Chart of the Day: All Time Highs on Bad Breadth

Fixed Income Weekly – 8/19/20

Searching for ways to better understand the fixed income space or looking for actionable ideas in this asset class? Bespoke’s Fixed Income Weekly provides an update on rates and credit every Wednesday. We start off with a fresh piece of analysis driven by what’s in the headlines or driving the market in a given week. We then provide charts of how US Treasury futures and rates are trading, before moving on to a summary of recent fixed income ETF performance, short-term interest rates including money market funds, and a trade idea. We summarize changes and recent developments for a variety of yield curves (UST, bund, Eurodollar, US breakeven inflation and Bespoke’s Global Yield Curve) before finishing with a review of recent UST yield curve changes, spread changes for major credit products and international bonds, and 1 year return profiles for a cross section of the fixed income world.

In this week’s report we review the implications of the euro’s large rally in recent weeks.

Our Fixed Income Weekly helps investors stay on top of fixed income markets and gain new perspective on the developments in interest rates. You can sign up for a Bespoke research trial below to see this week’s report and everything else Bespoke publishes free for the next two weeks!

Click here and start a 14-day free trial to Bespoke Institutional to see our newest Fixed Income Weekly now!

B.I.G. Tips — A Market Round Trip in “Concorde” Speed

Bespoke CNBC Appearance (8/19)

Bespoke co-founder Paul Hickey appeared on CNBC’s Squawk Box on Wednesday to discuss markets after the S&P 500’s new high. To view the segment, please click on the image below. Click here to view Bespoke’s premium membership options for our best research available.

Bespoke’s Morning Lineup – 8/19/20 – Nasdaq New Highs Trouncing S&P 500

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“In business or in life, don’t follow the wagon tracks too closely.” – H. Jackson Brown Jr.

Yesterday, it was Home Depot (HD) and Walmart (WMT) and today one of each company’s chief competitors released earnings, and they did not disappoint. Lowe’s (LOW) reported a 34.2% increase in comp sales which was basically twice expectations while Target’s (TGT) comp sales came in nearly triple forecasts (24.3% vs 8.6%). Whether they’re the result of stimulus or not, the results were astonishing.

Outside of those big earnings reports, there’s not a lot of data today besides the Fed minutes and Nvidia’s earnings after the close. Futures were higher earlier following on the record closing high from Tuesday but have been drifting lower as we approach the opening bell.

Be sure to check out today’s Morning Lineup for a rundown of the latest stock-specific news of note, market performance in the US and Europe, trends related to the COVID-19 outbreak, and much more.

The S&P 500 just broke a streak of nearly six months without making a new high on a closing basis, but the Nasdaq made its first post-COVID record high more than two months ago on June 8th and since then has made 18 record highs compared to the S&P 500’s one new high yesterday. For the entire year now, the Nasdaq (34) has made 20 more new highs than the S&P 500 (14). Going back to 1980, there have only been three other years where the spread was wider in the first 159 trading days of the year, and they were all in the 1980s. In other words, the gap between the number of record highs for the Nasdaq and S&P 500 hasn’t been this wide in more than 30 years. It’s time for the S&P 500 to play catch up, and don’t even get us started on the Russell 2000.

Daily Sector Snapshot — 8/18/20

Chart of the Day: Crash Concerns

Bespoke Stock Scores — 8/18/20

Tesla (TSLA) Now in Top 10

Tesla (TSLA) announced a 5 for 1 stock split one week ago after the close on August 11th. Shares are up 37% since then.

While Tesla (TSLA) is not yet in the S&P 500, if it were, it would now be the 10th largest stock in the index. TSLA’s $350 billion market cap puts it in between Walmart (WMT) at $380 billion and Procter & Gamble (PG) at $341 billion. Click here to view Bespoke’s premium membership options for our best research available.

Retail Earnings On Deck

Earnings season came to its unofficial end today with the release of Q2 results for Walmart (WMT). As shown in the snapshot of our Earnings Explorer below, the earnings slate has slowed considerably but there are still several reports per day over the next month. The busiest day will be August 27th with 37 reports.

