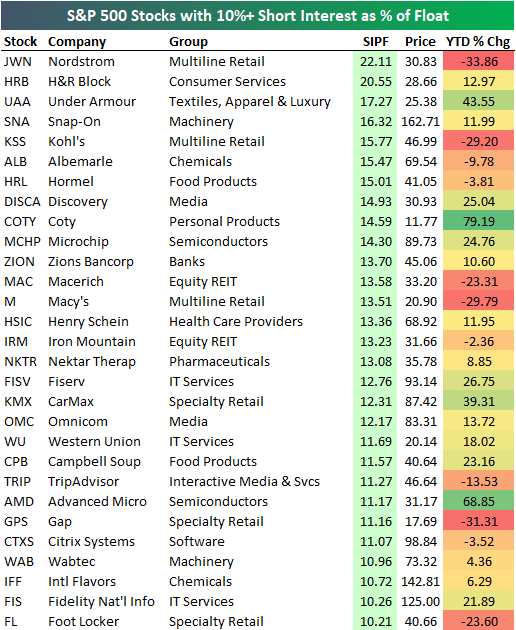

Most Heavily Shorted S&P 500 Stocks

Below is a list of the 29 stocks in the S&P 500 that have more than 10% of their share float sold short. Luxury retailer Nordstrom (JWN) currently tops the list with 22% of its float sold short. The stock is down 33.86% YTD and 55% from levels seen last November.

Tax-prep company H&R Block (HRB) is the second most heavily shorted stock with 20.55% of its float sold short. HRB is followed by sports retailer Under Armour (UAA), Snap-On (SNA), and Kohl’s (KSS). While JWN and KSS are both down big YTD, HRB, UAA, and SNA are all up nicely on the year.

There are plenty of other notables on the list, including Macy’s (M), Campbell Soup (CPB), TripAdvisor (TRIP), Gap (GPS), Western Union (WU), and Foot Locker (FL), but one common characteristic among many of them is that they are retailers.

On average, these stocks with 10%+ short interest as a percentage of float are up 8.5% on the year, which is well below the 17% gain that the S&P 500 has seen.

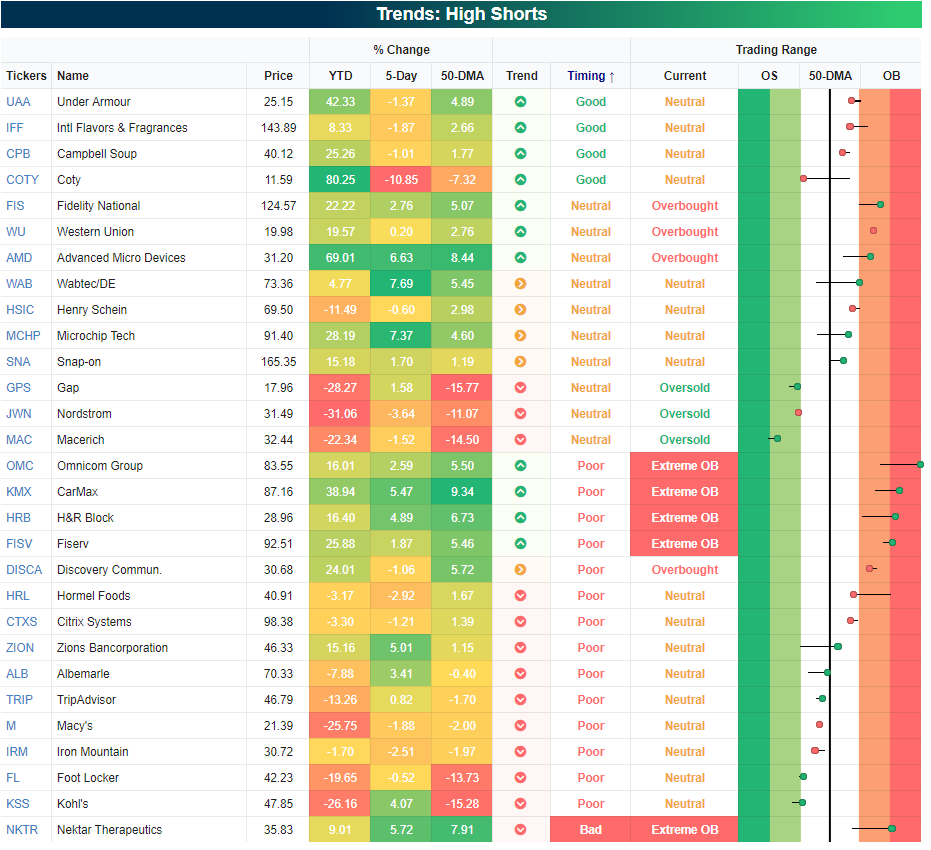

Below we have input the list of heavily shorted stocks into a custom portfolio that Bespoke members can create when they’re logged into our website. We’ve sorted the list by our algo-driven “Trend” and “Timing” scores. There are currently four stocks on the list that are in Bespoke “uptrends” with “good” timing scores — Under Armour (UAA), Intl Flavors & Fragrances (IFF), Campbell Soup (CPB), and Coty (COTY).

