The Closer – Sloppy Auction, Strong Spending, CPI Surge, Receipts Rock – 7/11/19

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we go over several factors that played into a brutal day for the bond market leading to a huge bear steepening at the long end of the curve. Namely, one of these factors was a very bad 30-year bond reopening which we look at the internals of. Next, we take a look at the strength of the consumer including the divergence between Bloomberg and other consumer sentiment indicators. After recapping today’s inflation data, we then give an updated look at the federal budget deficit.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

Bespoke’s Sector Snapshot — 7/11/19

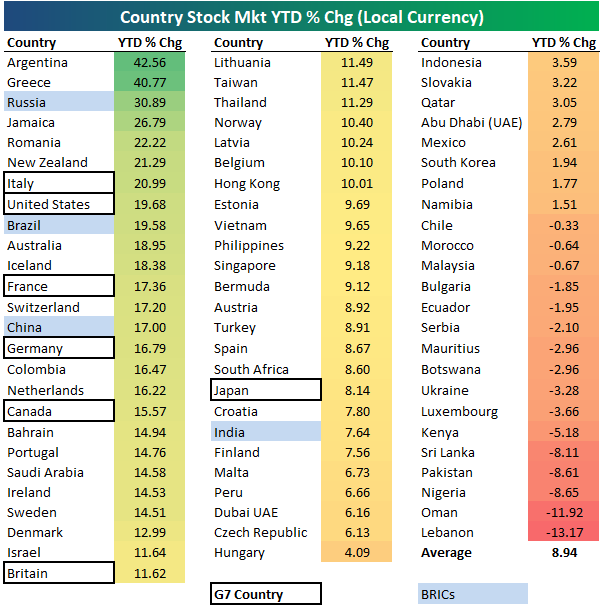

2019 Country Stock Market Returns

Below is a look at the year-to-date returns (in local currency) of stock markets for 75 countries around the world. The average country has posted a gain of 8.94% year-to-date, and 59 of the 75 countries (79%) are in the green. Argentina and Greece have posted the biggest YTD gains at this point with moves of 40%+. Russia ranks third with a gain of 30.89%, followed by Jamaica (+26.79%), Romania (+22.22%), and New Zealand (21.29%).

The United States has been the 8th biggest winner this year with a gain of 19.68%. Notice that six of the seven G7 countries are roughly in the top third, which means developed countries have been doing very well this year. Japan is the biggest laggard of the G7 countries, but it’s hard to be too disappointed with its YTD gain of 8.14%.

Three of the four BRIC countries rank in the top fourteen, led by Russia at +30.89%. Brazil ranks second of the BRICs with a YTD gain of 19.58%, while China is up 17%. India ranks last of the BRICs at +7.64%.

Lebanon and Oman have been the two worst-performing countries this year with declines of just over 10%. Nigeria, Pakistan, and Sri Lanka are all down more than 8%, while Kenya is down just over 5%. The remaining countries in the red are only down slightly. Start a two-week free trial to one of Bespoke’s three premium subscription services for in-depth market analysis and actionable ideas on a daily basis.

B.I.G. Tips – A Run of the Mill Rally

The first half of 2019 was extraordinarily strong for US equities, and if you measure the returns from the close on Christmas Eve, the gains look even more gaudy. But how gaudy were they really? Keep in mind that prior to the 12/24 low, the S&P 500 had declined 19.8% (on a closing basis) from its high on 9/20, so when you look at the period from the start of Q4 2018 through the end of Q2 2019, the returns are a lot less spectacular.

We define a bear market as any move of 20% or more from a closing high to a closing low, so based on that definition, last year’s Q4 decline was close but not quite a bear market (the 20% threshold was reached on an intraday basis). Surprisingly enough, there have been a number of instances in the last 50 years where the S&P 500 saw similar ‘near-bear’ markets with declines of 19%+ (but not 20%) which we have highlighted in the table and chart below. We include how the S&P 500 performed in the months and years following those “near-bear” lows to see how the current rally stacks up and where it might go from here.

To continue reading this B.I.G. Tips report, start a two-week free trial to Bespoke Premium.

