High Yield Spreads Still Holding Up

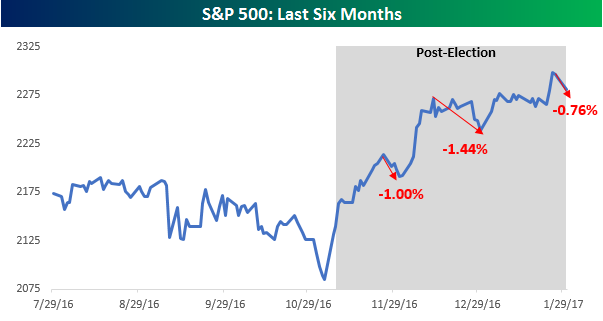

The S&P 500 is on pace for its fourth straight day of losses which would mark the longest losing streak for the index since the election (leading up to the election, through 11/4, the index was down for nine straight days). While the four-day decline has been relatively modest, whenever equities slump we like to see how things in the high yield market are playing out in order to see if there are any warning signs in this area of the fixed income market. Historically speaking, spreads (yield premium over treasuries) on high yield debt have been inversely correlated to the equity market. In other words, when spreads on high yield debt increase, equities usually decline, and vice versa.

Taking a look at the chart below, spreads on high yield debt have narrowed significantly over the last year. After hitting a peak of 887 bps back in February of last year, spreads contracted by more than half through their recent lows which occurred last Friday at 393 bps. In yesterday’s trading, spreads widened a bit, which is understandable given the increased risk aversion in the market. However, with an increase of just 3 bps, like the equity market, high yield debt markets aren’t showing a high degree of concern at this point.

The Headlines Have Spoken

The S&P 500 fell 60 bps Monday and is now down a whopping 0.76% from its most recent closing high last Wednesday. At this point, the current “sell-off” ranks as the third largest peak to trough decline from a closing high since the Election. As shown in the chart below, another couple of days like the last two and the current pullback could end up being the largest post-election decline since Trump became the President-Elect and subsequently President.

So is the rally over? Who knows. However, a look at the headlines from a lot of major media outlets that cover the market suggests that the answer is obvious — Yes.

The normally bullish Investors Business Daily (IBD) still isn’t sure and posed its headline in question form:

Same goes for CNN:

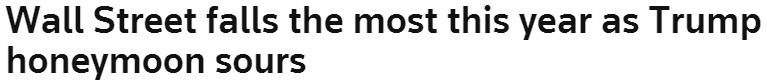

While IBD didn’t take a stand in either direction, other outlets were a lot more definitive in their headlines.

Fox Business reports that investors are having second thoughts on Trump:

Both Marketwatch and Reuters are calling an end to the honeymoon:

Not only is the honeymoon over, but based on the Wall Street Journal’s headline, the market and Trump may be heading straight for divorce.

Finally, if Bloomberg’s account of today’s sell-off is any indication, the divorce may be messy as today’s 0.6% drop only emboldened “Trump’s Haters.” We can only imagine how messy things would be if the S&P 500 actually fell a full percent!

The Closer 1/30/17 – Consumption & Correlation

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke Institutional clients, we break down today’s personal income and spending report from the BEA before moving on to investigating what a positioning-driven selloff looks in terms of sector correlation. Finally, we take a look at implied correlation and implied volatility.

The Closer is one of our most popular reports, and you can see it and everything else Bespoke publishes by starting a no-obligation 14-day free trial to our research!

Is a Positive Guidance Spread in the Cards?

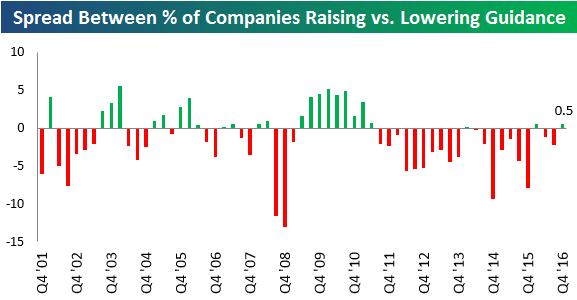

Roughly 500 companies have reported earnings so far this season (which began on January 9th), and believe it or not, more companies have raised guidance this earnings season than lowered.

While you might think that a positive guidance spread isn’t a big deal, it is when you look at the data over the last six years. Below is a chart showing the quarterly guidance spread (% of companies raising guidance minus % of companies lowering guidance) for each earnings season going back to 2001. As you can see, just two out of the last twenty-one earnings seasons have finished with a positive guidance spread.

This season, the guidance spread is positive not so much because companies are raising guidance at a higher clip, but more because less companies are lowering guidance. Even still, the spread is currently just barely positive. There’s still a long way to go before this earnings season ends.

Given the big jump in economic and stock market sentiment measures following the election, we’ve been curious to see how corporate America would respond as well. Guidance that’s released along with quarterly earnings numbers is one way to track this. Should this season’s spread finish in positive territory, it could be a sign that companies are finally coming out of a six-year funk.

