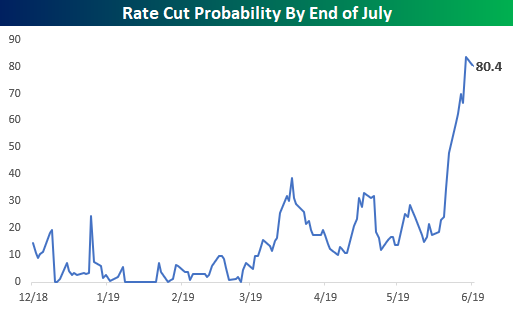

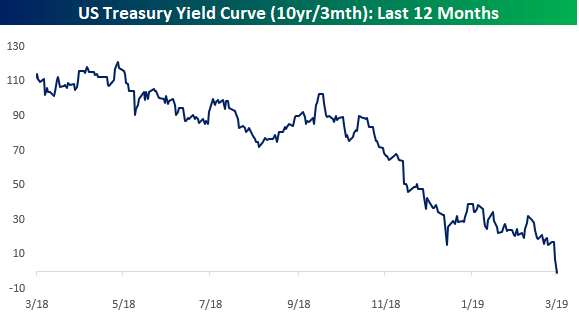

After the last ten to twenty years of market ups and downs, it takes a lot to surprise experienced investors. One recent trend that qualifies, though, is the rapid and aggressive pricing of Fed rate cuts in the coming months. The futures market is pricing in over an 80% chance that the FOMC will cut rates between now and the end of July. This comes even as there has been an absence of any overwhelmingly supportive or consistent commentary from Fed officials suggesting that rate cuts are imminent.

With rate cuts likely on the horizon, it’s time to look back at prior rate-cutting cycles from the FOMC to see how equities performed leading up to and after the first cut in an easing cycle. To do this, we looked at all prior periods in the last thirty years where the FOMC cut rates at least three times after a series of hikes. While we could have gone back further in our analysis, the last thirty years essentially covers the period since Greenspan became the Fed chair, and it also wasn’t even until 1994 that the FOMC actually announced what the interest rate policy was on the day of their meetings. Therefore, the further you go back in time the less relevance there is to circumstances today. Interestingly enough, at 1,272 calendar days and counting, the current rate hike cycle has been the longest of the last 30 years. Our latest B.I.G. Tips report provides an insightful look at the stock market’s performance during prior rate cut cycles. To see the report, sign up for a monthly Bespoke Premium membership now!

Rally Leads to Breakouts

Below are a handful of charts we wanted to highlight after browsing through our Chart Scanner tool over the weekend.