If you’re a Bespoke Premium or Bespoke Institutional member already, you can import this list of heavily shorted stocks into a custom portfolio by clicking here. We use these tools as starting points when we’re trying to find new long or short ideas, and our members can too! Start a two-week free trial to Bespoke Premium to build your own custom portfolios today.

Chart of the Day – Breakouts to 52-Week Highs

Bespoke Stock Scores — 7/2/19

S&P 500 Sector Weightings: Mid-Year 2019

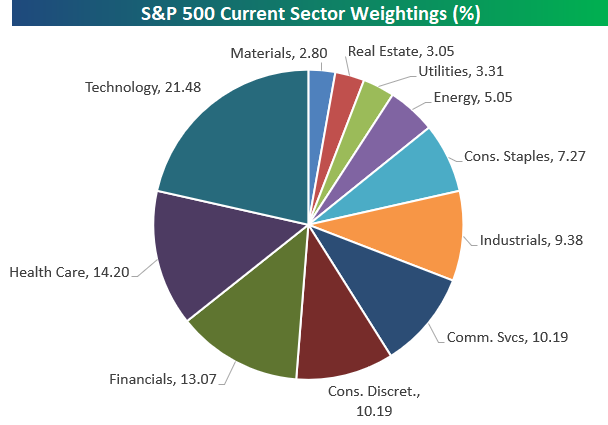

Below is an updated snapshot of S&P 500 sector weightings as of mid-year 2019. As shown, the Technology sector makes up the largest slice of the pie with a weighting of 21.48%. Health Care ranks as the second largest sector of the market at 14.20%, followed by Financials at 13.07%. The fact that technology and two service-oriented sectors making up nearly 50% of the index shows how much the US economy has shifted over the years. After the “big three” of Tech, Health Care, and Financials, we move down to Consumer Discretionary, Communication Services, and Industrials, which are all right around 10%. Consumer Staples has a weighting of 7.27%, and Energy is all the way down to 5.05% after years of losing share. Utilities, Real Estate, and Materials combine to add up to roughly 9% of the index, so these three sectors are basically immaterial at this point.

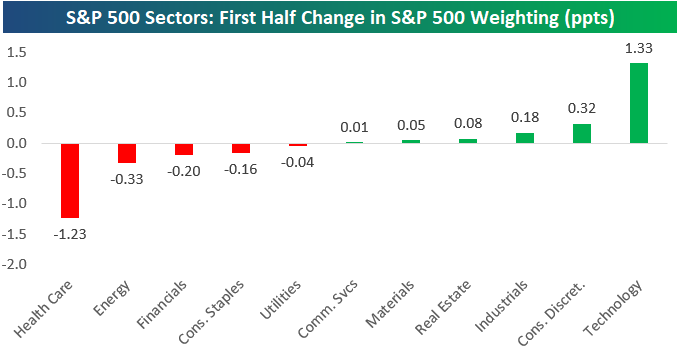

Below is a chart showing how much weightings changed in the first half of 2019. The Technology sector gained 1.33 percentage points while Health Care lost 1.23 percentage points, so the gap between the biggest sector (Tech) and the 2nd biggest sector (Health Care) widened by more than 2.5. Consumer Discretionary, Industrials, Real Estate, Materials, and Communication Services all gained share in the first half as well, while Energy, Financials, Consumer Staples, and Utilities all lost share along with Health Care. Start a two-week free trial to Bespoke Institutional for a closer look at S&P 500 sector weightings and access to ALL of our most actionable equity market research.

