Quick View Chart Book — 1/14/17

The Bespoke Report — Taking the Stairs — 1/13/17

If you’re not yet a Bespoke subscriber, you can still get Bespoke’s 2017 Outlook Report with a 30-day free trial to Bespoke’s premium research! Click here to learn more.

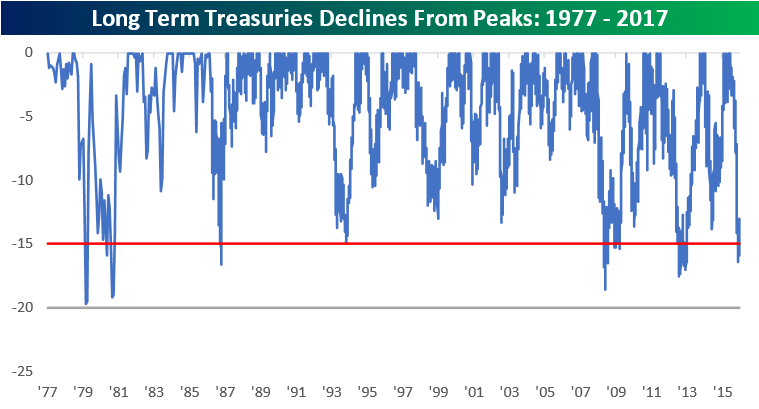

The chart below is included in this week’s Bespoke Report newsletter, which was just sent to Bespoke Premium subscribers. As shown, just when the pundits were telling everybody that interest rates across the treasury curve had nowhere to go but down, treasuries peaked and have since seen one of the steepest drawdowns from a peak on record. Among many of the topics covered in this week’s report was how treasuries and the S&P 500 have performed following prior drawdowns of similar magnitude.

If you’d like to see the rest of this week’s Bespoke Report newsletter, take advantage of our one-month Bespoke Premium free trial offer that includes our 2017 Outlook Report. Sign up now at this page.

Have a great weekend!

The Closer 1/13/17 – End of Week Charts

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke clients, we recap weekly price action in major asset classes, update economic surprise index data for major economies, chart the weekly Commitment of Traders report from the CFTC, and provide our normal nightly update on ETF performance, volume and price movers, and the Bespoke Market Timing Model.

The Closer is one of our most popular reports, and you can sign up for a trial below to see it and everything else Bespoke publishes free for the next two weeks!

Click here to start your no-obligation free Bespoke research trial now!

ETF Trends: US Indices & Styles – 1/13/17

Industrial metals continue to rally, with unexpectedly large inventory draws helping support prices. Turkey recovered somewhat over the last few days from the perspective of US investor; the South Korea ETF was also supported by stronger Korean won. Energy services and other oil exposures were the worst performers over the last five days, along with REITs/Real Estate and Pharma.

Bespoke provides Bespoke Premium and Bespoke Institutional members with a daily ETF Trends report that highlights proprietary trend and timing scores for more than 200 widely followed ETFs across all asset classes. If you’re an ETF investor, this daily report is perfect. Sign up below to access today’s ETF Trends report.

See Bespoke’s full daily ETF Trends report by starting a no-obligation free trial to our premium research. Click here to sign up with just your name and email address.

B.I.G. Tips – The Most Loved and Hated Sectors

Key Earnings Reports Next Week

Get Bespoke’s 2017 Outlook Report with a 30-day free trial to Bespoke’s premium research! Click here to learn more.