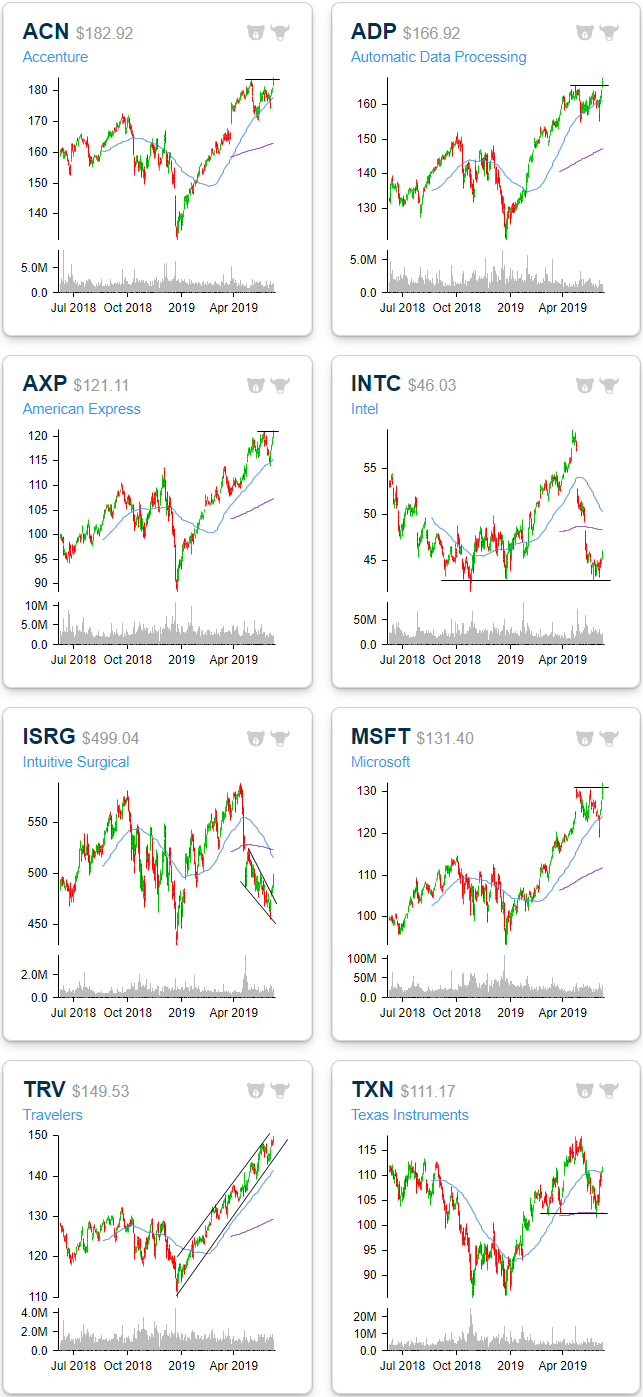

The strong rally off of oversold levels last week was a tide that lifted just about all boats. This was a sigh of relief for some individual stocks that have been breaking down recently like two of the semis, Intel (INTC) and Texas Instruments (TXN). Since the end of April, tariff talks had been hitting the semiconductor stocks hard. In INTC’s case, this also played a role in lowered guidance in the most recent earnings report on April 25th. These declines brought TXN down to the 200-DMA in addition to lows from earlier in the year and INTC all the way back down to 2018 lows. Both have found support at these levels, though, and last week’s rally was a sizeable bounce off of this support. TXN has even now managed to retake its 50-DMA. Similarly, Intuitive Surgical (ISRG) has been pretty volatile over the past year and since April has been in a short term downtrend and oversold. Last week’s price action helped to break the stock out of this downtrend.

Other stocks have been stronger in the past year and sit in longer-term uptrends. Traveler’s (TRV), for example, has been trading in a steady uptrend all year with last week’s gains bringing it to the upper end of this channel. Others like Accenture (ACN), Automatic Data Processing (ADP), American Express (AXP), and Microsoft (MSFT) have broken out to new highs. This is after all four constructively found support at their 50-DMAs. Start a two-week free trial to Bespoke Institutional to access our interactive Chart Scanner and much more.

Broad Participation During Last Week’s Rally

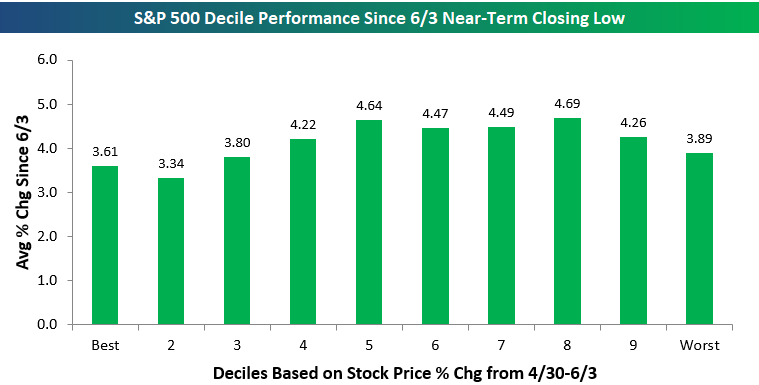

The average stock in the S&P 500 has gained 4.14% since last Monday’s near-term closing low. Usually, when we see such a strong bounce after a period of weakness, we see the stocks that were down the most during the pullback rally back the most during the bounce. That hasn’t been the case this time around, though.

