Dash For Trash To Start The Week In Europe

Early in the European trading week, stocks are showing some pep in their step with the broad Stoxx 600 index up just shy of 1% on almost 10:1 positive breadth. While gains are broad, commodities industries (Basic Resources, Oil & Gas), cyclicals (Auto & Parts, Tech, Travel & Leisure), and broad industrial plays (Industrial Goods & Services, Construction & Materials, Chemicals) are all leading the charge higher. While the price action is certainly encouraging, a lot of the bump to start this week is a function of oversold stocks mean-reverting. In the chart below, we show the relationship between performance today and each supersector’s move August-to-date. In short, today’s bounce is generally biggest for sectors that have been beaten down the most as markets fell earlier in the month. More defensive sectors that are actually up this month (notably Health Care and Utilities) are not exactly leading the charge today. For more global markets and macroeconomic coverage, make sure to check out Bespoke’s Morning Lineup and nightly Closer notes, as well as our weekly Global Macro Dashboard. Start a two-week free trial to Bespoke Institutional to access The Closer and the rest of Bespoke’s suite of Institutional products.

Biggest Losers Since Google IPO

Earlier today, we highlighted the best performing S&P 1500 stocks since the Google IPO in August 2014. In this post, we wanted to highlight the biggest losers. Given that we are looking at current members of the S&P 1500, there is a major survivorship bias with this table, because while the stocks listed are down the most since the Google IPO, a number of stocks simply went out of business, so investors would have lost everything. In fact, 200 of the companies that were in the S&P 1500 at the time of Google’s IPO have either been acquired or are out of business.

With that caveat aside, the table below lists the 21 current S&P 1500 stocks that are down 90%+ since Google’s IPO. Besides these 21, another 182 stocks in the index are down during that span. Topping the list of losers is Frontier Communications (FTR), which is down 99.58%. It doesn’t get much closer to a total loss than that! JC Penney (JCP) has been another of the market’s biggest losers falling 98.44%, while Flagstar Bancorp (FBC) is also down over 98%. In terms of sector representation, Consumer Discretionary and Financials top the list with five companies each, and while the high number of Financials listed generally stems from the Financial crisis, the high number of Consumer Discretionary stocks is a result of changing consumer habits. Also, while Technology and Health Care accounted for the largest number of stocks on the list of biggest winners, combined they account for just one stock on the list of biggest losers. That one stock is Unisys (UIS), and we have a hard time even recalling the last time it was considered anything close to a cutting edge tech stock. Start a two-week free trial to one of Bespoke’s premium research offerings to help avoid the stock market’s biggest losers and find the biggest winners.

Biggest Winners Since Google IPO

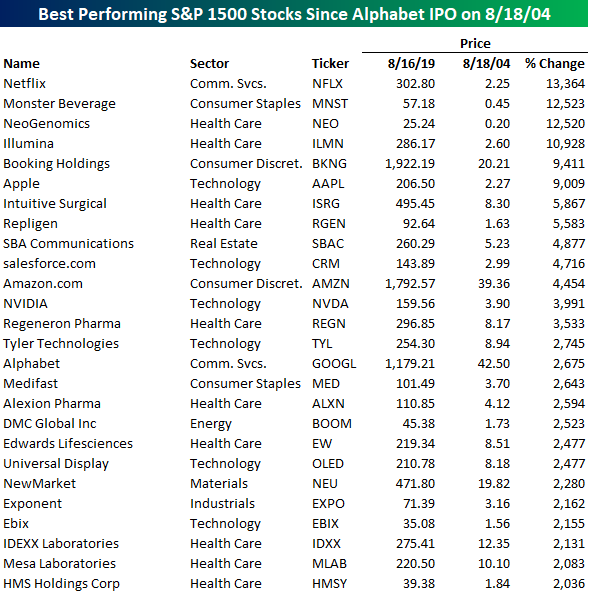

Yesterday marked the 15th anniversary of Google’s (now Alphabet) IPO on 8/18/04. For those that were around at the time, you may recall that Wall Street’s reception to the IPO wasn’t particularly enthusiastic due to the fact that Google bypassed the traditional Wall Street model and opted for a Dutch Auction approach in which the initial price was set by online ‘bidders’ in order to make the process more democratic. In more than one article published ahead of the IPO, investors were advised to keep “their money safe in their pockets” due to issues like management credibility, delays in the registration process, competition, and “a stock price that has been driven to the sky.” Despite some of the initial skepticism towards the IPO, by just about any performance measure, it was ultimately a success. After pricing at a pre-split adjusted level of $85, GOOGL rallied by over 25% in its first two days as a public company and has rallied by a total of 2,675% since its IPO 15 years ago. That works out to an annualized return of 24.8%!

