New York Home Prices on Top

Updated home price data from S&P CoreLogic Case Shiller was published this morning through the month of November 2024. Below is a summary table of key results across the 20 cities/regions tracked by Case Shiller.

Most cities saw home prices decline month-over-month from October to November, with San Francisco and Seattle down the most at roughly -0.75%. Boston, Miami, and New York were the only cities that saw meaningful gains month-over-month.

Over the prior year, 19 of 20 cities were up, with Tampa the only city down at -0.37%.

New York ranks first when it comes to year-over-year price gains at +7.32%.

After a major jump in home prices in the immediate aftermath of the pandemic, we saw a small dip in 2022 and 2023 when risk assets sold off hard. Since early 2023 lows, New York is also the city that has seen home prices jump the most at +16.76%.

Additionally, New York is now the only city where home prices are currently at all-time highs. On the flip side, San Francisco, Seattle, and Denver are all down more than 5% from all-time highs.

Below is a historical look at Case Shiller home prices for the 20 cities tracked along with the composite indices. We’ve highlighted New York in green because it’s the only city where prices are at all-time highs.

A Discerning Sell-Off

In listening to discussions over the market’s reaction to the DeepSeek sell-off yesterday, the term “shoot first, ask questions later” came up repeatedly. However, in looking at the performance of various indices and individual stocks yesterday, the market’s behavior looked more discerning than indiscriminate. At the individual stock level, most stocks in the S&P 500 finished the day higher, and the weakness was concentrated to stocks that have benefitted the most from the AI rally.

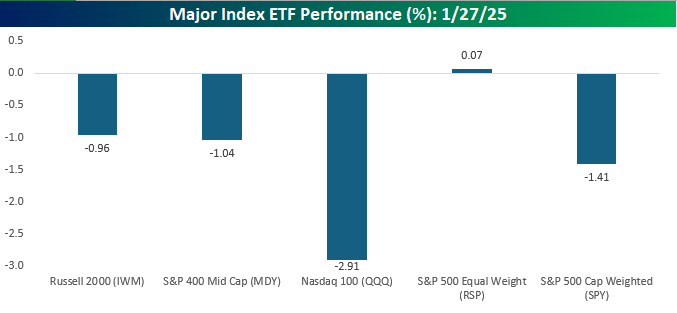

The chart below shows yesterday’s performance of major US index ETFs. As you would expect, the Nasdaq 100 with its concentration in technology was the hardest hit, falling by close to 3%. The cap-weighted S&P 500 (SPY) also declined more than 1% given its large weighting in Nvidia (NVDA) and other tech companies. The equal-weight index (RSP), however, finished the day in positive territory with a modest gain. The one index where performance was not as we expected was in small caps where the Russell 2000 (IWM) also fell nearly 1%. On a day when mega-cap tech was crushed but the majority of large-cap stocks rallied and interest rates declined, we would have expected small caps to show more strength. Given the entire Russell 2000 is smaller than NVDA, it doesn’t take much to get this area of the market to rally. Also, if DeepSeek means that the previous costs associated with adopting AI are now dramatically lower, shouldn’t that be good for small caps which presumably have smaller budgets?

Looking at the performance of these major index ETFs over the last week, outside of QQQ, they’re all still positive, even after Monday’s decline. Additionally, they’re also all trading right within the confines of their normal trading ranges (none are oversold or overbought) which is a level of homogeneity that it feels like we don’t see much these days.

The Russell 2000’s lack of a rally came within the context of a week-long period where IWM has been unsuccessfully attempting to break back above its 50-DMA. Yesterday marked the fifth straight day where it tested that level but failed to close above it.

The mid-cap ETF (MDY) finished well off its intraday high yesterday and also traded below its 50-DMA but managed to close the day just barely above that level.

The 50-DMA also acted as support for the S&P 500. After opening right at that level in the morning, the large-cap benchmark bounced throughout the session and finished at the highs of the session.

The chart of the Equal Weight S&P 500 (RSP) over the last few days looks similar to small caps with a tight range. The only difference is that, unlike IWM, RSP has closed above its 50-DMA for each of the last four trading days.

Finally, the Nasdaq 100 (QQQ) was the biggest pain point of the major indices. It started the session below its 50-DMA and made an attempt to rally back above that level intraday but came up just short by the time the closing bell rang. While QQQ failed to take out its December high in last week’s rally, it did manage a higher high, and as long as yesterday’s decline doesn’t see much in the way of follow-through, it isn’t in imminent danger of a lower low in the short-term.

Bespoke’s Morning Lineup – 1/28/25

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Profitability is coming from productivity, efficiency, management, austerity, and the way to manage the business.” – Carlos Slim

Below is a snippet of commentary from today’s Morning Lineup. Start a two-week trial to Bespoke Premium to view the full report.

