Fixed Income Weekly – 7/10/19

Searching for ways to better understand the fixed income space or looking for actionable ideas in this asset class? Bespoke’s Fixed Income Weekly provides an update on rates and credit every Wednesday. We start off with a fresh piece of analysis driven by what’s in the headlines or driving the market in a given week. We then provide charts of how US Treasury futures and rates are trading, before moving on to a summary of recent fixed income ETF performance, short-term interest rates including money market funds, and a trade idea. We summarize changes and recent developments for a variety of yield curves (UST, bund, Eurodollar, US breakeven inflation and Bespoke’s Global Yield Curve) before finishing with a review of recent UST yield curve changes, spread changes for major credit products and international bonds, and 1 year return profiles for a cross section of the fixed income world.

In this week’s report we take a look at the big divergence between global financial conditions and activity.

Our Fixed Income Weekly helps investors stay on top of fixed income markets and gain new perspective on the developments in interest rates. You can sign up for a Bespoke research trial below to see this week’s report and everything else Bespoke publishes free for the next two weeks!

Click here and start a 14-day free trial to Bespoke Institutional to see our newest Fixed Income Weekly now!

Chart of the Day – The Most Underwhelming Economy in Years

Triple Play Breaks the Downtrend for WD-40 (WDFC)

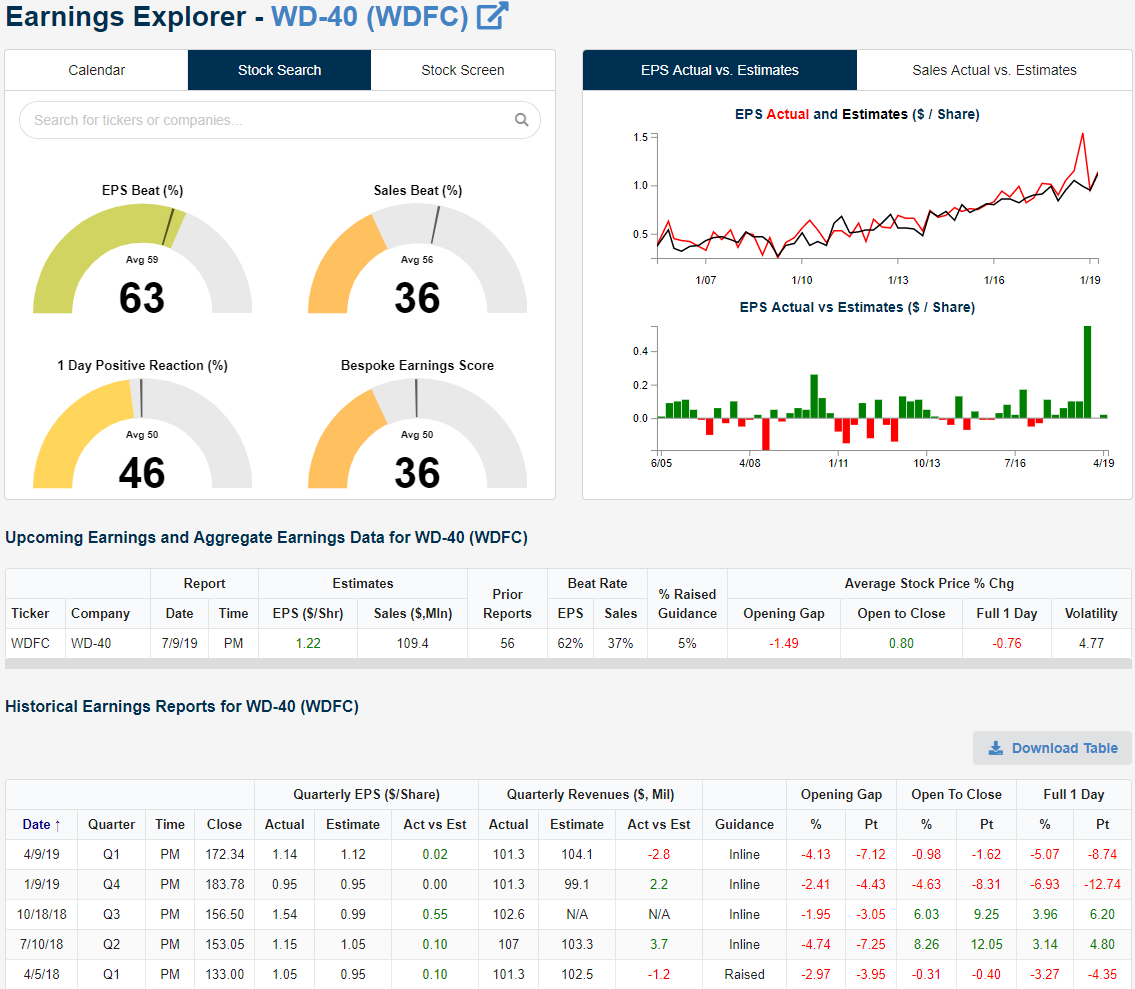

