Daily Sector Snapshot — 11/8/21

Chart of the Day – Sweet Sixteen in Eighteen

Extremes in Everything

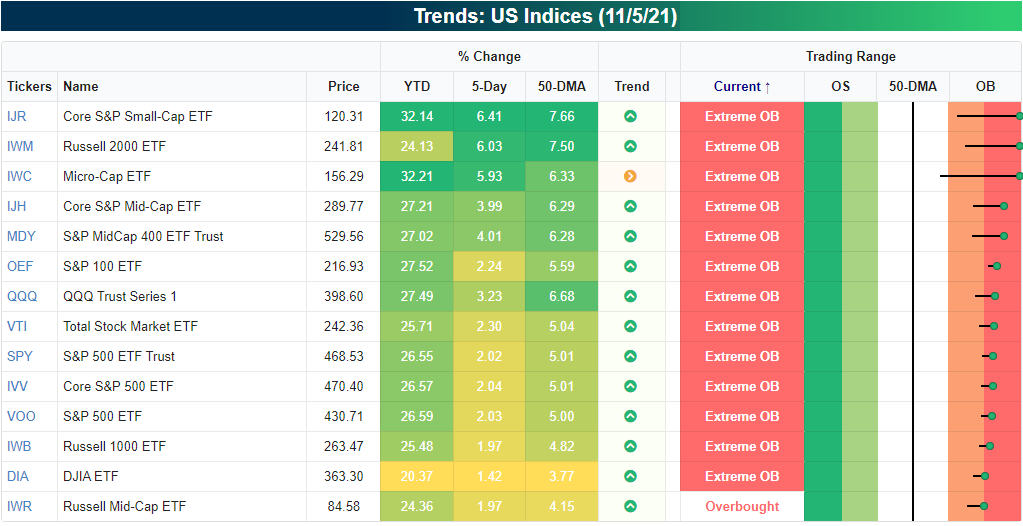

Across major US equity indices, regardless of market cap, the picture is the same: extreme overbought. As shown in the snapshot of our Trend Analyzer below, the Russell Mid-Cap ETF (IWR) was the only major index ETF that did not finish last Friday at least two standard deviations above its 50-DMA. With that said, IWR still finished the week at very overbought levels and only slightly below extreme overbought levels. For the most part, other mid-cap ETFs were some of the most overbought last week like the Core S&P Mid-Cap ETF (IJH) and S&P MidCap 400 ETF (MDY). Small-caps are even more extended with the Core S&P Small-Cap ETF (IJR), Russell 2,000 ETF (IWM), and Micro-Cap ETF (IWC) all off the chart overbought.

Again, looking across the four major US indices, each one is at ‘extreme’ overbought levels with a z-score reading at the high end of the past decade’s range. In the charts below, we show charts of how far the S&P 500, NASDAQ Composite, Dow Jones Industrial Average, and Russell 2,000 are trading from their 50-DMAs as measured in standard deviations. For large caps and the NASDAQ, the current readings are some of the highest since the summer. For the Russell 2,000, no point in the past decade has seen a more elevated reading. In fact, Friday’s close saw the Russell 2,000 finish 3.23 standard deviations above its 50-DMA; the most elevated reading since February 1991. Click here to view Bespoke’s premium membership options.

October 2021 Headlines

B.I.G. Tips – Record Run For Semis

Bespoke’s Morning Lineup – 11/8/21 – More New Highs

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“If you wish to increase your success rate, double your failure rate.” – Thomas Watson

There’s a modestly positive bias to the equity market following a week where new highs were seen across just about every major US average. This morning, the big moves have been seen in the crypto markets where ether is at record highs, and bitcoin is testing its highs from late October.

There haven’t been any major earnings reports yet to speak of today, but that pace will pick up again after the close with PayPal (PYPL) leading the charge. Economic data is also getting off on a slow start to the week, but Tuesday’s PPI and Wednesday’s CPI will be the most important reports of the week to watch.

