Rough Year for Analysts’ Most Loved Stocks

Get Bespoke’s 2017 Outlook Report with a 30-day free trial to Bespoke’s premium research! Click here to learn more.

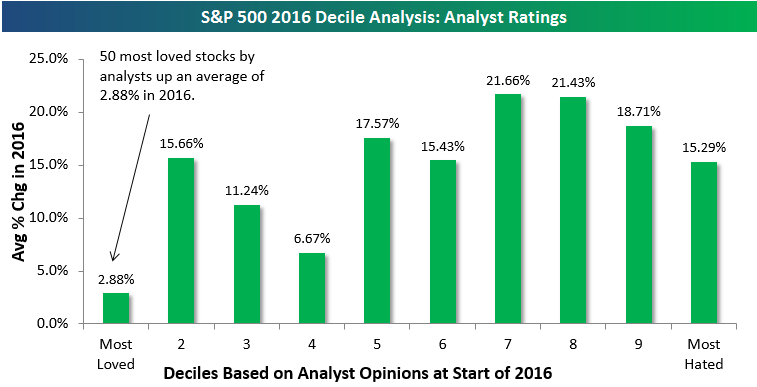

The chart below is pulled from the Intro section of our 2017 annual outlook report. We’ve broken the S&P 500 into deciles (10 groups of 50 stocks each) based on analyst buy and sell ratings at the start of 2016. The 50 stocks in decile 1 were the most loved stocks by analysts at the start of the year, while the 50 stocks in decile 10 were the most hated. We then calculated the average percentage change in 2016 for the 50 stocks in each decile. This allows us to see how well the most loved and hated stocks did this year.

As shown, analysts didn’t have a great year. The 50 stocks with the highest percentage of “Buy” ratings were up an average of just 2.88% this year, while the 50 stocks with the least amount of “Buy” ratings were up an average of 15.29%. Deciles 7, 8, and 9 all posted huge average gains as well.

Let’s see if 2017 is a better year for the analyst community than 2016 was.

A Bearish Signal From The 2017 Bespoke Report

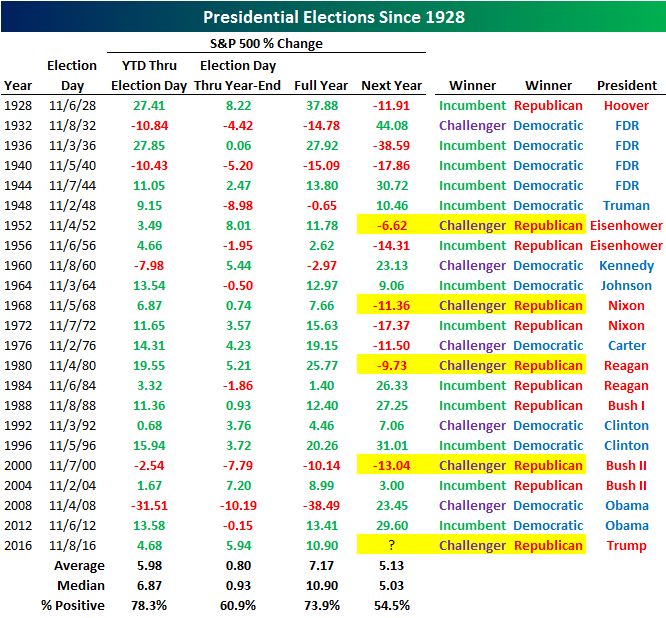

Our 2017 Bespoke Report market outlook contains a comprehensive view of where things stand today and what we expect for markets in 2017. We like to think it paints a full picture, taking into account all the positives and negatives facing investors. In 178 pages of charts, analysis and commentary there is obviously no shortage of important data points, some of which are bullish and some bearish. Below we’re including one of the more bearish tables from the outlook report. In an admittedly small sample set of only four historical examples, each time in history that a Republican president has followed a Democrat, stocks have fallen in the first year of the Republican administration. Returns were anywhere from -6.6% (Eisenhower) to -13.0% (Bush II). Lest we end 2016 on an overly pessimistic note, perhaps we’ll post a more bullish chart from the outlook report before the ball drops.

To view the full 2017 Bespoke Report, simply sign up for a 30-day free trial to Bespoke Premium. It’s that easy!

The Bespoke Report — 2017 — Intro/Our View

Our 2017 Bespoke Report market outlook is the most important piece of research that Bespoke publishes each year. We’ve been publishing our annual outlook piece since the formation of Bespoke in 2007, and it gets better and better each year! In this year’s edition, we’ll be covering every important topic you can think of dealing with financial markets as we enter 2017. And to say that 2017 should be an interesting year for asset classes would be an understatement given the huge rotation we’ve already seen in just a few weeks since the Presidential Election was held back on November 8th.