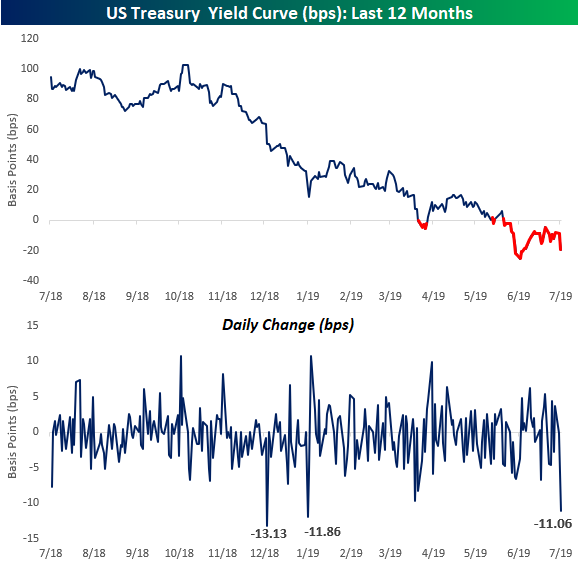

Yield Curve Craters

With the 10-year plummeting below 2% again and the 3-month yield spiking up by over 7 basis points (bps), which is its biggest one day gain since December 2017, the yield curve is cratering today. Today’s 11 bps move further into inverted territory is the biggest one-day move since January 2nd (see second chart). While not back at new lows, today marks the 29th day that the curve has now been inverted. In Fedspeak news, Cleveland Fed President Loretta Mester (who leans hawkish but isn’t a voter) just noted in a speech that she’s in no hurry to cut. She argues that “Cutting rates at this juncture could reinforce negative sentiment about a deterioration in the outlook even if this is not the baseline view, and could encourage financial imbalances given the current level of interest rates, which would be counterproductive.”

What would cause her to change her stance? “If I see a few weak job reports, further declines in manufacturing activity, indicators pointing to weaker business investment and consumption, and declines in readings of longer-term inflation expectations, I would view this as evidence that the base case is shifting to the weak-growth scenario.” A few weak job reports? In other words, she is in no hurry to take any action. Keep in mind, though, that as recently as late February, Mester was still of the view that the FOMC would need to be raising rates later on this year. Start a two-week free trial to Bespoke Institutional for full access to all of our research and interactive tools.