We broke the S&P 500 into deciles (10 groups of 50 stocks) based on stock performance during the market’s pullback from 4/30-6/3. We then calculated the average performance of the stocks in each decile since 6/3. As shown in the chart below, each decile has seen an average gain between 3.34% and 4.69%. The stocks that held up the best during the pullback are up an average of 3.61% since 6/3, while the stocks that fell the most during the pullback are up an average of 3.89%. We usually see more disparity between these two deciles in this type of market environment. Instead of bidding up the biggest losers during the sell-off, last week’s rally was much more evenly distributed.

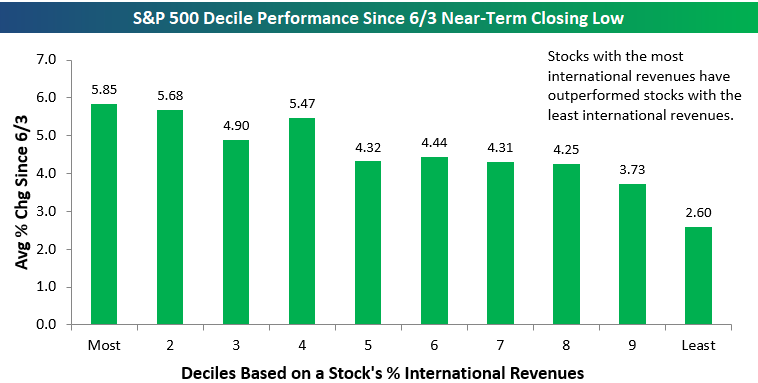

One stock characteristic that did have an impact was international revenue exposure. During the market’s sell-off in May on trade fears, S&P 500 stocks that generate the bulk of their revenues outside of the US were crushed. Stocks with all domestic revenues that are much more insulated from tariffs held up much better in May.

We’ve seen outperformance from stocks with heavy international revenue exposure since last Monday. As shown below, the decile of S&P 500 stocks with the most international revenues has posted an average gain of 5.85%, while decile 2 has posted an average gain of 5.68%. On the flip side, stocks with nearly all domestic revenues are only up 2.6% on average since last Monday.

The “internationals” are still down quite a bit from their Q1 highs, so if trade concerns continue to ease, these stocks stand to benefit the most. Bespoke maintains an “International Revenues” database that allows subscribers to find the geographic revenue breakdown for all stocks in the Russell 1,000 and S&P 500. (Click here to access.) It’s a very useful tool if you’re looking for buying or selling opportunities in the current market environment. Start a two-week free trial to Bespoke Premium to unlock our International Revenues tool!

Chart of the Day: Can Materials Keep Going?

Gauging the Bounce

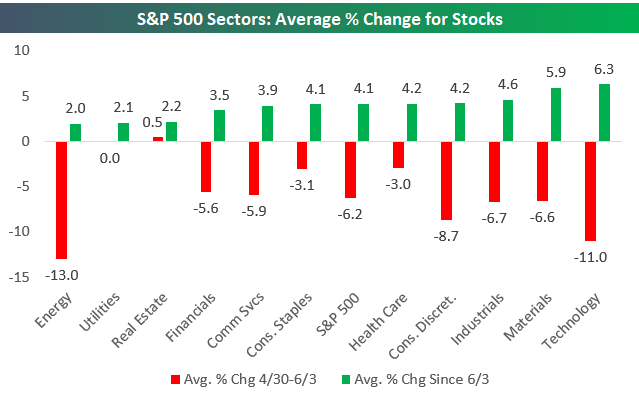

The average S&P 500 stock fell 6.2% from 4/30 (when the index made its last all-time closing high) through last Monday (June 3rd). Since the close last Monday, the average stock in the index has bounced back 4.1%.