While GOOGL’s gains have been great, it isn’t even the best performing stock in the S&P 1500 during that span. Looking at current companies that are part of the S&P 1500 that were also publicly traded 15 years ago, we screened for the best and worst-performing stocks over that span. Of the current members of the S&P 1500, 377 weren’t even around back then. That’s more than a quarter of the entire index. Of the remaining 1,123 companies, though, 90 have been 10-baggers which means that investors who held the stocks back then have seen their investment multiply by more than ten times. Further, of those 10-baggers, four have been 100-baggers!

While there isn’t enough space to list the 90 10-baggers in the S&P 1500, the table below lists the 26 current stocks in the S&P 1500 that have rallied more than 2,000% since Google’s IPO (20-baggers). Topping the list is Netflix (NFLX) which is up over 13,000%. Behind NFLX, Monster Beverage (MNST), NeoGenomics (NEO), and Illumina (ILMN) are the remaining 100-baggers. Again, while GOOGL has been great, it isn’t even the best performing of the FAANG stocks during that span. In fact, of the three other FAANGs that were around at the time of the IPO (Netflix, Apple, and Amazon), they have all outperformed GOOGL. Facebook didn’t come public until 2012, but since its IPO, it has also outperformed GOOGL.

Looking at the individual names on the list of biggest winners, even after their enormous gains, a lot of them aren’t even household names. In terms of their sector distribution, though, ten of the 26 names come from the Health Care sector, while six are Technology stocks. Besides those two sectors, no other accounts for more than two stocks listed.

Technology and Health Care have certainly been two of the biggest winners over the last decade and a half, but which sectors will be the leaders moving forward? Start a two-week free trial to one of Bespoke’s premium research offerings to stay on top of all the markets biggest winners.