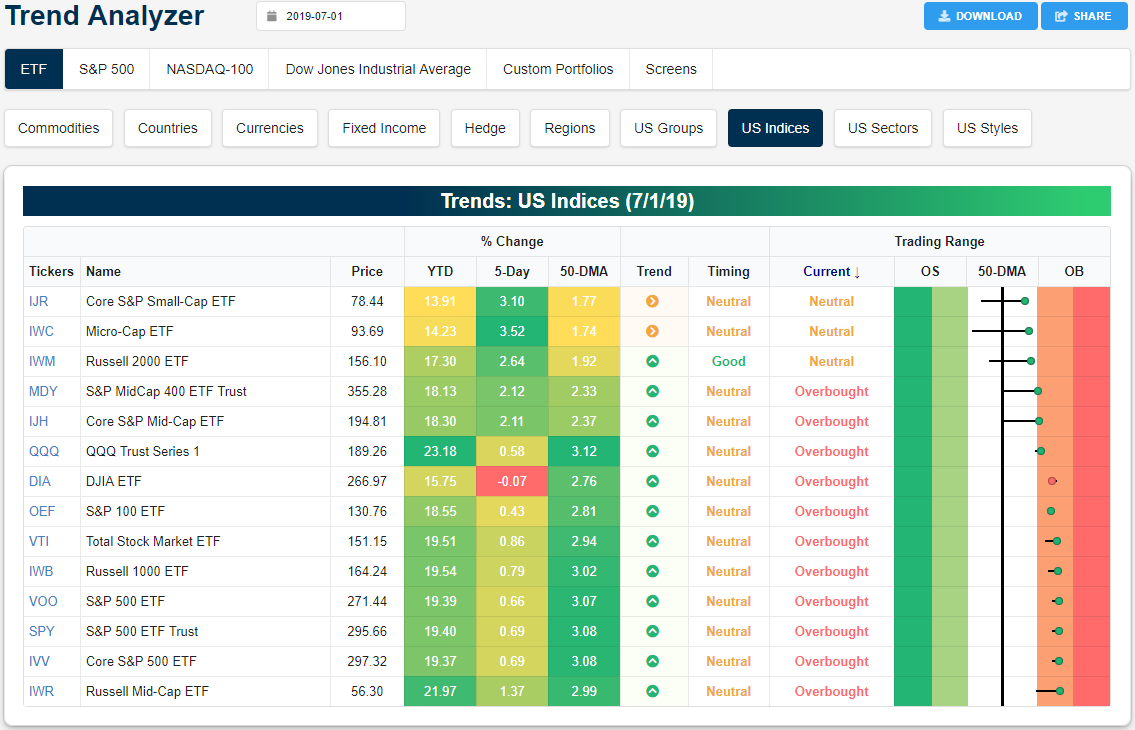

Trend Analyzer – 7/2/19 – Overbought in a Day

With equities surging to new all-time highs yesterday, several more major index ETFs joined the overbought club as those that are still neutral have also come increasingly close to overbought levels. Whereas most of these ETFs had been sitting in the red versus one week ago yesterday, today only the Dow (DIA) sits lower by 7 bps. Other large caps have done better but are also underperforming as the S&P 100 (OEF) and Nasdaq (QQQ) have the second and third worst gains in this time. Meanwhile, small caps have begun to surge from beneath the 50-DMA. The Core S&P Small Cap (IJR) and Micro-Cap (IWC) both have risen well over 3% now in the past week. Another small-cap index, the Russell 2000 (IWM), has also rallied through the 50-DMA but on a smaller gain of 2.64%.

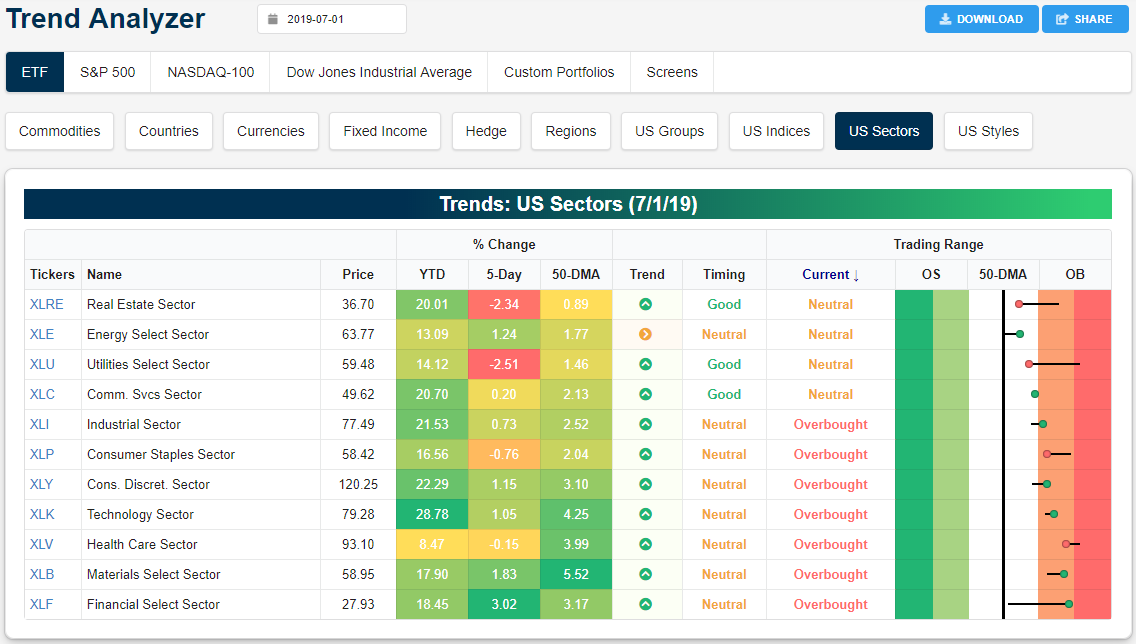

In the past couple months, defensive sectors have been rallying to new highs while more cyclical sectors continued to sit below their previous highs. There is now starting to be some rotation away from defensives and into cyclicals. For most of June and into last week, Utilities (XLU) had been trading at very overbought levels but XLU has finally seen some mean reversion. It has fallen 2.51% in the past week bringing it only 1.46% above the 50-DMA and moved back into neutral territory. Real Estate (XLRE) is a similar story now down 2.34% over the past five days after hovering around extreme overbought levels for a solid portion of last month. Granted, XLRE and XLU are now at the bottom of their recent uptrends earning them a good timing score.

Inversely, Financials (XLF) have been ripping higher after major financial plays got the all clear in last week’s stress tests. This has sent the sector higher by over 3% from just above the 50-DMA. The sector has approached extremely overbought territory in a very short span of time. Right on XLF’s heels in terms of overbought/oversold levels is Materials (XLB). The second best performer in the past week, XLB has gotten a boost from trade tailwinds over the weekend as it finished yesterday at the highs of the day. Start a two-week free trial to Bespoke Institutional to access our Trend Analyzer tool and much more.