In terms of Fedspeak today, a number of officials (including Powell) are scheduled to speak throughout the day.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, including the latest US and international COVID trends.

As mentioned above, it was a banner week for the US equity market as just about every major index touched and closed out the week right at record highs. In terms of the Russell 2000, Nasdaq, and S&P 500, last week was the first time since early February that all three of these indices had record closing highs on the same day. For all three indices, the recent moves are all starting to look extremely steep, and while they’re great for anyone who is long the market, they won’t last forever.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Bespoke Brunch Reads: 11/7/21

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium with a 30-day free trial!

Logistics

Highly Paid Union Workers Give UPS a Surprise Win in Delivery Wars by Thomas Black (Bloomberg)

While UPS pays a higher wages for its unionized workforce, it’s had no trouble managing the current labor market environment while rival FedEx has racked up hundreds of millions in extra costs. [Link; soft paywall]

I’m A Twenty Year Truck Driver, I Will Tell You Why America’s “Shipping Crisis” Will Not End by Ryan Johnson (Medium)

An inside look at how port snarls are playing out in practical terms. While the analysis is hyperbolic and excessively pessimistic, it does illustrate the challenges at stake in sorting out the logjam of US transportation. [Link]

Long Reads

The posthuman dog by Jessica Pierce (Aeon)

If humans disappeared, dogs would survive. In fact, there’s a case to be made that they might be better off, implausible as that sounds. But the real takeaway: we can make space for our four legged friends to be dogs without disappearing entirely. [Link]

When “Foundation” Gets The Blockbuster Treatment, Isaac Asimov’s Vision Gets Lost by Julian Lucas (The NYer)

A reflection on the challenges of translating a novel series based on a history textbook into a prestige TV show, both in general and thanks to the cultural narratives which swirl in 2020s America. [Link]

Crypto

Eric Adams vows to make NYC crypto-friendly, explore city’s own coin by Will Feuer (NYP)

New York’s new mayor is apparently taking a page out of the Miami playbook and hoping to focus the nation’s largest city on issuing new coins for the masses. [Link]

What Happens to Your Crypto When You Die? (Bloomberg/AP)

A users guide to making sure that the crypto you hold in this life doesn’t go into the grave if you pass on. [Link; soft paywall]

New Business Models

Zillow Shuts Home-Flipping Business After Racking Up Losses by Patrick Clark (Yahoo! Finance/Bloomberg)

After ploughing billions into a business designed to profit from guaranteed offers and quick resales of residential inventory, Zillow has decided to shutter the business after declaring failure. [Link]

A New Generation Leads Chick-fil-A’s Growing Flock by Heather Haddon (WSJ)

An interview with the latest Cathy family scion to lead the fried chicken giant, which is one of the most profitable US fast food businesses. [Link; paywall]

Ford makes classic pickup electric in surprise one-of-a-kind F-Series truck reveal by Phoebe Wall Howard (Detroit Free Press)

In a bid to show off the flexibility of its EV platform with a remodeled F-100 pickup dating to the 1970s…powered entirely with electric motors and batteries. [Link; auto-playing video]

Industry

Steel Is Back by Robinson Meyer (The Atlantic)

A US-EU pact designed to reduce tariffs on steel produced using less carbon-intensive measures was announced this week, with full support of US steel companies and workers. The new approach could represent a path forward for using trade incentives as a way to shift climate policy. [Link; soft paywall]

Poison in the Air by by Lylla Younes, Ava Kofman, Al Shaw and Lisa Song (ProPublica)

While the EPA does a reasonably good job restricting carcinogenic emissions from a single source, it doesn’t always take into account the compounding risks of multiple adjacent plants which can create horrifying cancer and other disease burdens for surrounding residents. [Link]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!

