Chart of the Day: Year 3 Of Election Cycle Going As Planned

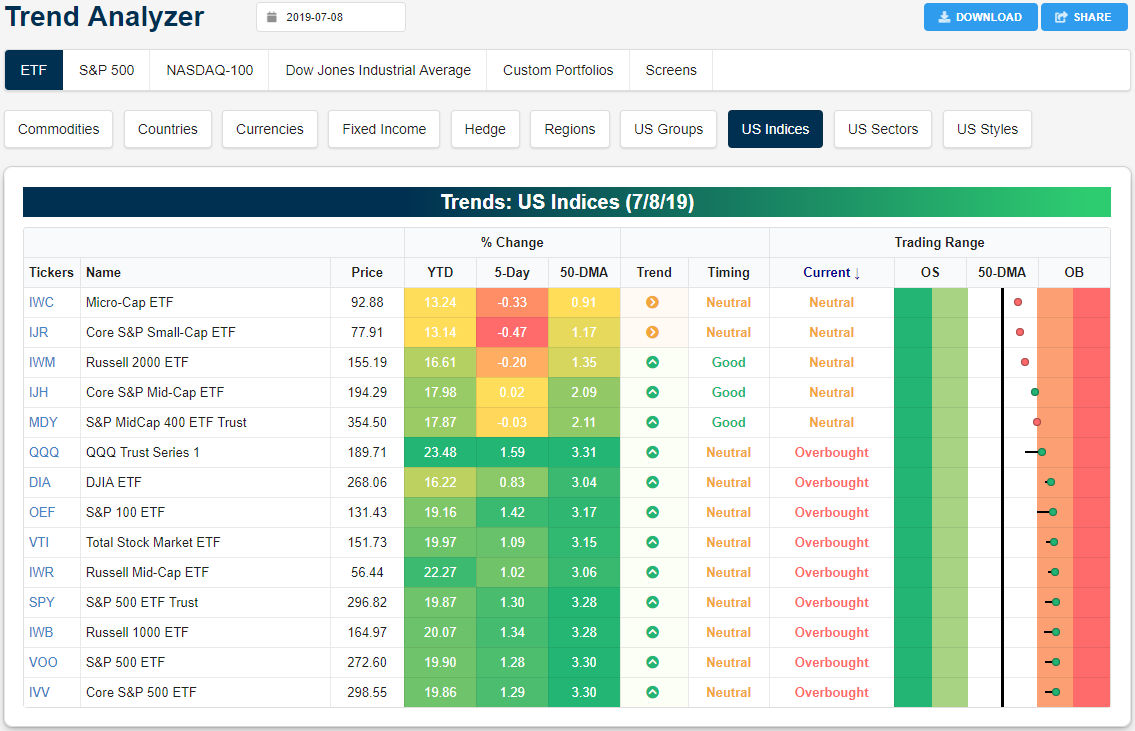

Trend Analyzer – 7/9/19 – Mid Caps Back to Neutral

Equities have continued to pull back off of their all-time highs from last week with further declines yesterday. Despite these declines, only small and mid-caps are in the red over the last five days. Whereas almost every major index ETF except for small-caps had been overbought, today there are nine overbought and another five that are neutral. Large caps remain overbought but have come off of near extreme levels. Meanwhile, mid-caps like the Core S&P Mid-Cap (IJH) and the S&P MidCap 400 (MDY) have moved back into neutral from overbought territory. These two ETFs are also about flat in the past week with each only having moved a few basis points. This is in stark contrast to the other mid-cap ETF in our Trend Analyzer, the Russell Mid-Cap (IWR), which has traded more in line with large caps. Currently, IWR is overbought and is dramatically outperforming other mid-caps as it has moved over 1% higher in the last week. As previously mentioned, small caps have yet to make it into overbought territory and are underperforming the rest of the market over the past week. Start a two-week free trial to Bespoke Institutional to access our interactive Trend Analyzer and much more.