Want to see more research like this? Click here to start a no-obligation two-week free trial.

Chart of the Day: S&P 500 Intra-Month Performance in February

Bespoke Stock Seasonality Report: 1/30/17

B.I.G. Tips – February 2017 Seasonality

ETF Trends: US Indices & Styles – 1/30/17

MLPs continue to rally, with Mexico also delivering solid returns on a relative basis as well. Banks and other Financial sectors have outperformed including homebuilders. On the losing side of the equation, there’s been no joy for EWI as Italian banks have weighed, while REITs, long-term Treasuries, and Retail have undeperformed within the US equity market.

Bespoke provides Bespoke Premium and Bespoke Institutional members with a daily ETF Trends report that highlights proprietary trend and timing scores for more than 200 widely followed ETFs across all asset classes. If you’re an ETF investor, this daily report is perfect. Sign up below to access today’s ETF Trends report.

See Bespoke’s full daily ETF Trends report by starting a no-obligation free trial to our premium research. Click here to sign up with just your name and email address.

Energy, Materials Stocks Responding Positively to Earnings

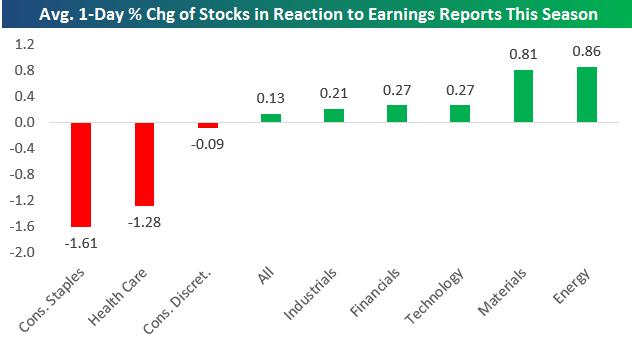

We keep track of every single earnings report throughout the quarter so we can continuously monitor emerging trends in things like beat rates and price reactions. So far this earnings season, the average stock that has reported has gained 0.13% on its earnings reaction day, which is the first trading day following a stock’s earnings report. (For a stock that reports in the morning before the open, its earnings reaction day is that trading day. For a stock that reports in the afternoon after the close, its earnings reaction day is the next trading day.)

The chart below only shows sectors where more than 10 stocks have reported earnings this season. Of the sectors shown, two stand out to the upside and two stand out to the downside. Energy and Materials stocks that have reported earnings this season have been reacting positively. The average Energy stock has gained 0.86% on its earnings reaction day, while the average Materials stock has gained 0.81%. Consumer Staples and Health Care stocks, on the other hand, have been selling off on earnings this season. The average Consumer Staples stock that has reported has fallen 1.61% on its earnings reaction day, while the average Health Care stock has fallen 1.28%.

Hundreds more companies will report their quarterly numbers this week, so we’ll have a much bigger sample size by week’s end.

Want to see more research like this? Click here to start a no-obligation two-week free trial.

Bespoke Brunch Reads: 1/29/17

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

Investing

Harvard Endowment to Lay Off Half Its Staff by Juliet Chung and Dawn Lim (WSJ)

The world’s largest university endowment has decided it’s time to call it quits and will pass off management to an outside manager. [Link; paywall]

Hedge Funds Risk Treasuries Wipeout After Bearish Bets Soar by Brian Cappatta and Liz McCormick (Bloomberg)

In futures markets, hedge funds are extremely short bonds, setting up the possibility of a messy market should rates fail to make a further significant upside move. [Link; auto-playing video]

Hedge Funds Strike Paydirt on Actelion Deal After Tracking J&J’s Jet (Bloomberg)

Is this what you call alternative investing? [Link]

Betting on Nordic Rain Pays Better Than Average Hedge Fund by Jesper Starn (Bloomberg)

And this as well? [Link]

Science

Hydrogen turned into metal in stunning act of alchemy that could revolutionise technology and spaceflight by Ian Johnston (The Independent)

Squeezing together two diamonds, hydrogen has been fused into a metal that has a huge range of potential applications in addition to its theoretically fascinating properties. [Link; auto-playing video]

Two Infants Treated with Universal Immune Cells Have Their Cancer Vanish by Antonia Regalado (MIT Technology Review)

While the results are not conclusive (due to the concurrent use of chemotherapy), there have been extremely promising results of new tests that use artificial immune-system cells to combat blood cancer. [Link]

Even wasps make trade deals, scientists discover (University of Sussex/Science Daily)

A new study about the “economic” structure of wasps and how they react to other wasps in uncertain social settings suggests they follow the laws of supply and demand. [Link]

Demographics

“Estimating trends in mortality for the bottom quartile, we found little evidence that survival probabilities declined dramatically.” by Andrew Gelman (Statistical Modeling, Causal Inference, and Social Science)

Are lower-income men dying at greater rates, as reported by Case and Deaton last year? It depends how you count it! When adjusting for the shifting prevalence of education, the effect disappears. [Link]

