Quiet January

You would think that with all the headlines over the past month suggesting political chaos in Washington, it would have been a volatile January for stocks. With the first month of the year now in the books, though, it was among the most stable Januarys in terms of market performance we have seen in quite some time. For starters, the largest drawdown that the S&P 500 saw from a closing high during the month was just 0.85%, which is the smallest since last July.

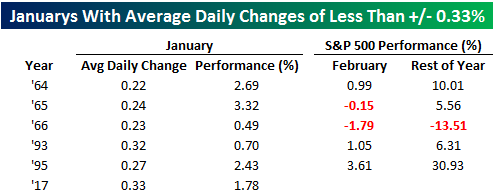

Even more impressive, though, was the S&P 500’s average daily percent change in January of just +/-0.33%. In the 1,069 months since 1928, January ranks as the 66th smallest average daily move for a given month in the S&P 500’s history. For the month of January specifically, there have only been five other Januarys where the S&P 500 saw an average daily percentage move that was smaller than this January. In the table below, we have highlighted each of those Januarys along with how the S&P 500 traded for the remainder of the year. As far as the month of February is concerned, quiet Januarys haven’t had any notable impact on market returns in February as the S&P 500 has been up three out of five times for a median gain of 0.99%. For the remainder of the year, the S&P 500 has been up a median of 6.31% with positive returns four out of five times, but here again, these results don’t show any meaningful variance from overall historical returns for all other years.

Manufacturing Accelerates Again

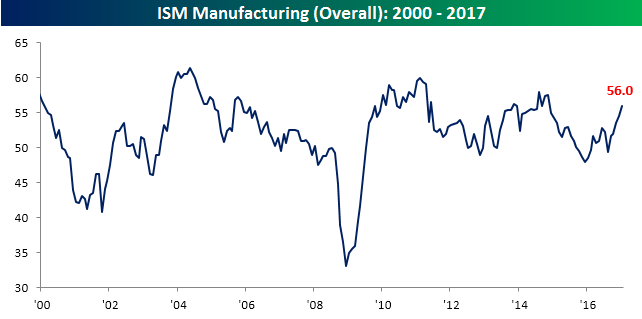

Based on today’s ISM Manufacturing report, manufacturing activity for the month of January jumped to its highest level in over two years. While economists were expecting the headline reading in the ISM Manufacturing report to come in at a level of 55.0, the actual reading rose to 56.0. That’s not only the highest monthly print since November 2014, but it also marks the fifth straight month that the index has shown a m/m increase. The last time we saw that much consistency in growth was in early 2012, when the ISM increased for six straight months. Going all the way back to 1948, the longest consecutive streak of monthly increases was from mid-1993 to mid-1994 when the headline ISM Manufacturing index increased for 12 straight months.

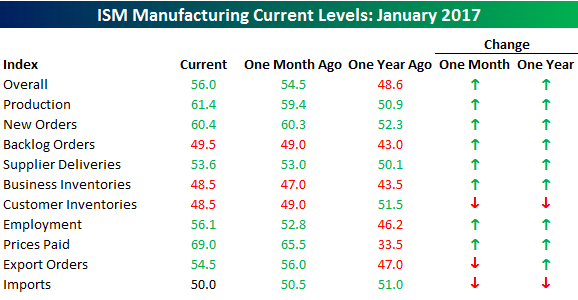

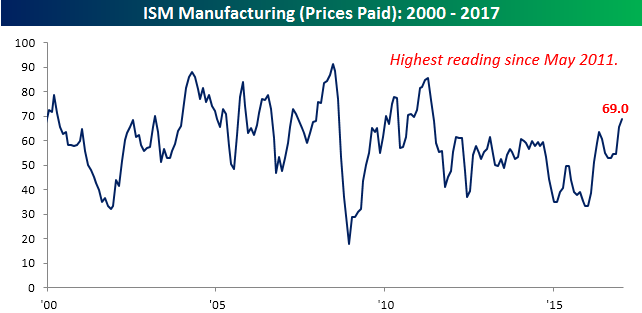

Not only was the headline index in this month’s report strong, but the internals also showed solid growth. As shown in the table below, of the index’s ten subcomponents, seven saw m/m increases, while eight out of ten are up y/y. The biggest increases this month were in Prices Paid (+3.5), Employment (+3.3), and Production (+2.0). The increase in Prices Paid is especially notable as that index is now at its highest level since May 2011, and over the last year, it has increased by 35.5 points (chart below)! Strong growth with rising prices? Not necessarily the news you want to see on an FOMC day.

