Bespoke’s Global Macro Dashboard — 7/17/19

Bespoke’s Global Macro Dashboard is a high-level summary of 22 major economies from around the world. For each country, we provide charts of local equity market prices, relative performance versus global equities, price to earnings ratios, dividend yields, economic growth, unemployment, retail sales and industrial production growth, inflation, money supply, spot FX performance versus the dollar, policy rate, and ten year local government bond yield interest rates. The report is intended as a tool for both reference and idea generation. It’s clients’ first stop for basic background info on how a given economy is performing, and what issues are driving the narrative for that economy. The dashboard helps you get up to speed on and keep track of the basics for the most important economies around the world, informing starting points for further research and risk management. It’s published weekly every Wednesday at the Bespoke Institutional membership level.

You can access our Global Macro Dashboard by starting a 14-day free trial to Bespoke Institutional now!

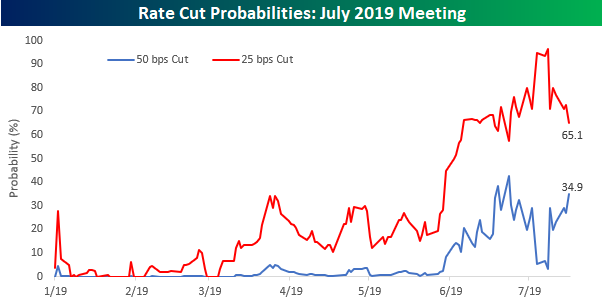

25, 25, 25, Do I have 50?

Remember back on July 5th after the stronger than expected employment report when the probability of a July 50 basis point (bps) rate cut plunged from 29% all the way down to 5%? Of course, you don’t! It was a summer Friday between July 4th and the weekend. The following Monday, though, market expectations for a 50 bps cut continued to fall, even falling below 3% early that week. Ever since that knee-jerk reaction to the employment report, though, probabilities for a 50 bps cut have been back on the rise and are higher now than they were right before the release of the June employment report. At over 34% now, the market is pricing in better than a 1 in 3 chance of a 50 bps cut at the July 31st meeting.

While there have been some weaker than expected data points since the employment report (Industrial Production, Capacity Utilization, Housing Starts, and Building Permits), there have been many more better than expected reports. Small Business Sentiment, Jobless Claims, Empire Manufacturing, Homebuilder Sentiment, Retail Sales, CPI, and PPI are all reports that have come in better than expected since July 5th. While not all the readings have been particularly strong, it’s puzzling to see probabilities of more aggressive easing rise even as the pace of better than expected reports improves. Start a two-week free trial to one of Bespoke’s premium equity market research services.

Bespoke’s Morning Lineup – Home Sweet Home

Earnings season is slowly starting to ramp into gear, and this morning’s reports continue to come in mixed relative to expectations. In terms of bottom-line numbers, the beat rates are still strong, but revenues have been coming up short. Only three of the ten companies to report so far this morning have exceeded revenue forecasts.

Read today’s Morning Lineup to get caught up on news and stock-specific events ahead of the trading day and a further discussion of recent earnings from the banks and overnight events including the latest trade data out of Singapore.

Bespoke Morning Lineup – 7/17/19

With two key housing reports due out momentarily, we wanted to take a quick look at how the housing stocks have been faring of late. To start off, let’s take a look at the performance of the iShares Home Construction ETF (ITB), which is primarily made up of homebuilders but also some peripheral companies like Home Depot (HD) and Lowe’s (LOW). With interest rates cratering in the last few months, the homebuilders have benefitted, and just like the broader market, the group is starting to break out from its recent sideways range. At a current level of $39.33, though, the ETF still has to clear the $40.23 level in order to take out its 52-week high from last summer. How today’s Housing Starts and Building Permits report comes in relative to expectations will go a long way in determining whether that happens today or not.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.

