The Closer 12/8/16 – The Alphabet: E, C, B to Z

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke Institutional clients, review the ECB policy changes made today as well as the release of the Fed’s Flow of Funds (Z.1) report showing the balance sheet of US macroeconomic sectors.

The Closer is one of our most popular reports, and you can see it and everything else Bespoke publishes by starting a no-obligation 14-day free trial to our research!

Bespoke’s Sector Snapshot — 12/8/16

We’ve just released our weekly Sector Snapshot report (see a sample here) for Bespoke Premium and Bespoke Institutional members. Please log-in here to view the report if you’re already a member. If you’re not yet a subscriber and would like to see the report, please start a 14-day trial to Bespoke Premium now.

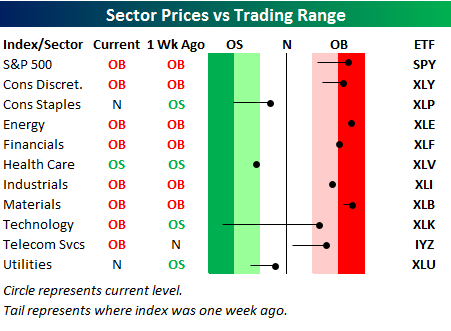

Below is one of the many charts included in this week’s Sector Snapshot, which is our trading range screen for the S&P 500 and its ten sectors. We discuss in more detail how to read the chart in the full version of the report, but basically the dot is where the sector is currently trading, while the tail end is where it was trading one week ago. As shown in the chart, the S&P 500 has moved up into the dark red shading, which represents extreme overbought territory. Along with the broad index, four individual sectors are in extreme overbought territory as well. The Health Care sector is the only area of the market that is oversold right now.

To see our full Sector Snapshot with additional commentary plus six pages of charts that include analysis of valuations, breadth, technicals, and relative strength, start a 14-day free trial to our Bespoke Premium package now. Here’s a breakdown of the products you’ll receive.

Chart of the Day: Energy and Financials Too Far Too Fast?

B.I.G. Tips – New Highs Break Out

Bespokecast Episode 3 — Katie Stockton — Now Available on iTunes, GooglePlay, Stitcher and More

We’re happy to announce that episode 3 of Bespokecast is now available to the general public via the various podcast platforms. Be sure to subscribe to Bespokecast on your preferred podcast app of choice to gain access to new episodes. We’d also love for you to provide a review as well!

We’re happy to announce that episode 3 of Bespokecast is now available to the general public via the various podcast platforms. Be sure to subscribe to Bespokecast on your preferred podcast app of choice to gain access to new episodes. We’d also love for you to provide a review as well!

In our newest conversation on Bespokecast, we speak with BTIG’s Chief Technical Strategist Katie Stockton. Katie is one of the top technicians around, and this is a wide-ranging discussion on technicals as an investment strategy that is both educational and instructive. Katie has a long career in markets and has been immersed in the discipline of technical analysis right from the beginning. In our hour-long conversation, we get her basic approach to technicals, background about the goals and toolkits that technicians use, and her current view of market technicals. We also discuss non-market topics, including the work-life balance for finance professionals with families. We had a fantastic time recording this conversation, and we hope you enjoy it!

Each new episode of our podcast will feature a special guest to talk markets with, and Bespoke subscribers receive access one week before it’s made available to the general public. If you’d like to try out a Bespoke subscription in order to gain access to these podcasts a week in advance, you can start a two-week free trial to check out our product. To listen to episode 3 or subscribe to the podcast via iTunes, GooglePlay, OvercastFM, or Stitcher, please click below.

Consumer Pulse: Spending and Inflation Expectations

Each month, Bespoke runs a survey of 1,500 US consumers balanced to census. In the survey, we cover everything you can think of regarding the economy, personal finances, and consumer spending habits. We’ve now been running the monthly survey for more than two years, so we have historical trend data that is extremely valuable, and it only gets more valuable as time passes. All of this data gets packaged into our monthly Bespoke Consumer Pulse Report, which is included as part of our Pulse subscription package that is available for either $39/month or $365/year. We highly recommend trying out the service, as it includes access to model portfolios and additional consumer reports as well. If you’re not yet a Pulse member, click here to start a 30-day free trial now! Below we highlight the results of questions we ask regarding discretionary spending and inflation expectations. These are two of literally hundreds of data points included in each monthly report.

