2020 Outlook — Our View & Introduction

Our 2020 Bespoke Report market outlook is the most important piece of research that Bespoke publishes each year. We’ve been publishing our annual outlook piece since the formation of Bespoke in 2007, and it gets better every year! In this year’s edition, we’ll be covering every important topic you can think of that will impact financial markets in 2020.

The 2020 Bespoke Report contains sections like Economic Cycles, Economic Indicators, The Fed, Sector Weightings and Technicals, Analyst Ratings, Housing, Commodities, and more. We’ll also be publishing a list of our favorite stocks and asset classes for 2020 and beyond.

Today we have published the “Our View & Introduction” section of the 2020 Bespoke Report.

To view this section immediately and all other sections, become a member with our 2020 Annual Outlook Special!

The Closer: End of Week Charts — 12/20/19

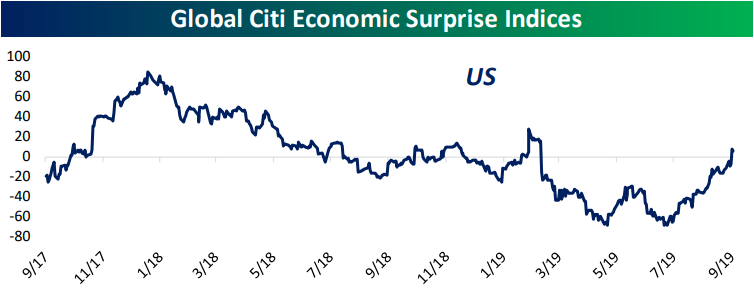

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke clients, we recap weekly price action in major asset classes, update economic surprise index data for major economies, chart the weekly Commitment of Traders report from the CFTC, and provide our normal nightly update on ETF performance, volume and price movers, and the Bespoke Market Timing Model. We also take a look at the trend in various developed market FX markets.

The Closer is one of our most popular reports, and you can sign up for a free trial below to see it!

See tonight’s Closer by starting a two-week free trial to Bespoke Institutional now!

2020 Outlook — International Markets

Our 2020 Bespoke Report market outlook is the most important piece of research that Bespoke publishes each year. We’ve been publishing our annual outlook piece since the formation of Bespoke in 2007, and it gets better every year! In this year’s edition, we’ll be covering every important topic you can think of that will impact financial markets in 2020.

The 2020 Bespoke Report contains sections like Economic Cycles, Economic Indicators, The Fed, Sector Weightings and Technicals, Analyst Ratings, Housing, Commodities, and more. We’ll also be publishing a list of our favorite stocks and asset classes for 2020 and beyond.

We’ll be releasing individual sections of the report to subscribers until the full publication is completed by year-end. Today we have published the “International Markets” section of the 2020 Bespoke Report, which looks at the performance, fundamentals, market caps, and more of stock markets around the globe. We also review the current and 2020 forecasted interest rate and broader economic environments for several of the world’s largest economies.

To view this section immediately and all other sections, become a member with our 2020 Annual Outlook Special!

2020 Outlook — Sentiment

Our 2020 Bespoke Report market outlook is the most important piece of research that Bespoke publishes each year. We’ve been publishing our annual outlook piece since the formation of Bespoke in 2007, and it gets better every year! In this year’s edition, we’ll be covering every important topic you can think of that will impact financial markets in 2020.

The 2020 Bespoke Report contains sections like Economic Cycles, Economic Indicators, The Fed, Sector Weightings and Technicals, Analyst Ratings, Housing, Commodities, and more. We’ll also be publishing a list of our favorite stocks and asset classes for 2020 and beyond.

We’ll be releasing individual sections of the report to subscribers until the full publication is completed by year-end. Today we have published the “Sentiment” section of the 2020 Bespoke Report, we take a look at various gauages on investor sentiment like TD Ameritrade’s Investor Movement Index, the Investor Intelligence survey, and AAII’s sentiment survey. We also review stock market performance after similar sentiment readings.

To view this section immediately and all other sections, become a member with our 2020 Annual Outlook Special!

2020 Outlook — Analyst Ratings

Our 2020 Bespoke Report market outlook is the most important piece of research that Bespoke publishes each year. We’ve been publishing our annual outlook piece since the formation of Bespoke in 2007, and it gets better every year! In this year’s edition, we’ll be covering every important topic you can think of that will impact financial markets in 2020.

The 2020 Bespoke Report contains sections like Economic Cycles, Economic Indicators, The Fed, Sector Weightings and Technicals, Stock Market Sentiment, Housing, Commodities, and more. We’ll also be publishing a list of our favorite stocks and asset classes for 2020 and beyond.

We’ll be releasing individual sections of the report to subscribers until the full publication is completed by year-end. Today we have published the “Analyst Ratings” section of the 2020 Bespoke Report, which looks at the percentage of Buy and Sell ratings from Wall Street strategists across the S&P 1500 and its sectors. We also look at how far stocks are trading from their price targets compared to where things stood at the end of the last decade in 2009.

