Daily Sector Snapshot — 1/24/23

Chart of the Day: As Goes January

Bespoke Stock Scores — 1/24/23

Bespoke’s Morning Lineup — 1/24/23

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“I reached my hand down and picked it up; it made my heart thump, for I was certain it was gold.” — James Marshall

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

Today’s quote of the day comes from James Marshall, a carpenter and sawmill operator who found gold in water at Sutter’s Mill near Coloma, California on this day in 1848. Marshall’s find sparked the California Gold Rush, one of the most memorable and famous events in US history. The “forty-niners” that rushed to California with hopes of striking it rich increased San Francisco’s population from 1,000 in 1848 to 25,000 by December 1849. This Sunday the San Francisco 49ers will play in their 18th NFC Championship game when they travel to Philadelphia to play the Eagles with a trip to the Super Bowl on the line.

The gold rush left economists and investors with two important lessons. The first is that you generally need to spot trends early to make big money (most of the gold was found by the earliest to arrive), and the second relates to the famous Mark Twain quote that “during the gold rush, it’s a good time to be in the pick and shovel business.” While most of the arriving miners looking to get rich quick didn’t end up turning a profit, the merchants supplying the miners with everything from tools to food made the big bucks. When it comes to investing in new trends, find the merchants, not the miners.

Earnings so far this morning have been positive with ten companies beating EPS estimates and just one EPS miss (3M). Even still, US equity futures are down slightly ahead of the open as investors digest back to back gains of 1%+ for the S&P 500.

Although we noted it in last night’s Closer, it’s worth pointing out again that both the S&P and the Nasdaq 100 managed to trade above the top of their one-year downtrend channels yesterday. It’s a small break at this point that could easily turn out to be a pump fake, but it’s at least a start. Technicians will now be looking for the two indices to break above their late November/early December highs — which would represent a higher high after we just saw a higher low for the indices earlier this month. A higher-high would trigger a new short-term uptrend formation, which is something we haven’t seen since last summer.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Daily Sector Snapshot — 1/23/23

Chart of the Day – Leading Indicators Head Further South

Earnings Onslaught On The Way

As we noted in today’s Morning Lineup, we may technically be in the midst of earnings season, but we have yet to see too heavy of a slate of reports. We are kicking off this week with another quiet day with only 11 reports scattered before and after the bell. Earnings will ramp up dramatically starting tomorrow, though, with the calendar remaining busy through the next month. As shown in the snapshot from our Earnings Explorer tool below, after today there will be another nearly 200 reports scheduled for this week alone.

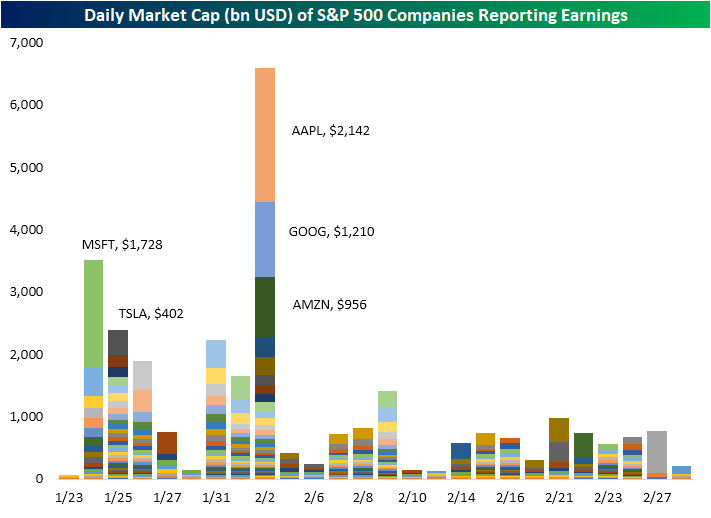

While the number of stocks reporting will remain high through February, this week and next will see the bulk of companies in terms of market cap. In the chart below from last Friday’s Bespoke Report, we show each day’s daily market cap of S&P 500 companies scheduled to report earnings through the end of February. Through next Friday alone, a combined $19.8 trillion in market cap will report, or 57% of the S&P 500’s total market cap. That includes the mega-cap names with Microsoft (MSFT) leading things off tomorrow followed by Tesla (TSLA) on Wednesday. Next Thursday, the combined $4.3 trillion in market cap from Apple (AAPL), Alphabet (GOOGL), and Amazon (AMZN) will all be out on the same day. After that, Berkshire Hathaway (BRK/B) will be the last remaining mega-cap stock to report earnings, and that will not be until February 27th.

To keep track of all upcoming earnings reports, be sure to check out our Earnings Explorer.Click here to learn more about Bespoke’s premium stock market research service.

Bespoke’s Morning Lineup — 1/23/23

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“It’s obvious that we don’t know one millionth of one percent about anything.” – Thomas Edison

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

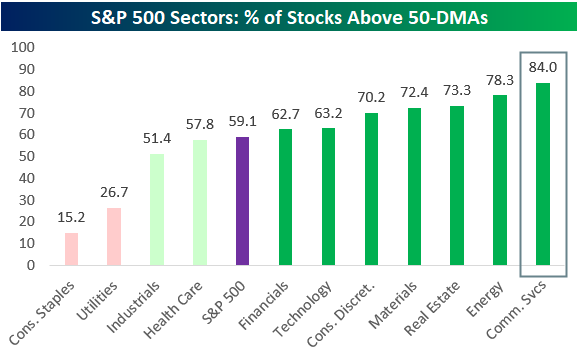

At 13 trading days into the new year, Communication Services (XLC) is currently the best-performing sector YTD with a gain of 10.65%. As shown below, XLC is easily the farthest above its 50-DMA of any sector, propelled last week by big moves higher in names like Netflix (NFLX) and Alphabet (GOOGL). Remember, Communication Services was the worst-performing sector of 2022 with a decline of more than 37%. We’ve clearly seen some bottom fishing this year in last year’s hardest-hit areas of the market.

It’s not just the mega-caps driving Communication Services higher either. 84% of stocks in the sector are currently above their 50-DMAs; the highest reading for any sector. On the other hand, it’s the defensive areas of the market that investors have moved away from recently, with just 26.7% of Utilities sector stocks and 15.2% of Consumer Staples above their 50-DMAs. Consumer Staples (XLP) is the only sector that’s currently oversold.

See more of our thoughts on Communication Services, including a look at the individual names that make up the sector, in today’s Morning Lineup.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

The Bespoke Report – 1/20/23 – We’ll Take It

This week’s Bespoke Report newsletter is now available for members. (Log in here if you’re already a subscriber.)

Since the start of Q4 last year we’ve seen a trend shift across a range of asset classes. Interest rates, the dollar, stocks, industrial metals, natural gas, and a range of other markets are moving in the opposite direction compared to most of last year. Some of this is down to luck – specifically related to the weather – but shifts from policymakers and economic data are also playing a major role. Despite trend shifts, US stocks have still not broken out. Earnings season is under way and could be the defining factor between whether bear market downtrends prevail or a new bull trend has been established.

View this week’s Bespoke Report newsletter by starting a one-month trial, or click the image below to view our membership options page.