Bespoke’s Consumer Pulse Report — December 2016

Bespoke’s Consumer Pulse Report is an analysis of a huge consumer survey that we run each month. Our goal with this survey is to track trends across the economic and financial landscape in the US. Using the results from our proprietary monthly survey, we dissect and analyze all of the data and publish the Consumer Pulse Report, which we sell access to on a subscription basis. Sign up for a 30-day free trial to our Bespoke Consumer Pulse subscription service here. With a trial, you’ll get coverage of consumer electronics, social media, streaming media, retail, autos, and much more.

Bespoke’s Sector Snapshot — 1/5/17

We’ve just released our weekly Sector Snapshot report (see a sample here) for Bespoke Premium and Bespoke Institutional members. Please log-in here to view the report if you’re already a member. If you’re not yet a subscriber and would like to see the report, please start a 14-day trial to Bespoke Premium now.

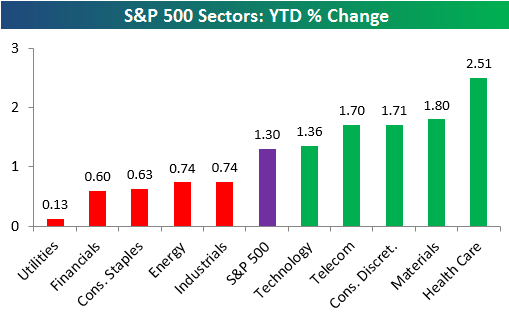

Below is one of the many charts included in this week’s Sector Snapshot, which simply highlights the year-to-date returns so far for the major S&P 500 sectors. In 2016, Health Care was by far the worst performing sector, but it has been the best so far this year. Financials and Energy, on the other hand, were two of the top sectors in 2016, but they’ve underperformed over the first few days of 2017.

To see our full Sector Snapshot with additional commentary plus six pages of charts that include analysis of valuations, breadth, technicals, and relative strength, start a 14-day free trial to our Bespoke Premium package now. Here’s a breakdown of the products you’ll receive.

Bespoke’s “Most Volatile Stocks on Earnings”

Get Bespoke’s 2017 Outlook Report with a 30-day free trial to Bespoke’s premium research! Click here to learn more.

Corporate earnings have pretty much been at the back of investors’ minds since the Presidential election back on November 8th. But earnings will come into view again beginning next week when the banks kick off the fourth quarter earnings reporting period. At the start of each quarterly earnings season, we update our list of the “most volatile stocks on earnings.”

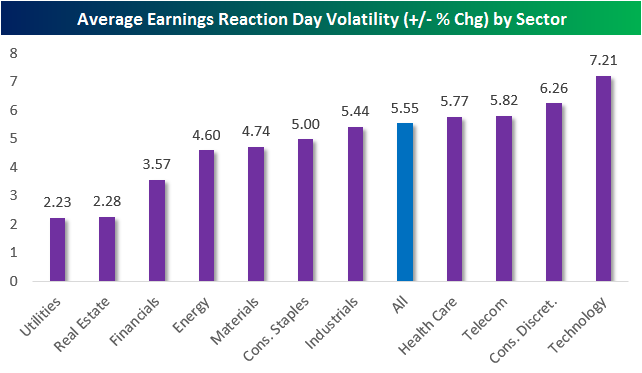

But before getting to the individual stocks, we wanted to take a look at earnings volatility at the sector level. Using our Interactive Earnings Report Database, which contains more than 135,000 individual stock earnings reports going back to 2001, we calculated the average one-day absolute percentage change that stocks in each sector have historically seen on their earnings reaction days. For a stock that reports in the morning, its earnings reaction day is that same trading day. For a stock that reports after the close, its earnings reaction day is the next trading day.

As shown below, the average one-day change on earnings for all stocks across all sectors going back to 2001 has been +/-5.55%. That means you can expect the average stock to move more than 5% in either direction when it reports earnings each quarter. But Tech stocks are much more volatile than Utilities stocks. The average Tech stock has historically moved +/-7.21% on its earnings reaction day, while the average Utilities stock only moves +/-2.23%. The next most volatile sector on earnings is Consumer Discretionary, followed by Telecom and then Health Care. The remaining sectors all see average one-day moves below the overall average for all stocks.

