The Bespoke Report — Trump 20,000 — 1/27/17

If you’re not yet a Bespoke subscriber, you can still get Bespoke’s 2017 Outlook Report with a 30-day free trial to Bespoke’s premium research! Click here to learn more.

The screen below is one of many graphics included in our just-published Bespoke Report newsletter (included weekly with all of our membership packages). As shown, we closed out the final full week of January with nearly all country ETFs trading above their 50-day moving averages. All but 7 of the 30 country ETFs in the screen are overbought. The post-election rally continues.

If you’d like to see the rest of this week’s Bespoke Report newsletter, take advantage of our one-month Bespoke Premium free trial offer that includes our 2017 Outlook Report. Sign up now at this page.

Have a great weekend!

Quick View Chart Book – 1/27/17

The Closer 1/27/17 – End of Week Charts

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke clients, we recap weekly price action in major asset classes, update economic surprise index data for major economies, chart the weekly Commitment of Traders report from the CFTC, and provide our normal nightly update on ETF performance, volume and price movers, and the Bespoke Market Timing Model.

The Closer is one of our most popular reports, and you can sign up for a trial below to see it and everything else Bespoke publishes free for the next two weeks!

Click here to start your no-obligation free Bespoke research trial now!

Sears: The 19th Century Amazon

Shares of Sears Holdings (SHLD) have been in free-fall the last three days, falling a staggering 23% during that span. This week’s decline is only a continuation of a longer-term decline where the stock has lost over half of its value in the last six months. The reason behind the most recent leg lower in the stock stems from a ratings downgrade from Fitch where there the agency said that, “although Sears has been able to fund its continued cash shortfalls through planned asset monetization, and additional financings, a meaningful business turnaround in fiscal 2017 is critical given the continued reduction of its asset base.” In other words, unless business picks up for Sears, it is going to run out of assets to fund its liabilities.

Shares of Sears Holdings (SHLD) have been in free-fall the last three days, falling a staggering 23% during that span. This week’s decline is only a continuation of a longer-term decline where the stock has lost over half of its value in the last six months. The reason behind the most recent leg lower in the stock stems from a ratings downgrade from Fitch where there the agency said that, “although Sears has been able to fund its continued cash shortfalls through planned asset monetization, and additional financings, a meaningful business turnaround in fiscal 2017 is critical given the continued reduction of its asset base.” In other words, unless business picks up for Sears, it is going to run out of assets to fund its liabilities.

The history of Sears is really a fascinating case study of how technology has upended the retail landscape. Whereas over a century ago, Sears completely altered the retail landscape with its famous catalog, today companies like Sears are being upended by technology and online sales. Back in the late 1800s, when the country was much more agrarian in nature, farmers had just one option to purchase their goods and supplies – the local general store. With zero competition, the owner of the store was a price maker and could, within reason, charge whatever he wanted for whatever he decided to sell. The customer basically had no choice as to selection or price. When the Sears catalog was first introduced, it completely upended the retail landscape by introducing uniform prices and a wider selection of merchandise (sound familiar).

With the success of the catalog business, Sears began to diversify its product offerings as well as its distribution by opening retail stores in cities and towns around the country. The company saw massive growth and success over a period that spanned decades, and in the early 1970s finished building the Sears Tower, which was at the time of its completion the world’s largest skyscraper. Sears was literally on top of the world! Nothing lasts forever, though, and looking back, the 1970s were probably the peak for Sears. Sales from the catalog started to decline as the concept became stale, and in the 1990s the company stopped publishing it. Then ten years later Sears was purchased by Kmart, another once famous retailer that was losing its relevance. While the combined company saw some success in its stock price after the merger, most of the period as a combined company has been negative for shareholders.

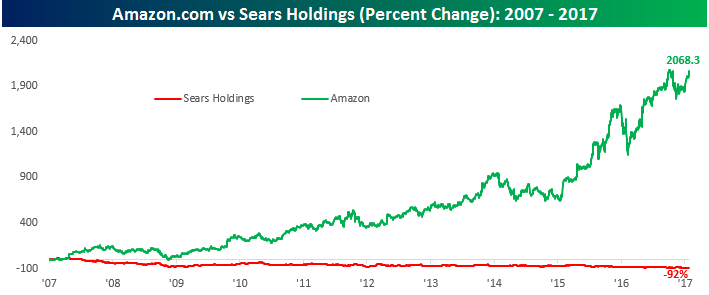

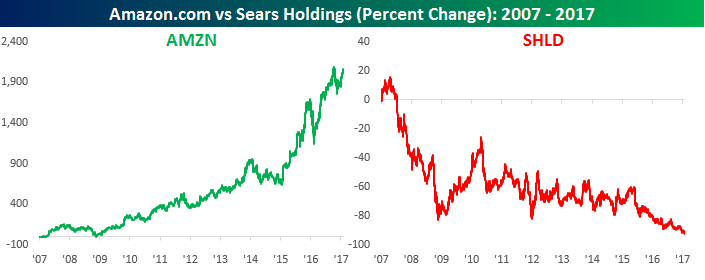

The experience of Sears really provides a perfect example of the ‘bricks to clicks’ trend we first highlighted several years ago in our Death By Amazon index. Like Sears over a century ago, starting with books, Amazon came into the traditional retail environment and completely transformed it. Numbers don’t lie, and the stock performance of Sears and Amazon.com over the last decade illustrates how traditional retail’s pain (in this case Sears) has been Amazon’s gain. Over that span, shares of AMZN are up over 2,000% while SHLD is down over 90%!

