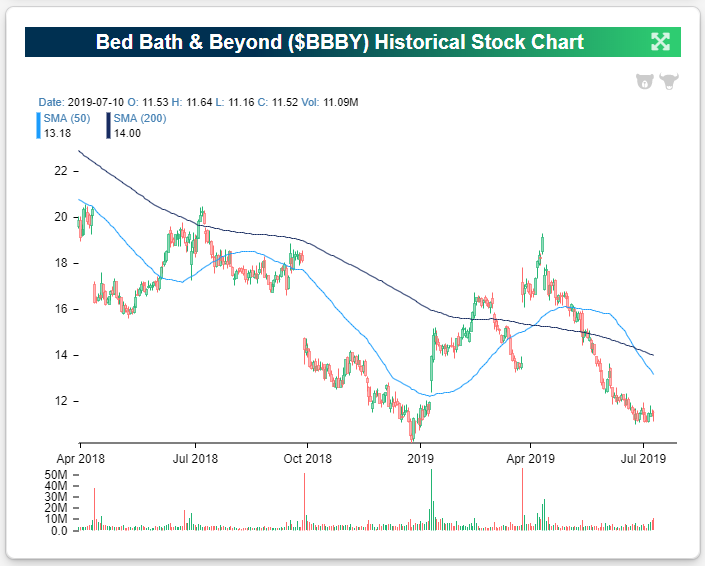

Bed Bath & Beyond Brutal

Bed Bath & Beyond (BBBY) was an $80 stock back in early 2015, but it’s trading at $11 this morning which represents a drop of 86% from its highs. The stock has been in a perpetual downtrend since peaking four years ago, and the news didn’t get better when the company reported earnings after the close yesterday. Shares are currently set to open down 5%.

Below is a snapshot of BBBY earnings reports over the last three years using our Earnings Explorer tool. We’ve highlighted the stock’s percentage move at the open of trading (versus the prior day’s close) following its quarterly earnings reports over this time period. Aside from one gap up of 7.75% following its January 2019 report, the stock has gapped down sharply on seven of its last eight reports. This morning’s gap down of 5% will be its eighth gap down of 5%+ out of its last nine reports. Start a two-week free trial to one of Bespoke’s three premium research services.

Biggest Winners and Losers 7/10/19

Below is a list of today’s biggest losers in the S&P 1500. Realogy (RLGY) and Granite Construction (GVA) took it on the chin the most with drops of 9%+. Other notables on the list of biggest losers include Applied Opto (AAOI), Hanesbrands (HBI), Pitney Bowes (PBI), and WW Grainger (GWW). Start a two-week free trial to one of Bespoke’s three premium research services.

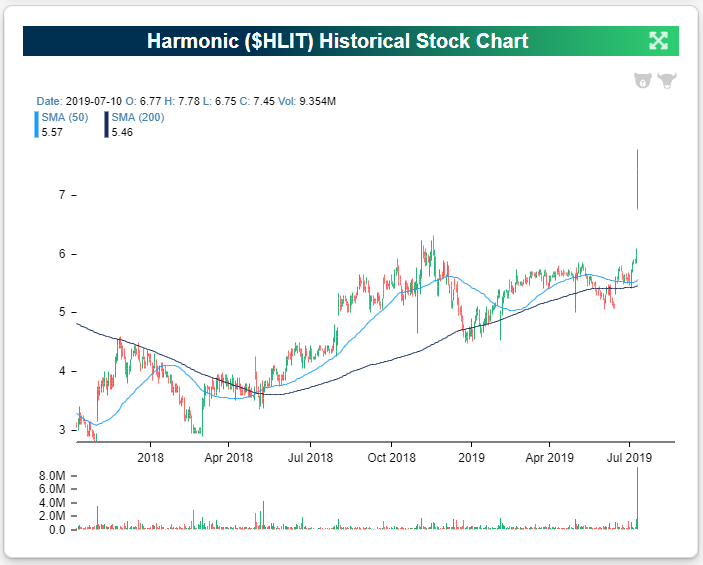

SMART Global (SGH) and Harmonic (HLIT) — two Tech stocks — gained nearly 25% in today’s trading. Three Energy stocks followed the two big Tech winners with moves of 11%+. McDermott (MDR) gained 12.89%, Pioneer Energy (PES) gained 12.5%, and Noble Energy gained 11.17%. Note that Pioneer and Noble have extremely low share price levels at this point, so just a small change in price represents a big percentage move. WD-40 (WDFC) is a stock we highlighted in a post yesterday for reporting a triple play, and it shows up on the biggest winners list as well with a gain of 8.55% on the day.