Our 2017 Bespoke Report market outlook is the most important piece of research that Bespoke publishes each year. We’ve been publishing our annual outlook piece since the formation of Bespoke in 2007, and it gets better and better each year! In this year’s edition, we’ll be covering every important topic you can think of dealing with financial markets as we enter 2017. And to say that 2017 should be an interesting year for asset classes would be an understatement given the huge rotation we’ve already seen in just a few weeks since the Presidential Election was held back on November 8th.

The 2017 Bespoke Report contains sections like Washington and Markets, Economic Cycles, Market Cycles, Sector Technicals and Weightings, Stock Market Sentiment, Stock Market Seasonality, Housing, Commodities, and more. In this year’s edition, we’ll also be featuring our new “Trump Index” of stocks that we expect to perform best in 2017 based on the new administration.

Today we have published the “Intro/Our View” section of the 2017 Bespoke Report.

To view this section immediately and also receive the full 2017 Bespoke Report, simply sign up for a 30-day free trial to Bespoke Premium. It’s that easy!

Europe Fades

Get Bespoke’s 2017 Outlook Report with a 30-day free trial to Bespoke’s premium research! Click here to learn more.

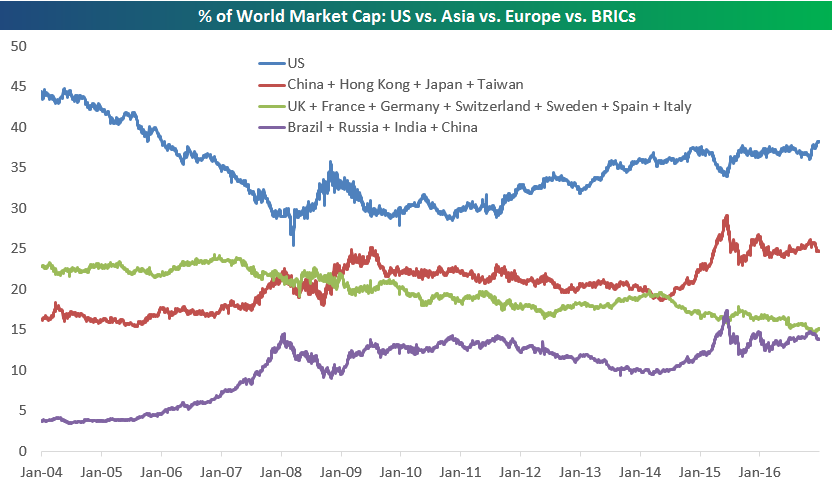

The chart below is one we included in the International section of our 2017 annual outlook report. It’s a historical chart showing trends in the share of global equity market capitalization for the US, Europe, Asia, and the BRICs (Brazil, Russia, India, and China). For the euro area, we used the UK, France, Germany, Switzerland, Sweden, Spain and Italy. For Asia, we used China, Hong Kong, Japan and Taiwan.

The main thing that stands out in this chart is the decline in share for Europe over the last 12 years. Back in 2004, the euro area held the second largest share of world market cap behind the US. Back then, its share was around 23%, while Asia made up just over 15%, and the BRICs made up less than 5%.

Over time, share has eroded for Europe while Asia and the BRICs have seen big gains. While the US still makes up 38%+ of world market cap, Asia now makes up roughly 25%, while Europe only makes up 15%. The BRICs are nearly inline with Europe with a combined share of 14%.

The Bespoke Report — 2017 — “Commodities”

Our 2017 Bespoke Report market outlook is the most important piece of research that Bespoke publishes each year. We’ve been publishing our annual outlook piece since the formation of Bespoke in 2007, and it gets better and better each year! In this year’s edition, we’ll be covering every important topic you can think of dealing with financial markets as we enter 2017. And to say that 2017 should be an interesting year for asset classes would be an understatement given the huge rotation we’ve already seen in just a few weeks since the Presidential Election was held back on November 8th.

Our 2017 Bespoke Report market outlook is the most important piece of research that Bespoke publishes each year. We’ve been publishing our annual outlook piece since the formation of Bespoke in 2007, and it gets better and better each year! In this year’s edition, we’ll be covering every important topic you can think of dealing with financial markets as we enter 2017. And to say that 2017 should be an interesting year for asset classes would be an understatement given the huge rotation we’ve already seen in just a few weeks since the Presidential Election was held back on November 8th.

The 2017 Bespoke Report contains sections like Washington and Markets, Economic Cycles, Market Cycles, Washington, Sector Technicals and Weightings, Stock Market Sentiment, Stock Market Seasonality, Housing, Commodities, and more. In this year’s edition, we’ll also be featuring our new “Trump Index” of stocks that we expect to perform best in 2017 based on the new administration.

