The Closer: End of Week Charts — 6/21/19

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke clients, we recap weekly price action in major asset classes, update economic surprise index data for major economies, chart the weekly Commitment of Traders report from the CFTC, and provide our normal nightly update on ETF performance, volume and price movers, and the Bespoke Market Timing Model. We also take a look at the trend in various developed market FX markets.

The Closer is one of our most popular reports, and you can sign up for a free trial below to see it!

See tonight’s Closer by starting a two-week free trial to Bespoke Institutional now!

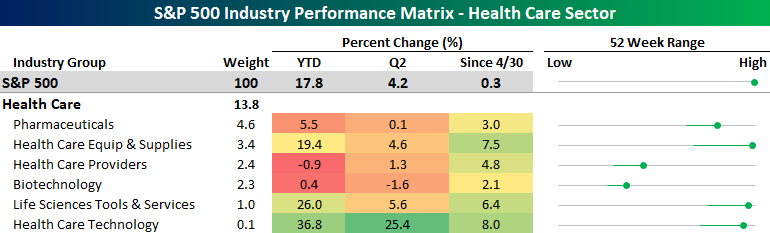

Broad Strength in Health Care Sector

In an earlier post, we highlighted the fact that some of the ten best performing S&P 500 Industries between the S&P 500’s highs on 4/30 and 6/20 were from the Health Care sector. It hasn’t just been these four industries that have been strong in the Health Care sector either. The performance snapshot of the sector below shows just how strong the sector has been lately. While all six of the industries within the sector aren’t up YTD or so far in Q2, between the S&P 500’s highs on 4/30 and 6/20, Health Care is the only sector where every industry within the sector has posted positive returns. Not even the industries within the Utilities sector have been this uniformly positive. The best performer of the bunch has been Health Care Technology, which is up 8% since the end of April and has extended its YTD gain to 36.8%. The worst performing industry in the sector has been Biotech which is up 2.1% since 4/30, and while that may not sound like much, it’s still better than more than half of the other industries in the index. Start a two-week free trial to Bespoke Institutional to access our interactive tools and much more.

Best and Worst Groups Between Highs

While the S&P 500 made a new high for the first time in 35 trading days yesterday, many of the characteristics of the groups driving the rally have shifted. To highlight this, in the table below we summarize the ten best and worst performing S&P 500 Industries from the close on 4/30 through yesterday. During that 35 trading day stretch, 34 Industries saw positive returns while another 27 declined.

Industries that have seen the biggest gains between the two new highs are primarily defensive in nature as all but three come from sectors that are typically considered defensive (Consumer Staples, Health Care, and Real Estate). Health Care has been the real star of the show, though. Of the sector’s six different industries, four of them made the top ten!

On the downside, cyclical industries have dominated the weak side. When industries like Semis, Autos, Construction & Engineering, and Air Freight are lagging the market, it really illustrates the presence of economic concerns. Leading the way lower, Energy Equipment and Services declined over 10%, followed by Semiconductors which were down just under 10% after failing at resistance on Thursday for the third time in a month. These two industries are followed by two industries (Tobacco and Power and Renewable Energy) that come from sectors that are traditionally considered defensive, but they have their own specific issues to deal with. Start a two-week free trial to Bespoke Institutional to access our interactive tools and much more.

