Small Business Optimism Surges

Get Bespoke’s 2017 Outlook Report with a 30-day free trial to Bespoke’s premium research! Click here to learn more.

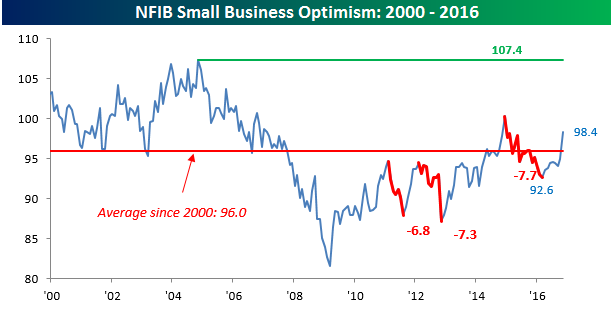

In the wake of one of the most surprising elections in history, small business optimism surged in November, posting its largest month-over-month gain in more than three years. As shown in the chart below, the overall index of small business optimism from the NFIB rose from 94.9 up to 98.4, which was the highest monthly reading since December 2014 and well ahead of consensus expectations for a level of 96.7. Even after this month’s increase in optimism, sentiment among small businesses is still below its cycle peak of 100.3, but it has made up a lot of the ground it lost during 2015 and early 2016.

Given its tendency for partisanship favoring the right, many won’t be surprised to see this index surge immediately after a Republican was elected to the White House. The closing paragraph (see below) from the commentary section of this month’s report pretty much illustrates which way the NFIB leans. Even with that caveat, however, it is hard to argue that sentiment hasn’t improved since early November.

Owners clearly expect a different, and better from their perspective, set of economic policies to help the economy shed the growing number of obstacles of the last eight years in tax and regulatory policies that have depressed growth. This economy has grown in spite of, not because of, Obama’s economic policies. Population growth explains most, if not all, of our progress. The prospective impact of expected policy changes was translated into very positive views of economic activity which will translate into more spending and hiring if maintained.

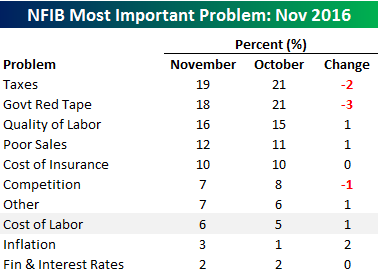

Among the issues that small business owners consider to be the biggest problems they face, this month also saw an interesting trend. As shown in the table to the right, while Taxes and Government Red Tape are still the issues that pose the biggest problems for small businesses, both were cited by less than 20% of owners. The last time both of these issues were below 20% was five years ago in November 2011. While these two issues were cited by fewer business owners, inflation was the issue that saw the biggest increase. Although at just 3%, it hardly seems to be a major concern at the moment.

Among the issues that small business owners consider to be the biggest problems they face, this month also saw an interesting trend. As shown in the table to the right, while Taxes and Government Red Tape are still the issues that pose the biggest problems for small businesses, both were cited by less than 20% of owners. The last time both of these issues were below 20% was five years ago in November 2011. While these two issues were cited by fewer business owners, inflation was the issue that saw the biggest increase. Although at just 3%, it hardly seems to be a major concern at the moment.

The Closer 12/12/16 – Tight Oil, Tight Labor Markets

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke Institutional clients, we take a look at oil production and the post-OPEC cut outlook for US crude output. We also review the new data on median wages released by the Atlanta Fed today.

The Closer is one of our most popular reports, and you can see it and everything else Bespoke publishes by starting a no-obligation 14-day free trial to our research!

2016 Dogs of the Dow Performance Update

Get Bespoke’s 2017 Outlook Report with a 30-day free trial to Bespoke’s premium research! Click here to learn more.