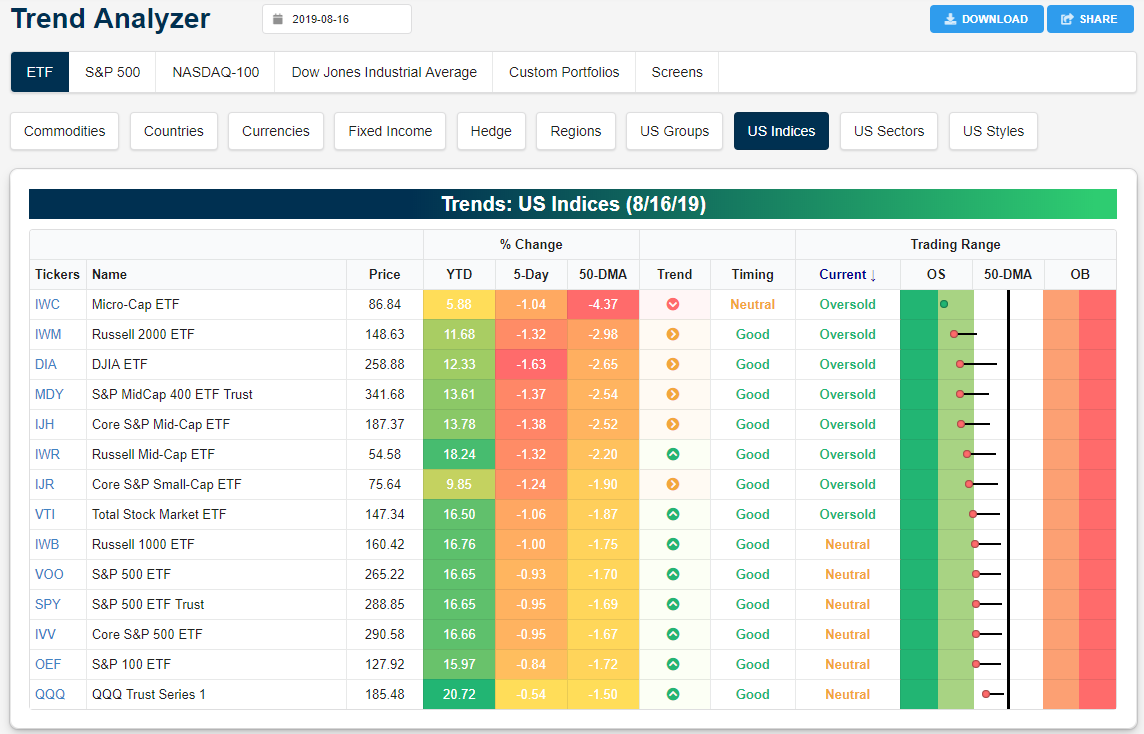

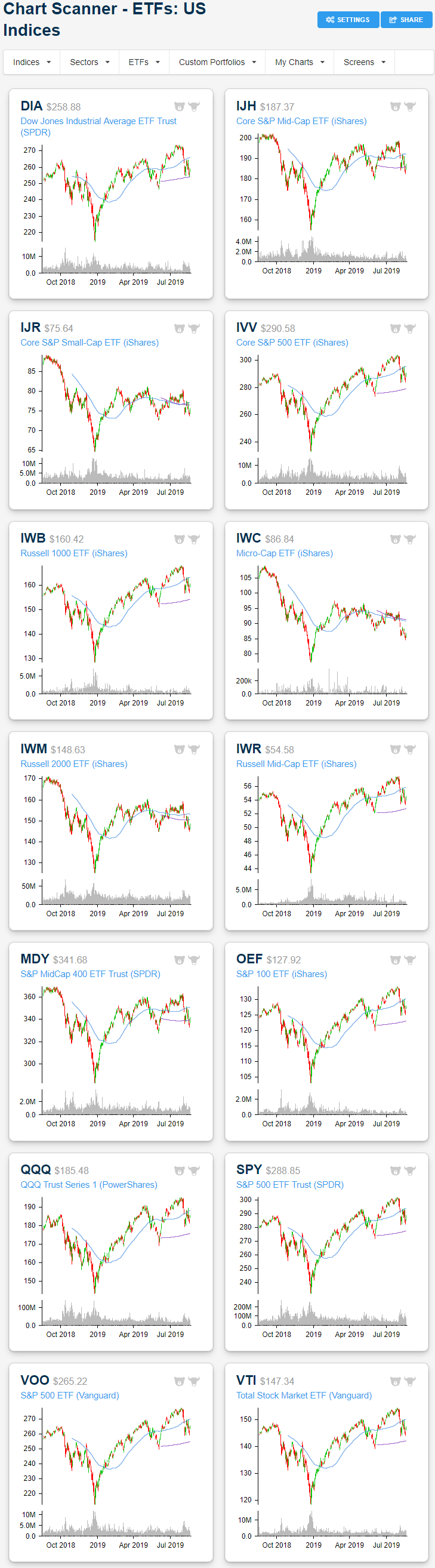

Trend Analyzer – 8/19/19 – Mean Reversion

Despite a nice rally on Friday, every major US index ETF in our Trend Analyzer tool is still below its 50-day moving average and lower within its trading range over the last week.

As stocks begin to bounce, some have found logical support like the Dow (DIA) at its 200-DMA and the Russell 2000 (IWM) at its previous low established in late May. Meanwhile, other indices like the S&P 500 (SPY) and Nasdaq (QQQ) have paused in the middle of their range between the 50-DMA and 200-DMA. Small and mid-caps like the Russell 2000 (IWM) and the S&P MidCap 400 (MDY) still remain below both moving averages. Start a two-week free trial to Bespoke Institutional to access our interactive Trend Analyzer, Chart Scanner, and much more.

Bespoke’s Morning Lineup — A Good Monday For a Change

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

Bespoke Brunch Reads: 8/18/19

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium for 3 months for just $95 with our 2019 Annual Outlook special offer.

Negative Rates

Depositors Are Next as Nordic Banks Buckle Under Negative Rates by Kati Pohjanpalo and Frances Schwartzkopff (Yahoo!/Bloomberg)

Banks in areas where policy rates are negative have so far avoided charging negative rates to depositors but that may start to change as other fees fail to support the profit drag of negative funding rates. [Link]

A Danish bank is offering mortgages at a 0.5% negative interest rate — meaning it is basically paying people to borrow money by Will Martin (Business Insider)

While depositors may end up being charged for holding money in their accounts, borrowers in Denmark are getting the chance to borrow at sub-zero rates. [Link]

Investors Ponder Negative Bond Yields in the U.S. by Sam Goldfarb and Daniel Kruger (WSJ)

