Bespoke Matrix of Economic Indicators: 7/2/19

Our Matrix of Economic Indicators is the perfect summary analysis of the US economy. We combine trends across the dozens and dozens of economic indicators in various categories like manufacturing, employment, housing, the consumer, and inflation to provide a directional overview of the economy.

To access our newest Matrix of Economic Indicators, start a two-week free trial to either Bespoke Premium or Bespoke Institutional now!

Morning Lineup – No Fireworks Yet

Quiet is the word this morning. There are no major economic reports on the calendar, no major earnings releases, and little in the way of volatility in overseas markets. China and Japan were basically flat overnight, most of Europe is little changed, and the yield on the 10-year Treasury is unchanged from yesterday. Even bitcoin is down just 4% after several days of 10%+ daily moves. The only major news headlines concern tariff threats (what else is new), but this time on European imports, and then talk that Saudi Aramco is looking to revive the IPO process.

Read today’s Morning Lineup to get caught up on news and stock specific events ahead of the trading day, as well as updated charts on the technical state of the market.

Bespoke Morning Lineup – 7/2/19

One indicator we track in order to asses the internal health of the market is the percentage of S&P 500 stocks hitting 52-week highs on a daily basis. In June, there were two days where the daily percentage of stocks hitting new highs clocked in at a healthy 20%, but in yesterday’s rally to new highs, the percentage of stocks that hit new highs only got as high as 11.9%, which is a relatively weak reading for a day when the S&P 500 breaks out to all-time highs. Going forward, we will be looking for stronger readings, especially on a positive market day like Monday.

In terms of the percentage of stocks in the ‘pipeline’ for new highs, the chart below summarizes where S&P 500 components finished yesterday relative to their 52-week highs. 20% of S&P 500 components are currently within 2% of a 52-week high (red bar), while another 21% are more than 2% but less than 5%, so on a strong market day there is certainly the potential for new highs to surge, but with futures indicating a slightly lower open, it’s unlikely we will see that surge today.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.

The Closer – Decile Analysis, Sector Weightings, ISM Beat – 7/1/19

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we provide our decile analysis of the S&P 500 for the month of June. We also look to see how sectors that perform best or worst in the 1st half of the year typically perform in the 2nd half. We update S&P 500 sector weightings and how they changed in the first half, and we finish the report off with a look at today’s better than expected ISM Manufacturing report.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

Broadly Weak Manufacturing Data

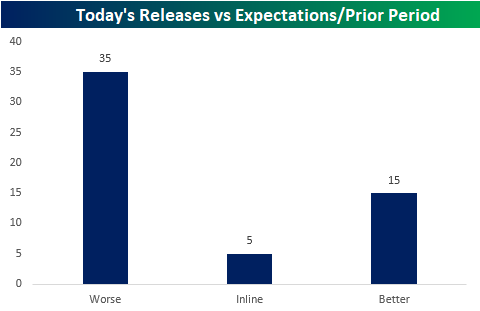

There was a huge slug of data out from all around the world overnight and today. The results did not live up to expectations as the majority (35 data points) came in either worse than forecasts or worse than the previous period. Meanwhile, five met expectations or were unchanged and fifteen indicators saw improvement.

The data slate over the past 24 hours was primarily comprised of manufacturing data including final June Markit PMIs, the ISM PMI in the US, and Japanese Tankan indices. Of all the manufacturing data points out today, over three quarters came in below expectations or worse than the previous period (highlighted in red in the Global Economic Scorecard below). The Americas and Australia at least provided some relief as the US, Mexico, Brazil, and Australia were the only bright spots for Markit PMIs. Each saw the opposite result of the rest of the world with beats. Granted, the picture is a bit more muddied taking other indicators into account. Australia’s AIG Performance of Manufacturing index was weaker and the US’s ISM PMI also had some weak spots despite a headline beat. ISM Prices Paid came in with a contractionary reading and ISM New Orders also weakened to a flatline reading of 50. Japanese data was similarly mixed in the quarterly results for Tankan indices. While the data was generally worse, large manufacturers were a silver lining given a better than expected reading for outlook. Additionally, non-manufacturing data for these same Tankan indices held up better than their manufacturing counterparts. Later this week (beginning tomorrow night into Wednesday) we will see other non-manufacturing data with the release of Markit Service PMIs from around the globe. Subscribers can use our Economic Monitors help to keep track of all of the day’s economic releases domestic and abroad. Start a two-week free trial to Bespoke Institutional to access our interactive economic monitor and much more.