To view this section immediately and all other sections, become a member with our 2020 Annual Outlook Special!

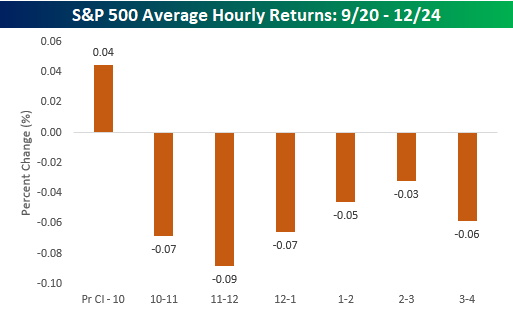

The Santa Claus Rally Feels Stronger Than It Is

Recent performance of the S&P 500 has impressed as the index has risen 7 of the last 8 sessions and logged a series of all-time highs along the way. But as shown in the chart below, this solid performance is hardly an outlier relative to history when looking at the performance of the S&P 500 from the close on Thanksgiving Day through year end. As shown in the chart, this has definitely been a better run than typical but by no means is an outlier relative to history over the last 30 years. Sign up for Bespoke’s “2020” special and get our Bespoke Report 2020 Market Outlook and Investor Toolkit.

The Great & The Goodwill

Below is an excerpt from a recent edition of Bespoke’s nightly Institutional note, The Closer.

One of the great complaints about the post-crisis equity market is that it is “propped up” via buybacks. However, buybacks are just one form of capital return (with dividends the other option). Firms with operating cash flow have limited options around what to do with it: hold the cash (which almost always has poor returns), reduce debt (which isn’t a very good strategy for most companies when real rates are low), invest in new production (again, a poor strategy in a world of relatively weak final demand growth), return capital (via dividends or buybacks) or, finally, purchase other businesses via M&A.

Given the buyback narrative, it may surprise investors to discover that 10% of S&P 500 assets are goodwill (that is, the asset recorded when a company is purchased above book value). The growth of goodwill represents a relatively aggressive acquisition strategy from major corporate CEOs, and frankly, it makes us somewhat nervous that 10% of all US equity assets (which themselves in aggregate are already being valued at 3.3x book value) are the remainder of acquisitions above and beyond the book value of assets.

Are companies really better-served continuing to accumulate these sorts of assets via acquisitions instead of returning capital to shareholders? As things currently stand, the 10% number is probably manageable, but we encourage investors to think critically when considering some of the alternatives implied by market memes similar to the complaints about buybacks. Sign up for Bespoke’s “2020” special and get our Bespoke Report 2020 Market Outlook and Investor Toolkit.

What Goes In To The US Current Account Deficit?

Last week, the Bureau of Economic Analysis (BEA) reported Q3 international transactions. The current account is comprised of credits (exports, income) and debits (imports, costs) between the US and other international economies. On a quarterly basis, these flows are very large, with more than $1 trillion moving out of the US and almost as much coming back in, for a net deficit (the current account deficit) of $124bn. That deficit isn’t too big relative to GDP, but it’s interesting to look at what goes into it instead of focusing on the headline number.

Below we show the various major categories by type. As shown, trade (exports and imports) is much larger than any other category and goods are the biggest factor in trade. Most changes come from this group of transactions, with industrial and capital goods the largest by far. Consumer goods, even including autos and parts, are less important than goods purchased for business consumption. Primary income is earned abroad: for instance, the income of US direct investments, employee wages and salaries, and portfolio income on securities’ dividends or coupons. Secondary income is generally transfers like remittances or foreign aid. Sign up for Bespoke’s “2020” special and get our Bespoke Report 2020 Market Outlook and Investor Toolkit.

Bespoke’s Morning Lineup – 12/20/19 – Tired of Winning?

S&P 500 futures are indicated higher again this morning (what else is new?) with the S&P 500 poised for another record high. If today’s gains hold it would be the sixth record close in the last seven trading days. Looking further out, since the S&P 500 first broke out in late October, we’ve seen record closes at a pace of once every other day!

There’s a heavy dose of economic data on the calendar today as reports get jammed in ahead of the holidays. The first batch that was just released generally came in right in line with expectations. The only outlier was Personal Consumption which rose more than expected (3.2% vs 2.9%), but overall the data shouldn’t ruffle any feathers in the futures market.

It’s not just US stocks rallying either. As shown in our snapshot of regional international ETFs from our Trend Analyzer tool, every single one of them is up over the last five trading days and trading at overbought levels.

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

The Closer – Stocks Surge, Sentiment Strong, Claimsonality – 12/19/19

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we take a look at the S&P 500’s price action compared to last year and relative to other years after Thanksgiving. We also show one downside of optimistic sentiment levels. Turning to macroeconomic data, we show why claims data is not surging as the numbers may appear at first glance. We finish with a look at our Five Fed Manufacturing Composite before reviewing the current account composition.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!