A survey of speculation on what future interest rate policy could bring to the US bond market, including the possibility of borrowers getting paid to take loans. [Link; paywall]

We Not Working

WeWork Officially Files To Be The Last IPO by Thornton McEnery (Dealbreaker)

A deeply sarcastic look at this week’s WeWork IPO filing, filled with self-dealing, dubious terminology, massive losses, complex corporate structures, concentrated ownership, and all manner of other foibles. [Link]

WeWork’s S-1: some quick observations by Jamie Powell (FT Alphaville)

More detail on WeWork and it’s massive, can-you-believe-they’re-actually-trying-to-get-away-with-this IPO filing. [Link; registration required]

Tech Dystopia

Three Years Of Misery Inside Google, The Happiest Company In Tech by Nitasha Tiku (Wired)

A massive read on the internal mess at Google, catalyzed by the election of President Trump but a long time coming in many other respects. [Link; soft paywall]

I Tried Hiding From Silicon Valley in a Pile of Privacy Gadgets by Joel Stein (Bloomberg)

Getting rid of the sometimes-accidental, sometimes-intentional surveillance apparatus of Silicon Valley can be incredibly difficult. [Link; soft paywall]

The Techlash Has Come to Stanford by April Glaser (Slate)

Similar to the financial industry’s fall from grace as a destination for graduates after the financial crisis, big tech is losing – or more properly, has lost – its cache as a place for Stanford students to work after their schooling is complete. [Link]

Google’s hate speech-detecting AI appears to be racially biased by Donna Lu (New Scientist)

A new study finds that the algorithm used by Google to identify hate speech appears to have a racial bias, focusing on language used by blacks more than whites. [Link; soft paywall]

At The Vanguard

How to Profit in Space: A Visual Guide by Robert Wall, Yaryna Serkez and Joel Eastwood (WSJ)

An amazing visual guide to the massive array of useful and junk objects in orbit around our planet, as well as a dive into the improving economics of launches. [Link; paywall]

A clean energy breakthrough could be buried deep beneath rural Utah by Sammy Roth (LAT)

One potential solution to the problem of storing energy produced by renewables is to push air underground into a massive salt cavern, then extract it as needed, matching supply and demand. [Link]

ClimaCell weather app alerts when it’s about to rain, down to the minute, all around the world by Jason Samenow (LMT Online/WaPo)

A new Boston-based company claims the ability to predict minute-to-minute weather forecasts at the street level in 50 countries. [Link]

Investing & Personal Finance

Bankruptcy filings rising across the country and it could get worse by John Aidan Byrne (New York Post)

Bankruptcy filings are up 3% YoY through July, which isn’t a very large spike given the low aggregate level, but deterioration is something to keep an eye on. [Link]

New To Investing? You May Be Better Off Picking Stocks At Random, Study Finds by Ben Renner (Study Finds)

While a few losses can be useful learning experiences, amateur investors are actually worse than random picks of stocks when they start investing. [Link]

The longevity of the world’s largest ETF rests on the lives of 11 U.S. millennials by Rachel Evans, Vildana Hajric, and Tracy Alloway (LAT/Bloomberg)

The story of SPY’s limited life tied to the longevity of 11 individuals born between 1990 and 1993; their deaths would trigger the wind-down of the biggest ETF in the world. [Link]

Fitness

The Trendiest Fitness Class Now: Working Out Alone at Home by Hilary Potkewitz (WSJ)

Streaming services that run from simple phone apps to complex exercise equipment wired to on-demand services are gaining popularity. [Link; paywall]

China

Huawei Technicians Helped African Governments Spy on Political Opponents by Joe Parkinson, Nicholas Bariyo and Josh Chin (WSJ)

An investigation by the Journal shows that Huawei worked with governments in Africa to help suppress opposition groups via its technology embedded in wireless networks. [Link; paywall]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!

The Bespoke Report – 8/16/19

This week’s Bespoke Report newsletter is now available for members.

In this week’s newsletter, we discuss what drove stocks to a third small weekly loss in a row. Crashing bond yields, firming US data, respectable earnings results, and slowing but not collapsing global economic data: all are pieces in the puzzle. To read the Bespoke Report and access everything else Bespoke’s research platform has to offer, start a two-week free trial to one of our three membership levels. You won’t be disappointed!