Today we have published the “Commodities” section of the 2017 Bespoke Report.

To view this section immediately and also receive the full 2017 Bespoke Report, simply sign up for a 30-day free trial to Bespoke Premium. It’s that easy!

The Bespoke Report — 2017 — “Economic Cycles”

Our 2017 Bespoke Report market outlook is the most important piece of research that Bespoke publishes each year. We’ve been publishing our annual outlook piece since the formation of Bespoke in 2007, and it gets better and better each year! In this year’s edition, we’ll be covering every important topic you can think of dealing with financial markets as we enter 2017. And to say that 2017 should be an interesting year for asset classes would be an understatement given the huge rotation we’ve already seen in just a few weeks since the Presidential Election was held back on November 8th.

Our 2017 Bespoke Report market outlook is the most important piece of research that Bespoke publishes each year. We’ve been publishing our annual outlook piece since the formation of Bespoke in 2007, and it gets better and better each year! In this year’s edition, we’ll be covering every important topic you can think of dealing with financial markets as we enter 2017. And to say that 2017 should be an interesting year for asset classes would be an understatement given the huge rotation we’ve already seen in just a few weeks since the Presidential Election was held back on November 8th.

The 2017 Bespoke Report contains sections like Washington and Markets, Economic Cycles, Market Cycles, Washington, Sector Technicals and Weightings, Stock Market Sentiment, Stock Market Seasonality, Housing, Commodities, and more. In this year’s edition, we’ll also be featuring our new “Trump Index” of stocks that we expect to perform best in 2017 based on the new administration.

Today we have published the “Economic Cycles” section of the 2017 Bespoke Report.

To view this section immediately and also receive the full 2017 Bespoke Report, simply sign up for a 30-day free trial to Bespoke Premium. It’s that easy!

The Bespoke Report — 2017 — “International”

Our 2017 Bespoke Report market outlook is the most important piece of research that Bespoke publishes each year. We’ve been publishing our annual outlook piece since the formation of Bespoke in 2007, and it gets better and better each year! In this year’s edition, we’ll be covering every important topic you can think of dealing with financial markets as we enter 2017. And to say that 2017 should be an interesting year for asset classes would be an understatement given the huge rotation we’ve already seen in just a few weeks since the Presidential Election was held back on November 8th.

Our 2017 Bespoke Report market outlook is the most important piece of research that Bespoke publishes each year. We’ve been publishing our annual outlook piece since the formation of Bespoke in 2007, and it gets better and better each year! In this year’s edition, we’ll be covering every important topic you can think of dealing with financial markets as we enter 2017. And to say that 2017 should be an interesting year for asset classes would be an understatement given the huge rotation we’ve already seen in just a few weeks since the Presidential Election was held back on November 8th.

The 2017 Bespoke Report contains sections like Washington and Markets, Economic Cycles, Market Cycles, Washington, Sector Technicals and Weightings, Stock Market Sentiment, Stock Market Seasonality, Housing, Commodities, and more. In this year’s edition, we’ll also be featuring our new “Trump Index” of stocks that we expect to perform best in 2017 based on the new administration.

Today we have published the “International” section of the 2017 Bespoke Report, which looks at equity markets and economic trends for international markets.

To view this section immediately and also receive the full 2017 Bespoke Report, simply sign up for a 30-day free trial to Bespoke Premium. It’s that easy!

The Bespoke Report — 2017 — “Washington”

Our 2017 Bespoke Report market outlook is the most important piece of research that Bespoke publishes each year. We’ve been publishing our annual outlook piece since the formation of Bespoke in 2007, and it gets better and better each year! In this year’s edition, we’ll be covering every important topic you can think of dealing with financial markets as we enter 2017. And to say that 2017 should be an interesting year for asset classes would be an understatement given the huge rotation we’ve already seen in just a few weeks since the Presidential Election was held back on November 8th.

Our 2017 Bespoke Report market outlook is the most important piece of research that Bespoke publishes each year. We’ve been publishing our annual outlook piece since the formation of Bespoke in 2007, and it gets better and better each year! In this year’s edition, we’ll be covering every important topic you can think of dealing with financial markets as we enter 2017. And to say that 2017 should be an interesting year for asset classes would be an understatement given the huge rotation we’ve already seen in just a few weeks since the Presidential Election was held back on November 8th.

The 2017 Bespoke Report contains sections like Washington and Markets, Economic Cycles, Market Cycles, Washington, Sector Technicals and Weightings, Stock Market Sentiment, Stock Market Seasonality, Housing, Commodities, and more. In this year’s edition, we’ll also be featuring our new “Trump Index” of stocks that we expect to perform best in 2017 based on the new administration.