Below are price charts for SGH and HLIT — yesterday’s two biggest gainers. SGH had been in a steep 12+ month downtrend before yesterday’s move, while HLIT looks much different, breaking out to new highs from what was already a nice uptrend channel. Subscribe to Bespoke Premium for access to our interactive investor tools, including our list of the day’s biggest winners and losers and biggest volume movers.

The Closer – Earnings Trends, Cyclical Bounce, Banks Weak, Fedspeak, ICI, EIA – 7/10/19

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we take a look at earnings estimates given the S&P 500’s 200-DMA, cyclicals rally, and bank’s underperformance. With Fed Chair Powell’s testimony on Capitol Hill acting as the day’s major catalyst, we then give an updated look at our Fedspeak monitor and some analysis on Fed policy. We finish with our weekly looks at ICI Fund Flows and EIA data.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

Bespoke Consumer Pulse Report – July 2019

Bespoke’s Consumer Pulse Report is an analysis of a huge consumer survey that we run each month. Our goal with this survey is to track trends across the economic and financial landscape in the US. Using the results from our proprietary monthly survey, we dissect and analyze all of the data and publish the Consumer Pulse Report, which we sell access to on a subscription basis. Sign up for a 30-day free trial to our Bespoke Consumer Pulse subscription service. With a trial, you’ll get coverage of consumer electronics, social media, streaming media, retail, autos, and much more. The report also has numerous proprietary US economic data points that are extremely timely and useful for investors.

We’ve just released our most recent monthly report to Pulse subscribers, and it’s definitely worth the read if you’re curious about the health of the consumer in the current market environment. Start a 30-day free trial for a full breakdown of all of our proprietary Pulse economic indicators.

New Highs For S&P 500 But Not a Lot of Sectors

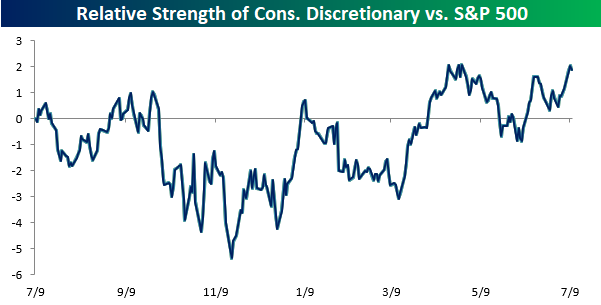

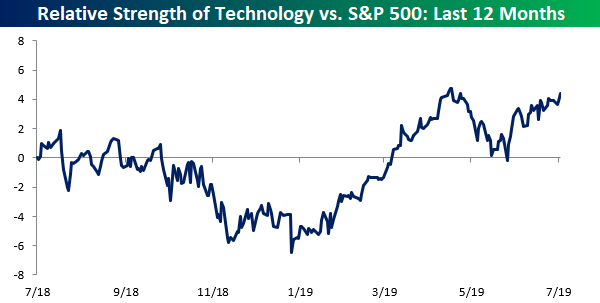

It was a monumental milestone for the S&P 500 earlier today as the index briefly crossed 3,000 for the first time in its history. While the S&P 500 traded up to a new all-time high, it was interesting to see that not a single sector made a new high in terms of their relative strength versus the index. The only two sectors where relative strength is even close to a 52-week high versus the S&P 500 are Consumer Discretionary and Technology. Just two sectors hitting new highs on a relative basis may not sound too impressive, but when those two sectors account for nearly one-third of the entire index, it’s not as bad.

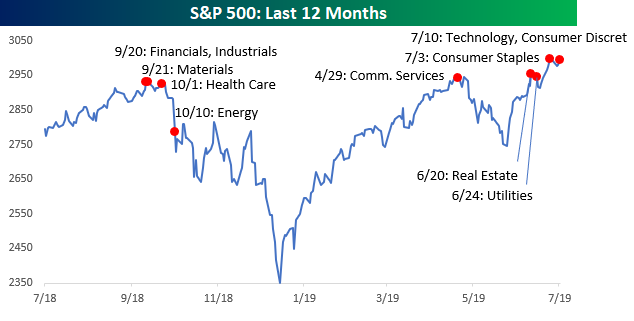

While no sectors are hitting new highs today on a relative basis, a number of sectors have recently hit new highs on an absolute basis. The chart below shows the S&P 500 over the last year, and on it we have notated the date of each sector’s 52-week high. When the S&P 500 recently first made a new high, the rally was being led by defensives like Real Estate and Utilities which made their highs on 6/20 and 6/24, respectively. On 7/3, another defensive sector joined the fray as Consumer Staples rallied to a new high. Today, we are finally beginning to see some non-defensive sectors get in on the act as both Consumer Discretionary and Technology made new highs. Trailing way back in the dust of these sectors are Financials, Industrials, Materials, and Health Care, which haven’t made new highs in over eight months. If these sectors can make it over the hump, the S&P will likely be in the midst of a big leg higher. Start a two-week free trial to Bespoke Institutional to access our full research suite.