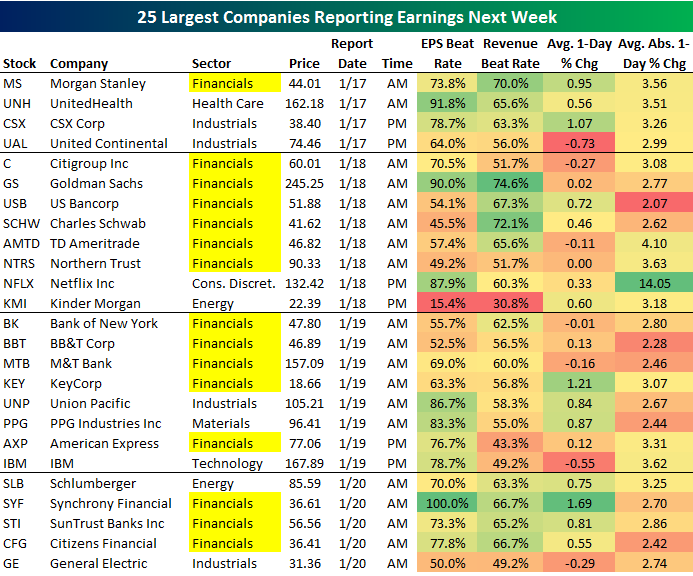

Using our Interactive Earnings Report Database, we’re able to tell Premium subscribers which companies typically beat or miss estimates the most, and which companies typically gain or lose the most in response to their earnings reports. Below is a list of the 25 largest companies reporting earnings next week, with some of our key earnings statistics included (shaded color-coded columns). This data covers all quarterly earnings reports for each company going back to 2001.

Sixty percent of next week’s key reports come from the Financial sector. 15 of the 25 largest stocks set to report are Financials. Given how well the sector has performed since the election, we think the expectations bar is going to be set high. Any misses or negative guidance will see stock prices fall more than they normally would.

On Tuesday (Monday is a holiday), we hear from Morgan Stanley (MS) and UnitedHealth (UNH), then we hear from Citigroup (C) and Goldman Sachs (GS) on Wednesday morning. Netflix (NFLX) is going to be watched closely when it reports Wednesday after the close. On Thursday, American Express (AXP) and IBM are the biggest reports (both after the close), and then General Electric (GE) rounds out the week on Friday morning.

Of the stocks shown, UNH, GS, NFLX, UNP, and SYF have historically beaten earnings estimates the most often. Goldman has also beaten revenue estimates the most often out of all stocks listed. Historically, stocks like MS, CSX, USB, KEY, and SYF have reacted the most positively on their earnings reaction days, while Netflix (NFLX) is by far the most volatile stock on earnings out of the names listed. You can view a full list of the most volatile stocks on earnings in this post we did last week.

B.I.G. Tips – Retail Sales Miss For Second Straight Month

Health Care Costs Down, Elective Procedures Up

Each month, Bespoke runs a survey of 1,500 US consumers balanced to census. In the survey, we cover everything you can think of regarding the economy, personal finances, and consumer spending habits. We’ve now been running the monthly survey for more than two years, so we have historical trend data that is extremely valuable, and it only gets more valuable as time passes. All of this data gets packaged into our monthly Bespoke Consumer Pulse Report, which is included as part of our Pulse subscription package that is available for either $39/month or $365/year. We highly recommend trying out the service, as it includes access to model portfolios and additional consumer reports as well. If you’re not yet a Pulse member, click here to start a 30-day free trial now!

Earlier this week we noted that our December Pulse survey showed big increases in expectations to purchase big ticket items like homes and autos. We saw similarly positive results in our series of questions regarding the Health Care sector. Over the last 6-9 months, consumers in our survey had been reporting higher health care costs, but as shown in the chart below, they noted declining costs in this month’s survey. This question asks consumers to compare current costs versus a year ago on a range of things like copays, deductibles, and premiums. Regardless of whether or not it was actually the case, the dip in reported costs versus our November survey is what consumers felt at least.