Even though the S&P 500 was down 1.4% yesterday, there were 351 advancers and just 152 decliners within the index. As shown below, Technology, Utilities, and Industrials pretty much saw all of the pain, while Consumer Staples and Health Care were actually up more than 2%. All of the weakness yesterday came from declines in the companies that deal with producing and powering AI.

NVIDIA (NVDA) ended last week as the largest company in the world with a market cap of roughly $3.5 trillion. It ended Monday with a market cap of $2.9 trillion and now ranks as the third largest company behind Apple (AAPL) and Microsoft (MSFT). Since last Thursday’s close, NVIDIA (NVDA) has lost $705 billion in market cap!

The Closer – AI’s Bad Day – 1/27/25

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight into markets? In tonight’s Closer sent to Bespoke Institutional clients, we lead off with some commentary regarding the situation with Colombia and the latest earnings (page 1). We also start out with a look at some stocks impacted by the AI hit (page 2) in addition to new home sales data (page 3). We then review the historic divergences in breadth and price in addition to the Tech and Consumer Staples sectors (page 4). We then pivot over to the record single day decline in our AI baskets (page 5) and put a bow on the topic on the following page (page 6). We finish by reviewing today’s Treasury auctions (page 7). We then finish with a recap of the latest positioning data (pages 8 – 11).

See today’s full post-market Closer and everything else Bespoke publishes by starting a 14-day trial to Bespoke Institutional today!

Daily Sector Snapshot — 1/27/25

AI Infrastructure Stocks Drop

The Nasdaq is down well over 3% as of this writing with AI hardware names driving the declines. The main AI infrastructure stock — NVIDIA (NVDA) — is down roughly 20% over the last two trading days, which equates to a drop of nearly $700 billion in market cap! Amazingly, news that DeepSeek out of China had built a ChatGPT-like product for a fraction of the cost was actually circulating weeks ago at the end of last year. It wasn’t until this weekend, though, that the ramifications of this news started being debated heavily on social media platforms like X.

Our AI Basket is a set of 50 stocks with exposure to the AI Boom. The headline basket is further broken down into two sub-baskets: the Infrastructure basket and the Implementation basket. The former is comprised of stocks whose hardware and software lay the foundation for AI to work. These include companies that make semiconductors, data centers, cloud storage, and more. The Implementation basket, on the other hand, is made up of companies whose products are more oriented towards end-users of AI. This includes stocks with products like AI augmented software, copilots, automated services and the like.

Although AI stocks are down broadly today, it is the Infrastructure basket that has been hit the hardest. With DeepSeek’s supposed low-cost to build its latest ChatGPT-like offering, it has brought into question the necessity for massive capex spend on chips and datacenters, and our AI Infrastructure sub-basket is down an incredible 8.2% on the day as a result! That compares to only a 1.5% decline in our Implementation sub-basket. As shown below, since the start of our AI Baskets a little over two years ago, this is easily the worst day for our Infrastructure basket relative to our Implementation basket to date, and it isn’t even close. In tonight’s Closer, we will provide a further look into the performance of the AI baskets in the wake of the DeepSeek discussion.

Q4 2024 Earnings Conference Call Recaps: SoFi Technologies (SOFI)

Bespoke’s Conference Call Recaps use AI to summarize lengthy earnings calls. The commentary below is AI-generated and then edited by Bespoke for quality control. As always, none of these summaries should be construed as recommendations to buy or sell any securities, and investors should do their own research and/or consult with a financial professional before making any investment decisions.

Our latest recap available to Bespoke subscribers covers SoFi Technologies’ (SOFI) Q4 2024 earnings call.

SoFi Technologies (SOFI) is a leading digital financial services company with offerings including personal loans, student loans, home loans, credit cards, investment services, and banking. Known for its “one-stop shop” approach, SOFI’s mission is to simplify and digitize financial services, serving over 10 million members and growing rapidly. That’s been evident through its recent diversification into fee-based revenue and partnerships, like its new role in the US Department of Treasury’s Direct Express program. To close 2024, SOFI added 785,000 new members and achieved record revenue of $739 million in the quarter and $2.6 billion for the year, driven by fee-based revenue up 74% to $970 million. Lending originations hit $7.2 billion in Q4, strengthened by $2.1 billion from its Loan Platform Business (LPB). Financial services revenue grew 84%. SOFI projects a 2025 revenue growth rate of 23-26%, targeting $3.2 billion while expanding SoFi Plus and alternative investments. Even with the better-than-expected results, SOFI shares fell more than 10% on 1/27 after guidance disappointed…

Continue reading our Conference Call Recap for SOFI by becoming a Bespoke Institutional subscriber. You can sign up for Bespoke Institutional now and receive a 14-day trial to read our newest Conference Call Recap. To sign up, choose either the monthly or annual checkout link below:

Chart of the Day – Monday Hangover

Bespoke’s Morning Lineup – 1/27/25 – DeepTrouble?