WD-40 Company (WDFC) manufactures and distributes a number of household and industrial products including its signature lubricating oil from which the company derives its name: WD-40. Perhaps as a result of an increase in squeaky door hinges, the company reported a strong quarter last night. WDFC reported an earnings triple play with EPS 8 cents above estimates and revenues of $114 million versus estimates of $109.4 million; a growth rate of 6.5% year-over-year. The company also raised guidance for the first time since April of last year. Raised guidance has not been a common occurrence for the company. In addition to the one last April, WDFC has only raised guidance two other times, once in 2005 and later in 2006. This is a pleasant change for WDFC which has historically not been the best stock on earnings as it has only beaten EPS estimates 63% of the time and sales 36% of the time. Historically its stock price has averaged a one-day loss of 0.76% on its earnings reaction day.

In reaction to its triple play this quarter, the improvements to the technical picture have been dramatic for WD-40. Opening at $169.17 with further buying in early trading, WDFC sits over 7% above yesterday’s close in early trading. With these gains, the stock has risen above both the 50 and 200-DMA. For most of the time since April, the stock has been stuck under both of these moving averages with only a few days with brief breaks above the 50-DMA. Additionally, WDFC has been in a downtrend for all of 2019, but today’s price action has sent the stock surging out of this downtrend channel. Start a two-week free trial to Bespoke Institutional to access our Security Analysis tool, Earnings Explorer, and more!

