Dow 20,000 – Finally

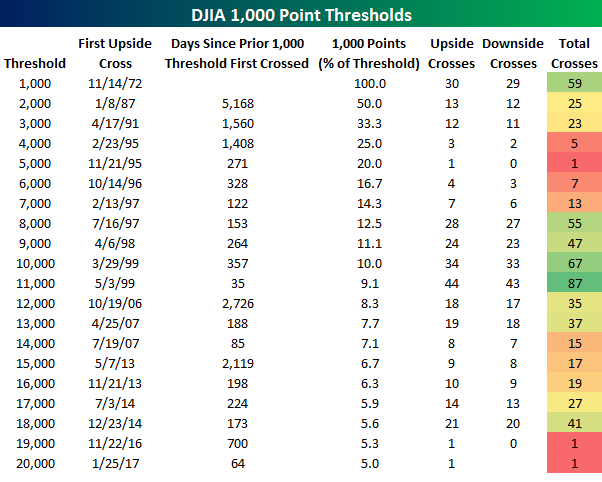

After at least a month of flirting with 20,000, the Dow Jones Industrial Average finally broke through the level that everyone…OK, just some people…has been watching for the last several weeks. In honor of crossing the 20,000 threshold, the table below lists the date that the DJIA first crossed each thousand point threshold (on a closing basis) going back to 1,000 back in 1972. We also show how many days elapsed between the first time the index crossed each level, the number of times it crossed that threshold to the upside and downside, and what percentage each successive 1,000 points represents as a percentage of the index’s level.

Looking at the table, a couple of things stand out. First, the 64 days that elapsed between the first cross of 19,000 and 20,000 would represent the second shortest amount of time that transpired between two thousand point levels. The only one that was shorter was the 35 days that elapsed between 10,000 and 11,000. The 64-day sprint between 19,000 and 20,000 may sound impressive, but when you consider the fact that 1,000 points only represents 5% at 20,000 compared to 10% at 10,000, it loses a bit of its luster. Another aspect of the current rally worth citing is that after first crossing 19K back in November, the DJIA has yet to look back and trade below that level. The only other 1,000 point level that the DJIA crossed to the upside and never looked back from was 5,000 back in November 1995. While 5K and 19K are levels the DJIA has yet to ever revisit, DJIA 10,000 and 11,000 were levels that the index just couldn’t shake off. The DJIA first crossed 10K in 1999, but over the years following that first cross, it moved above and below that level 66 times. 11K was even harder to shake off. Since first crossing that threshold in May 1999, the index has moved above and below that level on a closing basis 86 other times.

Want to see more research like this? Click here to start a no-obligation two-week free trial.

ETF Trends: US Sectors & Groups – 1/25/17

Who would have thought that in the week surrounding an executive order pulling out of NAFTA, Mexican equities would dramatically outperform in USD terms? Brazil and Poland have also done well while the homebuilders have been the strongest stocks in the US following very solid existing home sales data yesterday (which we discussed in The Closer last night). On the losing side over the last 5 days, biotech, Pharma, and long-term Treasuries continue to decline. Precious metals and the USD have also declined; interestingly GLD and UUP have identical performance over the last five sessions, an unusual correlation.

Bespoke provides Bespoke Premium and Bespoke Institutional members with a daily ETF Trends report that highlights proprietary trend and timing scores for more than 200 widely followed ETFs across all asset classes. If you’re an ETF investor, this daily report is perfect. Sign up below to access today’s ETF Trends report.

See Bespoke’s full daily ETF Trends report by starting a no-obligation free trial to our premium research. Click here to sign up with just your name and email address.

The Closer 1/24/17 – Hot Housing, State Level Labor, Richmond Confidence

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke Institutional clients, we chart state-level employment change across the US, including the impact of oil price declines, a diffusion index, and a heatmap of all 50 states. We also discuss strong existing home sales data today and a mixed Richmond Fed activity report on the Manufacturing and Services sectors.

The Closer is one of our most popular reports, and you can see it and everything else Bespoke publishes by starting a no-obligation 14-day free trial to our research!

Chart of the Day – How Recent Market Returns Stack Up

Earnings, Revenue Beat Rates + Best and Worst Stocks on Earnings

Get Bespoke’s 2017 Outlook Report with a 30-day free trial to Bespoke’s premium research! Click here to learn more.