Consumers seemingly feel healthier as well, as hospital visits over the past month dipped while the “1-3 month” category rose. You can see the dip in the chart below:

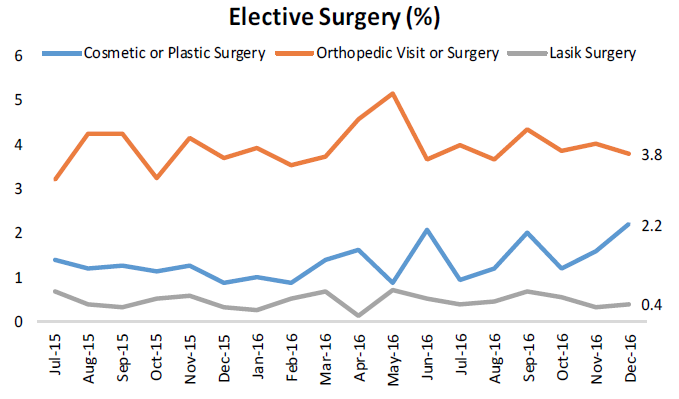

When consumers feel more flush, they’re more willing to spend on discretionary items and services. One of the questions we ask consumers in our monthly survey is if they’ve had cosmetic or plastic surgery recently, as well as orthopedic surgery and Lasik surgery. These are all elective procedures (although orthopedic and Lasik is much less elective than plastic surgery) that consumers cut back on when times are tight. If the economy is going into a downturn, we should see these categories start to dip right away. As shown in the chart below, while Lasik and orthopedic procedures remained steady, we saw a new high in those reporting cosmetic or plastic surgeries in December.

To see our full December Pulse report, click here to start a 30-day free trial now!

The Closer 1/12/17 – The Slowing Of Global Populations

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke Institutional clients, we chart up projected global population growth from the US Census for a range of countries. We also recap import price data released today.

The Closer is one of our most popular reports, and you can see it and everything else Bespoke publishes by starting a no-obligation 14-day free trial to our research!

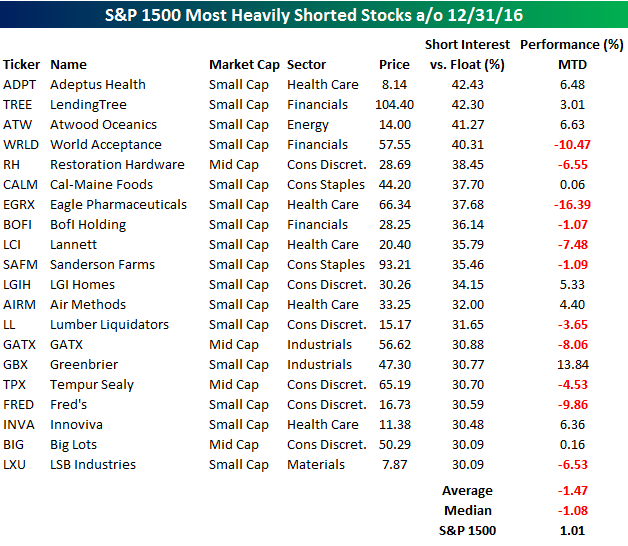

Most Shorted Stocks Lagging the Market

Short interest figures for the end of December were released after the close yesterday, and as one might expect given the rally in equities, negative bets on individual stocks continued their post-election decline. The table below lists the 20 stocks in the S&P 1500 that have 30% or more of their free-floating shares sold short, and for each stock we also include how they have fared so far in 2017. Even though equities have rallied so far this year, the most heavily shorted stocks haven’t taken part in the rally. The average return of the 20 stocks listed is a decline of 1.47% (median: -1.08%). In terms of breadth, it’s a more even split with nine stocks up and eleven down, but still skewed negative.

You won’t find a lot of household names on the list. Many people will recognize companies like LendingTree (TREE), Restoration Hardware (RH), Lumber Liquidators (LL), Tempur Sealy (TPX), and Big Lots (BIG), but most of the others are all obscure small cap companies. In terms of individual returns, though, there haven’t been too many outliers. The biggest downside losers have been Eagle Pharma (EGRX) and World Acceptance (WRLD), while the biggest winner has been Greenbrier (GBX). As we said at the top, though, normally in a rising market environment you tend to see the most heavily shorted stocks do best. Therefore, if this trend of underperformance continues, it would be a cause for concern for the broad market.

Interested in a more in-depth analysis of short interest trends? Earlier today, we published our bi-monthly short interest report, which is available to all Bespoke Premium and Institutional clients. Click here to start a no-obligation 14-day free trial now.