The Most Volatile Stocks on Earnings: Q2 2019

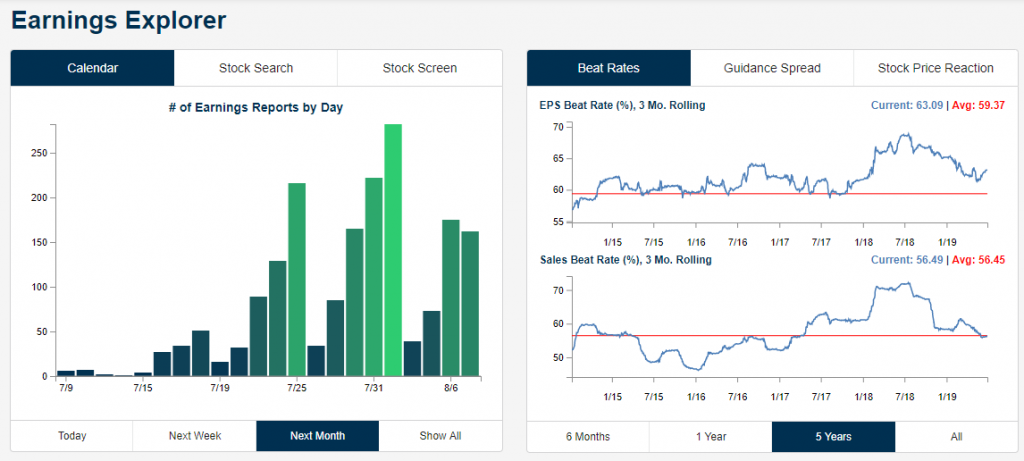

Below is a snapshot from our Earnings Explorer tool showing the number of publicly traded US companies that are set to report earnings over the next month. As shown, things don’t pick up until the second half of July and early August.

In terms of beat rates, coming into this earnings season, the rolling 3-month EPS beat rate stands at 63.09%, which is well above the long-term average beat rate of 59.37%. (The beat rate represents the percentage of companies that have beaten consensus analyst EPS estimates over the last 3 months.) The 3-month revenue beat rate is at just 56.49%, however, which is right inline with the historical average. You can keep track of numerous earnings-related stats on a daily basis using our Earnings Explorer tool. Try it out now with a two-week free trial to Bespoke Institutional.

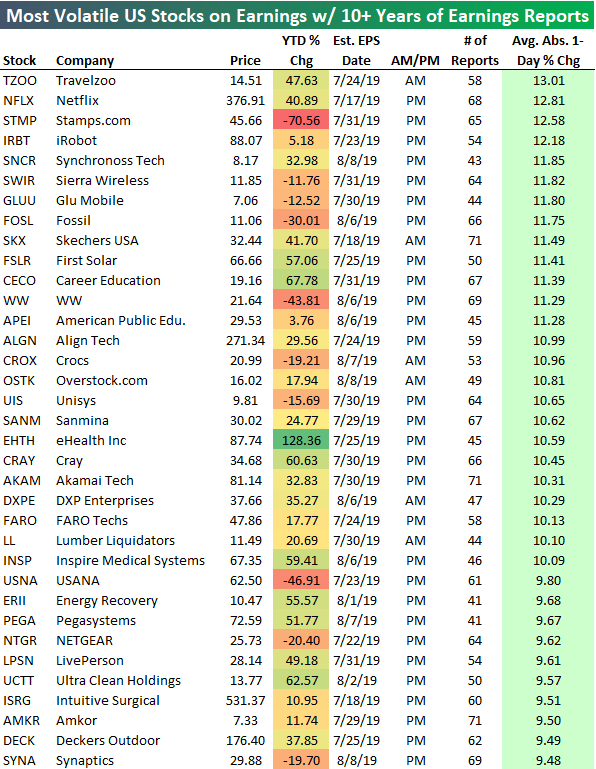

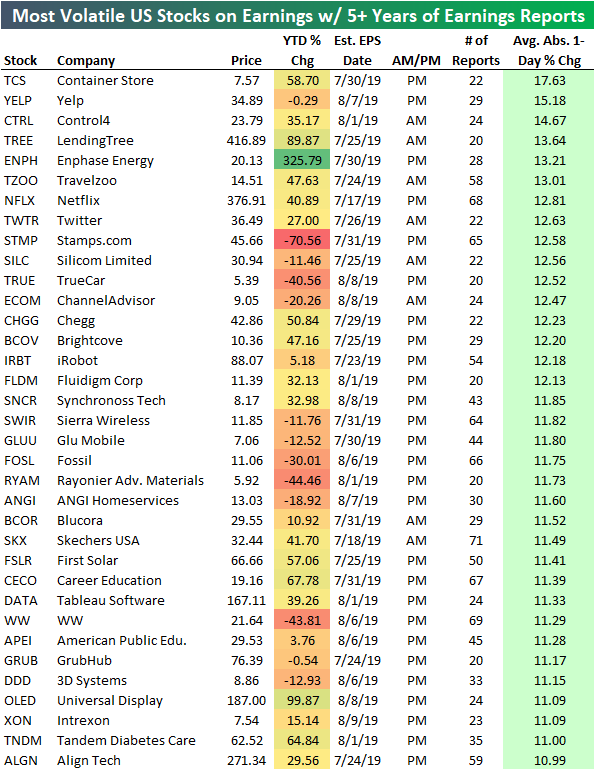

As we do at the start of each earnings season, below we take a look at the most volatile stocks on earnings. When we look at earnings volatility, we mean how the stock typically moves on the first trading day following its quarterly earnings report. For stocks that report after the close, we’re looking at its price change on the next trading day. For stocks that report in the morning before the open, we’re looking at its price change on that trading day.