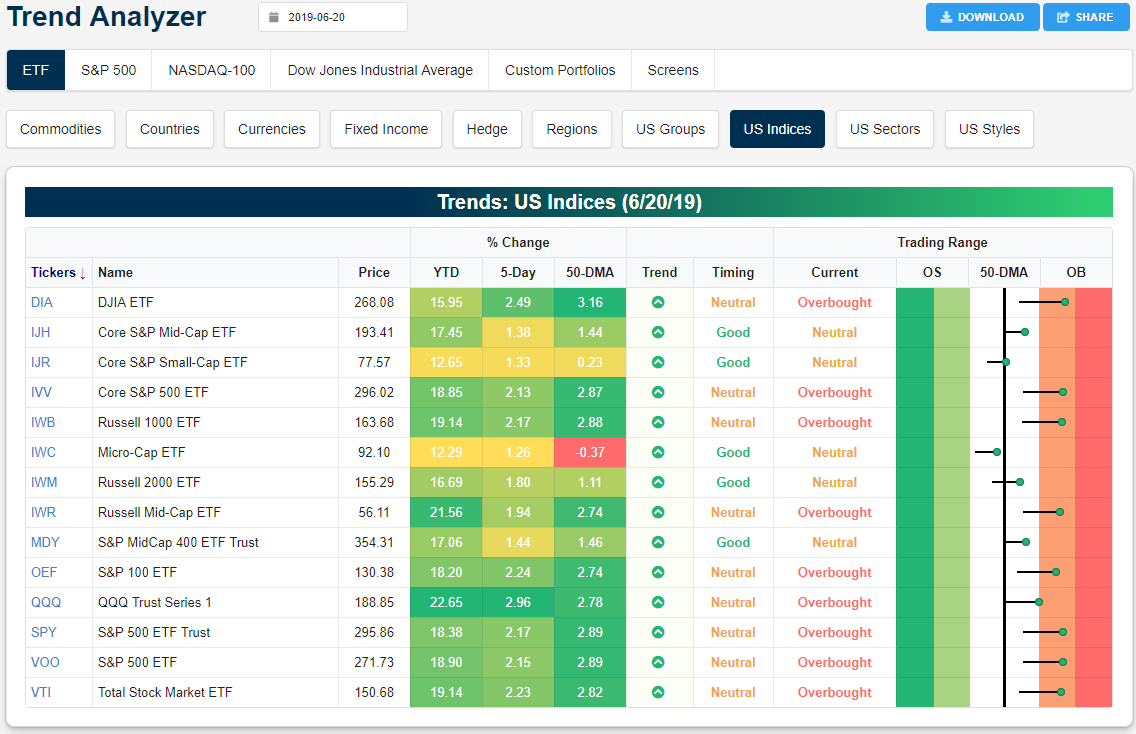

Trend Analyzer – 6/20/19 – Only Defensives Are Also At Highs

The major index ETFs began the day yesterday split down the middle with half overbought and the other half still neutral. A large gap higher at the open led to a few more also entering overbought territory; namely the large-cap S&P 100 (OEF) and Nasdaq (QQQ). Of this group, QQQ has surged the most over the past week and is now sitting almost 3% higher. While the gap higher did make conditions generally more overbought across the board, some intraday selling prevented things from reaching any sort of extreme level. With the Core S&P Small-Cap’s (IJR) gains in yesterday’s session, only the Micro-Cap ETF (IWC) still remains below the 50-DMA.

Panning over the charts of these same ETFs, the breakout to new highs is evident only for large caps. The Dow (DIA), Russell 1000 (IWB), and S&P 500 (SPY) clearly finished at new highs. The only non-large cap index ETF to also reach a new high is the Russell Mid Cap (IWR). Other small caps and mid caps all have a long way to go to reach last year’s highs though they have been progressing upwards in recent weeks.