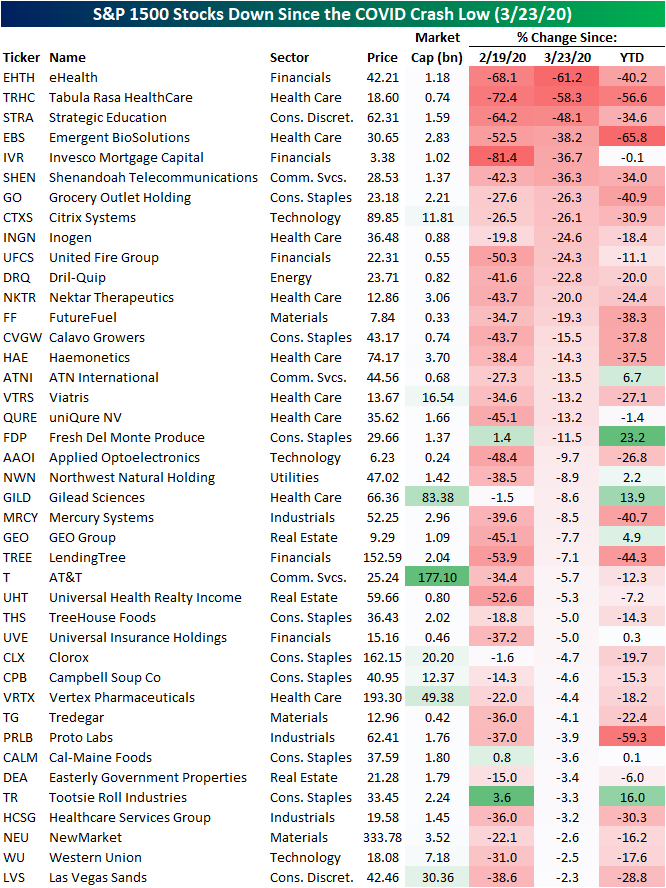

Best and Worst Performers Since the COVID Crash Low

The major indices have consistently been hitting new record highs over the past few days with the S&P 500 having now more than doubled off the COVID Crash low on March 23, 2020. As for individual stocks, there are currently only nine S&P 500 stocks that are below their levels from March 23, 2020, and expanding the universe to the S&P 1500 which includes small and mid-caps, there are currently 41 stocks that are below their levels from that date. Obviously, March 23, 2020 may not coincide with a particular high or low point on these individual stocks’ charts, but declines since then would be quite painful to handle given that the broad market has more than doubled over the same time frame.

As shown below, eHealth (EHTH) currently is the biggest decliner versus March 23, 2020 levels having fallen over 60% with a large share of that decline occurring this year. The only other stock that has been more than cut in half since the bear market low is Tabula Rasa HealthCare (STRA). TRHC has been declining since the spring, but a large share of that decline is actually occurring today after it reported an EPS and sales miss in addition to lowered guidance on earnings last night. Today, the stock has fallen nearly 50% in reaction to those weak earnings. There are a handful of stocks on this list that are up on a year-to-date basis with Fresh Del Monte Produce (FDP), Tootsie Roll Industries (TR), and Gilead Sciences (GILD) the only ones that are up double digits. While below their levels from the bear market low, TR and FDP are also two of the only stocks that are simultaneously above levels from February 19, 2020 which marked the last high prior to the start of COVID Crash bear market.

As for the stocks that have gained the most since the COVID Crash low on 3/23/20, meme mania darling GameStop (GME) still tops the list having rallied 5,492%. That is twice the rally of the next best performer, SM Energy (SM). As for the rest of the top performers since the bear market low, there are another 15 that have gained over 1,000%. One of those is a member of the trillion-dollar market cap club: Tesla (TSLA). Another one of these top performers, Tupperware Brands (TUP), is also one of the only stocks that is actually lower on a year-to-date basis, and those declines are significant at a 43.81% loss. TUP got below $2/share at its lows during the COVID Crash, but then surged back into the mid-$30s in late 2020. It has since moved back down into the teens. Click here to view Bespoke’s premium membership options.

