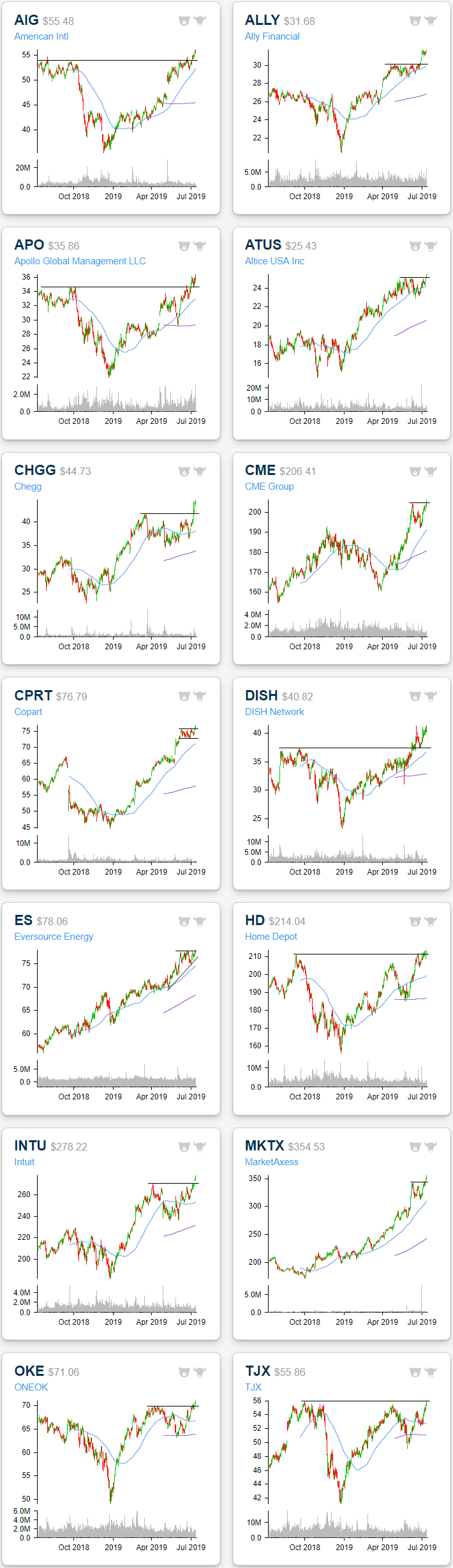

Breakouts to 52-Week Highs

At yesterday’s close, there were 271 stocks and ETFs that made a new 52-week high. We publish a list of new 52-week highs every day in our Chart Scanner tool, and looking through yesterday’s list, just about all of these names have been in strong uptrends in 2019 and are currently sitting at overbought or extremely overbought levels. The run up to 52-week highs for some of these names have come as a result of breaking longer-term resistance of a month up to over a year. Below are a handful of charts of these types of “breakout” stocks.

For some, the recent breakout was above longer-term resistance, as is the case for American International (AIG), Apollo Global Management (APO), and Dish Network (DISH). Two major US retailers, Home Depot (HD) and Target (TGT), also belong to this group. DISH is slightly different than these others in that it broke out above long term resistance a bit further back (in late June), but more recently came back to retest this former resistance as support. After a bounce off of these levels, the stock has rallied to reach another 52-week high.

The breakout for others comes after only a few months of consolidation. This is the case for Ally Financial (ALLY), Altice (ATUS), Chegg (CHGG), Copart (CPRT), and ONEOK (OKE). Similarly, stocks like CME Group (CME), Eversource (ES), Intuit (INTU), and MarketAxess (MKTX) all recently saw pullbacks after getting extended in their 2019 uptrends. Yesterday’s press back to 52-week highs has reconfirmed these uptrends. Start a two-week free trial to Bespoke Institutional to access our interactive Chart Scanner and much more.