Fixed Income Weekly – 7/10/19

Searching for ways to better understand the fixed income space or looking for actionable ideas in this asset class? Bespoke’s Fixed Income Weekly provides an update on rates and credit every Wednesday. We start off with a fresh piece of analysis driven by what’s in the headlines or driving the market in a given week. We then provide charts of how US Treasury futures and rates are trading, before moving on to a summary of recent fixed income ETF performance, short-term interest rates including money market funds, and a trade idea. We summarize changes and recent developments for a variety of yield curves (UST, bund, Eurodollar, US breakeven inflation and Bespoke’s Global Yield Curve) before finishing with a review of recent UST yield curve changes, spread changes for major credit products and international bonds, and 1 year return profiles for a cross section of the fixed income world.

In this week’s report we take a look at the big divergence between global financial conditions and activity.

Our Fixed Income Weekly helps investors stay on top of fixed income markets and gain new perspective on the developments in interest rates. You can sign up for a Bespoke research trial below to see this week’s report and everything else Bespoke publishes free for the next two weeks!

Click here and start a 14-day free trial to Bespoke Institutional to see our newest Fixed Income Weekly now!

Chart of the Day – The Most Underwhelming Economy in Years

Triple Play Breaks the Downtrend for WD-40 (WDFC)

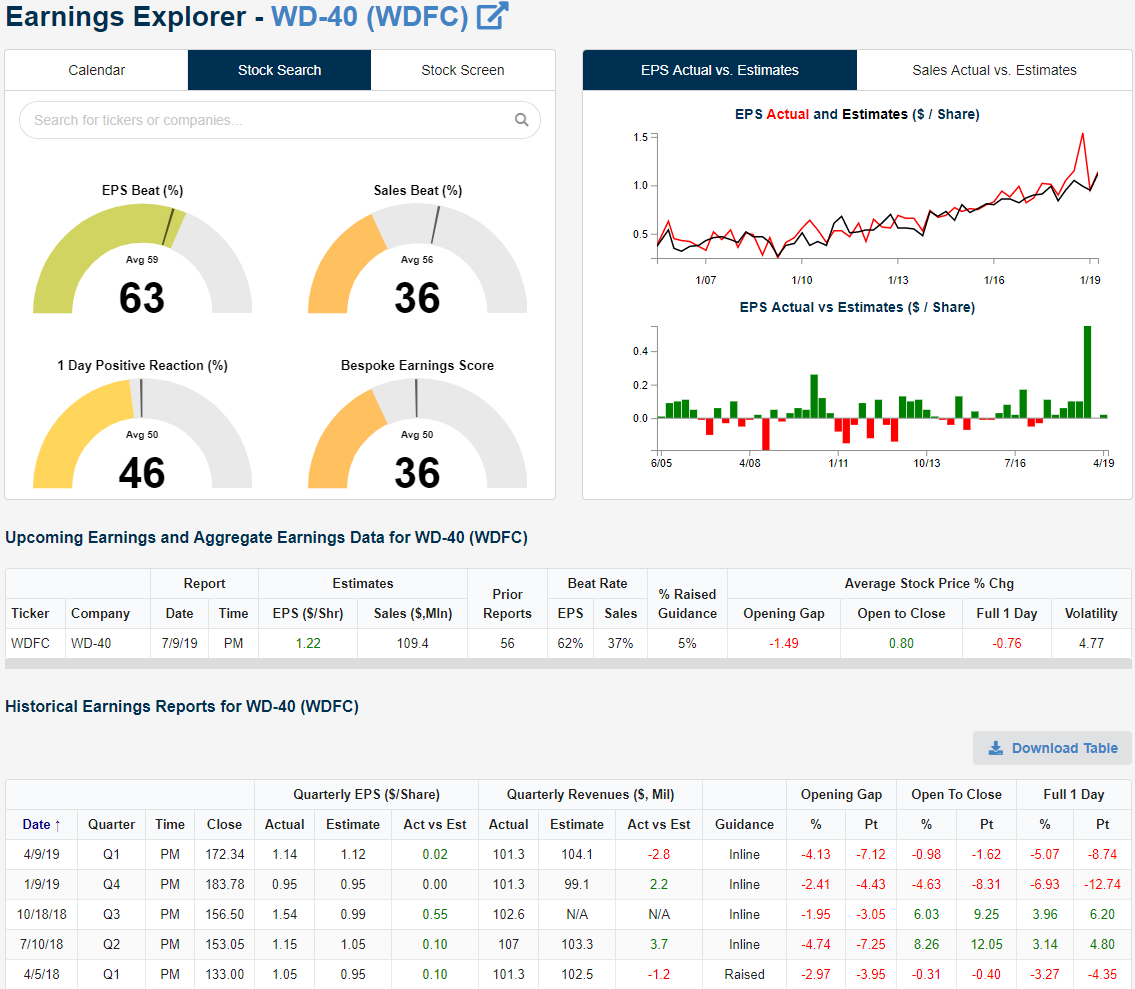

WD-40 Company (WDFC) manufactures and distributes a number of household and industrial products including its signature lubricating oil from which the company derives its name: WD-40. Perhaps as a result of an increase in squeaky door hinges, the company reported a strong quarter last night. WDFC reported an earnings triple play with EPS 8 cents above estimates and revenues of $114 million versus estimates of $109.4 million; a growth rate of 6.5% year-over-year. The company also raised guidance for the first time since April of last year. Raised guidance has not been a common occurrence for the company. In addition to the one last April, WDFC has only raised guidance two other times, once in 2005 and later in 2006. This is a pleasant change for WDFC which has historically not been the best stock on earnings as it has only beaten EPS estimates 63% of the time and sales 36% of the time. Historically its stock price has averaged a one-day loss of 0.76% on its earnings reaction day.

In reaction to its triple play this quarter, the improvements to the technical picture have been dramatic for WD-40. Opening at $169.17 with further buying in early trading, WDFC sits over 7% above yesterday’s close in early trading. With these gains, the stock has risen above both the 50 and 200-DMA. For most of the time since April, the stock has been stuck under both of these moving averages with only a few days with brief breaks above the 50-DMA. Additionally, WDFC has been in a downtrend for all of 2019, but today’s price action has sent the stock surging out of this downtrend channel. Start a two-week free trial to Bespoke Institutional to access our Security Analysis tool, Earnings Explorer, and more!