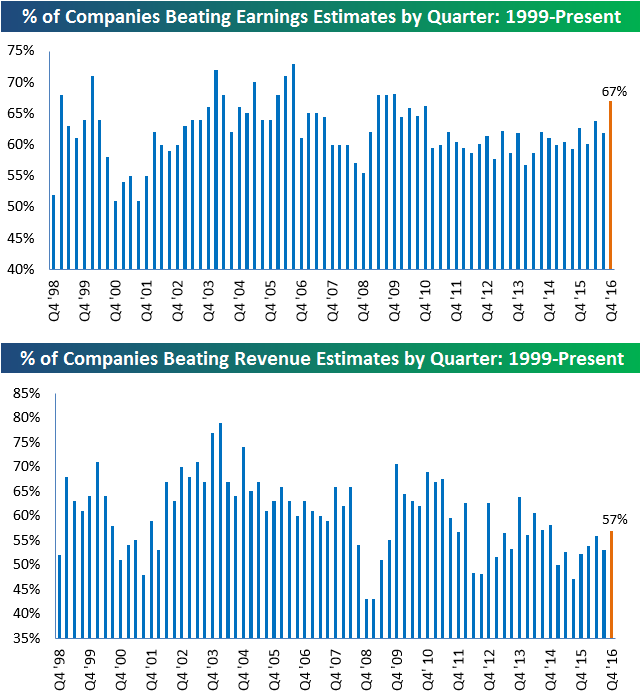

Just under 200 companies have reported earnings so far this season, which is only a tenth of the total amount that will have reported by the time the season ends in mid-February. Even still, we’re tracking the beat rates for earnings per share and revenues already, and we show them in the charts below.

As shown in the first chart, 67% of companies that have reported so far this season have posted better-than-expected earnings per share numbers. This would be a high reading relative to the low-60s that we’ve seen over the last six years if it were to hold up throughout earnings season, but we typically see the beat rate drift lower as more and more companies report.

The revenue beat rate this season only stands at 57%, which is ten percentage points lower than the bottom-line earnings beat rate. 57% is a relatively low reading, so it will be worth monitoring as earnings season progresses.

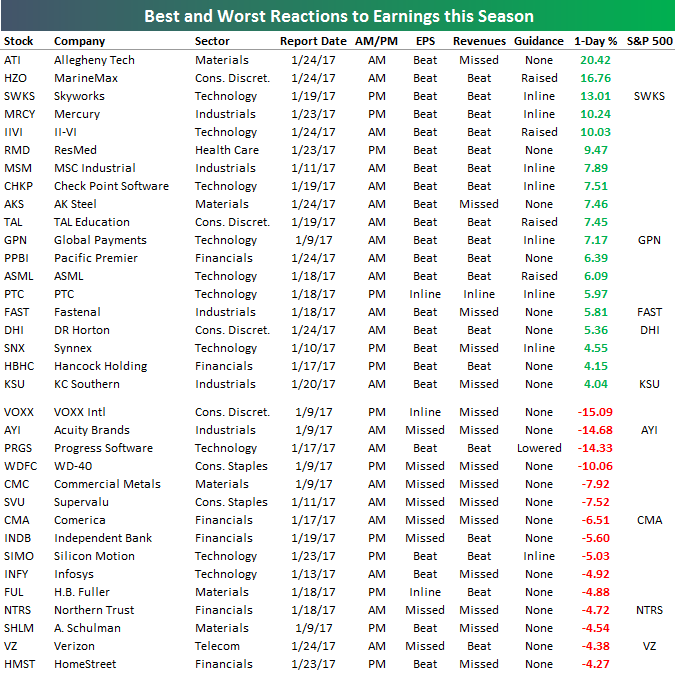

Below is a look at the stocks that have reported this earnings season that have posted the biggest one-day gains and losses on their respective report days. For companies that report in the morning before the open, we use that day’s change. For companies that report in the evening after the close, we use the next day’s change.

As shown, Allegheny Tech (ATI) has posted the biggest gain with a one-day move of +20.42%. MarineMax (HZO) ranks second with a gain of 16.76%, followed by Skyworks (SWKS) at +13.01%. Mercury (MRCY) and II-VI (IIVI) round out the top five with gains of just over 10%.

On the downside, VOXX International (VOXX) has posted the biggest decline on earnings this season with a one-day drop of 15.09%. Acuity Brands (AYI) ranks second worst with a drop of 14.68%, followed by Progress Software (PRGS) at -14.33%. WD-40 (WDFC), Infosys (INFY), Supervalu (SVU), Comerica (CMA), and Verizon (VZ) are additional names on the list of losers that are noteworthy.