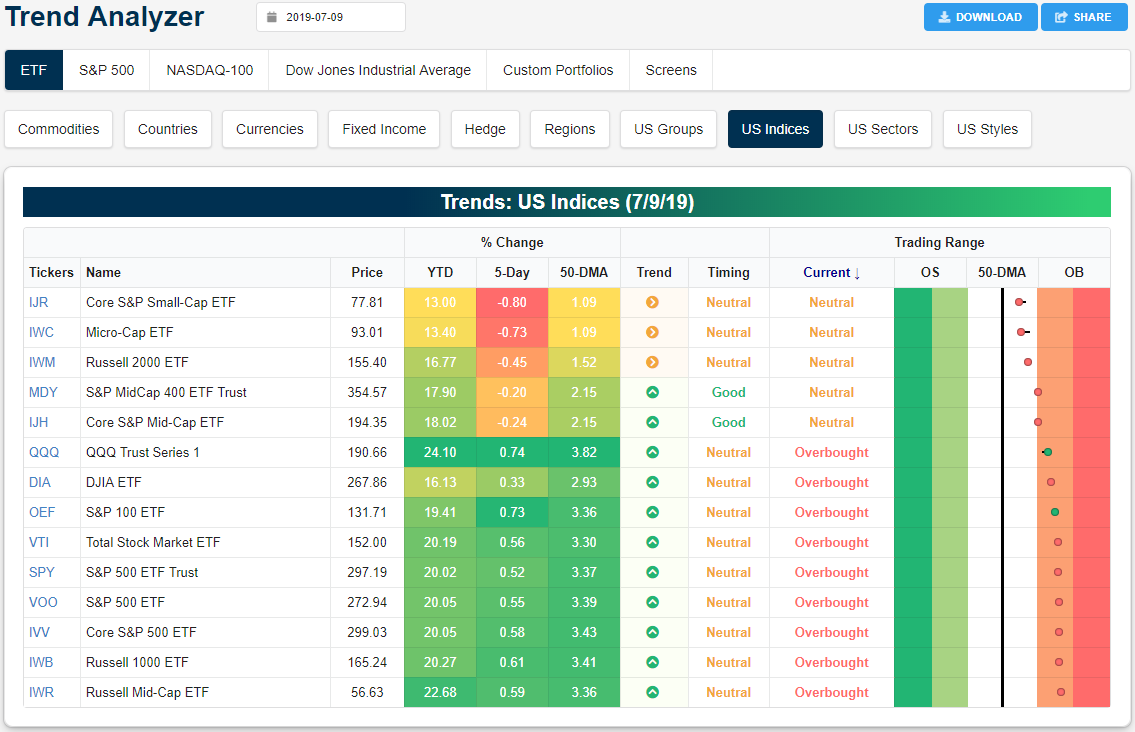

Trend Analyzer – 7/10/19 – Defensives Leading Again

The overbought/oversold picture is unchanged from yesterday with five major index ETFs in neutral territory while the remaining nine are all overbought. Not only has there been little change from yesterday, but there is also not much difference compared to levels from last week as seen through the lack of any tail in the Trading Range section of our Trend Analyzer for multiple ETFs. Small and mid-caps continue to underperform and all sit lower versus five days ago while large caps like the Nasdaq (QQQ) and S&P 100 (OEF) have outperformed.