Below is a look at how stocks within sectors have performed recently. During the pullback from 4/30 to 6/3, Energy stocks fell the most of any sector at -13%. Energy stocks have also bounced back the least since 6/3 with an average gain of just 2%. Technology stocks fell the second most during the pullback with an average decline of 11%, but Tech has bounced back the most since 6/3 with an average gain of 6.3%.

Notably, some sectors have seen average gains since 6/3 that are bigger on an absolute basis than the declines they saw during the pullback. The average Utilities stock was flat from 4/30-6/3, but since then the average stock in the sector has rallied 2.1%. The average Real Estate stock actually gained from 4/30-6/3, and since then the sector has seen an average gain of 2.2%.

Consumer Staples and Health Care both saw average declines of roughly 3% during the 4/30-6/3 pullback, and they have bounced back by an average of just over 4% since 6/3.

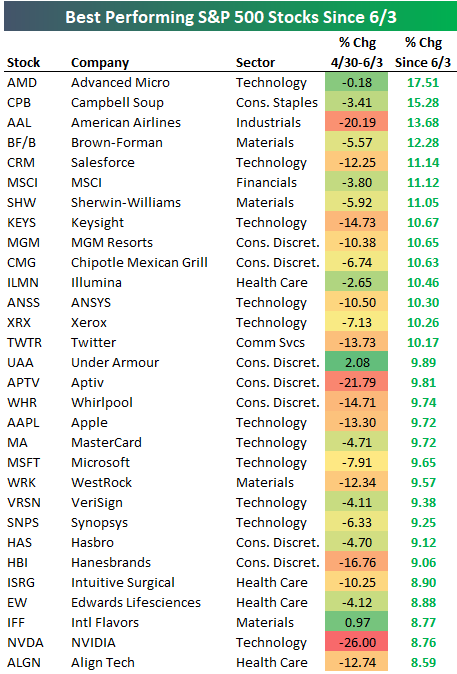

Below is a look at the best performing stocks since the S&P’s recent closing low on 6/3. Advanced Micro (AMD) is up the most of any stock in the S&P with a gain of 17.51%. Campbell Soup (CPB) — a company that couldn’t be much more different than AMD — is up the second most since 6/3 with a gain of 15.28%. American Airlines (AAL), Brown-Forman (BF/B), and Salesforce (CRM) round out the top five with gains of more than 11% each. Other notables on the list of winners include Chipotle (CMG), Twitter (TWTR), Under Armour (UAA), Apple (AAPL), MasterCard (MA), Microsoft (MSFT), and NVIDIA (NVDA). Start a two-week free trial to Bespoke Premium to unlock our premium research and investor tools!

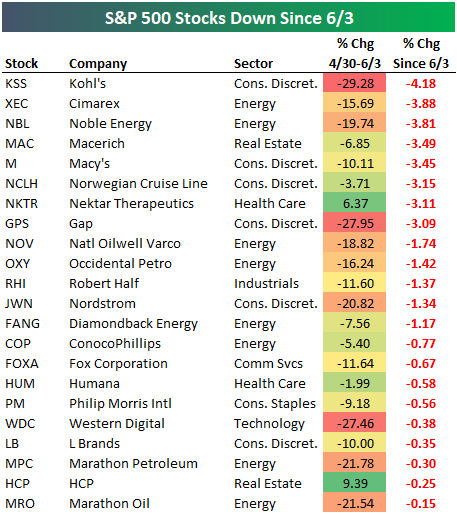

Below is a list of the 22 stocks in the S&P 500 that have the distinction of being down since last Monday. Kohl’s (KSS) is down the most with a decline of 4.18%, followed by Cimarex (XEC), Noble Energy (NBL), and Macerich (MAC). Other notables include retailers like Macy’s (M), Gap (GPS), Nordstrom (JWN), and L Brands (LB).