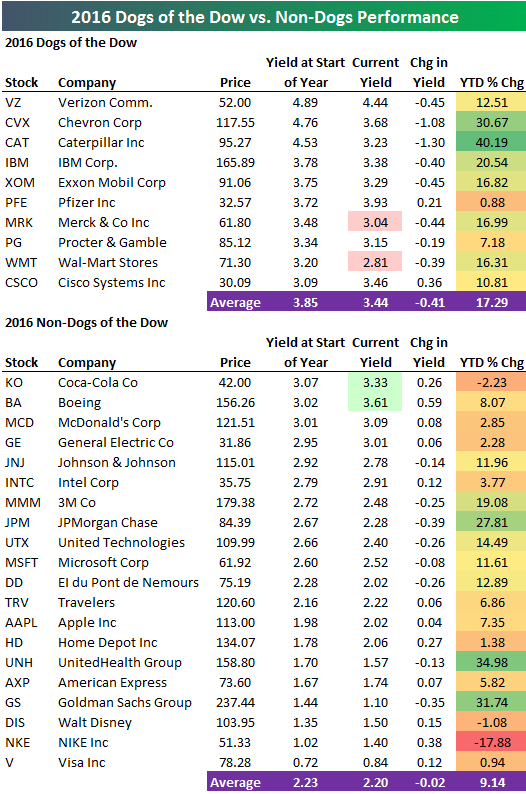

Back on October 12th, we published this report on the performance of 2016’s “Dogs of the Dow” strategy, which says to simply buy the 10 highest-yielding stocks in the Dow Jones Industrial Average at the start of each year. (You can read more about the strategy at this Investopedia link if you’re looking to learn more about the reasoning behind it.)

In our October post, the 10 “Dogs of the Dow” for 2016 were absolutely crushing the non-Dogs. At that point, the Dogs were up 12% on the year, while the non-Dogs were up just 0.57%.

Obviously a lot has changed for the market since October 12th, so how are the two baskets doing now that two more months have passed? Well, the Dogs have continued even higher, but the non-Dogs have also done extremely well thanks to stocks like Goldman Sachs (GS) and JP Morgan (JPM).

Below is a look at the updated year-to-date performance of the “Dogs of the Dow” versus non-Dogs. As shown, the Dogs are now up 17.3%, while the non-Dogs are up 9.14%. The Dogs are still up nearly double the non-Dogs, but the non-Dogs have rallied more since our last update.

We’ll provide a final update on 2016 performance at the end of the year and post the official list of 2017’s Dogs as well. If the year ended today, Merck (MRK) and Wal-Mart (WMT) would be removed and Coca-Cola (KO) and Boeing (BA) would be added. We also thought it was worth noting that tech-giant Cisco (CSCO) is now the fourth highest-yielding stock in the Dow with a yield of 3.46%. That’s pretty remarkable when you think back to where the stock stood during the Dot Com heyday of the late 90s.

Post-Election Losers Finally Have Their Day in the Sun

Get Bespoke’s 2017 Outlook Report with a 30-day free trial to Bespoke’s premium research! Click here to learn more.

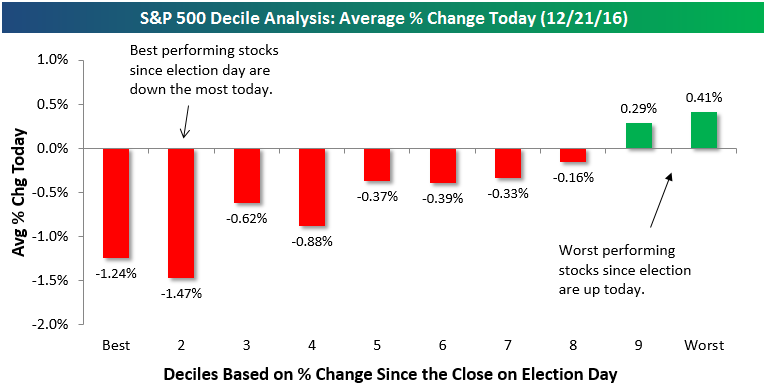

Even though the market essentially traded flat today, we finally saw sectors like Financials, Industrials and Consumer Discretionary pull back, while underperforming sectors like Utilities and Consumer Staples actually rallied. In terms of individual stocks, the post-election winners were finally in the red, while the post-election losers finally caught a bid. We can highlight this using our decile analysis of the S&P 500. To run the analysis, we broke the index into deciles (10 groups of 50 stocks each) based on stock performance from the close on Election Day (11/8) through last Friday’s close. We then calculated the average price change today for the stocks in each decile.

As shown below, the two deciles of stocks (top 100 stocks) that had done the best since Election Day saw average declines today of more than 1%. At the other end of the spectrum, the two deciles of stocks (bottom 100 stocks) that had done the worst since Election Day both actually averaged gains today.