We’ve been keeping track of earnings reports and price reactions to earnings for 20+ years now, and we have a database accessible to subscribers that lets you pull up historical earnings results for nearly every US company going back to 2001. Using our database, below is a list of the stocks with at least 10 years of quarterly earnings reports (at least 40 reports) that react the most violently to earnings. Each of the stocks listed has historically averaged a move of +/-9.4%+ on its earnings reaction day.

The most volatile stock on earnings with at least 10 years of reports is Travelzoo (TZOO). Over time, the stock has seen an average one-day move of +/-13.01% when it reports earnings. TZOO reports before the open on 7/24 this season. Netflix (NFLX) ranks second with an average one-day move of +/-12.81%, followed by Stamps.com (STMP), iRobot (IRBT), and Synchronoss Tech (SNCR). Other notables on the list of biggest movers include Fossil (FOSL), First Solar (FSLR), Align Tech (ALGN), and Intuitive Surgical (ISRG).

If we include companies that only have 5+ years of quarterly earnings results (20+ quarters), there are stocks with even more volatility. The Container Store (TCS) has 22 quarterly earnings reports, and the stock has averaged a one-day move of +/-17.63% on these days! Yelp (YELP) ranks 2nd with an average move of +/-15.18%, followed by Control4 (CTRL) at +/-14.67%, LendingTree (TREE) at +/-13.64%, and Enphase Energy (ENPH) at +/-13.21%.

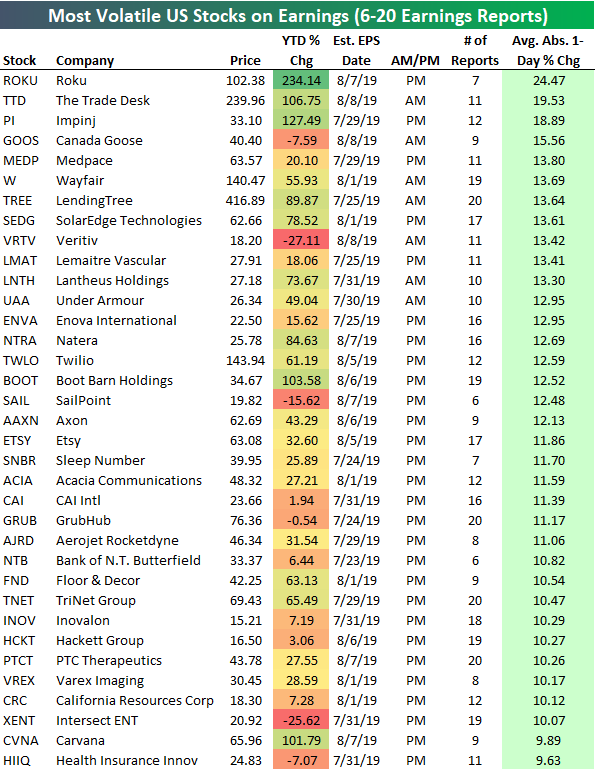

Finally, below is a list of companies that have between 6 and 20 quarterly earnings reports. Roku (ROKU) has 7 quarterly reports since it went public, and it has averaged a one-day move of nearly 25% on its earnings reaction day! The Trade Desk (TTD) has averaged a one-day move of +/-19.53% on its 11 earnings reports, while Inpinj (PI) has averaged a move of +/-18.89% on its 12 quarterly reports. Canada Goose (GOOS), Medpace (MEDP), and Wayfair (W) all average one-day moves of 13.6% or more. Start a two-week free trial to Bespoke Premium or Bespoke Institutional for comprehensive earnings analysis and a full calendar of upcoming reports. CLICK HERE to sign up now.

Bespoke’s Morning Lineup – Triple Digit Three-Peat

The Dow is on pace to post triple-digit declines in the opening minutes of trading for the third straight day, and that comes on the heels of several days where US large-cap stocks hit all-time highs. One drag on the DJIA this morning is 3M (MMM), which was downgraded at RBC Capital. Weakness in Europe is also helping to drag down sentiment in the US as BASF cut guidance last night, and the British pound is at a two-year low.