In fact, the chart above doesn’t even do justice to the disparity in the performance of the two stocks, because AMZN’s return has been so positive and SHLD’s has been so negative. Below we show the performance of both stocks on separate charts. Just to get back to where it was ten years ago, Sears would have to rally more than 1,300%. There’s probably a good chance that ten years from now Sears will no longer be around, but as ancient as the company now seems, it was once the Amazon of its day.

Most Shorted Stocks Getting Trounced

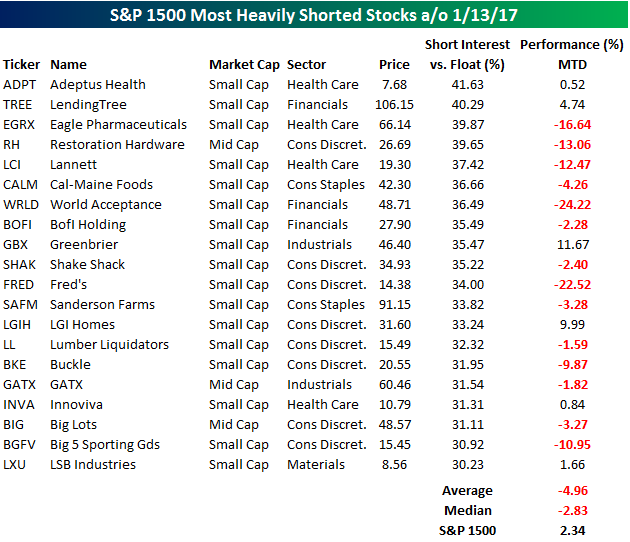

Short interest figures for the middle of January were released after the close Wednesday and as the rally in equities stalled out, traders took the opportunity to add some shorts to their books hoping that the stall would turn into a downdraft. The table below lists the 20 stocks in the S&P 1500 that have 30% or more of their free-floating shares sold short, and for each stock we also include how they have fared so far in 2017. Even though equities have rallied so far this year, the most heavily shorted stocks have completely sat out of the rally. The average return of the 20 stocks listed is a decline of 4.96% (median: -2.83%). In terms of breadth, it’s just as weak with only six out of the twenty stocks posting YTD gains.

The primary culprit behind the declines in the most shorted stocks this month is the consumer. Of the 20 names listed, eight are from the Consumer Discretionary (6) or Consumer Staples sectors (2), and of those stocks just one (LGIH Homes) is up YTD. Collectively, these stocks are down an average of 6.1% on the year, while the other 12 stocks are down an average of less than 4%. We’ve been discussing the ‘bricks to clicks’ trade and our Death By Amazon index for several years now, but based on the performance of many consumer related stocks so far this year, a lot of investors in the sector seem to still just be figuring it out.

Interested in a more in-depth analysis of short interest trends? Yesterday, we published our bi-monthly short interest report, which is available to all Bespoke Premium and Institutional clients. Click here to start a no-obligation 14-day free trial now.

ETF Trends: Fixed Income, Currencies, and Commodities – 1/27/17

A surprising name has popped up among the best performers of the past week. Master limited partnerships (oil infrastructure plays) are up over 5% versus last week, the second-best performer in our list of ETFs. Mexico, Russia, Homebuilders, and Materials have all performed well. The worst performers were precious metals, Turkey, and Italy. Retail and Pharma have also continued to underperform.

Bespoke provides Bespoke Premium and Bespoke Institutional members with a daily ETF Trends report that highlights proprietary trend and timing scores for more than 200 widely followed ETFs across all asset classes. If you’re an ETF investor, this daily report is perfect. Sign up below to access today’s ETF Trends report.

See Bespoke’s full daily ETF Trends report by starting a no-obligation free trial to our premium research. Click here to sign up with just your name and email address.

Bespoke Bloomberg TV Appearance (1/27)

The Closer 1/26/17 – All Charts On Deck!

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke Institutional clients, we take a look at a big range of US economic indicators: Bloomberg Consumer Comfort, the Leading/Coincident economic indicator ratio, new home sales, the Chicago Fed’s National Activity Index, crop exports and farm income, and truck tonnage.

The Closer is one of our most popular reports, and you can see it and everything else Bespoke publishes by starting a no-obligation 14-day free trial to our research!

Bespoke’s Sector Snapshot — 1/26/17

We’ve just released our weekly Sector Snapshot report (see a sample here) for Bespoke Premium and Bespoke Institutional members. Please log-in here to view the report if you’re already a member. If you’re not yet a subscriber and would like to see the report, please start a 14-day trial to Bespoke Premium now.

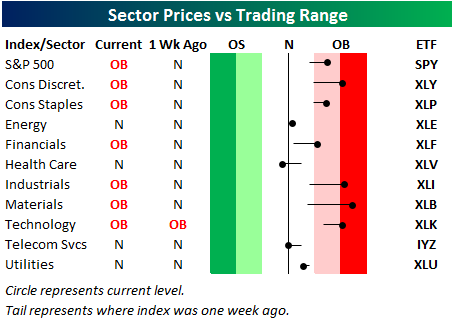

Below is one of the many charts included in this week’s Sector Snapshot, which highlights our trading range screen for the S&P 500 and ten sectors. Last week at this time, all ten sectors were above their 50-day moving averages, but Health Care and Telecom have now pulled back below their 50-days. Materials is currently the most overbought of any sector.

To see our full Sector Snapshot with additional commentary plus six pages of charts that include analysis of valuations, breadth, technicals, and relative strength, start a 14-day free trial to our Bespoke Premium package now. Here’s a breakdown of the products you’ll receive.