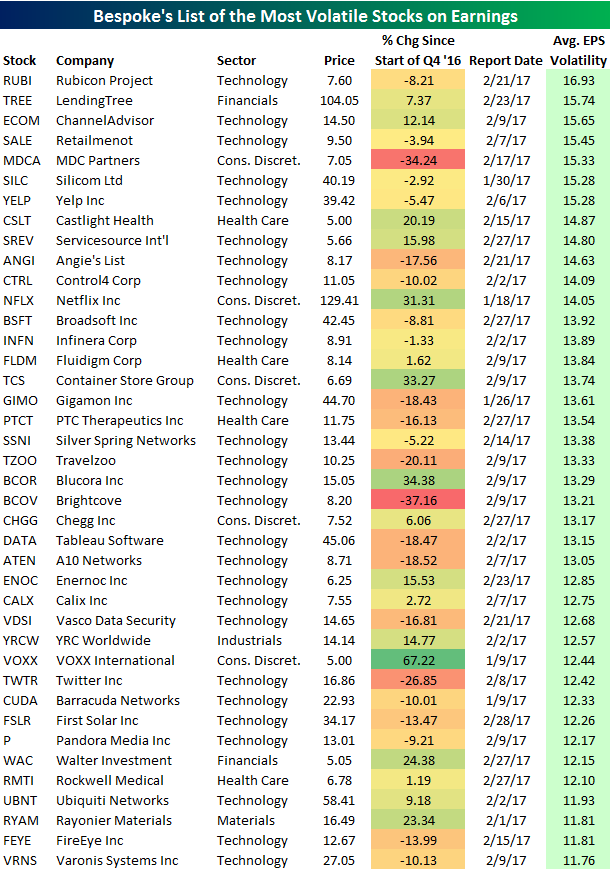

Now moving on to the most volatile individual stocks on their earnings reaction days, below is a list of the top 40. To make the list, the stock had to have at least 10 quarterly earnings reports in our database (2.5 years worth), and it had to be trading above $5/share. The stocks below all typically see an average one-day move of more than +/-11.75% on their earnings reaction days. As shown, Rubicon Project (RUBI) is the most volatile of any stock, moving +/-16.93% on its historical earnings reaction days. LendingTree (TREE) ranks second at +/-15.74%, followed by ChannelAdvisor (ECOM), Retailmenot (SALE), and MDC Partners (MDCA).

Some of the more notable stocks on the list include Netflix (NFLX), Travelzoo (TZOO), Tableau Software (DATA), Twitter (TWTR), First Solar (FSLR), and Pandora (P). Netflix (NFLX) typically sees a move of +/-14.05% on its earnings reaction days, so expect a big day either up or down when it reacts to its evening earnings report on January 18th.

Chart of the Day: Asia Breaking Out?

ISM Services Report Surprises to the Upside

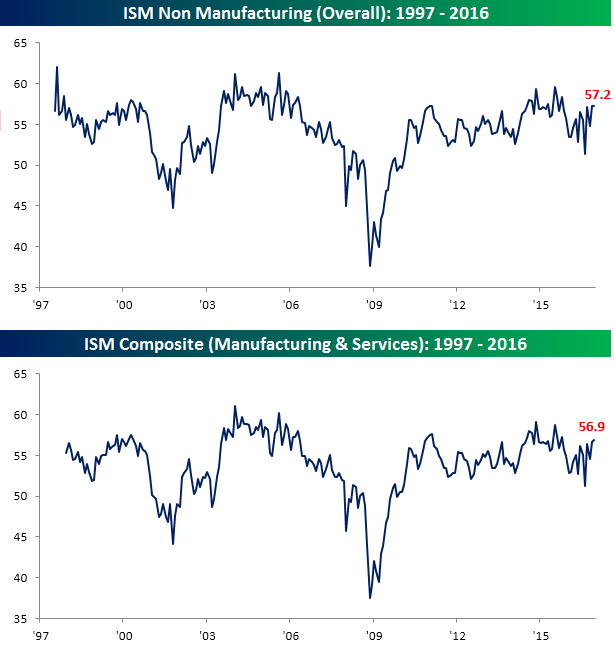

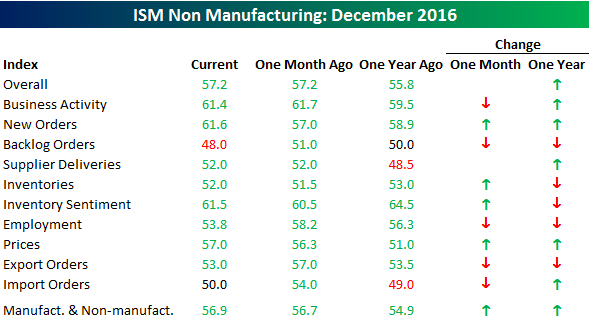

Following on the heels of Tuesday’s better than expected ISM Manufacturing report, the ISM Non-Manufacturing report for December also surpassed expectations this morning, coming in at a level of 57.2 versus consensus expectations for 56.8. On a combined basis, the ISM for the month of December was 56.9, which was up 0.2 points from November, up two full points from a year ago, and the highest since October 2015.

