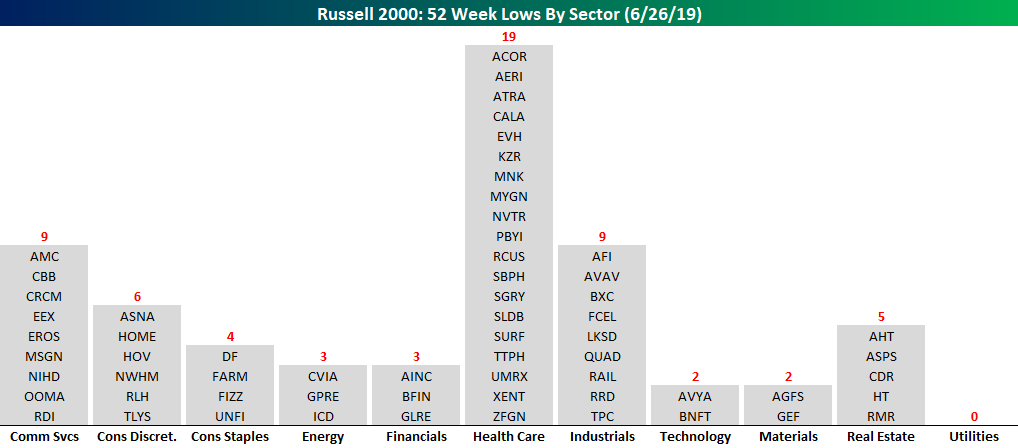

Russell 2000 New Lows By Sector

With the S&P 500 right near 52-week and all-time highs, there aren’t a lot of new lows to speak of in the index. So far today, for example, the only stocks in the index to hit a 52-week low are Iron Mountain (IRM), Kroger (KR), Macerich (MAC), and Simon Property (SPG). While the S&P 500 hasn’t seen much in the way of new lows, small-cap stocks have really lagged their large-cap peers which has resulted in significantly more stocks on the new low list. Through this afternoon, we have actually seen more than 60 new lows in the Russell 2,000.

We were curious to see if there was any specific sector driving the relatively high number of new lows in the Russell 2000, so the chart below breaks the stocks hitting new lows today out by sector. Looking at the list, we were somewhat surprised to see that the Health Care sector alone accounts for nearly a third of all the new lows today with 19. Behind Health Care, the next closest sectors are Communication Services and Industrials, each with nine. On the other extreme, not a single stock in the Russell 2000 Utilities sector traded at a new low today, but with the 10-year yield right around 2.0%, that should not come as a surprise. One sector with relatively few stocks on the new low list today is Energy with three. With oil rallying over the last few days, the sector has gotten a reprieve, but as recently as a week or two ago, there were regularly more than 30 stocks from the sector on the new low list. Start a two-week free trial to Bespoke Institutional to access our Chart Scanner tool which provides daily updates to the number of stocks hitting new 52-week highs and lows.

UniFirst (UNF) Ends Triple Play Drought

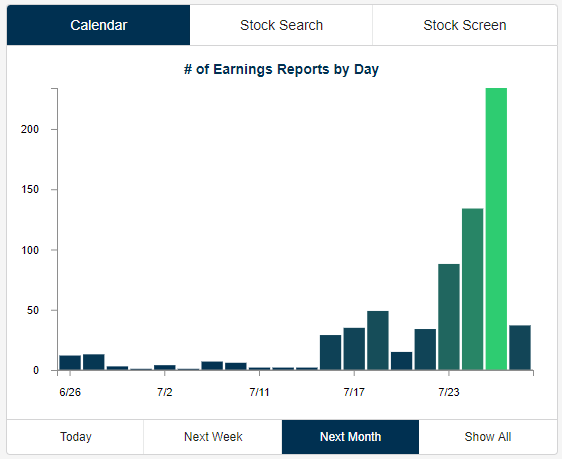

Seeing as we are between earnings seasons, the pace of earnings has been at a crawl over the past few weeks. As shown in the snapshot from our Earnings Explorer, things will more or less remain that way for the rest of June and into July with only 51 reports between now and July 15th. Afterward, things pick up when the major financials start to report their quarterly results as earnings season begins in earnest with 130 reports that week and 527 the following week.

With the caveat of small sample size, recently there have been very few earnings triple plays. This morning’s quarterly report from UniFirst (UNF), however, broke a two-week drought. Before UNF, the most recent triple play was Restoration Hardware (RH) on June 12th. We define a triple play as a beat in sales and EPS estimates in addition to the company raising guidance. We like to look at these as they can be indicative of solid fundamental health of a company.