Read today’s Morning Lineup to get caught up on news and stock specific events ahead of the trading day and a further discussion of overnight events in Asia (including a horrendous MTO report in Japan) and Europe.

Bespoke Morning Lineup – 7/9/19

Brazilian equities are one area of the emerging markets space that has continued to break out this week as the benchmark Ibovespa approaches 105,000 for the first time ever. Sentiment on the country has really improved of late as a result of optimism concerning the outlook for an overhaul of the country’s social security system.

Even in dollar terms, Brazilian equities are breaking out. In just the last three days, the dollar-adjusted Ibovespa also broke out to new 52-week highs. If dollar weakness going forward continues, Brazilian equities should present strong returns from the perspective of US investors.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.

The Closer – Bad Breadth, Credit Wider, Eurozone Banks, Sentix, Consumer Credit – 7/8/19

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we begin with a recap of today’s weak market breadth as well as the widening of credit spreads. Next, given the news of Deutsche Bank (DB), we provide some outlook for the rest of the European banking industry by taking a look at contingent convertible bonds and NPLs. We finish with Sentix analyst sentiment and Consumer Credit.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

Chart of the Day: Uptrends and Breakouts for Financials

B.I.G. Tips – Here Comes Q2 Earnings Season!

Second quarter earnings season kicks off this week as Pepsi (PEP) reports before the open tomorrow, while Kraft Heinz (KHC) reports Wednesday, and Delta (DAL) reports on Thursday. The real action, though, will come next week as the major banks and more than 50 other S&P 500 companies will report results. As shown in the chart below, the busiest day of this earnings season will be on 7/25 when 61 S&P 500 companies are scheduled to report, while the busiest week for earnings will be the following week when a total of 160 companies will be reporting. After that things will quickly start to die down in August.

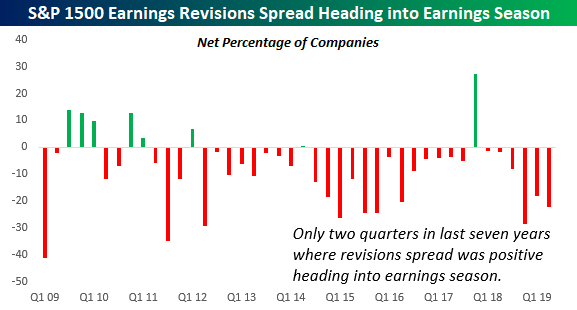

The key trend to watch this earnings season will be how often the term ‘China’ or ‘tariffs’ comes up in quarterly conference calls. With increased uncertainty created by the on-again, off-again escalation of trade disputes between the US and its largest trading partners, we have seen a significant uptick in negative analyst commentary. Over the last four weeks, analysts have raised EPS forecasts for just 278 companies in the S&P 1500 and lowered EPS forecasts for 611. This works out to a net of negative 333 or more than 22% of the stocks in the index. To put this in perspective, there has only been one other quarter in the last three years where the net EPS revisions spread heading into earnings season was more negative than it is now. This doesn’t mean that analysts are normally positive, though. As shown in the chart below, there have only been two quarters in the last seven years where the revisions spread was positive heading into earnings season.

We have just published our quarterly preview of the upcoming earnings season and what to expect in terms of overall market and sector performance based on trends in analyst revisions. To gain access to the full report, start a two-week free trial to our Bespoke Premium package now. Here’s a breakdown of the products you’ll receive.

Sentiment Slowly Recovering

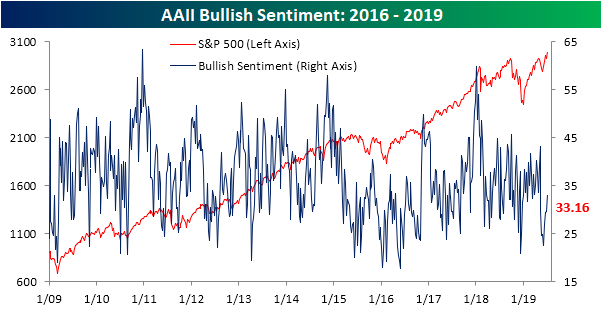

Despite the July 4th holiday, the American Association of Individual Investors (AAII) released their weekly readings on investor sentiment last Thursday. With the S&P 500 closing at all-time highs multiple times last week, bullish sentiment has continued to improve. Increasing by 3.57 percentage points to 33.16%, bullish sentiment now sits at its highest level since early May in what has been a steady recovery from the drop in sentiment as a result of the May pullback. This release also marked the fourth straight week with an uptick in bullish sentiment; the longest such streak since January 10th (also at 4 weeks) when sentiment was recovering from the depths of the Q4 2018 sell-off. Although bullish sentiment has recovered as the market has reached new highs, it is still fairly subdued by historical standards. At the current reading of 33.16%, it is only in the 14th percentile of readings when the S&P 500 has reached an all-time high within the past week. On average, bullish sentiment has been at 42.07% when new all-time highs are hit (since 1987).