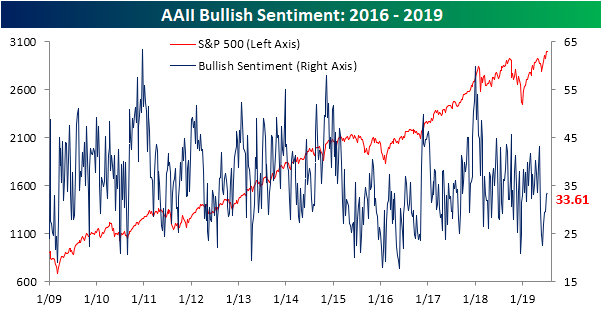

Sentiment Continues Its Slow Climb

The S&P 500 and Dow have continued to make pushes up to new all-time highs in the past week but sentiment remains subdued. AAII’s weekly sentiment survey showed 33.61% of respondents have bullish sentiment, up 0.5% from last week. As we have been mentioning, this is in the lower range of sentiment readings given the run-up to new highs. At this level, bullish sentiment is in the 15th percentile of times that the S&P 500 has reached a new all-time high in the past week. Additionally, the current reading is still below the historical average for bullish sentiment as it has been for nine straight weeks now. That is the longest such streak since the 12-week streak ending May 17th of last year.

While bullish sentiment only saw a slight increase, bearish sentiment saw its largest decline in a month falling from 32.35% down to 27.5%. Bearish sentiment is now at its lowest level since the first week of May and is also below the historical average for the first time since that same week.

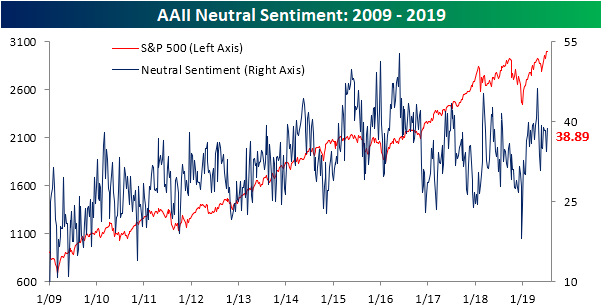

Most of the losses to bearish sentiment were picked up by those reporting as neutral. The percentage of investors reporting this sentiment rose 4.4% to 38.89%. This brings it back to the high 30’s levels that it has sat at for a majority of 2019. Start a two-week free trial to Bespoke Institutional to access our interactive economic indicators monitor and much more.

Chart of the Day: CPI Surges Just In Time For Fed To Cut

Lowest Claims In Three Months

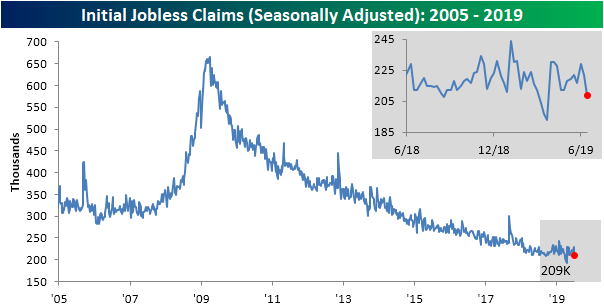

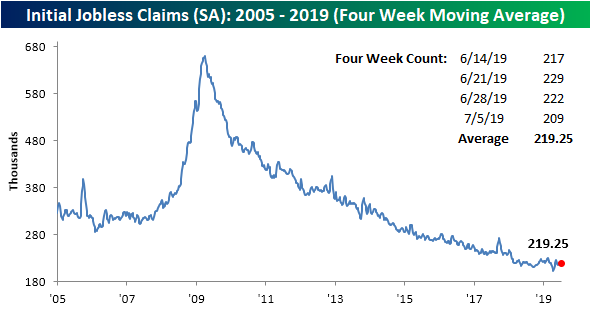

Fed Chair Powell’s testimony on Capitol Hill yesterday made frequent mentions of the strength of the labor market, and initial jobless claims data released this morning helped to give further support of this strength. Claims were expected to come in unchanged from last week at 221K but instead fell to a seasonally adjusted level of 209K. That is the lowest print in about three months (since April 12th) when claims came in at the multi-decade low of 193K. Whereas the past few weeks were near the upper end of the past year’s range, this drop now brings claims back down towards the lower end of that range. In other words, while not a new low, it is still a healthy number. As such, the record streaks at or below 250K and 300K continue at 92 weeks and 227 weeks, respectively.

The four-week moving average helps to sift out some of the fluctuations of the high-frequency weekly data. This week saw the moving average fall from 222.5K down to 219.25K. Unlike the weekly number, there were actually several lower prints throughout the past couple of months, so this does not bring the indicator back towards the lower end of its range. In fact, this decrease only brings things back to where they stood about one month ago.