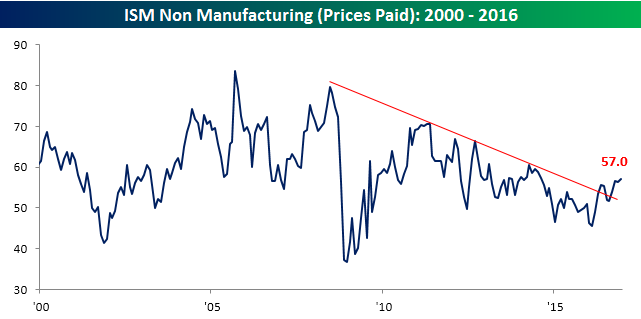

Looking at the internals of the report, the strongest component in December was New Orders which jumped to the highest since August 2015. On the downside, the biggest decliner was Employment, which fell from 58.2 down to 53.8. While that doesn’t seem to bode too well for Friday’s Employment report, we would note that the component saw a big jump last month that was not reflected in the employment data. Relative to a year ago, breadth in the internals of the report was mixed, although Prices Paid is up the most of any component. As shown in the chart below, the downtrend in that component has clearly been broken to the upside.

Like what you see? Click here to gain full access to Bespoke and our 2017 outlook report.

the Bespoke 50 — 1/5/17

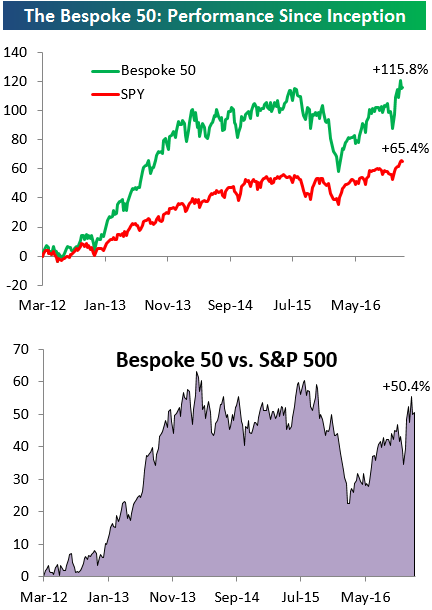

Every Thursday, Bespoke publishes its “Bespoke 50” list of top growth stocks in the Russell 3,000. Our “Bespoke 50” portfolio is made up of the 50 stocks that fit a proprietary growth screen that we created a number of years ago. Since inception in early 2012, the “Bespoke 50” has nearly doubled the performance of the S&P 500. Through today, the “Bespoke 50” is up 115.8% since inception versus the S&P 500’s gain of 65.4%.

To view our “Bespoke 50” list of top growth stocks, sign up for Bespoke Premium ($99/month) at this checkout page and get your first month free. This is a great deal!

Still No Majority Among the Bulls

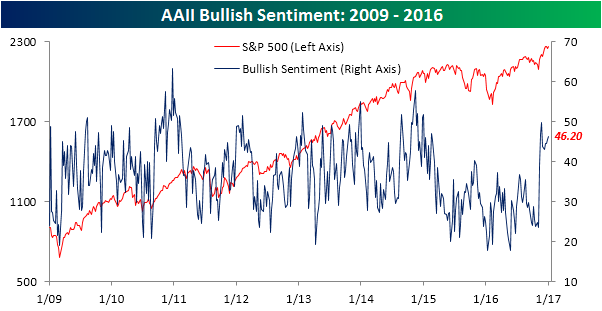

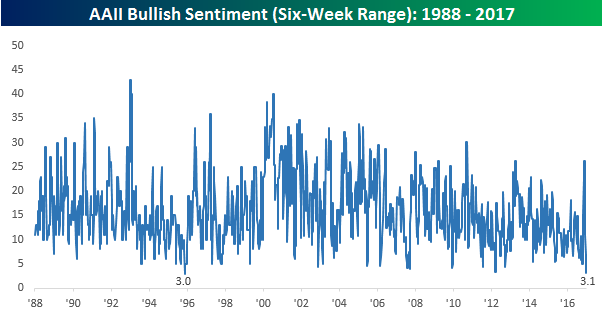

Despite a positive start to equities in the New Year, bullish sentiment among individual investors still can’t get over the hump. In this week’s sentiment survey from AAII, bullish sentiment increased from 45.57% up to 46.20%. This makes it 105 straight weeks where bullish sentiment has been below 50% – the second longest streak in the history of the survey (back to 1987).