Morning Lineup – Merger Monday Provides a Positive Encore

After the first ‘perfect’ week for the DJIA since May 2018, a slew of mergers and the deal with Mexico are helping to kick off the week on a positive note providing a nice encore to last week’s gains. In terms of economic data, the week is starting off slow but will progressively pick up as the week goes on.

Please read today’s Morning Lineup for our latest take on events from the weekend, overnight, and this morning.

Sectors have seen quite a move within their trading ranges over the last week. As shown in the chart below, at this time a week ago the S&P 500 and every sector were trading below their 50-day moving averages and most were oversold. Fast forward five days and there are now just three sectors below their 50-DMA, and Energy is the only sector that is oversold. Meanwhile, both Consumer Staples and Utilities have moved back into ‘extreme’ overbought territory.

As far as the major averages are concerned, while the S&P 500 is trading back above its 50 and 200-DMAs, the Nasdaq 100 is still below its 50-DMA, and the Russell 2000 isn’t above either of those thresholds. If the rally is going to keep on going, they have a lot of catching up to do.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.

Bespoke Brunch Reads: 6/9/19

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium for 3 months for just $95 with our 2019 Annual Outlook special offer.

Trade Wars

Trump’s Tariffs Could Nullify Tax Cut, Clouding Economic Picture by Jim Tankersley (NYT)

While tax cuts passed at the end of 2017 had a positive effect on household incomes, new tariffs rolled out over the last two years are raising costs and clawing back all the benefits of the tax cut for some households. In other words, this is the substitution of one kind of tax for another. [Link; soft paywall]

Chinese goods navigate alternate trade routes to US shores by Kyo Kitazume, Tomoya Onishi, and Yusho Cho (Nikkei Asian Review)

Companies are relocating production from China to other economies not impacted by tariffs, but trade flows are also being routed from producers in China through third-party economies that aren’t facing the same tariffs. [Link]

Fraud

The Couple Who Feds Say Scammed Berkshire Hathaway for Millions by Brian Eckhouse, Katherine Chiglinsky, and Mark Chediak (Bloomberg)

Solar financing company that got investment from Berkshire among many others was a Ponzi scheme, using a tax credit system to lure investors into plunking hundreds of millions into funds tied to the fraud. [Link; soft paywall]

Florida

Who is Florida Man? by Bob Norman (Columbia Journalism Review)

How wildly viral headlines tied to the odd crimes of Floridians cast light on the darker corners of the media landscape and the grim monetization of human pain. [Link]

Florida County School Board Approves Medical Marijuana Access in Public Schools by A. J. Herrington (High Times)

Students who have prescribed cannabis medications administered by a student’s parent or caregiver (and excluding smoking or inhalation-based treatments) will be permitted to use the treatments in Palm Beach County schools. [Link]

Homeowners

14 Millennials Got Honest About How They Afforded Homeownership by Anne Helen Petersen (Buzzfeed News)

Anecdotes from a range of 20 or 30-somethings that have bought homes. Notably, only one of the fourteen with a down payment over $10k was able to buy a home without parental contribution to down payments. [Link]

HOAs Are Popular Where Prejudice Is Strong and Government Is Weak by David Montgomery (City Lab)

More than half of single family homes are part of an HOA, but that number is greater than 80% when it comes to new homes. HOA homes tend to command higher price premiums in the South and West and tend to command higher price premiums in areas with less local land use regulation. [Link]

Data

Microsoft, Nasdaq, and Refinitiv empower everyday investors with real-time data and insights in Excel by Rob Howard (Microsoft)

In a new feature for Microsoft Excel, users will be able to stream real-time stock prices for free in updated versions of the ubiquitous spreadsheet software. [Link]

Boeing

Boeing Built Deadly Assumptions Into 737 Max, Blind to a Late Design Change by Jack Nicas, Natalie Kitroeff, David Gelles, and James Glanz (NYT)

More details on how the 737-MAX ended up with a huge design flaw that resulted in multiple fatal crashes. [Link; soft paywall]

Science

Laser flight path caught on camera for the first time by Jacob Aron (New Scientist)

This isn’t new news, but it’s still pretty cool: extremely high framerates allowed scientists to capture the path of laser beams through the air. [Link]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!