The Closer: End of Week Charts — 8/16/19

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke clients, we recap weekly price action in major asset classes, update economic surprise index data for major economies, chart the weekly Commitment of Traders report from the CFTC, and provide our normal nightly update on ETF performance, volume and price movers, and the Bespoke Market Timing Model. We also take a look at the trend in various developed market FX markets.

The Closer is one of our most popular reports, and you can sign up for a free trial below to see it!

See tonight’s Closer by starting a two-week free trial to Bespoke Institutional now!

Fixed Income Through the Roof

Our Trend Analyzer does a great job of finding those assets that are at extremes either on the oversold side or the overbought side. While equities are mostly oversold at this point, fixed income is in the stratosphere. Below is a look at the most overbought fixed income ETFs at the moment. Dozens of them are in extreme territory at 2-3 standard deviations above their 50-day moving averages. You don’t see readings like this often, and they’re due for some mean reversion. Start a two-week free trial to one of Bespoke’s premium research offerings.

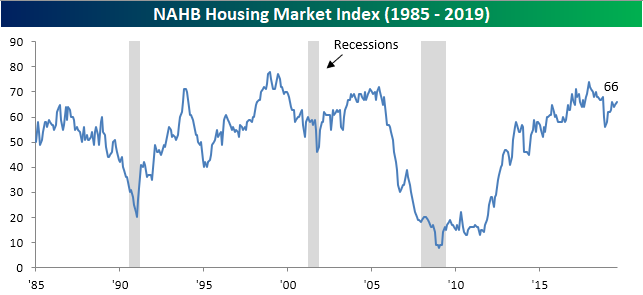

Home Builder Sentiment Keeps Climbing

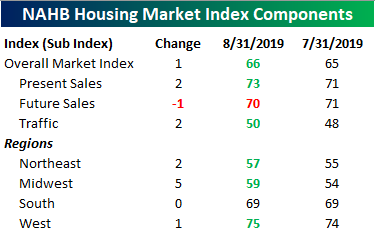

The NAHB’s Housing Market Index for August saw its second straight month with a modest increase bringing it to 66 compared to expectations of an unchanged 65. Although the index has been grinding higher since plummeting to its late 2018 low, it is still well off of its December 2017 record high of 74.

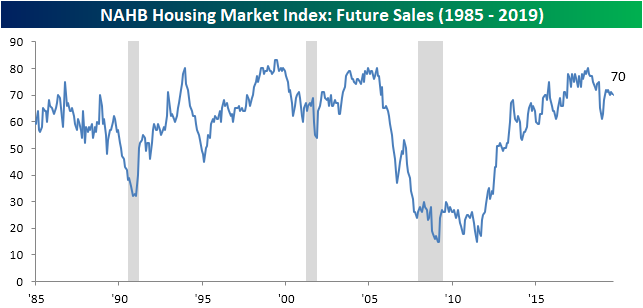

Breaking down the indicator by its sub-indices, improved present sales and traffic led to a stronger index in August. Both rose by 2 and are now at their highest levels of 2019. Future sales outlook still remains bleaker though as it declined to 70 in August. As shown in the chart below, in addition to the spike lower at the end of last year, future sales have been in a downtrend since February 2018. Unlike present sales and traffic, the rebound of future sales’ off of the December low has not seen promising follow-through.

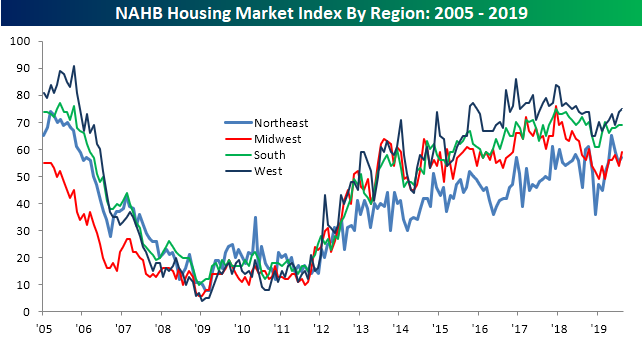

Of the individual regions, sentiment in the West continues to be the strongest improving to 75 in August. Granted this is still off of its cycle highs; as is the case for each of the regions. The other regions generally saw improvements as well, other than the South. While the South did not improve, it did hold steady at a solid reading of 69. The Midwest jumped by 5 points and the Northeast also improved to 57. Start a two-week free trial to Bespoke Institutional to access our interactive economic indicators monitor and much more.