Today we have published the “Washington” section of the 2017 Bespoke Report, which looks at historical market trends under various political scenarios including the upcoming GOP dominated set-up taking over in 2017.

To view this section immediately and also receive the full 2017 Bespoke Report, simply sign up for a 30-day free trial to Bespoke Premium. It’s that easy!

The Bespoke Report — 2017 — “Dollar and Stocks”

Our 2017 Bespoke Report market outlook is the most important piece of research that Bespoke publishes each year. We’ve been publishing our annual outlook piece since the formation of Bespoke in 2007, and it gets better and better each year! In this year’s edition, we’ll be covering every important topic you can think of dealing with financial markets as we enter 2017. And to say that 2017 should be an interesting year for asset classes would be an understatement given the huge rotation we’ve already seen in just a few weeks since the Presidential Election was held back on November 8th.

Our 2017 Bespoke Report market outlook is the most important piece of research that Bespoke publishes each year. We’ve been publishing our annual outlook piece since the formation of Bespoke in 2007, and it gets better and better each year! In this year’s edition, we’ll be covering every important topic you can think of dealing with financial markets as we enter 2017. And to say that 2017 should be an interesting year for asset classes would be an understatement given the huge rotation we’ve already seen in just a few weeks since the Presidential Election was held back on November 8th.

The 2017 Bespoke Report contains sections like Washington and Markets, Economic Cycles, Market Cycles, Washington, Sector Technicals and Weightings, Stock Market Sentiment, Stock Market Seasonality, Housing, Commodities, and more. In this year’s edition, we’ll also be featuring our new “Trump Index” of stocks that we expect to perform best in 2017 based on the new administration.

Today we have published the “Dollar and Stocks” section of the 2017 Bespoke Report.

To view this section immediately and also receive the full 2017 Bespoke Report, simply sign up for a 30-day free trial to Bespoke Premium. It’s that easy!

Jobless Claims Right on the Mark

Get Bespoke’s 2017 Outlook Report with a 30-day free trial to Bespoke’s premium research! Click here to learn more.

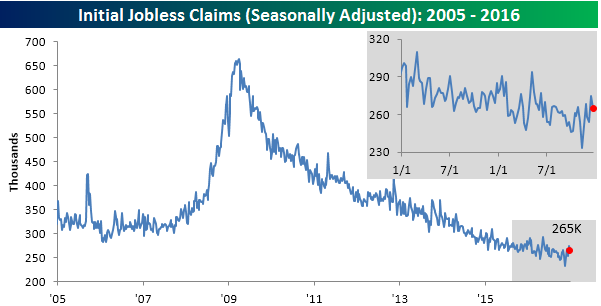

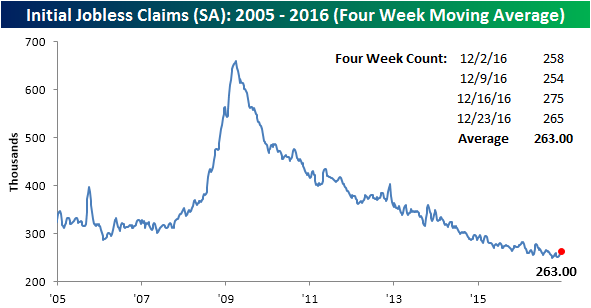

After an unexpected jump last week, jobless claims pulled back slightly this week, falling to 265K which was right inline with expectations. In a streak in length rivaling the one where bullish sentiment has been below 50% for 104 straight weeks, jobless claims have now printed sub-300K for the 95th straight week. That’s the longest streak since 1970!

With this week’s drop, the four-week moving average saw a slight decline falling from 263.75K down to 263K. That’s 13.5K above the cycle low of 249.5K back in early October.

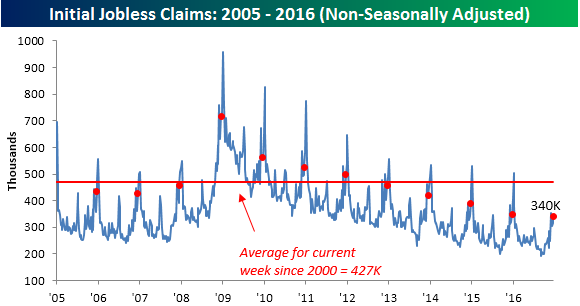

On a non-seasonally adjusted (NSA) basis, jobless claims increased from 315.1K up to 340K. For the current week of the year, that’s more than 130K below the average since 2000 and the lowest reading for the current week of the year since 1970.