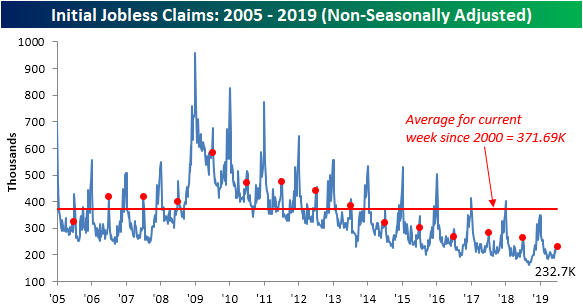

As could be expected given seasonal patterns, on a non-seasonally adjusted basis, claims rose to 232.7K after falling to 224.5K last week. Typically, the current week of the year sees a sizeable increase in claims averaging a week-over-week rise of over 42K over the past fifteen years, but this week’s change was much smaller with only an 8.2K increase. This week’s NSA number was also lower than the comparable week in 2018 when NSA claims were 264.9K. Additionally, this was the lowest reading in claims for the current week of the year of the current cycle and it was substantially under the average for the past couple of decades of 371.69K. Start a two-week free trial to Bespoke Institutional to access our interactive economic indicators monitor and much more.

The Bespoke 50 Top Growth Stocks

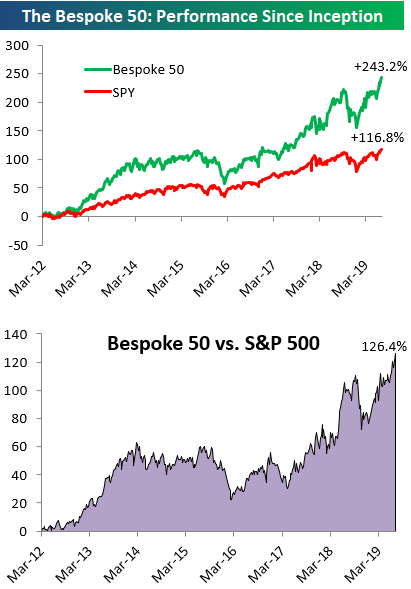

Every Thursday, Bespoke publishes its “Bespoke 50” list of top growth stocks in the Russell 3,000. Our “Bespoke 50” portfolio is made up of the 50 stocks that fit a proprietary growth screen that we created a number of years ago. Since inception in early 2012, the “Bespoke 50” has beaten the S&P 500 by 126.4 percentage points. Through today, the “Bespoke 50” is up 243.2% since inception versus the S&P 500’s gain of 116.8%. Always remember, though, that past performance is no guarantee of future returns. To view our “Bespoke 50” list of top growth stocks, please start a two-week free trial to either Bespoke Premium or Bespoke Institutional.

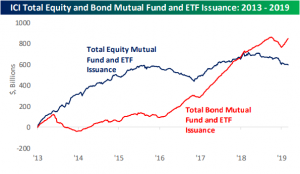

Extreme Equity Fund Outflows

Recent data from the Investment Company Institute shows that mutual fund investors are fleeing equity funds at a staggering pace. As shown in the table below, one-week outflows from equity funds were larger (more negative) than all but 2% of prior periods since 2007. The four week sum of flows is similarly negative. At the same time, fixed income mutual funds are seeing huge and consistent inflows, with total bond flows near the 90th percentile this week.

As shown in the charts below, the one-week collapse in equity fund flows are not without precedent. That said, only periods with extreme equity market volatility saw similarly large declines in cash. January 2008 (as the financial crisis was picking up), October 2008 (in the wake of Lehman and TARP), March 2009 (the ultimate low for the equity market), August 2011 (the US debt downgrade), November 2016 (the last Presidential election) and January of this year (when equities had dropped almost 20% from closing highs). Unlike all of those prior instances, stocks are near all-time highs and volatility is extremely low, presenting an interesting puzzle for assessing the sentiment implications of equity fund outflows. Start a two-week free trial to Bespoke Institutional for access to our weekly fund flows analysis in our Closer report.

Bespoke’s Morning Lineup – Fed Flood

If you thought yesterday was a busy day of Fed headlines, you ain’t seen nothing yet! In addition to another round of testimony from Fed Chair Powell in front of the Senate today, five other Fed officials are on the calendar starting with Williams at 11:10 AM and ending with Kashkare at 5:00 PM. In addition, we’ll also get jobless claims (221K expected) and CPI at 8:30 AM. There’s not much in the way of earnings news today, but that will all change next week, so check out our Earnings Explorer for a look at companies scheduled to report.

Read today’s Morning Lineup to get caught up on news and stock-specific events ahead of the trading day and a further discussion of overnight events in Asia and Europe.

Bespoke Morning Lineup – 7/11/19

One thing we have grown accustomed to with this market is for breadth, as measured by the S&P 500 cumulative A/D line, to lead price action higher, so we were a bit surprised yesterday to see that even as the S&P 500 made a new intraday high (but didn’t make a new high on a closing basis), the cumulative A/D line remains off its highs. As shown in the chart below, the cumulative A/D line is only slightly below its prior highs, so it’s way too early to start calling this a divergence, but it’s just something that stuck out to us when we were going through the charts last night.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.