Bespoke’s Global Macro Dashboard — 3/25/20

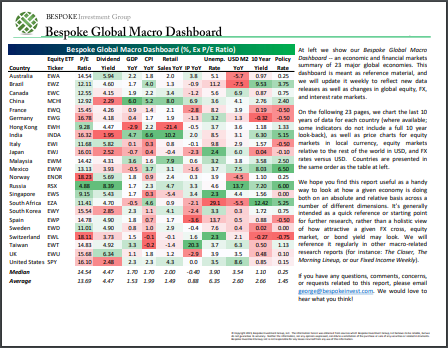

Bespoke’s Global Macro Dashboard is a high-level summary of 22 major economies from around the world. For each country, we provide charts of local equity market prices, relative performance versus global equities, price to earnings ratios, dividend yields, economic growth, unemployment, retail sales and industrial production growth, inflation, money supply, spot FX performance versus the dollar, policy rate, and ten year local government bond yield interest rates. The report is intended as a tool for both reference and idea generation. It’s clients’ first stop for basic background info on how a given economy is performing, and what issues are driving the narrative for that economy. The dashboard helps you get up to speed on and keep track of the basics for the most important economies around the world, informing starting points for further research and risk management. It’s published weekly every Wednesday at the Bespoke Institutional membership level.

You can access our Global Macro Dashboard by starting a 14-day free trial to Bespoke Institutional now!

Bespoke’s Morning Lineup – 3/25/20 – Volatility Still Reigns Supreme

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

Equity futures are indicating a modestly higher (or lower depending on when you look at the futures) open, but don’t let the numbers fool you. From midnight to around 4:30 eastern, S&P 500 futures rallied more than 4.5% in reaction to news of a deal being struck in DC over the $2 trillion coronavirus relief bill. From 4:30 through now, though, all of those gains have been erased.

Markets are still searching for equilibrium and trying to figure out when the economy will be able to re-open, and right now there is just about zero clarity on that front. Then, when the time comes where certain areas of the country look to be in the clear and can open for business a whole new set of questions will arise. First, how do you cordon off these areas that are no longer hotspots from the areas that are still hot?

Read today’s Bespoke Morning Lineup for a discussion of the details of the relief bill in DC, Asian and European markets, and the latest trends and statistics of the outbreak.

It’s been an exceptionally strong two days for gold as the yellow metal has rallied over 5% on back to back days. With all the liquidity being thrown into the system, some investors are clearly worried about the dollar’s purchasing power down the road. Going back to 1980, there have only been four prior periods where gold has seen similar moves on back to back days, with the last occurrence coming in September 2008. In other words, it has been extremely rare to see these kinds of moves.

The Closer – Epic Dash For Trash Drives Volatility Up – 3/24/20

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we review what factors drove today’s rally and where that leaves credit markets. We also show other ways that fixed income markets are returning to normal before reviewing today’s 2 year Treasury note auction. We close out tonight with a recap of our Five Fed Manufacturing Composite.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

Daily Sector Snapshot — 3/24/20

Warren Buffett Portfolio Check Up

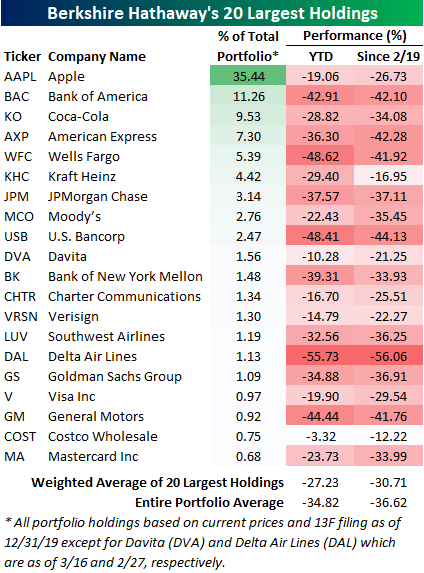

During tumultuous times, investors always turn to the sage advice of the Oracle of Omaha: Warren Buffett. With the S&P 500 down almost 30% from its record high back on February 19th, many are surprised from the silence out of Omaha. While Buffett is well known for weathering the worst market downturns and coming out stronger, the last several weeks have been just as painful on his portfolio as it has on the broader market. Fortunately for him, though, a mountain of cash has helped to cushion the blow of the decline.

Of Berkshire’s top holdings, the average stock is down 36.62% since the S&P 500’s last all-time closing high on 2/19 and down 34.82% YTD. The worst performing of the portfolio’s holdings has unsurprisingly been an energy sector name, Occidental Petroleum (OXY), which is down roughly 75% this year. On the other hand, Amazon (AMZN) has been a top performer in 2020 as it is currently up 3.5% YTD. But neither of these stocks are particularly large holdings. In the table below, we show the 20 largest holdings in the Berkshire portfolio as of the most recent 13F filing (in addition to positions in Davita (DVA) and Delta (DAL) which were added and disclosed more recently). Apple (AAPL) continues to be the crown jewel with a 35.44% weighting in the portfolio. At the S&P 500’s peak, Buffett’s position in AAPL was worth $79.3 bn, but the 26.7% decline since then has brought that value down to $58.13 bn. The next largest position and the only other one taking up a double-digit percentage in the portfolio’s total weight is Bank of America (BAC) which is down even more dramatically at 42%. Other notable weak holdings have been the airlines, Southwest (LUV) and Delta (DAL). For clients with access, we have also created a custom portfolio of Berkshire’s reported equity portfolio so you can track these names. Start a two-week free trial to Bespoke Institutional to access our Custom Portfolios, interactive tools, and full library of research.

B.I.G. Tips – A Top Ten Day

Chart of the Day – Near Record VIX Decline

Bespoke Stock Scores — 3/24/20

February 2020 Headlines

Best Performing Russell 3,000 Stocks

The Russell 3,000 is currently down about 35% from its February 19th high. With such a substantial decline in the index in just over one month, it should come as no surprise that only a small handful of individual stocks are higher since the 2/19 peak. In fact, less than 2% of the index has risen in that time. The bulk of these stocks are Health Care names. As shown below, there are 28 Health Care stocks that have risen since 2/19 with two, Tocagen (TOCA) and Vir Biotechnology (VIR) having doubled in price in that time. Sixteen other stocks have seen double digit percentage gains in that time.

Of the stocks that are up in other sectors, many appear to be plays on a socially distanced coronavirus world. For example, in the Consumer Discretionary sector, the best performer has been food delivery and ordering app Waitr (WTRH) which has gone from $0.39 to $1.56. In that same vein, Domino’s Pizza (DPZ) has also performed well. Outside of the Health Care sector, the only sector with a large number of stocks that are up are Consumer Staples. As with many of these other stocks, these seem to be plays on the COVID-19 economy. Multiple grocers, wholesale stores, and food related names make the list alongside cleaning product company Clorox (CLX). Additionally, despite the rout of Energy names, there also are four Energy stocks that have distanced themselves from the pack and risen since 2/19 — TNK, SWN, DHT, EQT. Start a two-week free trial to Bespoke Institutional to access our full range of research and interactive tools.