Trend Analyzer – 7/10/19 – Defensives Leading Again

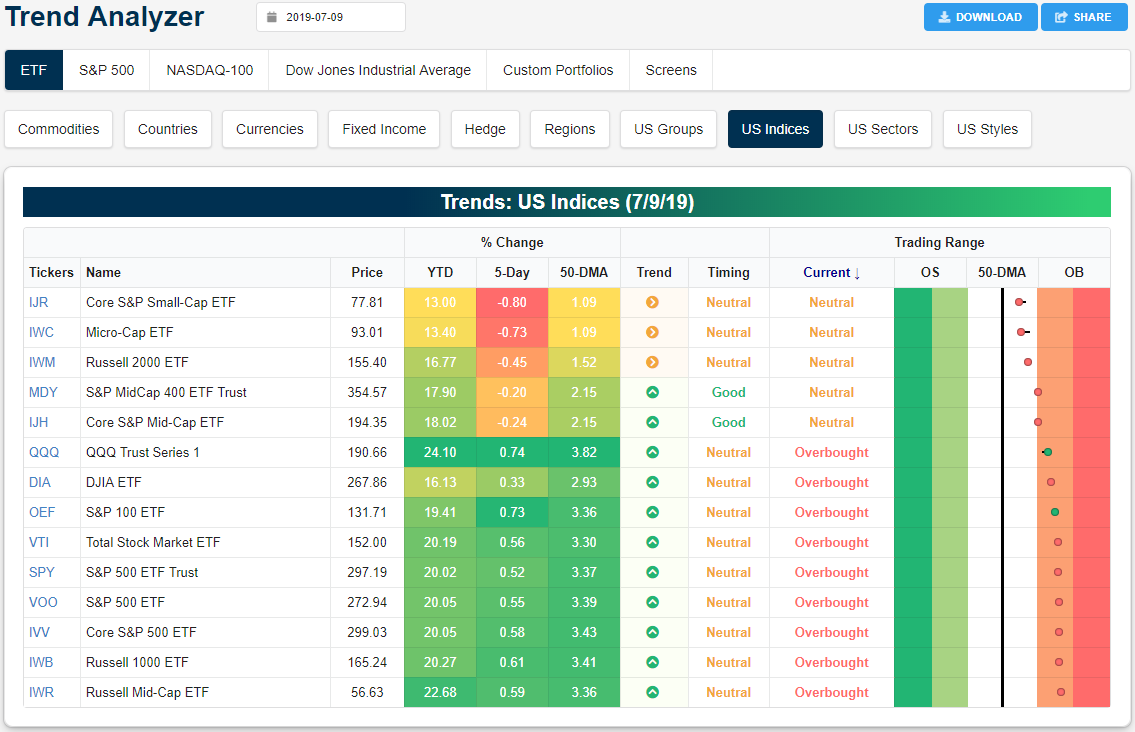

The overbought/oversold picture is unchanged from yesterday with five major index ETFs in neutral territory while the remaining nine are all overbought. Not only has there been little change from yesterday, but there is also not much difference compared to levels from last week as seen through the lack of any tail in the Trading Range section of our Trend Analyzer for multiple ETFs. Small and mid-caps continue to underperform and all sit lower versus five days ago while large caps like the Nasdaq (QQQ) and S&P 100 (OEF) have outperformed.

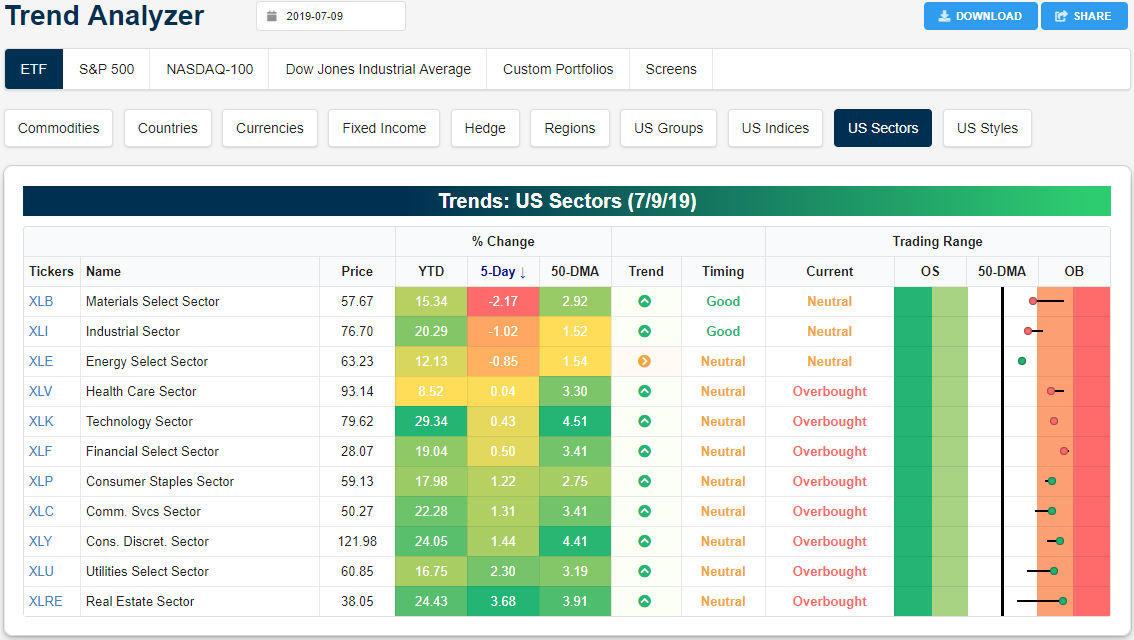

As the market has pulled back from record highs over the past week, Materials (XLB), Industrials (XLI), and Energy (XLE) have all led the way lower. XLB, in particular, has run into a rough patch and is now down 2.17% working off of overbought levels from last week. Meanwhile, XLI and XLE have also seen losses of 1.02% and 0.85%, respectively. With these losses, all three of these sectors now sit in neutral territory. With more cyclical sectors like XLB and XLI lagging, defensives have been surging as XLRE and XLU have outperformed. XLRE has surged 3.68% this week and XLU has rallied 2.3% in the same time. Last week, both of these, in addition to Communication Services (XLC), were only in neutral territory, but the recent gains have brought them up back up to overbought levels. Start a two-week free trial to Bespoke Institutional to access our Trend Analyzer and much more.