Bespoke Stock Scores — 1/10/23

Chart of the Day: Bulls and Bears Around the Globe

Bespoke’s Morning Lineup – 1/10/23 – As Goes the First Week…

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Instinct is a marvelous thing. It can neither be explained nor ignored.” – Agatha Christie

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

After a good first week of the year for stocks, futures are in a bit of a retreat this morning, and a key reason for the caution is that Fed Chair Powell will be speaking on Central Bank Independence at 9 AM eastern. Given his recent penchant to crush the market, no one really wants to make a big stand ahead of that speech. Along with lower equity prices, bond yields are higher while crude oil is up marginally even as natural gas pulls back.

In terms of economic data, NFIB Small Business Sentiment came in weaker than expected and fell back down near its lowest levels in a decade. The only other report on the calendar today is Wholesale Inventories at 10 AM.

By nature, people put a lot of weight on first impressions, and that’s especially true in the stock market. If the year starts out on a positive note, it is thought to set a positive tone for the rest of the year and vice versa. With the new trading year fully one week old, below we take a look at how the S&P 500 has performed in the first week of this year compared to all other years since 1953 when the five-day trading week started. The S&P 500’s first week gain of 1.37% this year is definitely an improvement over last year’s decline of 1.87%, and it’s also more than double the 0.58% median gain dating back to 1953. But does it mean anything?

The scatter chart below shows the S&P 500’s performance in the first five trading days of the week versus the rest of the year, and the shaded area indicates all periods where the S&P 500 rallied more than 1% in the first five trading days. Since 1953, there have been 27 other years where the S&P 500 gained 1%+ in the first five trading days, and of those years, the S&P 500’s median rest of year performance was a gain of 13.9% with positive returns 79% of the time. For all other years, the S&P 500’s median rest-of-year return was a gain of 5.6% with gains 59% of the time. Maybe first impressions really do matter.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Daily Sector Snapshot — 1/9/23

European Markets Stage Comeback

While the S&P 500 remains down 18% from its all-time highs, we’ve seen some positive developments in major European markets over the last few months. As shown below, investors in Germany have recently seen the DAX enter a new bull market with a 23.7% gain off the recent lows. In local currency, the DAX is now just 8.9% below its 1/5/22 high.

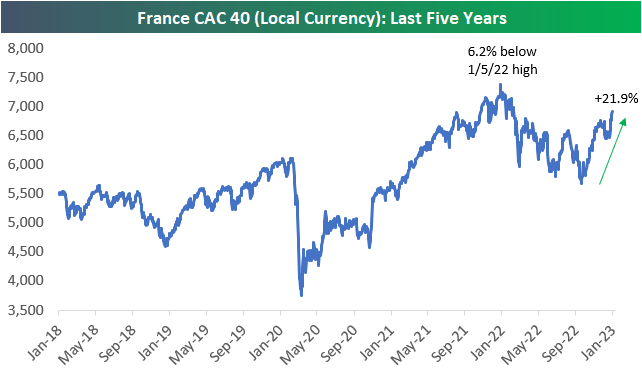

In France, the CAC 40 has also entered a new bull market with a 21.9% gain off the lows, leaving the index just 6.2% below its 1/5/22 high.

Finally, just today in the UK, the FTSE 100 traded to a four-year high after gaining 13.1% off its late 2022 low. From a technical perspective, this clearing above resistance that formed from four major highs going back to 2019 is quite notable. Within US equities, one of the main questions investors face is whether the October lows will hold in 2023, but in Europe, investors are shifting their focus and asking if 2023 will be a year of new highs. Click here to learn more about Bespoke’s premium stock market research service.

Short-Term Treasury Yields Provide the Tell

The yields on short-term Treasuries have been offering up some important tells recently. Below we highlight the yields on 6-month, 12-month, and 2-year Treasuries over the last 12 months. After trading with a positively sloped curve (the longer the duration, the higher the yield) through the first half of 2022, the yields on all three began to converge in late July/early August. In November, the 2-year yield started to drift lower, while yields on the 6-month and 12-month held firm. And just in the last week or so, we’ve seen the yield on the 12-month start to drift lower as well, while the yield on the 6-month has ticked slightly higher. As things stand now, the 2-year yield is at 4.18%, the 12-month is at 4.66%, and the 6-month is at 4.82%. This means the 2-year is inverted with the 6-month by 64 basis points, while the 12-month is now inverted with the 6-month by 16 basis points.

Yields on these three Treasuries are telling investors (and the Fed) where “the market” expects the Fed Funds Rate to be over the duration of the maturities. Right now the market expects rates to peak at some point in mid-2023 before ultimately pulling back. The fact that no points on the Treasury curve are currently above 5% tells you what the market thinks about the Fed’s unanimous support of getting the Fed Funds Rate above 5% and holding it there. It’s not buying it. While “the market” sees inflationary indicators falling pretty much everywhere it looks, Fedspeak has so far been unwilling to acknowledge any meaningful progress. The more inverted we see longer duration yields become with the 6-month T-Bill, the more damage the hawkish Fedspeak will become. Click here to learn more about Bespoke’s premium stock market research service.