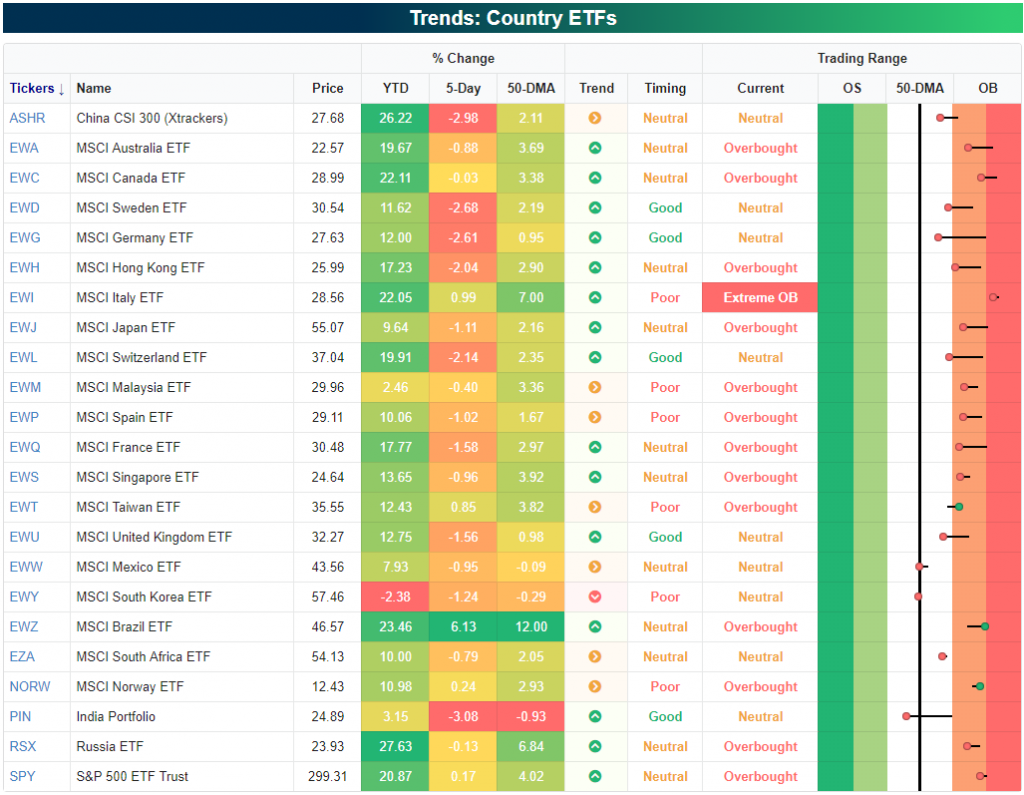

Country Stock Markets See Downside Mean Reversion

Yesterday we highlighted the year-to-date performance of stock markets for 75 countries around the world. Below is a snapshot of how 23 of the largest countries have been performing more recently relative to their normal trading ranges. While Brazil (EWZ) is up 6% and the US (SPY) is up slightly over the last 5 trading days, most countries are actually in the red. Given how extended a lot of countries were last week at this time, the action we’ve seen since then can be categorized as simple downside mean reversion.

While nearly all of these country ETFs are above their 50-day moving averages, there are three countries that have moved below — South Korea (EWY), Mexico (EWW), and India (PIN). India has shown the most weakness over the last week with a decline of more than 3%, leaving it 1% below its 50-DMA.

As mentioned earlier, Brazil (EWZ) has seen a huge move higher gaining 6% over the last week. The ETF is now 12% above its 50-day moving average, but remarkably, it’s still not even two standard deviations above its 50-DMA because of the big volatility the ETF typically experiences. Start a two-week free trial to one of Bespoke’s three premium subscription services for in-depth market analysis and actionable ideas on a daily basis.

Bespoke’s Morning Lineup – End of the Nightmare?

Is this the end of the long national nightmare? This morning’s release of the June PPI came in slightly higher than expected on both the headline and core readings, and that has sent US Treasury yields slightly higher moving the yield curve (10-year vs 3-month) out of inverted territory (for now). Just when everyone had written off inflation forever, CPI and PPI both came in higher than expected.

Read today’s Morning Lineup to get caught up on news and stock-specific events ahead of the trading day and a further discussion of overnight events in Asia and Europe.

Bespoke Morning Lineup – 7/12/19

As mentioned above, the yield curve has briefly moved out of inverted territory for the first time in 35 trading days. There’s still an entire trading day left to go, but if this trend holds, it’s the story of the day.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.

The Closer – Sloppy Auction, Strong Spending, CPI Surge, Receipts Rock – 7/11/19

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we go over several factors that played into a brutal day for the bond market leading to a huge bear steepening at the long end of the curve. Namely, one of these factors was a very bad 30-year bond reopening which we look at the internals of. Next, we take a look at the strength of the consumer including the divergence between Bloomberg and other consumer sentiment indicators. After recapping today’s inflation data, we then give an updated look at the federal budget deficit.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