Dow 30 and Country Trading Range Screens

Get Bespoke’s 2017 Outlook Report with a 30-day free trial to Bespoke’s premium research! Click here to learn more.

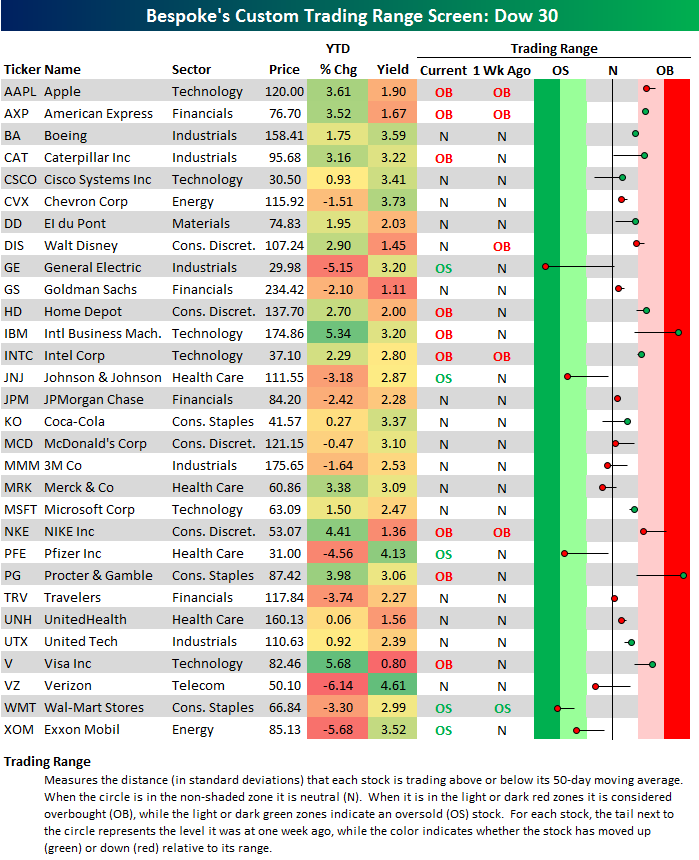

Below is a look at our Dow 30 trading range screen. For reach stock, the dot represents where it’s currently trading within its range, while the tail end represents where it was trading one week ago. The black vertical “N” line represents each stock’s 50-day moving average.

Currently there are 22 Dow stocks above their 50-DMAs and just 8 below. General Electric (GE) is now the most oversold stock in the Dow after a big move lower within its range since its earnings report last Friday. Johnson & Johnson (JNJ), Pfizer (PFE), Wal-Mart (WMT), and Exxon Mobil (XOM) are also oversold.

On the flip side, IBM and Procter & Gamble (PG) are the most overbought stocks in the Dow, with both trading nearly two standard deviations above their 50-DMAs. IBM is currently the second best performing Dow stock of 2017 with a gain of 5.34%. Only Visa (V) has gotten off to a better start with a YTD gain of 5.68%.

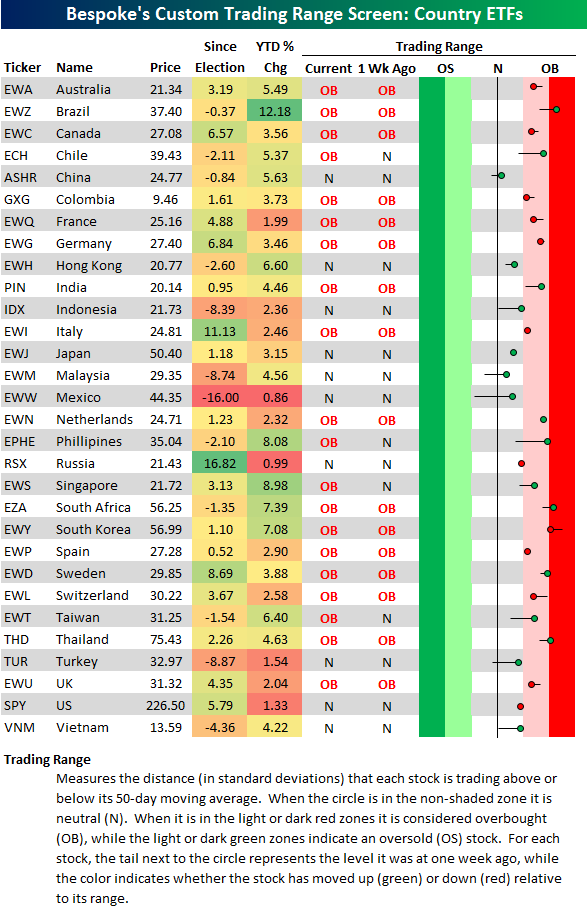

Our second trading range update looks at the 30 largest country ETFs traded on US exchanges. This gives you a good snapshot of how global equity markets currently look.