Now let’s see if today’s “mean reversion” trade has any legs or if it’s just a one-day thing.

Bespoke Stock Seasonality: 12/12/16

Chart of the Day: Long Bond in Long Downtrend?

Short Interest Report: 12/12/16

A Milestone For Energy Sector Short Interest

Get Bespoke’s 2017 Outlook Report with a 30-day free trial to Bespoke’s premium research! Click here to learn more.

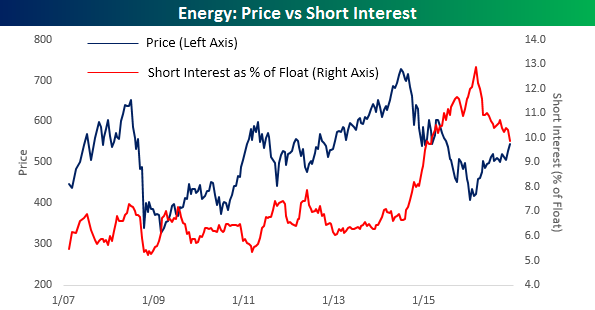

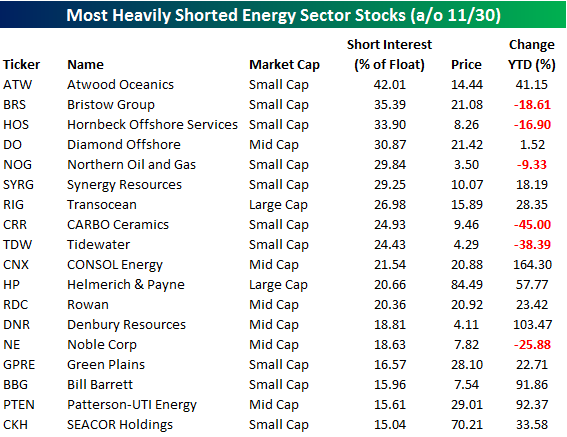

Short interest figures for the end of November were released after the close on Friday. As one might expect given the market’s rally during the month, negative bets declined pretty much across the board. One notable aspect of the month end data, though, concerns the Energy sector. At a level of 9.88%, the average level of short interest as a percentage of float (SIPF) for energy stocks is the highest of any sector, but it marks the first time in more than a year that the sector’s average SIPF level has been under 10%. The chart below compares the Energy sector’s average SIPF level to its price going back to 2007. While the sector has always had one of the highest average short interest levels, heading into 2015, its average SIPF level was closer to 7%. As oil prices plunged, average short interest levels surged and peaked at 12.55% just as oil prices were bottoming earlier this year. Since then, shorts have been steadily covering as prices have risen. Based on the sector’s historical levels of short interest, though, there is still plenty of room for these levels to decline as along as oil prices remain stable.

Despite the sub-10% average level for the entire sector, a number of energy stocks still have extremely elevated levels of short interest. The table below lists the eighteen stocks in the sector where short interest levels exceed 15% of the individual stock’s float. Of these eighteen, seven have more than a quarter of their float sold short, including large cap Transocean (RIG) at 26.98%. The stock has rallied 28% this year, but because crude oil prices remain below levels where offshore exploration is deemed profitable, the stock still has more than its fair share of skeptics.

ETF Trends: US Sectors & Groups – 12/12/16

Oil-related ETFs have paced the pack over the last week with massive gains over the weekend thanks to additional cuts agreed by non-OPEC countries. Spain, Italy, and Mexico all continue to move higher, while small cap US equities (especially Value) have surged. Biotech, bonds, and gold miners are the worst performers over the past week, while aerospace and defense stocks (most of all Lockheed-Martin, LMT) plunged thanks to a negative tweet about the cost of the F-35 program from the President Elect.

Bespoke provides Bespoke Premium and Bespoke Institutional members with a daily ETF Trends report that highlights proprietary trend and timing scores for more than 200 widely followed ETFs across all asset classes. If you’re an ETF investor, this daily report is perfect. Sign up below to access today’s ETF Trends report.

See Bespoke’s full daily ETF Trends report by starting a no-obligation free trial to our premium research. Click here to sign up with just your name and email address.