Bespoke’s Sector Snapshot — 7/11/19

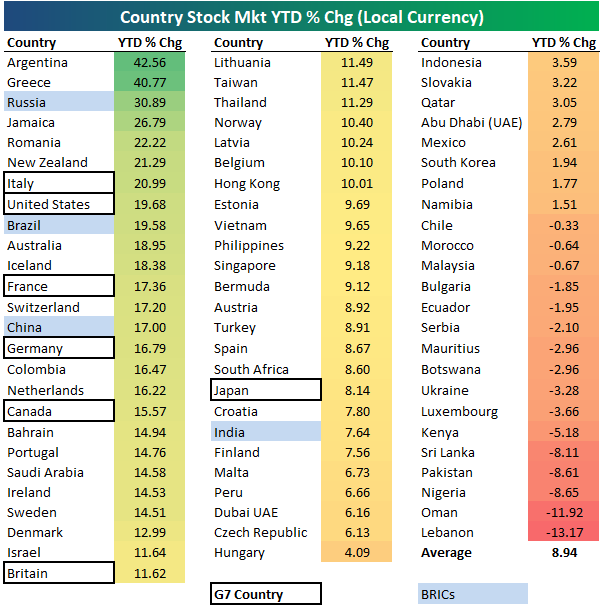

2019 Country Stock Market Returns

Below is a look at the year-to-date returns (in local currency) of stock markets for 75 countries around the world. The average country has posted a gain of 8.94% year-to-date, and 59 of the 75 countries (79%) are in the green. Argentina and Greece have posted the biggest YTD gains at this point with moves of 40%+. Russia ranks third with a gain of 30.89%, followed by Jamaica (+26.79%), Romania (+22.22%), and New Zealand (21.29%).

The United States has been the 8th biggest winner this year with a gain of 19.68%. Notice that six of the seven G7 countries are roughly in the top third, which means developed countries have been doing very well this year. Japan is the biggest laggard of the G7 countries, but it’s hard to be too disappointed with its YTD gain of 8.14%.

Three of the four BRIC countries rank in the top fourteen, led by Russia at +30.89%. Brazil ranks second of the BRICs with a YTD gain of 19.58%, while China is up 17%. India ranks last of the BRICs at +7.64%.

Lebanon and Oman have been the two worst-performing countries this year with declines of just over 10%. Nigeria, Pakistan, and Sri Lanka are all down more than 8%, while Kenya is down just over 5%. The remaining countries in the red are only down slightly. Start a two-week free trial to one of Bespoke’s three premium subscription services for in-depth market analysis and actionable ideas on a daily basis.

B.I.G. Tips – A Run of the Mill Rally

The first half of 2019 was extraordinarily strong for US equities, and if you measure the returns from the close on Christmas Eve, the gains look even more gaudy. But how gaudy were they really? Keep in mind that prior to the 12/24 low, the S&P 500 had declined 19.8% (on a closing basis) from its high on 9/20, so when you look at the period from the start of Q4 2018 through the end of Q2 2019, the returns are a lot less spectacular.

We define a bear market as any move of 20% or more from a closing high to a closing low, so based on that definition, last year’s Q4 decline was close but not quite a bear market (the 20% threshold was reached on an intraday basis). Surprisingly enough, there have been a number of instances in the last 50 years where the S&P 500 saw similar ‘near-bear’ markets with declines of 19%+ (but not 20%) which we have highlighted in the table and chart below. We include how the S&P 500 performed in the months and years following those “near-bear” lows to see how the current rally stacks up and where it might go from here.

To continue reading this B.I.G. Tips report, start a two-week free trial to Bespoke Premium.

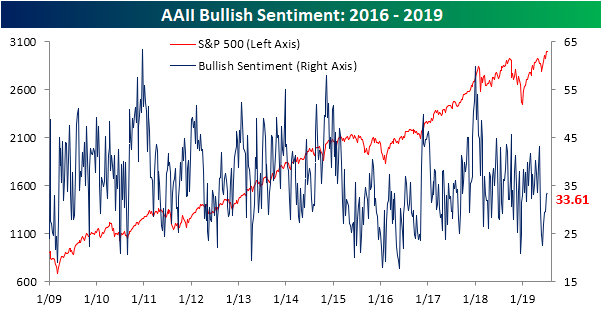

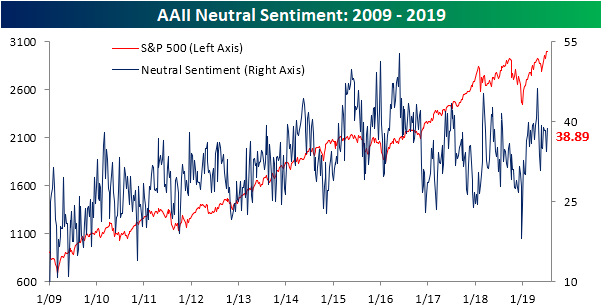

Sentiment Continues Its Slow Climb

The S&P 500 and Dow have continued to make pushes up to new all-time highs in the past week but sentiment remains subdued. AAII’s weekly sentiment survey showed 33.61% of respondents have bullish sentiment, up 0.5% from last week. As we have been mentioning, this is in the lower range of sentiment readings given the run-up to new highs. At this level, bullish sentiment is in the 15th percentile of times that the S&P 500 has reached a new all-time high in the past week. Additionally, the current reading is still below the historical average for bullish sentiment as it has been for nine straight weeks now. That is the longest such streak since the 12-week streak ending May 17th of last year.