Daily Sector Snapshot — 11/5/21

Heard on Conference Calls – 11/5/21

Below are some of the most interesting things we heard on quarterly conference calls from Corporate America this week:

Supply Chain

Clorox (CLX) CFO Kevin Jacobsen commented, “We now project that transportation costs will remain elevated.”

Jacobsen continued, “We’re facing an even tougher cost environment than previously expected.”

SolarEdge Technologies (SEDG) CEO Zvi Lando referenced the “unprecedented logistics and supply chain challenges” and “a twelve week COVID-related shutdown in our Vietnam manufacturing facility” as restraining factors.

The SEDG management team referenced high demand for their products throughout the call, and made it clear that supply constraints were holding back growth. CFO Ronen Faier added, “whatever we can manufacture, we’re shipping.”

Some companies seem to be better insulated than others in terms of the supply chain headwinds. Lumen (LUMN) CEO Jeffrey Storey stated, “We’ve been in close communication with our diverse and reliable supplier base and have commitments from them on their ability to deliver. However, we take nothing for granted and this is an area where we will continue to closely monitor.”

Energy

Intercontinental Exchange (ICE) President Benjamin Jackson stated, “The supply shortages and price volatility that we saw in the third quarter are a peek into the future of what the energy transition could look like.”

Jackson later added, “Energy consumption is expected to double over the next 30 years, yet carbon emissions are expected to be reduced by half. This imbalance in supply and demand will introduce additional complexity and volatility to energy markets.”

Although Diamondback Energy (FANG) ramped up oil production during prior bull trends in oil prices, management is committed to maintaining oil production at current levels. According to CEO Travis Stice, “Moving to 2022, we are committed to holding our Permian oil production flat next year.” Oil demand has been robust, and the market is in need of a supply hike to lower prices for consumers. At FANG at least, increased supply does not appear to be coming.

Inflation

Jacobsen stated, “we plan to take additional actions, including more pricing, resulting in increases to about 70% of our portfolio.” Based on this, consumers should expect to continue to face higher prices for products.

Johnson Controls (JCI) CFO Olivier Leonette added, “we do expect supply chain constraints and the inflationary environment to continue at least over the next couple of quarters.” Leonette continued, “The inflated level of pricing will result in margin headwinds”.

Broader Economy

Retail spending seems to be making a comeback, and Simon Property Group (SPG) CEO David Simon pronounced, “demand for our space from a broad spectrum of tenants is growing. Occupancy gains continued, retails sales accelerated… and cash flow increased.”

The quotes above are from our detailed Conference Call recaps. Throughout earnings season, we publish Conference Call recaps for select companies. These summaries include information regarding each company’s financial results, growth by segment, as well as some aspects of the business that management expects to impact future results. As always, none of these summaries should be construed as recommendations to buy or sell any securities, and investors should do their own research and/or consult with a financial professional before making any investment decisions.

Our Conference Call recaps are available to Bespoke Institutional subscribers only. If you’re not currently a Bespoke Institutional subscriber, click here to sign-up for or upgrade to Bespoke Institutional now.

Bespoke Conference Call Recaps Published So Far This Earnings Season:

Johnson Controls (JCI)

Cloudflare (NET)

AmerisourceBergen (ABC)

Lumen Technologies (LUMN)

Diamondback Energy (FANG)

Sprout Social (SPT)

SolarEdge Technologies (SEDG)

Simon Property Group (SPG)

Clorox (CLX)

Apple (AAPL)

Amazon (AMZN)

Merck (MRK)

United Rentals (URI)

Ford (F)

Automatic Data Processing (ADP)

Boeing (BA)

Evercore (EVR)

McDonald’s (MCD)

Alphabet (GOOGL)

Microsoft (MSFT)

Digital Realty (DLR)

3M (MMM)

Facebook (FB)

Olin (OLN)

Tesla (TSLA)

Equifax (EFX)

Baker Hughes (BKR)

Netflix (NFLX)

Intuitive Surgical (ISRG)

Johnson & Johnson (JNJ)

NextEra Energy (NEE)