UniFirst (UNF), a uniform/workwear rental and facility service company, saw EPS come in at $2.46, well above estimates of $1.70. Revenues were over $12 million above estimates at $453.72 mln; 6.2% growth versus the comparable quarter last year. This was UNF’s second consecutive triple play. The company cited revenues benefiting from solid organic growth and lower costs in its core business in addition to solid growth and margins in its specialty garments business (nuclear decontamination and cleanroom operations) thanks to a 2018 acquisition paying off.

In the other six triple plays in its earnings history, UNF has averaged a gap up of 6.78% followed by an average decline from open to close of 1.7%. UNF has followed this script today with the stock gapping up 7.37% and so far falling 1.28% from the open as of this writing. Start a two-week free trial to Bespoke Institutional to access our interactive Earnings Explorer tool and much more.

Fixed Income Weekly – 6/26/19

Searching for ways to better understand the fixed income space or looking for actionable ideas in this asset class? Bespoke’s Fixed Income Weekly provides an update on rates and credit every Wednesday. We start off with a fresh piece of analysis driven by what’s in the headlines or driving the market in a given week. We then provide charts of how US Treasury futures and rates are trading, before moving on to a summary of recent fixed income ETF performance, short-term interest rates including money market funds, and a trade idea. We summarize changes and recent developments for a variety of yield curves (UST, bund, Eurodollar, US breakeven inflation and Bespoke’s Global Yield Curve) before finishing with a review of recent UST yield curve changes, spread changes for major credit products and international bonds, and 1 year return profiles for a cross section of the fixed income world.

In this week’s report we look at the historic returns from international bond markets and the outlook based on current yields.

Our Fixed Income Weekly helps investors stay on top of fixed income markets and gain new perspective on the developments in interest rates. You can sign up for a Bespoke research trial below to see this week’s report and everything else Bespoke publishes free for the next two weeks!

Click here and start a 14-day free trial to Bespoke Institutional to see our newest Fixed Income Weekly now!