While bullish sentiment only saw a slight increase, bearish sentiment saw its largest decline in a month falling from 32.35% down to 27.5%. Bearish sentiment is now at its lowest level since the first week of May and is also below the historical average for the first time since that same week.

Most of the losses to bearish sentiment were picked up by those reporting as neutral. The percentage of investors reporting this sentiment rose 4.4% to 38.89%. This brings it back to the high 30’s levels that it has sat at for a majority of 2019. Start a two-week free trial to Bespoke Institutional to access our interactive economic indicators monitor and much more.

Chart of the Day: CPI Surges Just In Time For Fed To Cut

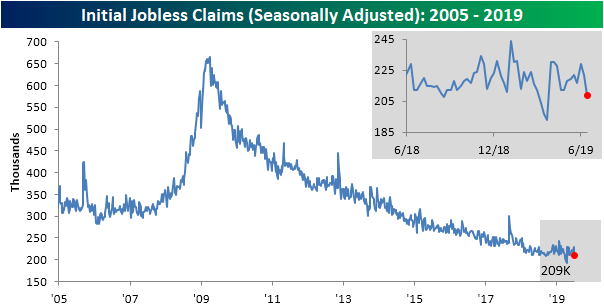

Lowest Claims In Three Months

Fed Chair Powell’s testimony on Capitol Hill yesterday made frequent mentions of the strength of the labor market, and initial jobless claims data released this morning helped to give further support of this strength. Claims were expected to come in unchanged from last week at 221K but instead fell to a seasonally adjusted level of 209K. That is the lowest print in about three months (since April 12th) when claims came in at the multi-decade low of 193K. Whereas the past few weeks were near the upper end of the past year’s range, this drop now brings claims back down towards the lower end of that range. In other words, while not a new low, it is still a healthy number. As such, the record streaks at or below 250K and 300K continue at 92 weeks and 227 weeks, respectively.

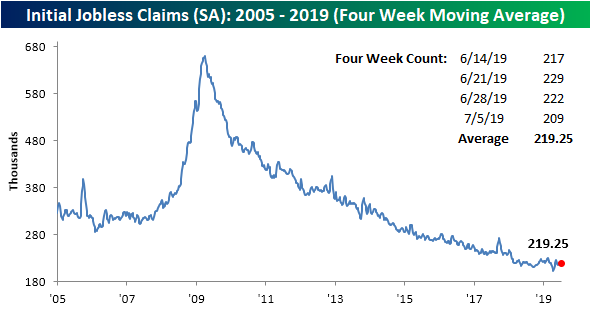

The four-week moving average helps to sift out some of the fluctuations of the high-frequency weekly data. This week saw the moving average fall from 222.5K down to 219.25K. Unlike the weekly number, there were actually several lower prints throughout the past couple of months, so this does not bring the indicator back towards the lower end of its range. In fact, this decrease only brings things back to where they stood about one month ago.

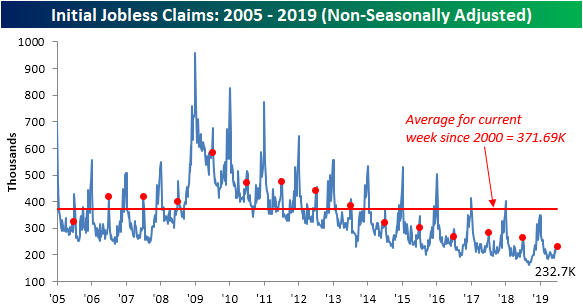

As could be expected given seasonal patterns, on a non-seasonally adjusted basis, claims rose to 232.7K after falling to 224.5K last week. Typically, the current week of the year sees a sizeable increase in claims averaging a week-over-week rise of over 42K over the past fifteen years, but this week’s change was much smaller with only an 8.2K increase. This week’s NSA number was also lower than the comparable week in 2018 when NSA claims were 264.9K. Additionally, this was the lowest reading in claims for the current week of the year of the current cycle and it was substantially under the average for the past couple of decades of 371.69K. Start a two-week free trial to Bespoke Institutional to access our interactive economic indicators monitor and much more.