Q1 2025 Earnings Conference Call Recaps: Okta (OKTA)

Bespoke’s Conference Call Recaps use AI to summarize lengthy earnings calls. The commentary below is AI-generated and then edited by Bespoke for quality control. As always, none of these summaries should be construed as recommendations to buy or sell any securities, and investors should do their own research and/or consult with a financial professional before making any investment decisions.

Our latest recap available to Bespoke subscribers covers Okta’s (OKTA) Q1 2026 earnings call.

Okta (OKTA) is a leading identity and access management (IAM) company that provides secure authentication, authorization, and user management solutions for enterprises. Its cloud-based platform enables organizations to manage digital identities across employees, customers, and now increasingly, non-human identities (NHIs) such as AI agents and service accounts. Okta’s core offerings include Workforce Identity Cloud and Customer Identity Cloud (Auth0), serving large enterprises, public sector agencies, and developers. Its impressive growth in areas like Identity Governance, Threat Protection, and AI-integrated tools positions it at the intersection of cybersecurity, digital transformation, and the evolving AI infrastructure landscape. Okta reported a strong start to FY26, with standout growth in new product adoption, a successful rollout of go-to-market specialization, and significant traction in public sector deals (4 of the top 10). The company is heavily investing in securing NHIs, highlighting a near-400% growth in workflow executions over 3 years and upcoming GA launch of “Auth for GenAI.” Management emphasized a cautious outlook due to macro uncertainty but reported no material Q1 softness. Total revenue is expected to grow 9–10% for FY26. Okta is positioning itself as the independent identity backbone for both human and AI-driven ecosystems…

Continue reading our Conference Call Recap for OKTA by becoming a Bespoke Institutional subscriber. You can sign up for Bespoke Institutional now and receive a 14-day trial to read our newest Conference Call Recap. To sign up, choose either the monthly or annual checkout link below:

Bespoke’s Morning Lineup – 5/30/25 – Farewell to May

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“If you don’t occasionally make a mistake, you’re not doing your job.” – Jim Sinegal

Below is a snippet of commentary from today’s Morning Lineup. Start a two-week trial to Bespoke Premium to view the full report.

There wasn’t a lot of action going on in the markets this morning. That was up until just a few minutes ago when the President started “truthing” about China, and said “No more Mr. Nice Guy!” Futures on both the S&P 500 and Nasdaq quickly went from unchanged to down about 0.5%. European stocks were higher but have given up some of their gains, while Asian stocks fell on the on/off/now back on Trump tariffs. Like the equity market, treasuries are little changed. Crude oil is one of the bigger movers this morning with a gain of just over 1% while gold, the dollar, and crypto are all in the red.

It may be Friday, but there’s a busy batch of economic data on the calendar with Personal Income and Spending, PCE, Chicago PMI, and Michigan Sentiment.

One of the more high-profile earnings reports since yesterday’s close was Costco (COST), which reported better than expected EPS on inline sales and an 8% increase in comp sales. COST is trading marginally lower in response to the report, with the stock on pace to gap down about 0.5% at the open. What’s notable about this morning’s weakness is that it continues a trend that has been in place for the stock since the start of 2022. As shown in the table below, not including this morning, shares of COST have gapped down in reaction to 11 of its last 13 earnings reports. Another negative open today would make it 12 out of the last 14!

The Closer – Tariffs, Claims, GDP – 5/29/25

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight into markets? In tonight’s Closer sent to Bespoke Institutional clients, we lead off with some commentary regarding the latest updates to tariff policies in addition to a dive into the latest jobless claims data (page 1) including a breakdown by demographics (pages 2 and 3). We then review today’s update of GDP and the latest earnings from Costco (COST) (pages 4).

See today’s full post-market Closer and everything else Bespoke publishes by starting a 14-day trial to Bespoke Institutional today!

Bespoke’s Weekly Sector Snapshot — 5/29/25

Q1 2025 Earnings Conference Call Recaps: Salesforce (CRM)

Bespoke’s Conference Call Recaps use AI to summarize lengthy earnings calls. The commentary below is AI-generated and then edited by Bespoke for quality control. As always, none of these summaries should be construed as recommendations to buy or sell any securities, and investors should do their own research and/or consult with a financial professional before making any investment decisions.

Our latest recap available to Bespoke subscribers covers Salesforce’s (CRM) Q1 2026 earnings call.

Salesforce (CRM) is the world’s leading customer relationship management (CRM) platform, providing cloud-based software that helps businesses manage sales, service, marketing, and commerce. The company powers many of the world’s largest enterprises and is widely recognized for pioneering Software-as-a-Service (SaaS). Its real competitive edge today lies in its AI + Data + CRM strategy, led by innovations like Agentforce (digital labor platform) and Data Cloud (enterprise data unification). Salesforce serves over 150,000 customers, including companies across technology, healthcare, retail, government, and financial services. It offers a unique view into enterprise software trends, digital transformation, and now, the evolution of AI in large organizations. Agentforce, now in over 8,000 deals and 800 active deployments, dominated the call as Salesforce’s answer to the agentic AI wave. The $8B Informatica acquisition was framed as strategic, accretive, and essential to Salesforce’s data harmonization ambitions. Flex Credits (consumption pricing) and SMB strength signaled growth from both model evolution and market reach. Risks noted: EMEA softness, AI deployment complexity, and macro caution. Guidance held steady, but enterprise AI remains a slower build than consumer hype implies…