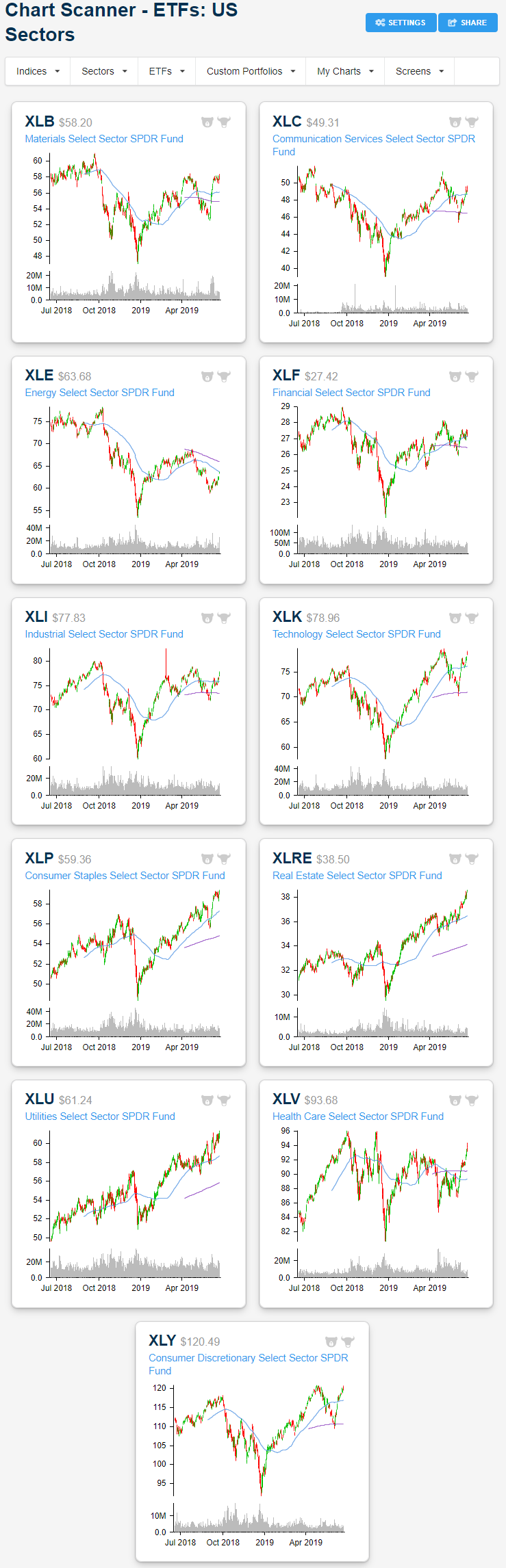

With the market reaching new highs, one would expect that most of the movement has been a result of cyclical high growth sectors, but that simply has not been the case. Defensives have continued to perform well with Consumer Staples (XLP), Utilities (XLU), Health Care (XLV), and Real Estate (XLRE) all sitting firmly at extremely overbought levels on solid gains (though XLP has lagged a bit this week). But now cyclical sectors have also begun to see a string of buying in the past week. Sectors like Communication Services (XLC), Industrials (XLI), and Tech (XLK) have all risen well over 2.5% and are slightly outperforming this week. While the performance of these sectors has been strong, Energy (XLE) has actually seen the largest gains over the past five days as it works off oversold readings from last week. This is also the only sector that is not in an uptrend. With yesterday’s substantial gains, it heads into trading today just barely below the 50-DMA.

The charts of the defensives are a bit better of a look into just how much they have outperformed in recent weeks. For most of the year, these have sat in solid, and relatively uninterrupted, uptrends. Whereas other sectors still sit a decent distance off of their 52-week highs, XLU, XLP, and XLRE all finished yesterday at another new high. Given that these sectors have become overextended, it is increasingly likely that they could see some sort of pullback. Additionally, while defensives have sat in uptrends (with their moving averages reflecting this), other sectors’, like Materials (XLB), Communication Services (XLC), and Industrials (XLI), moving averages have become very flat recently. XLE, despite strong performance this week, actually still has downward sloping moving averages.

Morning Lineup – On Again, Off Again

After authorizing a strike on Iran last night, President Trump reportedly abruptly called it off, putting the US’s response to the shooting down of a drone over international waters into question again. US futures, understandably, are trading modestly lower on the uncertainty as the on again off again series of breakouts to new highs pauses again. Since January of last year, the S&P 500 has now made four separate runs to new highs, but in the grand scheme of things has little to show for it, although so far in 2019, the first half is shaping up to be a very good one.

Ahead of the weekend today, there are no earnings reports to speak of, but we will get PMI data from Markit for June, and US Existing Home Sales at 10 AM

Please read today’s Morning Lineup for a discussion of the latest events surrounding Iran, the latest Flash PMIs from Europe and Asia, as well as some strong data on the French Labor market.

Bespoke Morning Lineup – 6/21/19

The ongoing tensions in Iran have provided a much-needed boost to oil prices. Through this morning, WTI crude has rallied 9.54% on the week. If this pace holds through the close, it will be the best week for ‘black gold’ since December 2016.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.

The Closer – Dollar Down, Confidence Up, Current Account Sideways – 6/20/19

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, as the dollar suffers its worst two-day span in over a year, we take a look at what crosses are leading this decline and taking a deeper look into CAD. Next, we review today’s Consumer Comfort index which came it at the second highest level of the current cycle. We make note of some of the interesting dynamics concerning political factors and homeownership. We then show how the leading versus coincident indicator ratio is not flashing any sort of alarming warning signs, and finish with an update on the US current account balance.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

Bespoke’s Sector Snapshot — 6/20/19

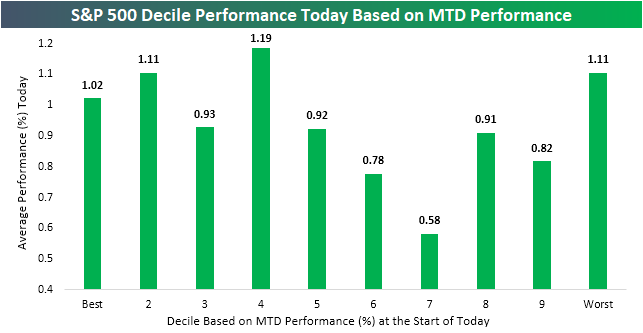

Worst Stocks in June Taking a Turn

Headed into the final hour of trading, with oil surging over 5.7% on the back of tensions escalating with Iran, energy stocks have been the top performers today. Capital Goods and the Software and Services industries are also experiencing strong rallies today. A strong earnings report from Oracle (ORCL) has been the major catalyst for Software and Services. The only industry groups to have moved lower are Consumer Services, Telecom, and Banks. Another factor in some stocks’ gains today has also been recent weakness so far this month.