Real Estate

China’s Army of Global Homebuyers Is Suddenly Short on Cash (Bloomberg)

Housing markets from California to the UK are starting to sag as Chinese capital controls choke of the spigot of investment that has supported prices in recent years. [Link; auto-playing video]

Home prices in the Hamptons are collapsing by Akin Oyedele (Business Insider)

High-end New York vacation property has seen prices decline as much as 20% YoY with buyers hesitant to step in and sellers pushing higher numbers of listings. [Link]

Mall Owners Rush to Get Out of the Mall Business by Esther Fung (WSJ)

With declining fortunes for the retail industry, their landlords are starting to select default and foreclosure over keeping the doors of indoor malls open. [Link; paywall]

Remember ABX? Wall Street Said to Test New Mortgage Index by Matt Scully (Bloomberg)

Prime mortgage credit risk is starting to trade again, part of an effort to reduce credit risk for government sponsored entities like Fannie and Freddie. But the new derivatives look nothing like the sub-prime CDS index of “The Big Short” fame. [Link]

Economic Research

A Challenge to the ‘Secular Stagnation’ Theory by David Harrison (WSJ Real Time Economics)

Arguing that productivity variations driven by workers’ ages are more important than dependency ratios, a new Acemoglu and Restrepo paper argues that automation will unleash per capita growth. [Link]

Expert group studying the causes of low inflation (ECB)

An impressive 14 papers on the causes of low inflation in the Euro area. We haven’t had a chance to read through all of these yet but the repository is quite a thing! [Link]

The Best vs. the Rest: The Global Productivity Slowdown Hides an Increasing Performance Gap across Firms by Dan Andrews, Chiara Criscuolo, and Peter Gal (OECD Ecoscope)

Interesting data from the OECD on the extreme levels of productivity achieved by the most efficient firms, but the middling at best levels of output per worker hour in the rest of the business sector. [Link]

Local Government

Assessing Fiscal Capacities of States by Tracy Gordon, Richard Auxier, and John Iselin (Urban Institute)

We can’t blame you for not clicking on a link to a PDF this large, but we assure you that the data assembled within is worth some of your time, detailing the mechanics of revenue collection and spending outlays across the 50 states. [Link; 150 page PDF]

Alternative Perspectives

Disability Is Not An Asterisk: Eric Garcia Interviews Dylan Matthews by Eric Garcia (NOS Magazine)

A conversation between two of DC’s small handful of autistic journalists. We found the conversation deeply revealing and offering a very different perspective than one that would have played out between two neurotypical conversationalists. [Link]

Trump Trade

Under Trump, It’s Make a Deal With the President—or Else by Justin Sink (Bloomberg)

A summary of the techniques by which Trump is hoping to push growth. [Link; auto-playing video]

Trump Aide Reassures Canada on Trade Talks, Isolating Mexico by Josh Wingrove and Greg Quinn (Bloomberg)

North of the border, there’s little attachment to defending NAFTA, though free trade with the United States is viewed as critical. [Link; auto-playing video]

Will U.S. Policy Trump Canadian Trade? Some Questions And Answers by Brian DePratto (TD Economics)

A handy primer on the US-Canada bilateral trade relationship, with a variety of detailed backgrounders, charts, and outlook for trade with the United States. [Link; 7 page PDF]

Amazon

Amazon’s next frontier to conquer? Auto parts by Josh Kosman and James Covert (NY Post)

Auto parts are a huge business ($50bn per year) and Amazon wants a piece, turning its expertise in inventory, logistics, and customer interfacing towards traditional retailers. [Link]

AWS Snowmobile (Amazon Web Services)

In a bid to help clients convert server farms to the cloud, Amazon is rolling out a service that amounts to a motorized shipping container full of flash memory. [Link]

FedEx Bandwidth (xkcd what if?)

Semi-related to the above link, this is a fantastic if somewhat unserious answer to the question “what is the bandwidth of FedEx?” [Link]

The Buck

Companies Can’t Stop Talking About the Strong Dollar by Ben Eisen (WSJ Moneybeat)

A round-up of the earnings commentary related to the US dollar so far this earnings season. While it’s early yet, there’s been a lot of it. [Link]

Media

Facebook, Snapchat Deals Produce Meager Results for News Outlets by Gerry Smith (Bloomberg)

Despite handy user interfaces and large user counts, content owners are having a very hard time squeezing blood out of the stones that are Snapchat and Facebook. [Link]

Pursuits

The Fitness Shift That Should Worry Every Gym Owner by Rachel Bachman (WSJ)

Services that allow users to flit between gyms offering workout classes are fantastic for folks getting in their exercise but carry dangers for gym owners. [Link; paywall]

Doomsday Prep For The Super Rich by Evan Osnos (The New Yorker)

How do you get ready for the end of the world when you have too much money to spend? The answer to that question is, if this article is any indication, a barrel of laughs. [Link]

Have a great Sunday!