The Closer – Energy Technicals, Cyclical Silver, Strong Data – 7/16/19

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we review the technical setup of the Energy Sector ETF (XLE) given the news of tensions easing between the US and Iran, which sent oil prices and the energy sector sliding today. We also note the breakout of silver over the past couple of sessions and Consumer Discretionary’s outperformance versus the rest of the market. Next, we turn to the dovish turn in Fedspeak with Kaplan and Powell’s statements today. We finish with a look at today’s data releases including Retail Sales, NAHB Homebuilder Sentiment, and Industrial Production, all of which showed strength and further muddle the reasoning of rate cuts.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

US Beats World When It Comes to Stocks

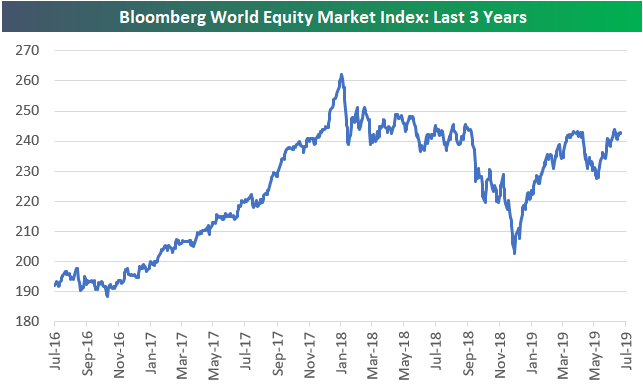

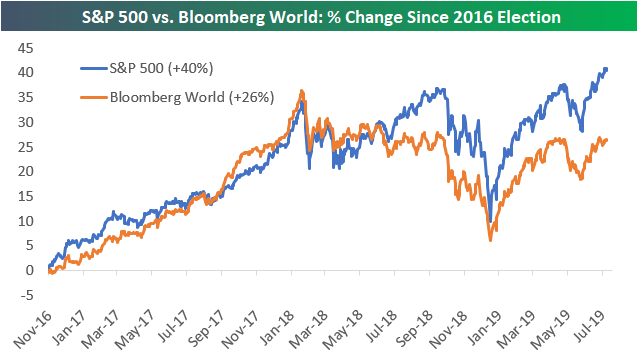

The Bloomberg World index is a cap-weighted index made up of nearly 5,000 stocks from around the world (including US stocks). While the S&P 500 has been hitting new all-time highs over the last week, the Bloomberg World index remains 7% below highs that it last made back in January 2018.

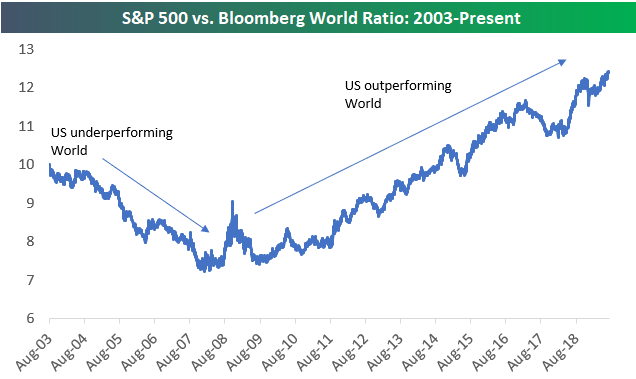

Below is a chart showing the ratio of the S&P 500 to the Bloomberg World index since the World index’s inception back in August 2003. While the World index outperformed the US for five years in the mid-2000s, the US has been outperforming since the end of 2007, which includes both the Financial Crisis and the bull market that has been in place since the 2009 lows.

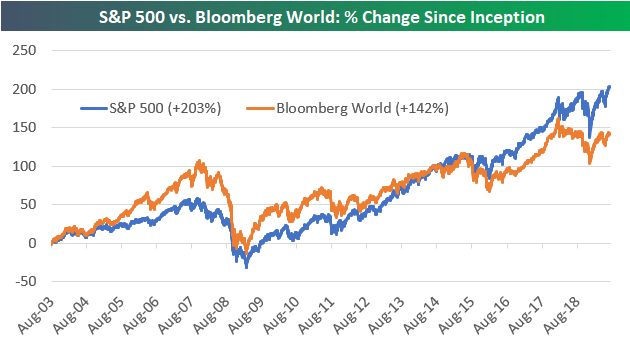

Along with the relative strength chart between the two indices above, below we show the price change of the S&P 500 versus the Bloomberg World index since August 2003. Through today, the S&P was up 203% versus a gain of 142% for the Bloomberg World index.