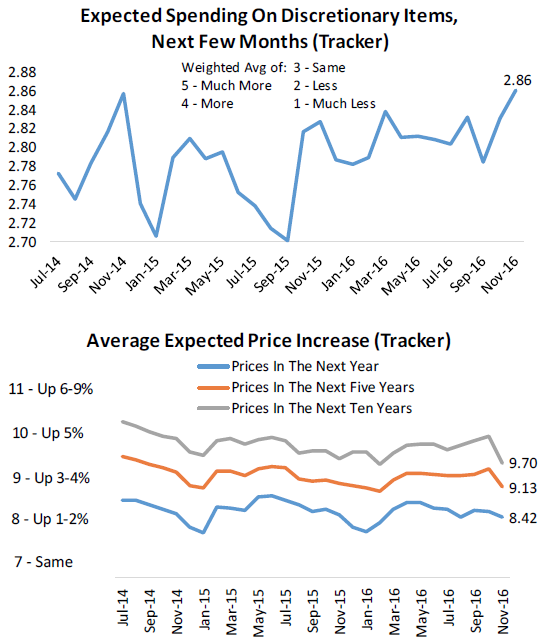

Our monthly tracker for expected discretionary spending over the next few months broke out in November to its highest levels in the history of our survey. Obviously, seasonal strength is a major contributor as holiday spending drives a huge portion of total US consumer spend, but this result also suggests that the Black Friday to December holiday shopping period is trending towards exceptionally strong levels. As the Atlanta Fed’s GDPNow tracker of Q4 growth is expecting total growth of +3.6%, if this holiday season proves to be as strong as our tracker seems to indicate, then that number could be setting up for a 4-handle GDP in Q4 2016.

Piggybacking off consumer expectations, one interesting development in the data this month was that we saw a steep drop-off in inflation expectations (lower chart). The average expected price increase over the next one, five, and ten years all fell sharply for a typically stable tracker from month to month. There doesn’t seem to be a good explanation for this decline, but given the prior trend of accelerating price pressures (which have also been visible in market pricing of inflation, realized CPI and PCE inflation, commodity prices, and other indicators) the sharp shift was eye-catching.

Want to see more of our proprietary survey analysis, including data for individual consumer technology stocks? If you’re not yet a Pulse member, click here to start a 30-day free trial and view our full November Pulse report.

Dynamic Upgrades/Downgrades: 12/8/16

Individual Investors Still Not on the Bus

Get Bespoke’s 2017 Outlook Report with a 30-day free trial to Bespoke’s premium research! Click here to learn more.

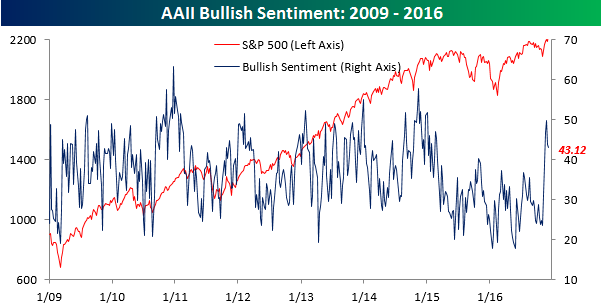

While sentiment on the part of individual investors definitely has seen an uptick since the election, in the last two weeks the positive momentum has stalled. In this week’s sentiment survey from AAII, individual investor bullish sentiment saw a very slight decline, falling from 43.78% down to 43.12%. While the move was extremely small, optimism is still down over six percentage points from where it was two weeks ago even as equities have been rallying to record highs. While you may say that it’s perfectly natural for investors to become less positive as stocks become more expensive, that would mean that they would have had to become positive in the first place, and that has not been the case. In fact, the last time more than half of individual investors were bullish was 101 weeks ago at the start of 2015.