The Bespoke Report — Negative Void Coefficient

This week’s Bespoke Report newsletter is now available for members. Equity markets surged despite short term interest rate markets pricing near-certainty of multiple Fed rate cuts this year. How can an economy so bad that the Fed needs to cut mean stocks go up? We take a look around for some answers. We also review just how dovish the Fed has been relative to what markets have been pricing of late. While the domestic economy has definitely slowed down from the torrid pace of 2018, even the disappointing nonfarm payrolls number today paints a different picture than assumptions of multiple cuts from the front end. The global economy is less constructive, but there’s a difference between weakness and a recession panic, as we show. Finally, we present an argument for why Fed rate cuts may not be necessary for the economy to stabilize and start to pick up again thanks to negative feedback loops.

We cover everything you need to know as an investor in this week’s Bespoke Report newsletter. To read the Bespoke Report and access everything else Bespoke’s research platform has to offer, start a two-week free trial to one of our three membership levels. You won’t be disappointed!

The Closer: End of Week Charts — 6/7/19

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke clients, we recap weekly price action in major asset classes, update economic surprise index data for major economies, chart the weekly Commitment of Traders report from the CFTC, and provide our normal nightly update on ETF performance, volume and price movers, and the Bespoke Market Timing Model. We also take a look at the trend in various developed market FX markets.

The Closer is one of our most popular reports, and you can sign up for a free trial below to see it!

See tonight’s Closer by starting a two-week free trial to Bespoke Institutional now!

Earnings Disasters

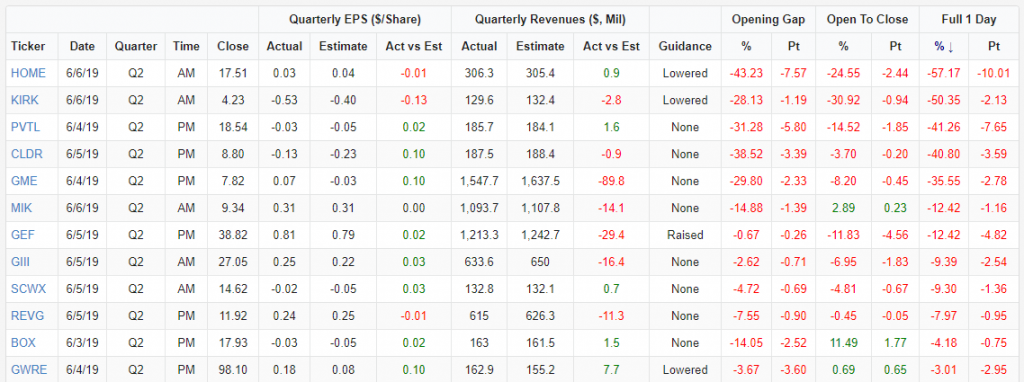

While the broad stock market had a banner week, companies that reported earnings this week generally did not. A total of 42 companies reported earnings this week, and the price reactions certainly left something to be desired. The average stock that reported this week opened down 2.44%, then traded down another 1.75% from the open to the close. The average full-day change for the 42 stocks that reported this week was a decline of 3.63%.