Since the November 2016 election, the S&P 500 is up 40% versus a gain of 26% for the Bloomberg World index. Notably, the World index kept up with the S&P through early 2018, but weakness for the World index in mid-2018 and a failure to bounce back as much as the US this year has left the World index well behind. Start a two-week free trial to one of Bespoke’s premium equity market research services.

Best Performing Stocks Over the Last 12 Months

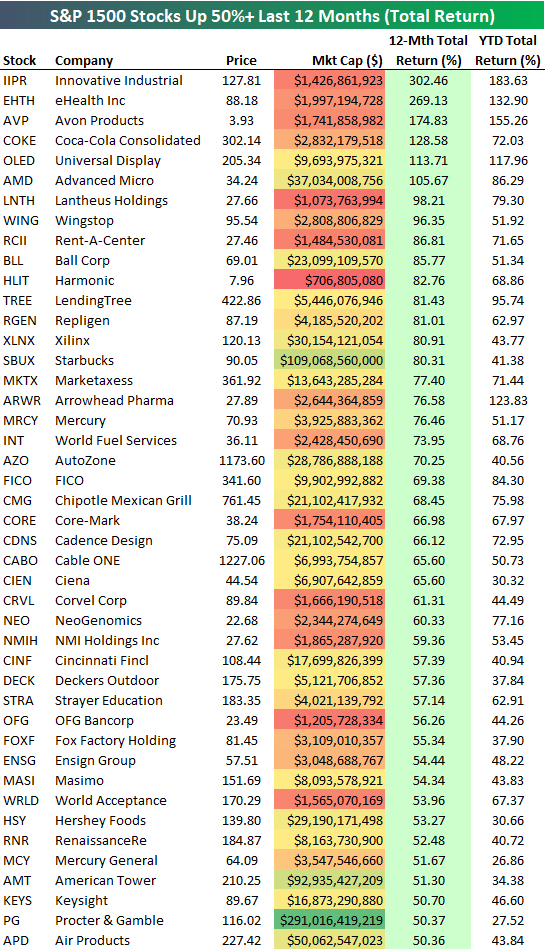

The S&P 500 is up over 20% YTD, but over the last 12 months, it is up just under 10% on a total return basis. And within the S&P 1500, there are only 44 stocks that are up more than 50% on a total return basis over the last 12 months. These 44 stocks are listed below.

Innovative Industrials (IIPR) — a cannabis REIT — has been the best performing stock in the S&P 1500 over the last year with a total return of 302%. In second place is eHealth (EHTH) with a gain of 269%, followed by Avon Products (AVP) at +174.8% and Coca-Cola Bottling (COKE) at +128.58%. Coca-Cola Bottling is probably one of the last names you would have guessed as a top five performer over the last year! Other notables on the list of biggest winners include Advanced Micro (AMD), LendingTree (TREE), Starbucks (SBUX), AutoZone (AZO), Chipotle (CMG), Hershey (HSY), and Procter & Gamble (PG).

Some names that aren’t on the list that you may have expected to see? AMZN, NFLX, MSFT? Nope. None of the mega-cap Tech companies are on the list of biggest winners due to serious weakness from this group in Q4 2018. Start a two-week free trial to Bespoke Institutional to unlock all of Bespoke’s premium equity market research and interactive looks.

Bespoke Stock Scores — 7/16/19

Chart of the Day: Old Pattern, New Highs For Cisco (CSCO)

COTD Bullet Points:

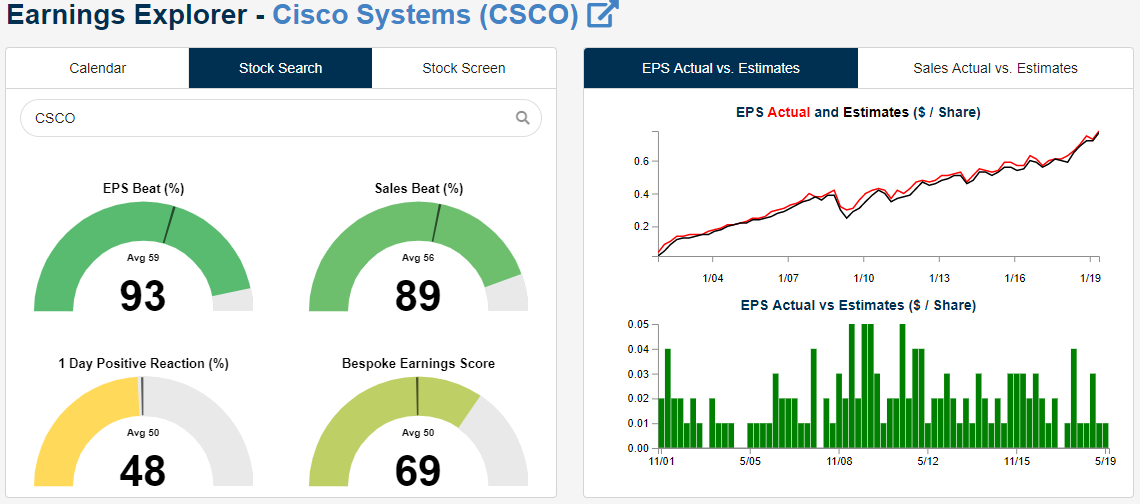

- Cisco (CSCO) has just broken out above resistance that it has been stuck under for the past three months ahead of next month’s earnings.

- The chart pattern has played out multiple times in the past few years and has usually been followed by sizeable runs.

Chart of the Day:

Back in February, we noted a chart pattern over the past several years for Cisco (CSCO) where the stock has repeatedly broken out on its third test of resistance usually thanks to a positive reaction to its quarterly report. In the chart below, we show this pattern in addition to CSCO’s quarterly reports represented by the vertical lines. Only being in the first few days of earnings season, CSCO does not report for another month (August 14th), but this same pattern of a breakout on the third test of resistance is more or less playing out again now. After three months of being stuck under the $57 level, CSCO is now breaking out.

In late June, CSCO reached this resistance at the prior 2019 high from April. Without earnings acting as a catalyst as it has the past few times this pattern played out, the stock only briefly broke out intraday on June 21st but fell in the following days. This pullback from overbought levels brought CSCO down to support at the 50-DMA in the first days of July, where it made a higher low. From there, it has been rallying further and has broken out in the past week. Although it is now elevated at current levels, this breakout to 52-week highs has been a promising sign for the stock in the past.

While CSCO’s earnings report is still about a month away, the stock has consistently exceeded forecasts. The last time CSCO missed EPS or sales forecasts was back in 2013. Going back to the start of our data in 2001, it has beaten EPS estimates 93% of the time and sales estimates 89%. Additionally, it has only raised guidance around 10% of the time. Despite consistent beats, in aggregate, the full day price reaction has been positive a little less than half the time, averaging a one day gain of just 9 bps. Fortunately, for Q2 reports, performance is slightly better with the stock averaging a one-day gain of 1.05% with positive returns 53% of thr time.

2% Days Few and Far Between

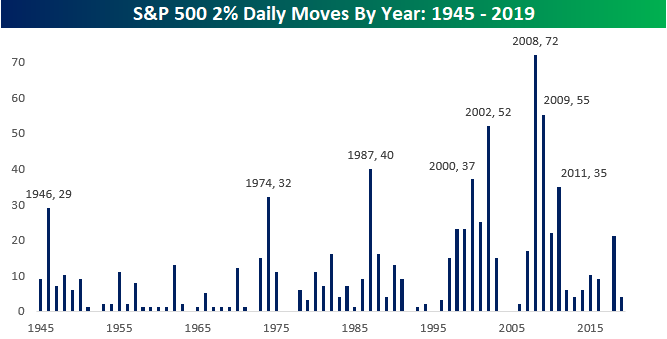

Although the last two trading days have seen exceptionally narrow daily ranges, today we wanted to take a quick look at the S&P 500’s frequency of 2% daily moves (either up or down) in the post-WWII period. The chart below breaks out the frequency of 2% days by year, and years with more than 25 one-day moves of 2% are notated accordingly.

Overall, there have been an average of 11 daily 2% moves in a given year. After five straight years from 2007 to 2011 where we saw an above-average number of 2% days, the last seven years have only seen one year with an above-average number of occurrences (2018, 21). Remember, in 2017 there wasn’t one single trading day that saw the S&P move up or down 2%!