In the chart below, we break up the S&P 500 into deciles (groups of 50) based on month-to-date performance headed into today’s trading. As shown, the 10th decile made up of the weakest stocks in June through yesterday’s close (the only decile with MTD decliners) has been one of the best-performing groups. The average stock in this decile is up 1.11% today. That is the joint second best performance across these deciles shared with the second-best performers on a MTD basis. Additionally, the best-performing stocks in June have continued to rally over 1% on average today. But neither the best nor worst MTD stocks are the leading decile, that actually belongs to the fourth decile with an average gain of 1.19%. Some names in this decile include ULTA (ULTA), Phillips 66 (PSX), and BlackRock (BLK).

The best-performing stock in June has been Under Armor (UAA) with an MTD gain through yesterday’s close of 18.82%. It is down around 1.17% today. Whirlpool (WHR), which has seen similar performance MTD, is holding up a tiny bit better, but is still in the red today, down 0.3%. On the other end of MTD performance, GAP (GPS) has gotten crushed in June falling over 12.5%. The losses have kept coming today as it has fallen just under half of a percent more. But the second-worst performer this month, Noble Energy (NBL), has been lifted by strength in energy and has rallied 6% today; nearly erasing all of its June losses. Start a two-week free trial to Bespoke Institutional to access our interactive tools and much more.

Strike Three

Back in early May when President Trump put hopes of a trade deal with China on hold, one of the groups hardest hit was semiconductors. The Philadelphia Semiconductor Index (SOX) declined 19.8% from its intraday high in late April to its low on 5/29 and first traded back below its 50-day moving average (DMA) on 5/13. From its low, the SOX has erased just about half of its losses from the April high, but three times now, the group has seen a rally stall out right at or below its 50-DMA. As long as the SOX is able to hold on to its higher low from earlier this week, it’s not much of a problem, but if it goes on to make a new short-term low, it would be a worrisome sign.

With the SOX failing to retake its 50-DMA, we wanted to see which stocks in the group have been holding the group back. The table below lists each of the components of the SOX and where each one is trading relative to its 50-DMA. Of the 30 stocks in the index, just 13 are currently above their 50-DMA, while the remaining 17 are still below that level, so it’s not as though just a handful of stocks are holding the SOX back. Micron (MU), MKS Instruments (MKSI), Cree (CREE), NVIDIA (NVDA), and Qorvo (QRVO) are all more than 5% below their 50-DMAs, while Cypress (CY), Advanced Micro (AMD), and Silicon Motion (SIMO) are the only three stocks more than 5% above their 50-DMAs. Start a two-week free trial to one of Bespoke’s three membership levels to access our interactive tools and in-depth research.

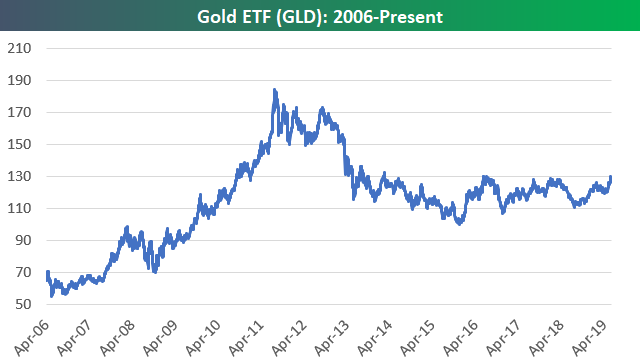

Gold Breaks Out to 5+ Year High

Earlier this week we published a Chart of the Day suggesting that gold (in the form of the GLD ETF) was looking strong but needed to get above the $130/share level to experience a breakout and potentially leg nicely higher. We’re seeing that break above $130 today as the yellow metal makes a new 5+ year high. Below are updated charts showing the move. You can really see in the longer-term chart (second below) how $130 has acted as stiff resistance over the last few years. A solid clearing above this level in the coming days opens up a move towards $150 in our view. Start a two-week free trial to one of Bespoke’s three membership levels to access our interactive tools and in-depth research.