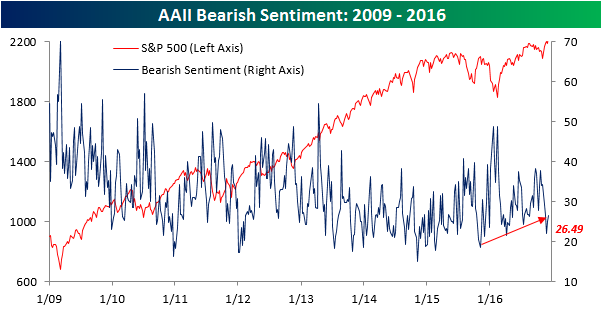

Looking at pessimism, we have now seen two straight weekly increases in bearish sentiment from 22.08% up to 26.49%. This is still low relative to recent history, and as shown in the chart below, the level of bearish investors remains below the uptrend that was broken to the downside three weeks ago.

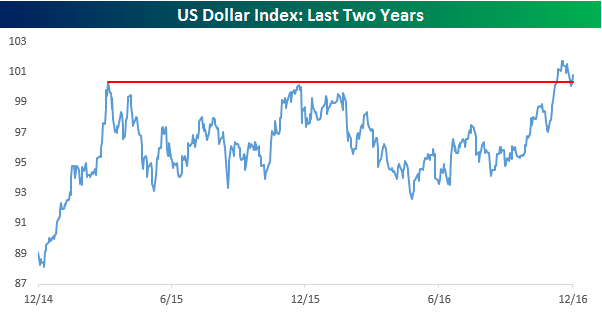

US Dollar Index Bounces at Support

Get Bespoke’s 2017 Outlook Report with a 30-day free trial to Bespoke’s premium research! Click here to learn more.

For all of the talk about the strong dollar in the last several days, one might be surprised to hear that today’s gain in the US Dollar Index is only the third up day since Thanksgiving (10 trading days). Yes, this consolidation in the greenback comes after a big surge following the election, but it just illustrates how it isn’t just in politics where the rhetoric often differs from reality. In the initial post-election surge, the US Dollar Index rallied nearly 4% – a huge move over such a short period of time – and broke out above resistance from its prior peaks in March and December 2015. Since its high on 11/23, though, the greenback has been trading in a two-week consolidation phase. During this period, though, it has managed to stay above its former highs, which acted as support from which it is bouncing today.

the Bespoke 50 — 12/8/16

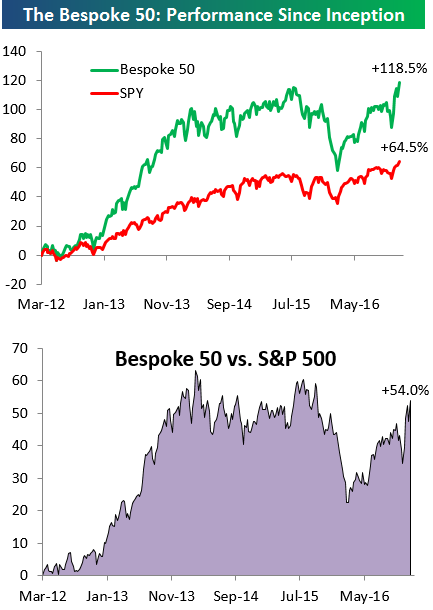

Every Thursday, Bespoke publishes its “Bespoke 50” list of top growth stocks in the Russell 3,000. Our “Bespoke 50” portfolio is made up of the 50 stocks that fit a proprietary growth screen that we created a number of years ago. Since inception in early 2012, the “Bespoke 50” has nearly doubled the performance of the S&P 500. Through today, the “Bespoke 50” is up 118% since inception versus the S&P 500’s gain of 64%.

To view our “Bespoke 50” list of top growth stocks, sign up for Bespoke Premium ($99/month) at this checkout page and get your first month free. This is a great deal!