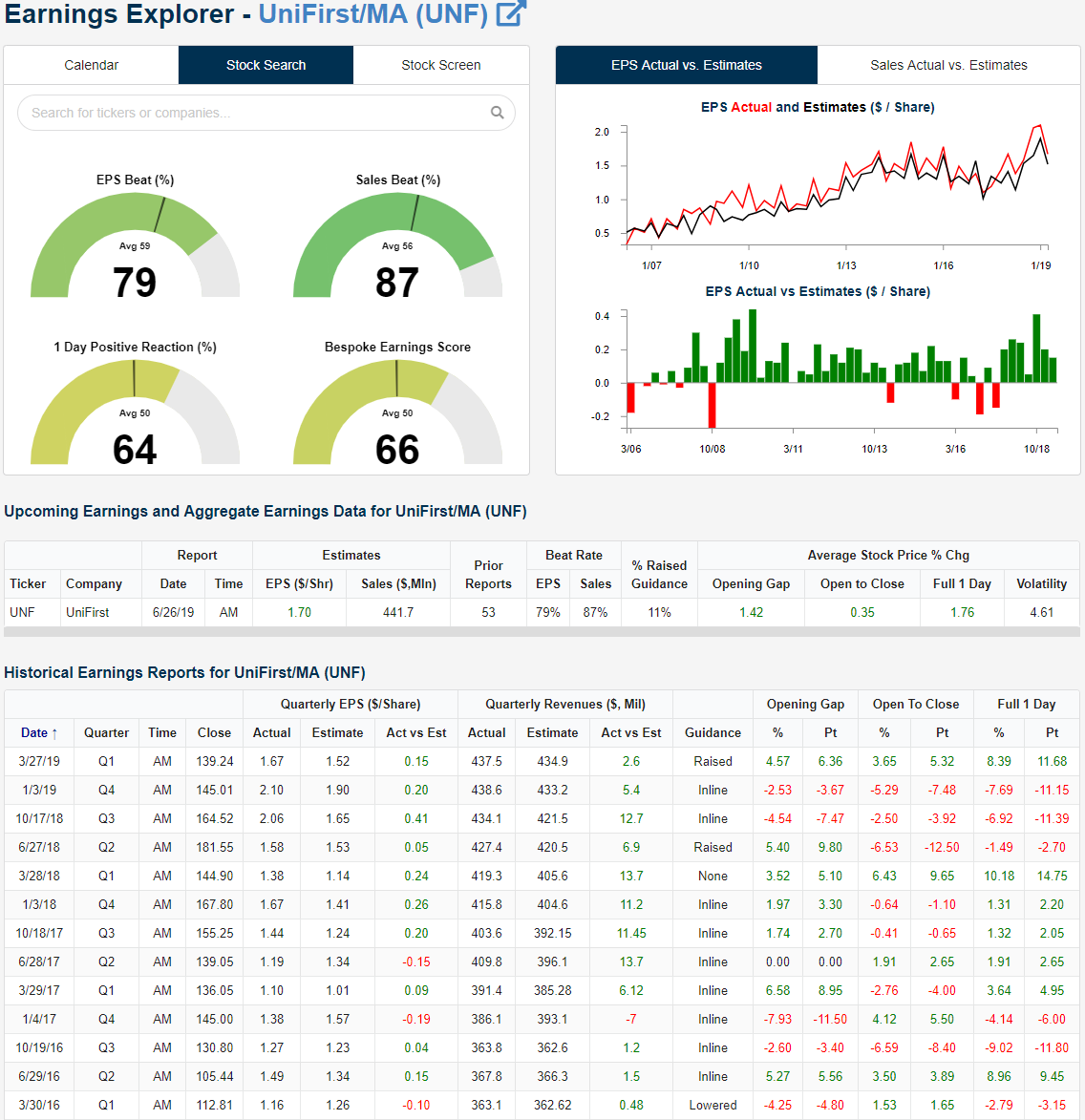

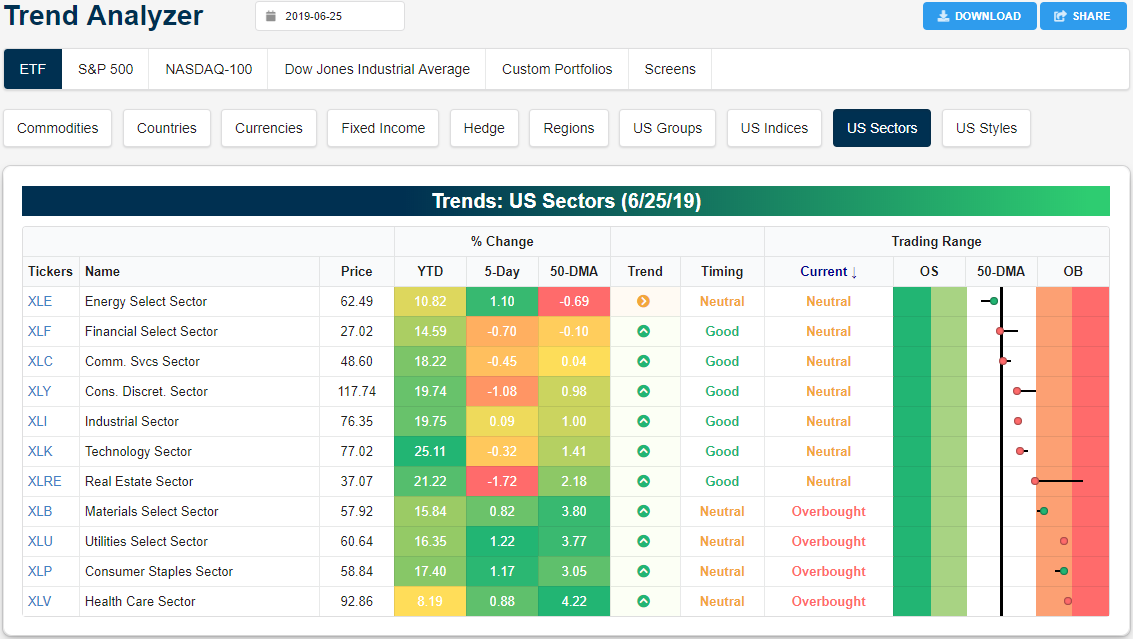

Trend Analyzer – 6/26/19 – Dow (DIA) Remains Overbought

Stocks broadly declined yesterday, although the Dow (DIA) fared slightly better than the other indices. Only declining 0.71% in yesterday’s session—versus a 0.98% decline in the S&P 500 (SPY) and 1.72% loss for the Nasdaq (QQQ)—DIA is now the only major index ETF that is still overbought and the only one to be up from this time last week. All of the other index ETFs have fallen off of overbought levels from the past few weeks and currently sit at neutral. Granted, most of this movement still leaves the ETFs on the border of neutral/overbought so it will not take much upside for a return to overbought. With this fall to neutral, all of these ETFs are also down over the past five days with losses ranging from a very small 1 bp decline for the Core S&P 500 (IVV) to a much more substantial 1.86% loss for the Russell 2000 (IWM). IWM is not alone in large losses though as other small and mid caps also have lost over 1%, also bringing them below the 50-DMA as well. Start a two-week free trial to Bespoke Institutional to access our interactive Trend Analyzer and much more.