Chart of the Day: Stocks vs Bonds

June 2019 Headlines

Trend Analyzer – 7/1/19 – Strong End of June, Strong Start to July

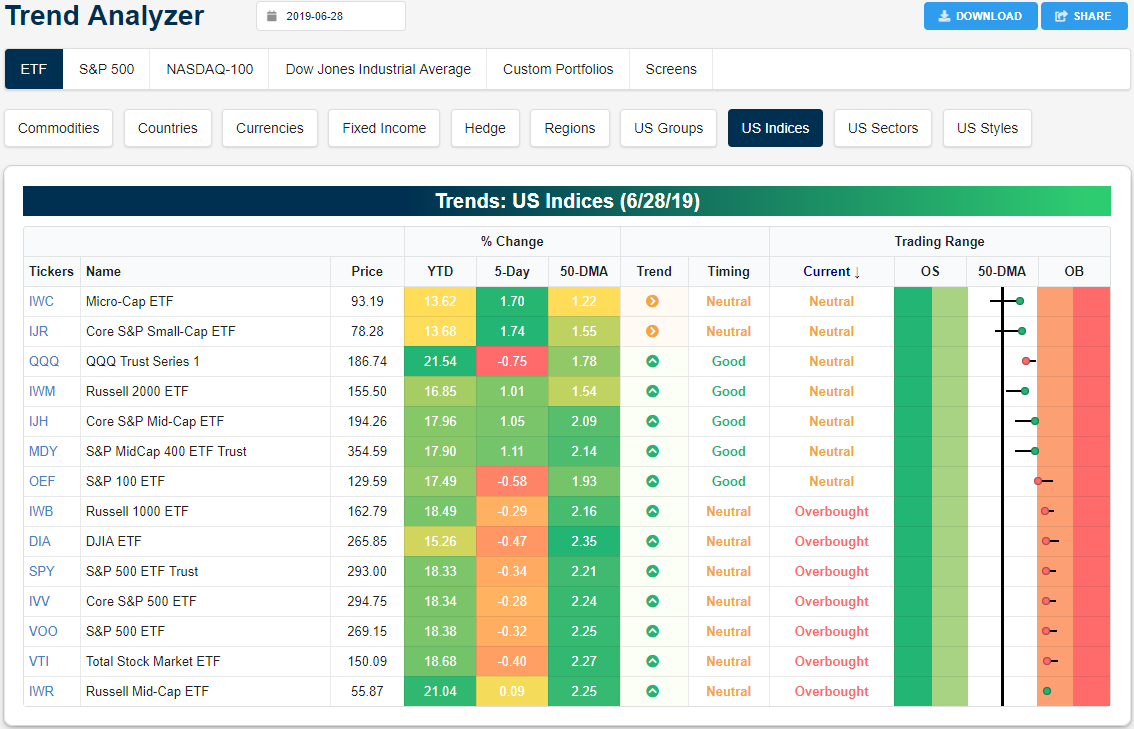

After finishing the session higher on Friday to cap off a strong June and first half of 2019, conditions have not necessarily become overly extended as the major indices work their way back all-time highs. Only half of the 14 the major index ETFs are overbought while the rest are neutral. These overbought ETFs are primarily comprised of large caps including the Dow (DIA), S&P 500 (SPY), and Russell 1000 (IWB). Meanwhile, distancing itself from some of its peers, the Nasdaq (QQQ) was the worst performer last week and has actually fallen out of overbought territory. Now sitting at neutral, QQQ is actually one of the least overbought ETFs of this group.

While large caps are mostly overbought, they are down versus one week ago, and as such, less extended than they were a week ago as well. The red dots and tails to the right in our Trend Analyzer tool show this slight pullback off of more overbought levels. On the other hand, small and mid-caps outperformed last week as each saw a gain of over 1%—save the Russell Mid Cap (IWR) which only rose 0.09% as it is also the most overbought index ETF. The Micro Cap (IWC) and Core S&P Small Cap (IJR) were the strongest performers rising over 1.7%, taking out the 50-DMA in the process. Despite the short term performance for these two, the long term trend is still sideways.