Chart of the Day – ISMs On The Decline While Job Growth Holds Up

Bespoke’s Morning Lineup – 1/9/23 – Follow Through

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“The finest steel has to go through the hottest fire.” – Richard Nixon

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

It’s a merger Monday to start the week with three relatively small deals by today’s standards. In the biotech space, CinCor (CINC) will be acquired by AstraZeneca (AZN) in a deal that could be valued at up to $1.8 billion while Albireo (ALBO) will be acquired by Ipsen for just under $1 billion. Both of those stocks are trading up 90% or more in the pre-market. Outside of biotech, software company Duck Creek Technologies will be acquired by Vista Equity Partners for $19 per share in cash ($2.6 billion). While the deal represents a 46% premium to Friday’s closing price, it’s worth noting that DCT traded for just under $60 per share in early 2021. So, the price of the deal is still less than a third of where it once traded during the height of the mania in software stocks.

Along with the deal activity, futures are seeing some follow-through from Friday’s big rally, and growth stocks are leading the move higher with Nasdaq futures trading up just over 0.5%. Some of the reasons for optimism this morning include reports that China has removed all of its border restrictions and that the saga to elect a Speaker of the House is finally behind us. Yields are slightly higher on the long end of the curve, and it’s a quiet day on the economic calendar.

Friday’s rally for the bulls was a nice respite from what had been some disappointing sessions. On the positive side, it was nice to see the S&P 500 finally break out of what had been a nearly two-week very tight trading range- and not break out of that range to the downside! For all the optimism about the rally, it’s still important to note that the S&P 500 wasn’t even able to close out the week above its 50-day moving average (DMA). Late in the day Friday, it attempted to take out that level but pulled back modestly into the close after briefly touching it.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Bespoke Brunch Reads: 1/8/23

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium with a 30-day trial!

State & Local

The Circus Came to Town—and Bought the Place by Kirsten Grind (WSJ)

A company that operates lewd performances on the Las Vegas strip has bought an entire town on the edge of the Mojave desert. Plans for the purchase remain foggy at best. [Link; paywall]

U-Haul Growth States of 2022: Texas, Florida Top List Again (U-Haul)

Trucks and trailers in the U-Haul rental fleet are flowing out of California, Illinois, and New York while Texas, Florida, the Carolinas, and the broader Sunbelt receive the lion’s share of flows. [Link]

Scams

Twitch Streamer and NFT Founder DNP3 Admits to Gambling Away Investor Funds by Rosie Perper (Coindesk)

A personality who made his name on Twitch and launched several crypto projects has admitted to literally gambling away customer funds. [Link]

The Lottery Lawyer Won Their Trust, Then Lost Their Mega Millions by Simon van Zuylen-Wood (Bloomberg)

The rise and fall of a Long Island lawyer with an impressively specific practice: catering to the legal needs of lottery winners. [Link; soft paywall]

Retail

Walgreens executive says ‘maybe we cried too much last year’ about theft by Gabrielle Fonrouge (CNBC)

The CFO of Walgreens cited a significant drop in the “shrinkage” rate of lost inventory after a failed effort at hiring security guards and an admission that management may have “cried too much last year”. [Link]

Labor Markets

FTC Proposes Rule to Ban Noncompete Clauses, Which Hurt Workers and Harm Competition (FTC)

The Biden Administration has proposed a new rule that would ban noncompete agreements. The agreements have already been restricted by numerous states and in specific instances through federal regulation. [Link]

Bond Markets

Global negative-yielding debt wiped out by Japan policy shift by Tommy Stubbington (FT)

Rate hikes, guidance changes, and a global bond market selloff have driven the stock of negative yielding debt from a December 2020 peak of more than $18trn to nothing. [Link; paywall]

Supply Chains

Dell looks to phase out ‘made in China’ chips by 2024 by Cheng Ting-Fang (Nikkei Asia)

In an effort to prevent geopolitics from disrupting the flow of chips into PCs, Dell is getting rid of Chinese suppliers for chips entirely. [Link; soft paywall]

Monetary Policy

Why We Missed On Inflation, and Implications for Monetary Policy Going Forward by Neel Kashkari (Federal Reserve Bank of Minneapolis)

Kashkari makes the argument that bad forecasting was driven by an under-estimate of how significant shocks can be for inflation. [Link]

EVs

The Secret That Explains the Price of the Cheapest Tesla by Tom Randall (Bloomberg)

Unlike traditional auto OEMs, Tesla regularly changes prices for its various models depending on demand and costs. This article discusses why. [Link; soft paywall]

Sports

Pickleball popularity exploded last year, with more than 36 million playing the sport by Jessica Golden (CNBC)

Enthusiasm is building for the cheap, accessible, and low impact sport of pickleball, which is gaining fans and players at an unprecedented rate across the country. [Link]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!

The Bespoke Report — Equity Market Pros and Cons — Q1 2023

This week’s Bespoke Report is an updated version of our “Pros and Cons” edition for Q1 2023.

With this report, you’re able to get a complete picture of the bull and bear case for US stocks right now. It’s heavy on graphics and light on text, but we let the charts and tables do the talking!

On page three of the report, you’ll see a full list of the pros and cons that we lay out. Slides for each topic are then provided on page four and beyond.

To read this report and access everything else Bespoke’s research platform has to offer, start a two-week trial to Bespoke Premium.