Like what you see? Click here to gain full access to Bespoke and our 2017 outlook report.

The reality is that sentiment on the bullish side really hasn’t moved much in either direction over the last six weeks. In fact, with a range of just over three percentage points in the last six weeks, bullish sentiment has been in the narrowest range since 1995 and the second narrowest six-week range on record.

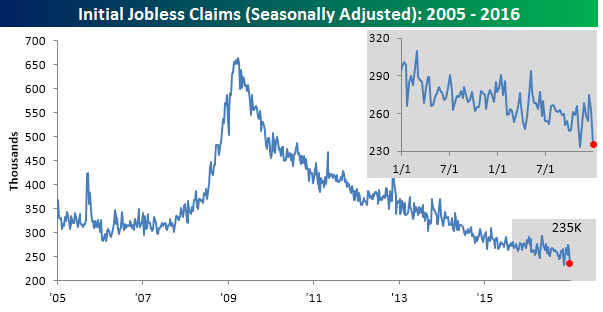

Jobless Claims Back Down Near Cycle Lows

Jobless claims surprised to the downside this morning, falling from 263K down to 235K in what was the largest weekly decline since January 2015. This morning’s print was also 25K below consensus expectations of 260K and marked the 96th straight week that claims were below 300K. That’s the longest streak in decades (or since 1970 to be exact).

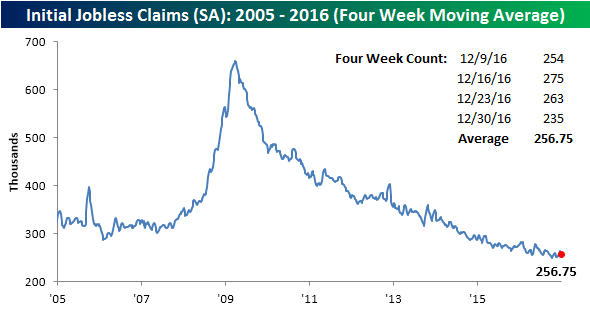

This week’s lower than expected reading also brought the four-week moving average down to 256.75, but that is still more than 7K above the cycle low of 249.5K from early October. We are going to have to see a few more strong prints like this week’s in order to get the four-week moving average back down to new lows.

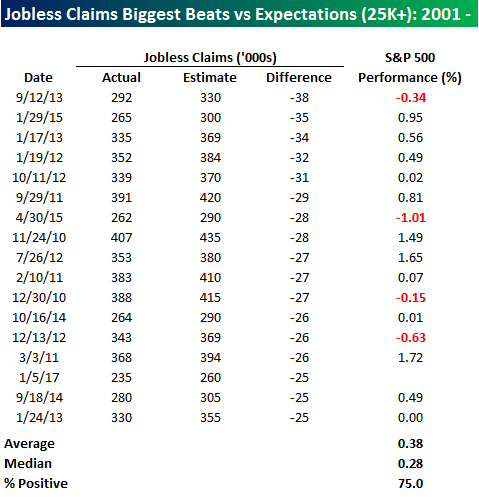

Getting back to the headline number, today’s report was just the 17th time since 2001 that weekly claims have been at least 25K below consensus expectations. Using our Economic Indicators Database (Institutional clients only), on the 16 prior days where jobless claims beat expectations by a wider margin, the S&P 500 averaged a gain of 0.38% (median: 0.28%) on the day with gains 75% of the time.

Like what you see? Click here to gain full access to Bespoke and our 2017 outlook report.

The Closer 1/4/17 – Fed Embraces The Unknown

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke Institutional clients, we review December auto sales and the results of the Fed minutes today.

The Closer is one of our most popular reports, and you can see it and everything else Bespoke publishes by starting a no-obligation 14-day free trial to our research!

ETF Trends: Fixed Income, Currencies, and Commodities – 1/4/17

There have been remarkably few ETFs trading down by a substantial amount over the last few days. Natural gas (smoked by warmer-than-expected winter weather) Semis, Turkey, and oil-related stocks have been the only ETFs we track losing over 1%. There have, on the other hand, been a number of big gainers. Gold, EM, Coffee, and Telecoms have been the best performers. REITs have also been solid performers as interest rates have reversed their gains somewhat in recent sessions.

Bespoke provides Bespoke Premium and Bespoke Institutional members with a daily ETF Trends report that highlights proprietary trend and timing scores for more than 200 widely followed ETFs across all asset classes. If you’re an ETF investor, this daily report is perfect. Sign up below to access today’s ETF Trends report.

See Bespoke’s full daily ETF Trends report by starting a no-obligation free trial to our premium research. Click here to sign up with just your name and email address.