So far this year, there have only been four 2% days, but with the most volatile part of the year on tap, we are likely to see that number increase in the months ahead. Don’t expect the relative calm that we have seen in the last few trading days to last forever. Volatility is unpredictable and usually comes up and surprises you when you least expect it! Start a two-week free trial to Bespoke Institutional to access our premium content and interactive tools.

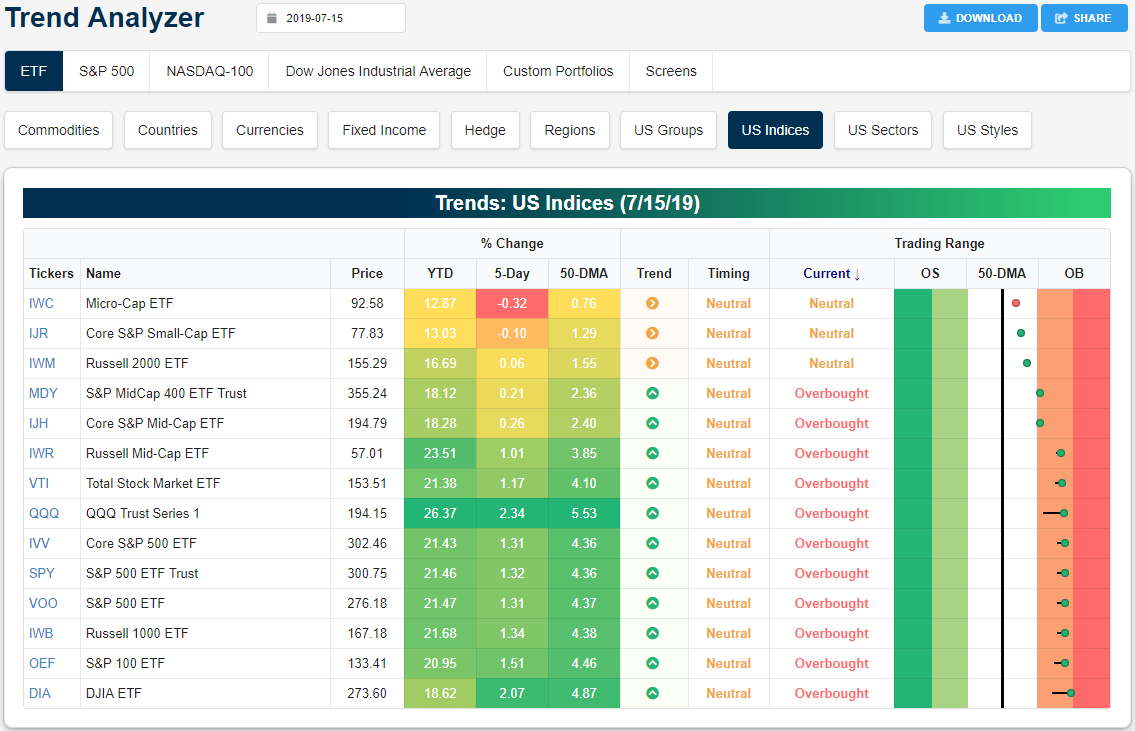

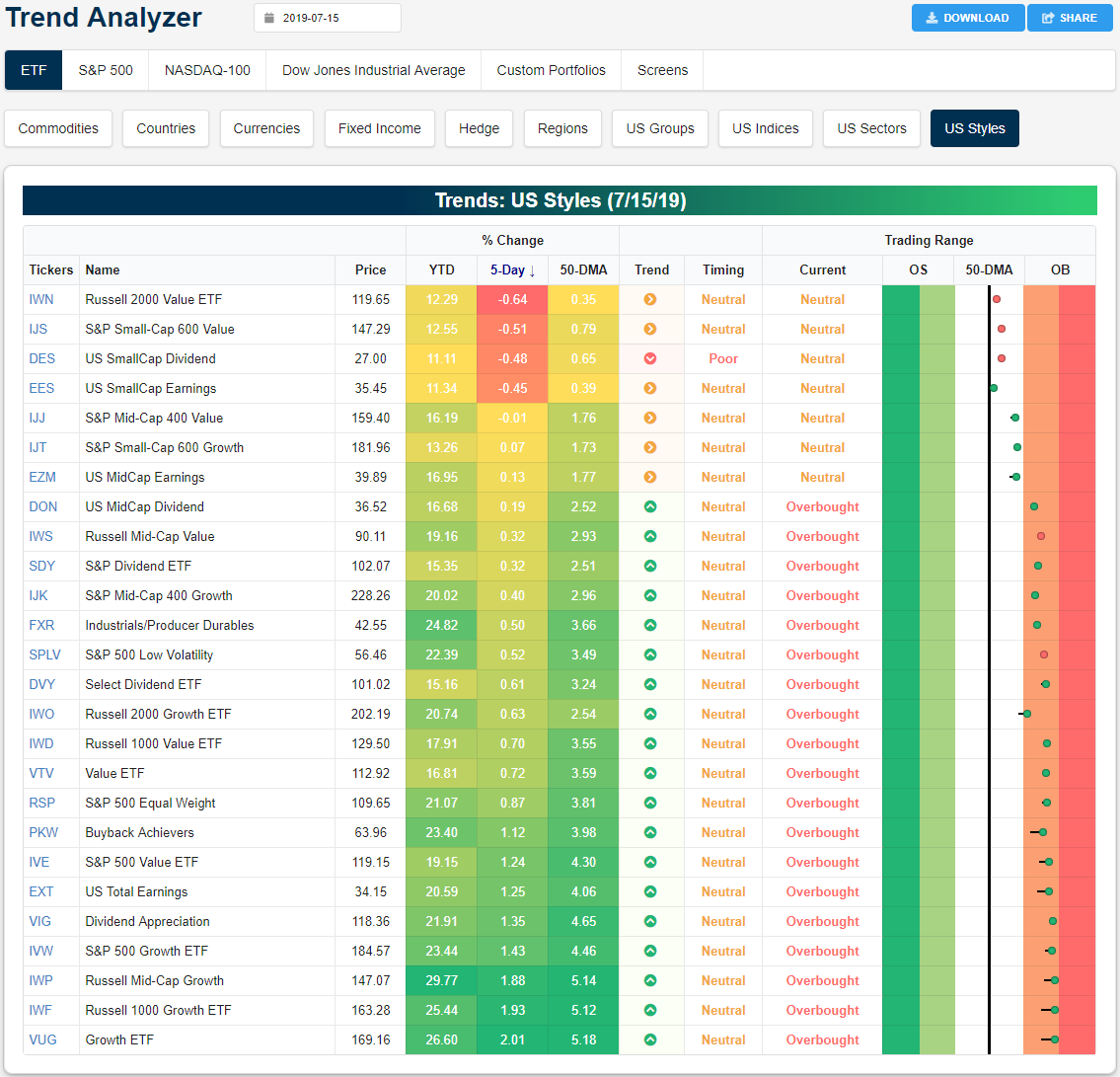

Trend Analyzer – 7/16/19 – Growth Outpacing Value

After starting at extreme overbought territory yesterday, the Dow (DIA) has come back a little bit within its trading range despite closing slightly higher in yesterday’s session. That brings the sum of overbought major index ETFs to eleven while the three small caps remain neutral. The Micro-Cap (IWC) and Core S&P Small-Cap (IJR) both have fallen in the past five days—the only major index ETFs to have done so—while the Russell 2000 (IWM) has moved only 6 bps higher. Even with the large-cap indices like the S&P 500 (SPY) reaching new all-time highs, the small-caps are sitting in sideways trends over the past six months. Given this, they also have risen the least year-to-date. Conversely, the Nasdaq (QQQ) has risen over 26% in 2019, the best of these ETFs by a solid margin.

Even with the various style ETFs, small-cap underperformance is evident as the four worst performing ETFs of the group are all small-cap focused. In addition to the underperformance of small-caps, value has also been underperforming growth recently. Across the ETFs in the US Styles screen of our Trend Analyzer, not a single value ETF is doing better than its growth counterpart for the major indices. The Growth ETF (VUG), Russell 1000 Growth (IWF), and Russell Mid-Cap Growth (IWP) have been the top performers of these. Additionally, the S&P Mid-Cap 400 Value (IJJ), S&P Small-Cap 600 (IJS), and Russell 2000 Value (IWN) have all declined in the past week. Start a two-week free trial to Bespoke Institutional to access our interactive Trend Analyzer and much more.