Bespoke Matrix of Economic Indicators: 7/2/19

Our Matrix of Economic Indicators is the perfect summary analysis of the US economy. We combine trends across the dozens and dozens of economic indicators in various categories like manufacturing, employment, housing, the consumer, and inflation to provide a directional overview of the economy.

To access our newest Matrix of Economic Indicators, start a two-week free trial to either Bespoke Premium or Bespoke Institutional now!

Morning Lineup – No Fireworks Yet

Quiet is the word this morning. There are no major economic reports on the calendar, no major earnings releases, and little in the way of volatility in overseas markets. China and Japan were basically flat overnight, most of Europe is little changed, and the yield on the 10-year Treasury is unchanged from yesterday. Even bitcoin is down just 4% after several days of 10%+ daily moves. The only major news headlines concern tariff threats (what else is new), but this time on European imports, and then talk that Saudi Aramco is looking to revive the IPO process.

Read today’s Morning Lineup to get caught up on news and stock specific events ahead of the trading day, as well as updated charts on the technical state of the market.

Bespoke Morning Lineup – 7/2/19

One indicator we track in order to asses the internal health of the market is the percentage of S&P 500 stocks hitting 52-week highs on a daily basis. In June, there were two days where the daily percentage of stocks hitting new highs clocked in at a healthy 20%, but in yesterday’s rally to new highs, the percentage of stocks that hit new highs only got as high as 11.9%, which is a relatively weak reading for a day when the S&P 500 breaks out to all-time highs. Going forward, we will be looking for stronger readings, especially on a positive market day like Monday.

In terms of the percentage of stocks in the ‘pipeline’ for new highs, the chart below summarizes where S&P 500 components finished yesterday relative to their 52-week highs. 20% of S&P 500 components are currently within 2% of a 52-week high (red bar), while another 21% are more than 2% but less than 5%, so on a strong market day there is certainly the potential for new highs to surge, but with futures indicating a slightly lower open, it’s unlikely we will see that surge today.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.

The Closer – Decile Analysis, Sector Weightings, ISM Beat – 7/1/19

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we provide our decile analysis of the S&P 500 for the month of June. We also look to see how sectors that perform best or worst in the 1st half of the year typically perform in the 2nd half. We update S&P 500 sector weightings and how they changed in the first half, and we finish the report off with a look at today’s better than expected ISM Manufacturing report.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

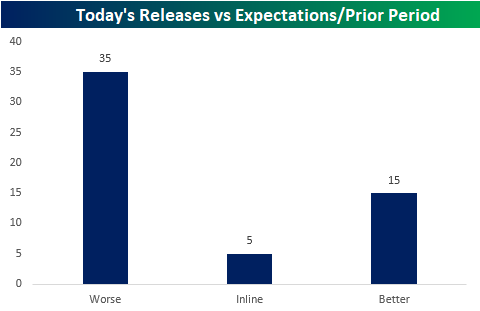

Broadly Weak Manufacturing Data

There was a huge slug of data out from all around the world overnight and today. The results did not live up to expectations as the majority (35 data points) came in either worse than forecasts or worse than the previous period. Meanwhile, five met expectations or were unchanged and fifteen indicators saw improvement.

The data slate over the past 24 hours was primarily comprised of manufacturing data including final June Markit PMIs, the ISM PMI in the US, and Japanese Tankan indices. Of all the manufacturing data points out today, over three quarters came in below expectations or worse than the previous period (highlighted in red in the Global Economic Scorecard below). The Americas and Australia at least provided some relief as the US, Mexico, Brazil, and Australia were the only bright spots for Markit PMIs. Each saw the opposite result of the rest of the world with beats. Granted, the picture is a bit more muddied taking other indicators into account. Australia’s AIG Performance of Manufacturing index was weaker and the US’s ISM PMI also had some weak spots despite a headline beat. ISM Prices Paid came in with a contractionary reading and ISM New Orders also weakened to a flatline reading of 50. Japanese data was similarly mixed in the quarterly results for Tankan indices. While the data was generally worse, large manufacturers were a silver lining given a better than expected reading for outlook. Additionally, non-manufacturing data for these same Tankan indices held up better than their manufacturing counterparts. Later this week (beginning tomorrow night into Wednesday) we will see other non-manufacturing data with the release of Markit Service PMIs from around the globe. Subscribers can use our Economic Monitors help to keep track of all of the day’s economic releases domestic and abroad. Start a two-week free trial to Bespoke Institutional to access our interactive economic monitor and much more.