Bespoke Stock Scores: 12/6/16

Dynamic Upgrades/Downgrades: 12/6/16

Bespoke Recent Media Appearances

Bespoke Co-Founder Paul Hickey appeared on CNN’s Outfront with Erin Burnett last Friday (12/2) to discuss the market rally in the post-election period. To view that segment, please click on the image below.

Paul Hickey was also on CNBC’s Closing Bell on Monday (12/5) to discuss a number of market topics. Links to a few of those segments are below.

Buyback Boom on the Way?

Finally Seeing Rally in New Sectors

Amazon Exploring Several Grocery Store Concepts

Bespoke Stock Seasonality: 12/6/16

The Closer 12/5/16 – The Rally Continues, US Equities And JPY

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke Institutional clients, we discuss some of the important dynamics in recent equity price action. We also take a look at how JPY has been trading recently.

The Closer is one of our most popular reports, and you can see it and everything else Bespoke publishes by starting a no-obligation 14-day free trial to our research!

The Most and Least Loved Stocks in the S&P 500

Like our free content? You’ll like Bespoke Premium even more! Click here to start a no-obligation 14-day free trial now.

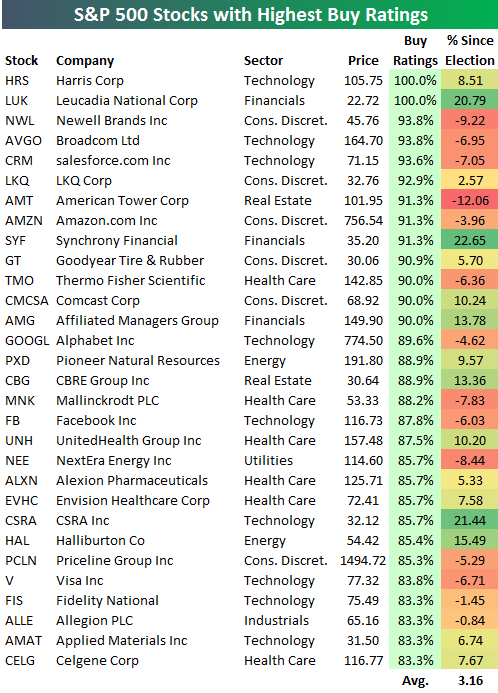

Below is an updated look at the most loved stocks in the S&P 500 by analysts. As shown, two stocks in the index have 100% “Buy” ratings — Harris Corp (HRS) and Leucadia (LUK). Analysts can’t get more bullish than that! Both stocks are up nicely since the election as well. The next three most loved stocks, however, are down 6%+ since the election. These three names are Newell Brands (NWL), Broadcom (AVGO), and salesforce.com (CRM), and they all have more than 93% “Buy” ratings. With these names trending lower since the election, are they ripe for downgrades?

Other notable names on the “most loved” list include Amazon.com (AMZN), Alphabet (GOOGL), Facebook (FB), Priceline (PCLN), Visa (V), and Celgene (CELG).

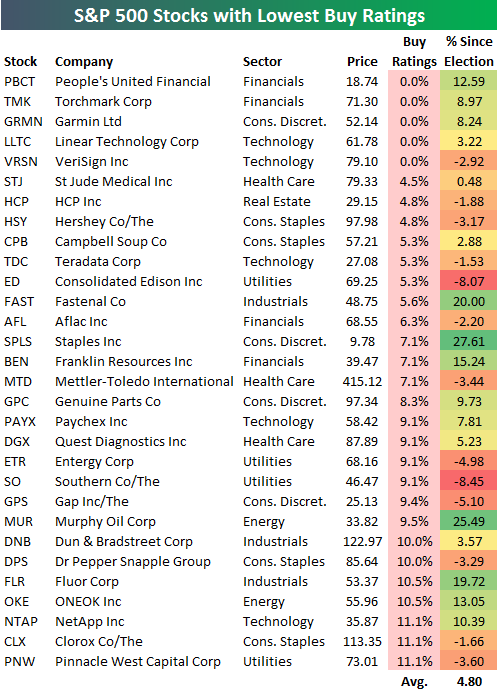

Looking to the least loved stocks, below is a list of the S&P 500 names with the lowest percentage of analyst “Buy” ratings. As shown, five stocks in the index have zero “Buys” right now — PBCT, TMK, GRMN, LLTC, and VRSN. Four of these five stocks are up nicely since the election. Are these candidates for future upgrades?

Chart of the Day: “Buys” Struggling Post Election

ISM Services Tops Expectations

Like our free content? You’ll like Bespoke Premium even more! Click here to start a no-obligation 14-day free trial now.