Below is a snapshot of the stocks that had the most negative price reactions to earnings this week:

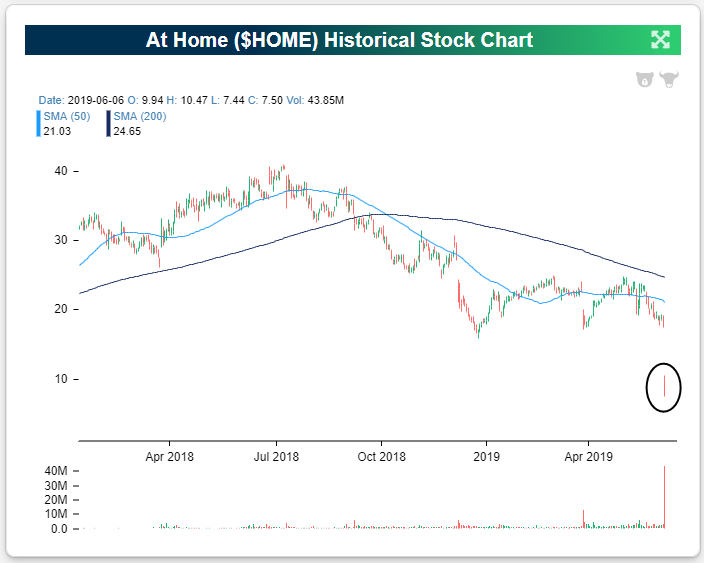

Home furnishing retailer At Home (HOME) tops the list of losers after the stock lost more than half of its value after its most recent earnings report Thursday morning. On top of lowering guidance, the company was expected to see EPS fall to $0.04, a massive decline versus the previous quarter’s $0.47 and last year’s Q2 $0.34, but the company reported an even worse EPS of $0.03. This profitability drop overshadowed YoY revenue growth of just over 6%. The stock’s complete collapse yesterday accelerated what was already a long-term downtrend, bringing the stock to an all-time low.

Another specialty home decor retailer, Kirkland’s (KIRK), reported its second abysmal quarter in a row with lowered guidance, lower and negative EPS, and a miss in revenues. Last quarter saw a similarly poor report and the stock slid 23.38% in response. The punishment kept coming this time around as the stock was cut in half, falling from $4.23 at Wednesday’s close to $2.10 by the end of the day Thursday; the stock’s lowest level in over a decade.

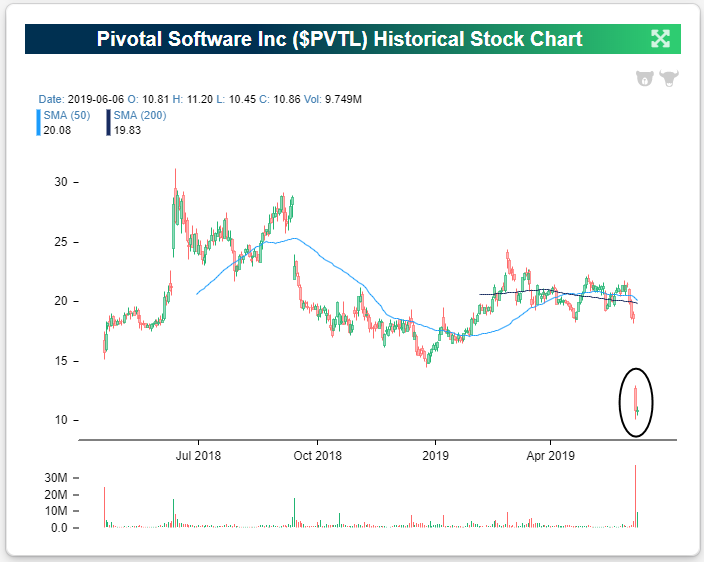

At first glance, cloud services provider Pivotal Software’s (PVTL) most recent quarter may not have looked too bad, especially given its solid earnings history headed into the report. Even after Tuesday’s report, the company has never missed an EPS estimate in its history, and it has only missed revenue estimates once (the prior quarter). Despite maintaining this pretty strong track record, PVTL fell 41.26% in response in Wednesday’s trading. These declines were a result of weakness under the hood of this report. PVTL claimed several deals had fallen through and competition had become more of a headwind. In turn, the stock received multiple analyst downgrades. This perfect storm leaves the stock near all-time lows and 36.12% below its price when the stock first hit the market just over one year ago. Start a two-week free trial to Bespoke Premium to use our Earnings Calendar and other tools!