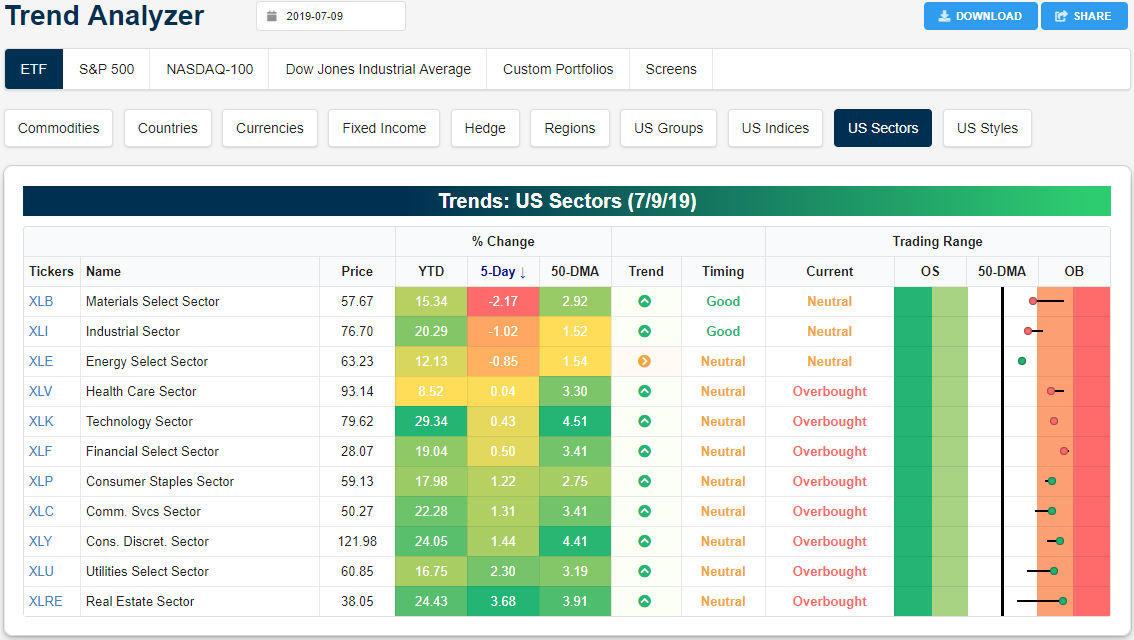

As the market has pulled back from record highs over the past week, Materials (XLB), Industrials (XLI), and Energy (XLE) have all led the way lower. XLB, in particular, has run into a rough patch and is now down 2.17% working off of overbought levels from last week. Meanwhile, XLI and XLE have also seen losses of 1.02% and 0.85%, respectively. With these losses, all three of these sectors now sit in neutral territory. With more cyclical sectors like XLB and XLI lagging, defensives have been surging as XLRE and XLU have outperformed. XLRE has surged 3.68% this week and XLU has rallied 2.3% in the same time. Last week, both of these, in addition to Communication Services (XLC), were only in neutral territory, but the recent gains have brought them up back up to overbought levels. Start a two-week free trial to Bespoke Institutional to access our Trend Analyzer and much more.

B.I.G. Tips – Top S&P 500 Charts 7/10/19

Bespoke’s Global Macro Dashboard — 7/10/19

Bespoke’s Global Macro Dashboard is a high-level summary of 22 major economies from around the world. For each country, we provide charts of local equity market prices, relative performance versus global equities, price to earnings ratios, dividend yields, economic growth, unemployment, retail sales and industrial production growth, inflation, money supply, spot FX performance versus the dollar, policy rate, and ten year local government bond yield interest rates. The report is intended as a tool for both reference and idea generation. It’s clients’ first stop for basic background info on how a given economy is performing, and what issues are driving the narrative for that economy. The dashboard helps you get up to speed on and keep track of the basics for the most important economies around the world, informing starting points for further research and risk management. It’s published weekly every Wednesday at the Bespoke Institutional membership level.

You can access our Global Macro Dashboard by starting a 14-day free trial to Bespoke Institutional now!

Bespoke’s Morning Lineup – Powell Delivers

Investors will have to contend with a ton of headlines related to the Federal Reserve over the next two days. Beginning today with Powell’s testimony in front of the House Financial Services Committee, we will also hear from Bullard at 1:30 and the Minutes from June’s meeting at 2 PM. Then tomorrow, another six Fed officials are on the calendar. Suffice it to say, that in the next 36 hours markets should have a much better idea of what the FOMC plans to do at its July 31st meeting, although the fact that futures are already pricing in 100% certainty of a cut suggests that markets are already pretty confident in their views.

Just released text of Powell’s testimony is being met with a positive reaction from the markets as the Chairman said that uncertainty continues to weigh on the outlook.

Read today’s Morning Lineup to get caught up on news and stock-specific events ahead of the trading day and a further discussion of overnight events in Asia and Europe.

Bespoke Morning Lineup – 7/10/19

Futures have seen a nice rebound in reaction to the just-released Powell comments, and one section of the equity market that could really use a lift is small caps. On a relative strength basis, small caps are right at their lowest level of performance versus the S&P 500 since the end of the Financial Crisis in 2009.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.

The Closer – Small Caps Slide, Labor Market Rundown, Italian NPLs – 7/9/19

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we start off with a look at just how dramatic the underperformance of small caps relative to the S&P 500 has been recently. We delve a bit deeper into the potential reasons for this weakness. Turning to macroeconomic data, we then recap today’s release of JOLTS Job Openings which echoed some weakening that has been observed in other indicators like today’s NFIB small business data.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