We’d say they look pretty darn good considering that all 30 are now above their 50-day moving averages. Even Mexico (EWW) is trending higher in the near term.

ETF Trends: Hedge – 1/24/17

Mining and industrial metals stocks have been the best performers over the past week with Mexico also rallying. Other emerging markets (Philippines, LatAm, Turkey, Singapore, Taiwan) have gained while Home Construction and Materials have also gained. On the losing side of the column, Pharmaceuticals, Biotech, and Retail have been the worst performers over the past week with long-term Treasuries, Solar, and Telecoms also underperforming.

Bespoke provides Bespoke Premium and Bespoke Institutional members with a daily ETF Trends report that highlights proprietary trend and timing scores for more than 200 widely followed ETFs across all asset classes. If you’re an ETF investor, this daily report is perfect. Sign up below to access today’s ETF Trends report.

See Bespoke’s full daily ETF Trends report by starting a no-obligation free trial to our premium research. Click here to sign up with just your name and email address.

Bespoke Stock Scores: 1/24/17

Poor Old Alcoa (AA)

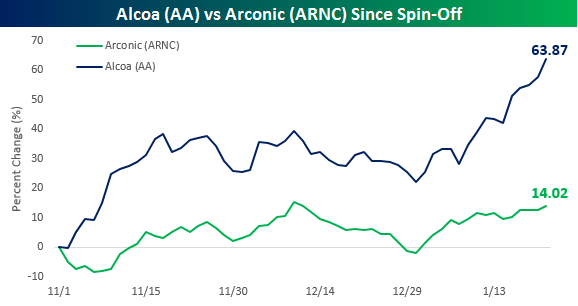

Even though the company lost a lot of its relevance as a bell weather years ago and was even booted from the DJIA way back in 2013, we always considered the release of Alcoa’s (AA) earnings report to mark the unofficial start of earnings season. Late last year, though, Alcoa split up into two separately traded companies, and neither of the two remaining companies releases its report until late January, so the company’s distinction as kicking off earnings season is no longer applicable. Tonight, after the close, AA, which consists of the former company’s legacy raw aluminum operations, reports earnings, while Arconic (ARNC), which represents the company’s higher-growth business of manufactured goods for the aerospace and automotive industries, reports a week from today on 1/31.

With both companies now trading on their own for close to three months, we wanted to take a look at how they have performed as their own independent entities. For a little background, when the split was first announced in late 2015, the purpose was meant as a way to free Arconic from the shadows of the old line slow growth Aluminum company. The thinking was that this would help the market to fully recognize the value of this high growth business and for just about everyone involved, Arconic was the company with better prospects going forward. The fact that CEO Klaus Kleinfeld said he would take over as the CEO of Arconic showed which business he thought had the best potential, and he was quoted as saying, “You have to look at where you can create more value.”

So while everyone seemed to get all excited for the prospects of Arconic and left Alcoa for dead, which stock do you think has done better on its own? The chart below shows the performance of both stocks since they started trading on a separate basis. In the nearly three months that Arconic has been on its own, the stock has rallied a pretty impressive 14%, or nearly twice the gain of the S&P 500. That’s all well and good, but over that same time period, poor old Alcoa has rallied more than 60%! For any stock, that’s a major move in three months, but for a stock that did essentially nothing for several years and sat out the bull market, it’s monstrous, and it all came from the legacy slow-growth business that Arconic and executives at the combined company were trying to get away from. It’s still early, but as of now Alcoa’s performance still casts quite a shadow over Arconic!

The Closer 1/23/17 – Market Updates

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke Institutional clients, we update our valuation model for the Bloomberg USD Index (a proxy for the broad dollar), present tables of the most volatile and highest implied volatility stocks in the Russell 1000, and take a look at the characteristics of volatility for major US equity index ETFs and S&P 500 sector ETFs.

The Closer is one of our most popular reports, and you can see it and everything else Bespoke publishes by starting a no-obligation 14-day free trial to our research!