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“The music is not in the notes, but in the silence between.” – Mozart

Below is a snippet of commentary from today’s Morning Lineup. Start a two-week trial to Bespoke Premium to view the full report.

The S&P 500 finished last week with its second straight weekly gain, and it was the first week of back-to-back 1.5%+ advances since mid-May as the S&P 500 managed to close at an all-time high last Thursday. Since the S&P 500 ETF’s (SPY) closing low on 1/10, the large-cap benchmark is up 4.73% while the Nasdaq 100 ETF (QQQ) has rallied by a similar amount (4.42%). Moving down the market cap spectrum, mid-caps (MDY) have rallied 5.64% while small caps (IWM) are up 5.47%. The leader has been micro-caps, though, as the Russell 2000 micro-cap ETF is up 5.75%.

Much of those gains from the last two weeks have been erased over the weekend as both the S&P 500 and the Nasdaq 100 are indicated to open sharply lower on concerns over DeepSeek upending the entire investment landscape for AI. News of DeepSeek first dropped around Christmas and started to pick up steam early last week as articles reported that the model has achieved comparable progress in AI to the most advanced US models for fractions of the cost. Articles published over the weekend have hit a nerve, resulting in a massive sell-off in mega cap US stocks.

If the reports of DeepSeek’s success at such low costs are true, and this is a big if as there is still a lot we don’t know in terms of how it was developed, it would pose problems for some of the biggest AI winners over the last two years. As we type this, the S&P 500 (proxied by SPY) is trading down about 2.25% which would be the largest downside gap since early August and the 60th largest downside gap in the ETF’s history dating back to 1993.

For the Nasdaq 100 (QQQ), the declines are even steeper. With the ETF poised to gap down 3.8% at the open, it would be QQQ’s largest downside gap since early August and the 20th largest downside gap since its inception in 1999. As shown in the chart below, before last August’s downside gap, the last time QQQ gapped down as much as it on pace to today was back in September 2020.

Among the mega cap stocks, this morning’s declines aren’t uniform. The chart below shows where each trillion-dollar market cap stock is trading this morning relative to Friday’s close. Leading the way to the downside, Broadcom (AVGO) and Nvidia (NVDA) are both down by double-digit percentages. These have been the biggest AI winners, so it’s no surprise that investors are selling them the fastest. Microsoft (MSFT) has also declined more than 5% given its close relationship with OpenAI. One name that has barely been impacted by the overnight sell-off is Apple (AAPL); in pre-market trading, it’s down less than 1%. Ironically, all anyone could talk about last week concerning AAPL was how it’s overvalued and missed the boat on AI. Today, that lack of investment in AI is being looked at as a plus!

Brunch Reads – 1/26/25

Welcome to Bespoke Brunch Reads — a linkfest of some of our favorite articles over the past week. The links are mostly market-related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

Dr. Travell: On January 26th, 1961, President John F. Kennedy appointed Dr. Janet Travell as the first female physician to the White House medical team. Dr. Travell was an expert in musculoskeletal pain and myofascial trigger points and had treated Kennedy for his chronic back pain when he was a Senator. When he became president, Kennedy brought her on board as his personal physician, recognizing her expertise as vital to managing his debilitating pain, which was often kept hidden from public view. One of her more famous prescriptions to the President was the use of a rocking chair as a way to manage his back pain as its gentle motion relieved pressure on the spine and promoted circulation. His fondness for rocking chairs became iconic during his presidency, and sales skyrocketed. You can even buy an official one for around $800 today. Above all else, Travell’s appointment was a major win for women, breaking new ground in medicine!

AI & Technology

Open-source DeepSeek-R1 uses pure reinforcement learning to match OpenAI o1 — at 95% less cost (VentureBeat)

DeepSeek, a Chinese AI startup, just launched a new model called DeepSeek-R1. It matches OpenAI’s o1 in performance on tasks like math, coding, and reasoning but is much more affordable, making it a strong competitor. What’s impressive is that it’s open-source, meaning anyone can access or build on it, and DeepSeek even used it to help improve smaller models to outperform much larger ones in certain benchmarks. It’s a significant step forward for open-source AI, especially in the race for AGI. [Link]

Continue reading our weekly Brunch Reads linkfest by logging in if you’re already a member or signing up for a trial to one of our two membership levels shown below! You can cancel at any time.