Recently, there has been a steady rotation into more defensive sectors, but in the past week this picture has become more mixed as the distinction between cyclical/counter-cyclical performance has muddied. The second best performing sector this year has been Real Estate (XLRE) with better than a 20% gain YTD but in the past week, XLRE has underperformed dramatically losing 1.72%. After sitting at extremely overbought levels last week, it has fallen sharply in its trading range and is now neutral like six other sectors. While no other sector experienced quite as large of a decline, there are four other sectors (all cyclicals) that are lower versus last week including Financials (XLF), Communication Services (XLC), Consumer Discretionary (XLY), and Technology (XLK). Each of these also sits in neutral territory along with Industrials (XLI) and Energy (XLE). XLE has been the only sector ETF to sit below the 50-DMA recently, and given this more oversold level, the sector has begun to be bought up rising 1.1% in the past week. While XLRE has fallen, there is a disconnect with other defensives—Utilities (XLU), Staples (XLP), and Health Care (XLV)—which have done well. XLU, XLP, and XLV in addition to Materials (XLB) have all outperformed the other sectors in the past week. Additionally, these four are the only sectors that have become overbought with XLV sitting just below extreme levels.

SOX Catching a Case of the “Quitters”

Whenever old socks start to lose some of their elasticity and won’t stay up anymore, they’re called quitters, and looking at a recent chart of the Philadelphia Semiconductors Index, otherwise known as the SOX, it too seems to have come down with a case of the quitters. Ever since initially falling below its 50-day moving average back on May 13th, bulls have made multiple attempts to pull up the SOX, but each time gravity has taken over. This morning’s rally in the semiconductor space, driven by Micron’s (MU) earnings report, marks the 4th attempt by the SOX to retake its 50-DMA in the last six weeks, but that early strength has given way to some modest profit-taking. There’s still a lot of time left in the trading day, though, and breadth for the semis is very strong today. Therefore, there’s still a chance that the group manages to rally back to its earlier highs, but a fourth unsuccessful attempt wouldn’t be very encouraging. Start a two-week free trial to one of our three membership levels to stay on top of all the economic trends and developments.

Bespoke’s Global Macro Dashboard — 6/26/19

Bespoke’s Global Macro Dashboard is a high-level summary of 22 major economies from around the world. For each country, we provide charts of local equity market prices, relative performance versus global equities, price to earnings ratios, dividend yields, economic growth, unemployment, retail sales and industrial production growth, inflation, money supply, spot FX performance versus the dollar, policy rate, and ten year local government bond yield interest rates. The report is intended as a tool for both reference and idea generation. It’s clients’ first stop for basic background info on how a given economy is performing, and what issues are driving the narrative for that economy. The dashboard helps you get up to speed on and keep track of the basics for the most important economies around the world, informing starting points for further research and risk management. It’s published weekly every Wednesday at the Bespoke Institutional membership level.

You can access our Global Macro Dashboard by starting a 14-day free trial to Bespoke Institutional now!

Morning Lineup – Trade Optimism Bubbles Up Again

US equities are attempting to get back on track this morning after three straight days of declines. Futures are currently indicated to erase about half of yesterday’s decline as sentiment regarding this weekend’s trade talks between the US and China was given a boost following some comments from Treasury Secretary Steve Mnuchin. Whether there is really anything to those comments remains to be seen.

Please read today’s Morning Lineup to get caught up on everything you need to know ahead of the new trading day including the latest news on trade, Asian markets, and confidence in Germany.

Bespoke Morning Lineup – 6/26/19

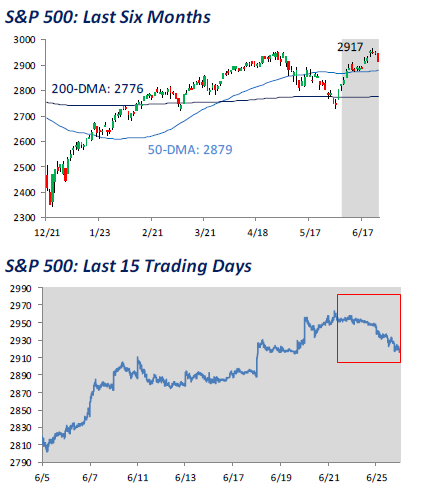

After hitting a new all-time high on Thursday, the S&P 500 comes into today having had three straight daily declines. Looking back over history this is not a very common occurrence. As we highlighted in The Closer last night, going back to 1928, there have only been 11 other periods where the S&P 500 closed at a 52-week high (after not having done so in the prior four weeks) only to follow it up with three straight days of declines.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.

The Closer – Mean Reversion In Stocks, CBO Forecasts, New Homes Getting Cheap – 6/25/19

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, given the decline over the past three sessions, we provide a decile analysis of the best-performing stocks in June and performance following similar declines. Next, we take an in-depth look at the CBO’s budget outlook including potential impacts of changes in rates. We finish with an update of today’s New Home Sales which showed significant weakness in the West, and that prices have gotten cheap.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!