Following geopolitical progress made this past weekend at the G-20 summit, S&P 500 futures have gapped up to all-time highs leading to what will likely be a sizable gap up for other indices at the open as well. As shown in the charts from our Chart Scanner tool below, another gap up will lead some of these index ETFs back up towards their all-time or prior highs. A number of index ETFs reached new highs in the past couple of weeks in the form of both all-time highs for the Dow (DIA) and the S&P 500 (SPY) as well as lower highs like the S&P MidCap 400 (MDY). The major indices once again reaching these highs would be a positive sign for stocks. Similarly, late last week, the small cap IWC and IWM both managed to see some positive technical developments in taking out both the 200 and 50-DMA. Currently, none of the major index ETFs sit below either the 200 or 50-day. Start a two-week free trial to Bespoke Institutional to access our Trend Analyzer tool and much more.

Bespoke ETF Matrix — First Half Asset Class Total Returns

The S&P 500 (SPY) gained 7% on a total return basis in June, leaving it up 18.37% on the year at the halfway mark. The Nasdaq 100 (QQQ) gained 21.54% in the first half, while the Dow was more than 6 percentage points weaker at +15.18%. Mid-caps performed about inline with large-caps in the first half, while small-caps underperformed slightly.

Looking at S&P sectors, Energy (XLE) had a very strong June, but that still wasn’t enough to put it in positive territory for the entirety of the second quarter. Materials (XLB) was the best sector in June with a gain of 11.57%, while Utilities (XLU) was up the least in June at +3.18%. For the first half, Tech (XLK) was up the most at +26.89%. The Tech sector was actually the best performing ETF in the entire matrix in the first half of 2019.

Outside of the US, every country gained in June except India (PIN), which was down 1.44%. For the second quarter and the full first half, Russia (RSX) was the best-performing country. In Q2, RSX gained 14.71%, while the ETF gained 26.03% for the full first half.

Oil (USO) was up 24.53% in the first half, while natural gas (UNG) was down 19.51%. Gold was up 9.86% in the first half, but silver (SLV) was actually down 1.31%.

Finally, Treasury ETFs posted solid returns across the board in the first half, with the 20+ Year (TLT) gaining more than 10%. Start a two-week free trial to Bespoke Premium to see our just-published Mid-Year Outlook report.

Morning Lineup – And They’re Off!

It’s hard to imagine a stronger way to start off the second quarter as US equities and risk assets around the world are surging following what is being billed as a cease-fire in the US-China trade war and President Trump’s meeting with North Korean leader Kim Jung-Un over the weekend.

While the news surrounding trade has been positive, the reality on the ground remains less optimistic. Manufacturing PMIs for the month of June continued to show weakness around the world, and this morning’s ISM Manufacturing report for the US will kick off a busy week of economic data in the US that will go a long way in determining whether the market is correct in its pricing of 100% certainty that the FOMC will cut rates at the end of the month.

Read today’s Morning Lineup to get caught up on everything you need to know ahead of the new trading day including a recap of overnight trading in Asia and Europe as well as a rundown of all economic data released.

Bespoke Morning Lineup – 7/1/19

The S&P 500 SPY ETF is set to gap up more than 1% this Monday morning, so we wanted to highlight a few stats surrounding similar types of moves.

Since 1993 when SPY began trading, there have been 255 gaps up of 1%+, which accounts for 3.8% of all trading days. On these 255 days, SPY has averaged a further gain of 0.20% from the open to the close of trading after the initial jump at the open.

Today is also a Monday morning, and there have been 49 Monday mornings since 1993 in which SPY began the trading week with a 1%+ jump at the open. On these 49 Mondays, SPY has averaged a further gain of 0.18% from the open to the close of trading. Notably, though, returns one week from the open following Monday gaps up of 1% have been poor, with SPY down an average of 1.12% five days later.

It’s also the first trading day of the month. Since 1993, SPY has gapped up 1%+ on the first trading day of the month 16 prior times, which is about 5% of the time. The average open to close change on these days has been positive at +0.34%.

And what about Monday gaps up of 1%+ to start a new month? That has happened 9 times since 1993, which is 7.4% of the time. On these 9 trading days, SPY has basically been flat from the open to the close of trading.

Finally, there have been just 4 starts to a new quarter that have seen 1%+ gaps higher at the open for SPY, and on these 4 days, SPY has continued higher from open to close twice (50%). Five days later, though, SPY has been higher every time.

Today would be the first time in its history that SPY has gapped up 1%+ at the open on the first trading day of July.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.