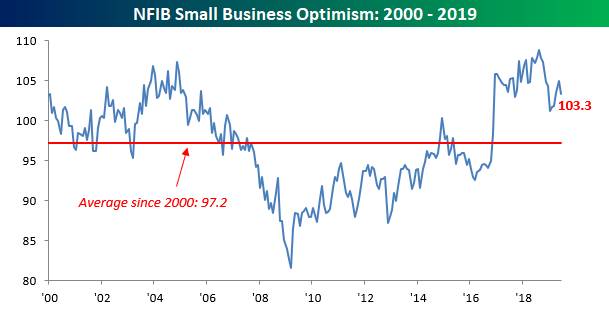

Small Business Optimism Takes a Pause

Small business optimism took a dip in June, ending a streak of four straight monthly increases. According to the NFIB, the headline small business optimism index fell from 105.0 down to 103.3. Despite the decline, the headline reading was better than expected. The key behind the pullback this month was most likely tied to the increased uncertainty created by the escalation in trade tensions between the US and China as well as the threat of tariffs on imports from Mexico. As the NFIB’s President summed things up, “Last month, small business owners curbed spending, sales expectations and profits both fell and the outlook for expansion dampened.” That’s definitely not a sign of confidence, although we would note that with the trade war back on hold and the threatened tariffs on Mexican imports not materializing, that should set the stage for a rebound in sentiment next month.

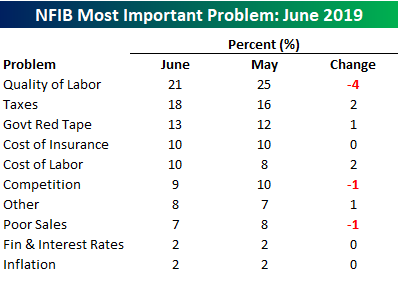

With respect to the issues that small businesses see as their biggest problems, Quality of Labor remains the biggest problem, although the percentage of businesses that cited it as a problem last month fell from 25% down to 21%. Issues that took up the slack were Taxes (increased from 16% up to 18%) and Cost of Labor (up to 10% from 8%). With regards to interest rates, only 2% of small businesses see interest rates as their biggest problem, so it’s not as though small businesses are having any trouble borrowing. Inflation is a very minor issue as well as it too was only cited by 2% of small business owners.

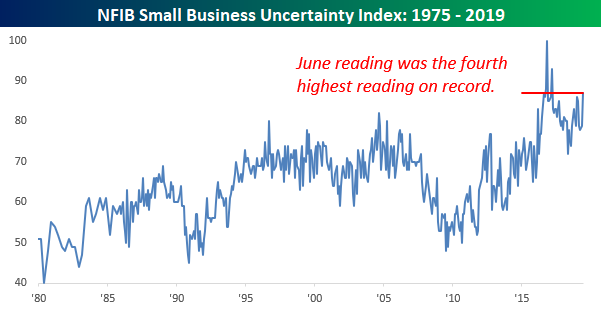

Above we mentioned that the threat of higher tariffs was lifting levels of uncertainty, and that is reflected in the NFIB Uncertainty index which saw its largest one-month increase since the 2016 election. At its current level of 87, the index has only been higher three times in the history of the index, and all three of those higher readings occurred during the period following Brexit and the 2016 election. Get more in-depth market analysis with a two-week free trial to Bespoke Premium.

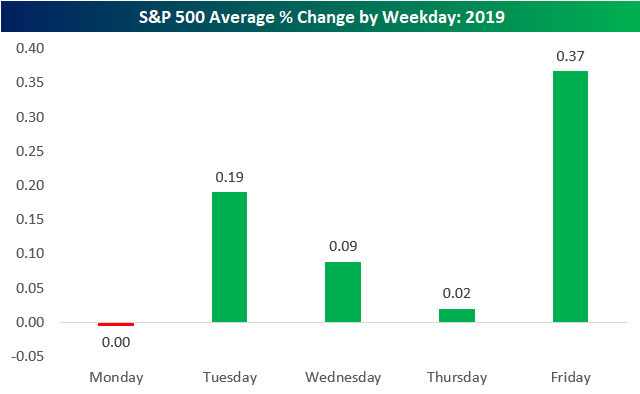

Fridays Still Leading

Below is a quick update on the S&P 500’s average performance by weekday so far in 2019 now that we are more than halfway through the year. As shown, Monday has been the only weekday to average a small decline, while Friday has been by far the best day of the week with an average gain of 0.37%. Tuesday has been the 2nd best day of the week with an average gain of 0.19%, followed by Wednesday at +0.09% and Thursday at +0.02%. So now you know! Get more in-depth market analysis with a two-week free trial to Bespoke Premium.