Continue reading our Conference Call Recap for CRM by becoming a Bespoke Institutional subscriber. You can sign up for Bespoke Institutional now and receive a 14-day trial to read our newest Conference Call Recap. To sign up, choose either the monthly or annual checkout link below:

Q1 2025 Earnings Conference Call Recaps: NVIDIA (NVDA)

Bespoke’s Conference Call Recaps use AI to summarize lengthy earnings calls. The commentary below is AI-generated and then edited by Bespoke for quality control. As always, none of these summaries should be construed as recommendations to buy or sell any securities, and investors should do their own research and/or consult with a financial professional before making any investment decisions.

Our latest recap available to Bespoke subscribers covers NVIDIA’s (NVDA) Q1 2026 earnings call.

NVIDIA (NVDA) is the global leader in accelerated computing, designing GPUs, networking hardware, and software that power AI, gaming, data centers, and industrial digitalization. Best known for its CUDA-enabled GPU platforms like Hopper and Blackwell, the company enables everything from AI model training and inference to robotic automation. NVDA’s technology forms the backbone of AI infrastructure across hyperscalers, enterprises, and sovereign governments. NVDA delivered $44B in revenue (up 69% YoY), powered by a 73% surge in data center sales driven by its new Blackwell architecture. Over 70% of compute revenue came from Blackwell as hyperscalers ramped up NVL72 rack deployments. Inference demand soared, with Microsoft processing over 100T tokens in Q1 and startups tripling output on B200 chips. Despite recognizing $4.6B in H20 sales to China, new US export controls forced a $4.5B write-down and halted $2.5B in shipments. The company highlighted over 100 sovereign AI factory projects and onshore manufacturing efforts in Arizona and Texas. NVDA beat expectations on the top and bottom lines for the tenth consecutive quarter, and the stock opened 5.3% higher on 5/29 as a result…

Continue reading our Conference Call Recap for NVDA by becoming a Bespoke Institutional subscriber. You can sign up for Bespoke Institutional now and receive a 14-day trial to read our newest Conference Call Recap. To sign up, choose either the monthly or annual checkout link below:

Chart of the Day – UST Issuance

Bespoke’s Morning Lineup – 5/29/25 – Nvidia At Post DeepSeek Highs

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“No technology has ever had the opportunity to address a larger part of the world’s GDP than AI.” – Jensen Huang

Below is a snippet of commentary from today’s Morning Lineup. Start a two-week trial to Bespoke Premium to view the full report.

To see yesterday’s CBNC interview, click on the image below.

The biggest report of the earnings season has come and gone, but as Nvidia CEO Jensen Huang said on last night’s call, “This is just the beginning.” At least that’s what NVDA bulls are hoping. Based on pre-market levels, shares of NVDA are looking at an upside gap of over 5%. That would be the stock’s biggest upside gap in reaction to earnings since last May, and as we highlighted in Tuesday’s Chart of the Day, would extend its streak of positive reactions to May reports to four.

NVDA’s current pre-market levels are at the high end of the range the stock has traded in since the DeepSeek news first hit markets in late January. If NVDA can build on these gains during the trading day, it would be notable for two reasons. First, it would indicate a breakout from the post-DeepSeek range (shaded area in the chart below). More importantly, it would help to reverse a trend where the stock has repeatedly capped rallies with intraday negative reversals (see arrows in the chart below).

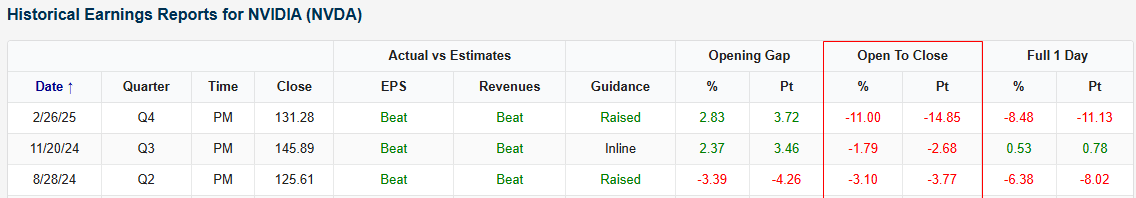

This trend has also been evident on the stock’s recent earnings reaction days. Following the last three earnings reports, the stock has sold off from the open to close, including in February when it sank 11% after initially gapping up nearly 3%.

The Closer – NVDA Earnings, GSEs, Shorts – 5/28/25

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight into markets? In tonight’s Closer sent to Bespoke Institutional clients, we kick off with a rundown of the long awaited NVIDIA (NVDA) earnings (page 1). We also recap the Fed Minutes (page 2) in addition to some commentary regarding GSEs like Fannie Mae and Freddie Mac (pages 3 and 4). After updating our Five Fed Manufacturing Composite (page 5), we round out tonight’s report with a look into the change in short interest levels (page 6).

See today’s full post-market Closer and everything else Bespoke publishes by starting a 14-day trial to Bespoke Institutional today!