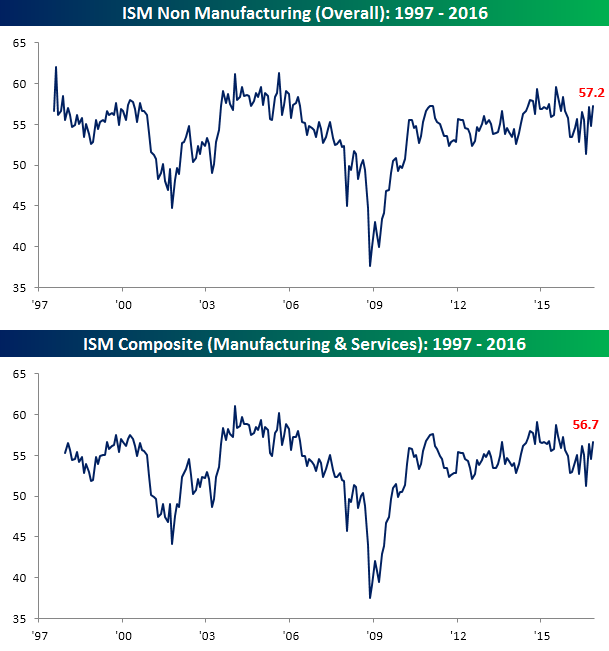

Chalk up another one for the pile of better than expected economic data recently. Today’s ISM Non-Manufacturing report for the month of November came in at a level of 57.2 compared to expectations for 55.5 and represents the highest level since October 2015. On a combined basis and accounting for both the weight of the Manufacturing and Non-Manufacturing sectors’ weights in the economy, the ISM for November hit a level of 56.7, which is also the highest level seen since October 2015.

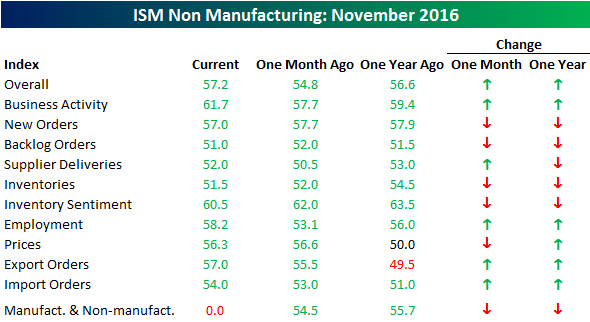

The table below breaks out this month’s ISM report by each of the index’s sub-categories. Overall, breadth was split right down the middle relative to October and one year ago as five categories showed improvement and five weakened. Relative to October, the biggest winners this month were Employment and Business Activity. On the downside, Inventory Sentiment and Backlog Orders saw the largest declines. While every sector remains in growth territory (above 50), no category is at or near a cycle high. The closest is Employment, which is just one point off its high of 59.2 back in July 2015.

Consumer Pulse: Home Purchase Intentions Trend Higher

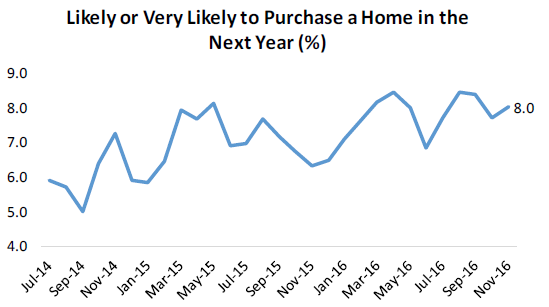

Each month, Bespoke runs a survey of 1,500 US consumers balanced to census. In the survey, we cover everything you can think of regarding the economy, personal finances, and consumer spending habits. We’ve now been running the monthly survey for more than two years now, so we have historical trend data that is extremely valuable, and it only gets more valuable as time passes. All of this data gets packaged into our monthly Bespoke Consumer Pulse Report, which is included as part of our Pulse subscription package that is available for either $39/month or $365/year. We highly recommend trying out the service, as it includes access to model portfolios and additional consumer reports as well. If you’re not yet a Pulse member, click here to start a 30-day free trial now! Below we highlight the results of a question we ask regarding the likelihood of purchasing a home in the next year. This is one of essentially hundreds of data points included in each monthly report.

Our home purchase tracker in our monthly Consumer Pulse Report has been slowly trending higher over the last two years, which is inline with most of the housing related indicators we follow. As shown below, the share of consumers likely or very likely to purchase a home in the next year continues to grind higher. This is one reason to be optimistic about the path of both existing and new home sales despite the surge in mortgage rates following the election a few weeks ago. In our full Pulse report, which you can access with a 30-day free trial, we have additional proprietary housing data that covers sales, new constructions, mortgages, permits, and home improvement projects.

ETF Trends: US Sectors & Groups – 12/5/16

Energy, steel, and banks continue to outperform while Italy is the best performing country ETF of the past week – a surprising outcome given the vote against government reform in the referendum held by Italy over the weekend. Laggards include coffee, Brazil, Turkey, and rate sensitive US Utilities along with other bond proxies and gold.

Bespoke provides Bespoke Premium and Bespoke Institutional members with a daily ETF Trends report that highlights proprietary trend and timing scores for more than 200 widely followed ETFs across all asset classes. If you’re an ETF investor, this daily report is perfect. Sign up below to access today’s ETF Trends report.

See Bespoke’s full daily ETF Trends report by starting a no-obligation free trial to our premium research. Click here to sign up with just your name and email address.