Similar to today, retail earnings dominate the upcoming calendar. While WMT and Home Depot (HD) blew the doors off their reports, upcoming earnings will give a better picture of how the consumer has been impacted by the pandemic. Over the next month there are 52 retailers scheduled to report second-quarter results. Of these retailers, less than half are expected to show positive EPS. Companies that have historically beaten EPS the most include Ollie’s Bargain Outlet (OLLI), Ulta Beauty (ULTA), and Restoration Hardware (RH). In terms of topline results, Vipshop (VIPS), OLLI, and Alibaba (BABA) have topped sales forecasts the most consistently.

In terms of stock price reactions, Land’s End (LE) has averaged the strongest performance on earnings days with an average full-day gain of just under 6% with positive returns a little better than half the time. Sportsman’s Warehouse (SPWH) is the only other stock on this list to have averaged a gain of more than 5% on earnings days. SPWH along with ULTA, and Burlington Stores (BURL) have also been the ones to most consistently experience a positive stock price reaction.

Given retailers tend to be fairly seasonal businesses, the table below looks only at these companies’ beat rates and average stock price reactions in just their reports for the Q2 earnings season. As shown, Sportsmans Warehouse (SPWH) has most consistently topped EPS and sales estimates. SPWH has averaged a 9.11% gain following its Q2 reports. On a side note, PDD has a 100% beat rate for its Q2 earnings season reports, but it has only had one prior report during the Q2 earnings season. While SPWH has seen positive returns, stocks like At Home Group (HOME), Duluth Trading (DLTH), and Vipshop (VIPS) have all averaged the worst performance fin reaction to their Q2 earnings reports.

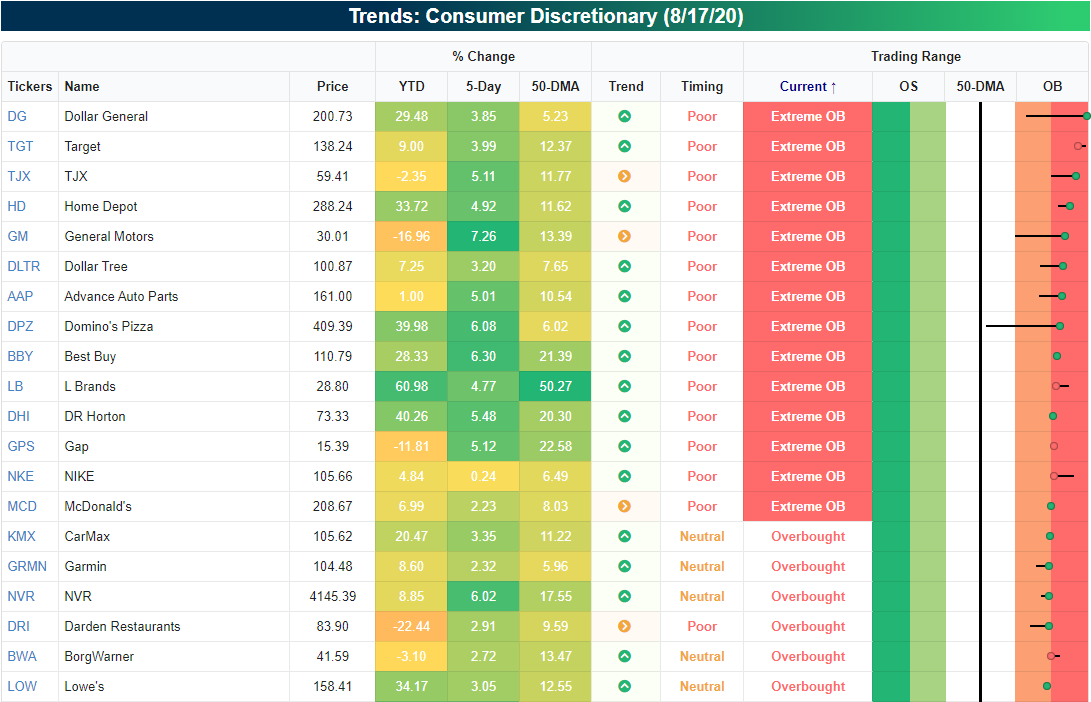

As for where retail stands ahead of their earnings, the snapshot below from our Trend Analyzer shows the 20 most overbought stocks in the sector. Many of the stocks making the cut are retailers that are currently extremely overbought after sizeable runs. As of Monday’s close, the average S&P 500 retail stock is 1.7 standard deviations above its 50-DMA. Click here to view Bespoke’s premium membership options for our best research available.