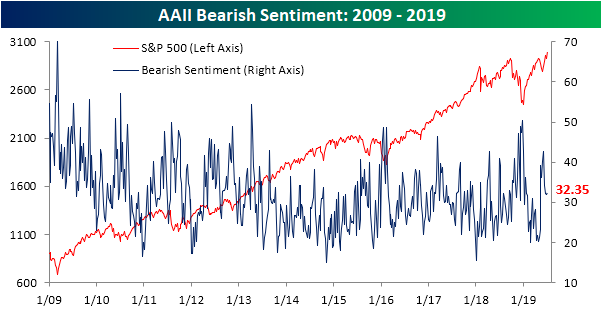

Meanwhile, bearish sentiment actually saw a small 0.3 percentage point increase, snapping a three-week long streak of declines. Readings of pessimism are essentially mirroring bullish readings in that it is still a bit elevated with the market at record highs. As with bullish sentiment, given price action, this is a bit unusual as bearish sentiment is in the 88th percentile of readings when the S&P 500 reached a new high within the past week. At 32.35%, it is also above the average of 25.29% for bearish sentiment when new highs are reached.

Bulls and bears both borrowed from the neutral camp last week as the percentage of respondents reporting neutral sentiment fell from 38.36% to 34.49%. This brings it to the lower end of its recent range and to its lowest level since mid-May. Given this decrease, sentiment is pretty evenly split amongst the bullish, bearish, and neutral camps. Start a two-week free trial to Bespoke Institutional to access our interactive economic indicators monitor and much more.

Trend Analyzer – 7/8/19 – Overbought but Off of Highs

The major US indices saw their first declines of the month on Friday after a stronger than expected Nonfarm Payrolls report put a damper on hopes for rate cuts. Despite Friday’s declines, conditions are still firmly overbought across the board with twelve major index ETFs overbought—many approaching extreme levels—and two at neutral levels. While large caps have primarily been leading the way higher with gains of 2%+ over the last week, the Russell MidCap (IWR) has actually performed the best in the past week with a gain of 2.53%. Other mid-caps like the S&P MidCap 400 (MDY) and Core S&P Mid-Cap (IJH) have also been making solid moves higher, both rising 2.28% last week, but IWR has recently more resembled the large-cap indices that its mid-cap peers. Meanwhile, small caps have lagged a bit. Both the Micro-Cap (IWC) and Core S&P Small Cap (IJR) both remain at neutral levels and in sideways trends over the past six months as they still have yet to reach new highs.

As previously mentioned, small caps have struggled to make a solid push back to last year’s highs. Over the past six months, small caps have basically been flat with current levels at the upper end of this range and near a longer-term downtrend line. It is a similar picture for mid caps although they are currently much closer to prior highs. The moving averages for these indices are basically all flat if not sloped downwards. The only outlier is the Russell Mid-Cap (IWR) which was reaching new highs as recently as last week with a chart that looks more similar to large caps like the S&P 500 (SPY) than IJH or MDY. Start a two-week free trial to Bespoke Institutional to access our interactive Trend Analyzer, Chart Scanner, and much more.

Bespoke’s Morning Lineup – July 4th Hangover Continues

After five straight days of gains and a number of record highs for the S&P 500 heading into July 4th, the post-holiday hangover for bulls continues this morning as US equities are poised for a second straight day of declines. The economic and earnings calendars are light today, so it could end up being a quiet summer day of trading as markets gear up for Powell testimony later this week and the start of earnings season next week.

Read today’s Morning Lineup to get caught up on news and stock specific events ahead of the trading day and a further discussion of the Deutsche Bank news over the weekend.

Bespoke Morning Lineup – 7/8/19

Friday’s better than expected jobs report put a dent in the narrative for rate cuts as far as the eye could see. However, while the market is now pricing in less than a 5% probability of a 50 bps rate cut at the July meeting versus something closer to a one-three chance at this time last week, there is still 100% certainty that the FOMC will cut rates by 25 bps at the July meeting. So, it’s not as though cuts have been taken off the table.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.