Bespoke Brunch Reads: 6/30/19

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium for 3 months for just $95 with our 2019 Annual Outlook special offer.

M&A

A New Era For Blockbuster Bank M&A by Nathan Stovall (S&P Global)

In the wake of the massive BB&T/SunTrust merger, the outlook for bank mega-mergers looks sunnier now than it has for some time. Other recent deals follow a similar theme. [Link]

Economic Background

The Balance of Payments by Claus Vistesen (AlphaSources)

A review of the balance of payments: what they are, where they come from, why they should be taken with a grain of salt, and more. [Link; 18 page PDF]

Birth Control

The first clinical trial of a male contraceptive gel is starting in the UK, and it could mean an alternative to the pill by Lindsay Dodgson (Business Insider)

A drug trial is under way in the UK which offers a male alternative to female-only hormonal birth control. The medication offers an additional or alternative family planning method and has some major advantages over existing treatments as far as reliability goes. [Link]

George Rosenkranz, 102, a Developer of the Birth Control Pill, Is Dead by Robert D. McFadden (NYT)

In 1951, George Rosenkranz synthesized the key ingredient that would become hormonal birth control pills, altering the history of human reproduction in the process. [Link]

Edge of Investing

Yale Enlists Endowment Chief to Help Develop New Asset Managers by Janet Lorin (Bloomberg)

A new one-year program offered by Yale School of Management will feature classes from the legendary manager of the school’s endowment, David Swensen. [Link; soft paywall]

Most Interesting ETF Filing Ever: Libra by David Nadig (ETF.com)

The details of Facebook’s new blockchain product look an awful lot like a very plain vanilla exchange traded fund, although the regulatory status of the instrument is significantly less clear. [Link]

Graft

A Plan to Mine the Minnesota Wilderness Hit a Dead End. Then Trump Became President. by Hiroko Tabuchi and Steve Eder (NYT)

A Minnesota mine project’s approval process was brought back from the dead after the major investor bought a house in DC and rented it to Ivanka Trump and Jared Kushner at a sub-4% cap rate. [Link; soft paywall]

Yesterday, I had a story taken down on Forbes for a post about Jedi DoD by John Furrier (Medium)

The Department of Defense’s massive effort to create a secure cloud is ripe for abuses, and Furrier appears to have stumbled on to one at the hands of Cisco. [Link]

Sports Stories

Megan Rapinoe’s greatest heartbreak, and hope by Gwendolyn Oxenham (ESPN)

While Rapinoe’s on-field successes are a massive contrast to the much darker path her brother has walked: more than half of his adult life has been spent incarcerated, and he’s battled drug addiction and gang violence in his path out of darkness. [Link]

‘What’s a Scarlet Letter?’ The Improbable Reinvention of A-Rod by Ben Reiter (Sports Illustrated)

Starting with the question “what is A-Rod doing at the Oscars?” and ending with a spelling lesson, the improbable propriety of Alex Rodriguez’s post-baseball career. [Link]

Europe

EU closes in on plan for European Commission and ECB top jobs by Alex Barker and Mehreen Khan (FT)

Backroom dealings in Brussels are pushing a possible compromise European Commission presidency headed by a center-left Dutchman, a center-right European Parliament president from Germany, and a French ECB President. [Link]

Strange Marketing

Reservations for Taco Bell’s hotel sell out in 2 minutes by Amelia Lucas (CNBC)

A pop-up hotel in Palm Springs offered by Taco Bell for its superfans sold out its 70-room offering almost immediately. [Link]

Tech Dystopia

Hunched backs and double eyelids: How tech-obsessed humans might look in 2100 by Rachel O’Donoghue (Daily Star)

A hypothetical exercise into the possible implications of extreme technology use, just realistic enough to scare readers but probably not something we’re going to see. [Link]

Mortality

‘It’s totally unfair’: Chicago, where the rich live 30 years longer than the poor by Jamiles Lartey (The Guardian)

Poorer sections of segregated Chicago have a life expectancy almost one-third as long as those of richer, whiter neighborhoods. [Link]

Overdose Deaths Likely to Fall for First Time Since 1990 by Jon Kamp (WSJ)

Early results for 2018 show that fatalities related to drug overdoses likely dropped for the first time since 1990. Experts attribute the decline to wider availability of Narcan (a drug that can stop an opiate overdose in its tracks) and possibly (and more darkly) fewer people susceptible to overdose after years of high death counts. [Link; paywall]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!