Auto Sales Off To A Decent Start In 2017

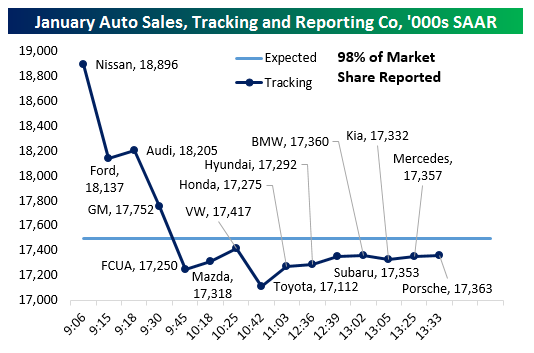

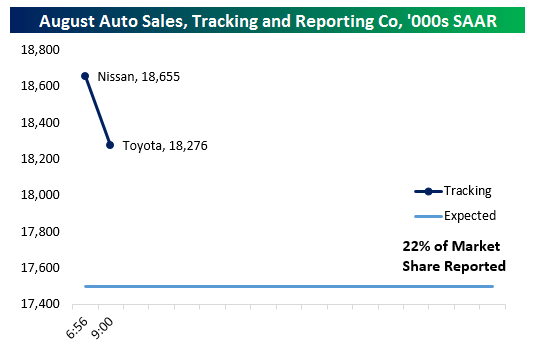

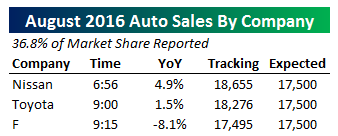

Early reports from US auto manufacturers suggest that the industry will beat strong sales figures recorded in December 2016. With three manufacturers (~25% of market share) reported, individual OEMs are coming in ahead of analyst estimates with Ford and Audi both producing strong results. When translated to seasonally adjusted annual sales rates, the first three reports track to a sales pace of about 18.2mm SAAR. That compares with 18.3mm SAAR reported last month and economist estimates of about 17.5mm SAAR. As we get more reports throughout the day, we will update the table at right and charts below.

Early reports from US auto manufacturers suggest that the industry will beat strong sales figures recorded in December 2016. With three manufacturers (~25% of market share) reported, individual OEMs are coming in ahead of analyst estimates with Ford and Audi both producing strong results. When translated to seasonally adjusted annual sales rates, the first three reports track to a sales pace of about 18.2mm SAAR. That compares with 18.3mm SAAR reported last month and economist estimates of about 17.5mm SAAR. As we get more reports throughout the day, we will update the table at right and charts below.

Update 1 9:40 AM: A bigger than expected drop for GM sales (3.8% versus the 2.4% decline forecast by analysts) led to a big swoon in our tracker. We are still showing the industry on pace to beat analyst estimates in the first month of 2017 but by a much narrower margin of +250,000 SAAR.

Update 2 10:15 AM: With over half the industry now reported, our tracker is indicating the US auto industry will miss analyst sales estimates in January, a huge shift from the big beat we were tracking an hour ago! As shown in the chart below, big sales pace declines from GM and Fiat-Chrysler contributed to the slowdown. That said, it could have been worse; while the Fiat-Chrysler sales numbers were down YoY, they were estimated to be 14% lower rather than the more digestible 11.2% decline reported.

Update 3 10:51 AM: While Mazda and Volkswagen delivered decent sales prints, both seeing double-digit YoY volume gains, Toyota announced an absolutely brutal miss with sales falling 11.3% YoY versus 2% declines expected. Now, with 75% of US auto sales market share reported, it’s very unlikely that the overall sales pace will be able to beat analyst estimates even if smaller, later-reporting companies generate large sales gains like those we’ve seen for Nissan, Audi, Mazda, and VW.

Update 4 1:57 PM: Since our last update, virtually all of the remaining market share has come in, with only Mitsubishi remaining unreported. While Subaru and Honda both reported solid months and the high end (Mercedes, Porsche) performing well, BMW and Hyundai saw middling sales while Kia reported a pretty soft result. Overall, it’s a slight positive given seasonal adjustments and we’re now tracking a bit of an improvement versus our last updated of 17.11mm SAAR. With 98% reported, auto sales should miss estimates and come in around 17.36mm to start 2017.

The Closer 1/31/17 – Uncertainty, Confidence, Wages, Houses, & North American Growth

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke Institutional clients, we discuss domestic and international economic data: policy uncertainty, consumer confidence, the employment cost index, Case-Shiller home prices, Chicago PMI, Mexican GDP, and Canadian GDP.

The Closer is one of our most popular reports, and you can see it and everything else Bespoke publishes by starting a no-obligation 14-day free trial to our research!

B.I.G. Tips – Fed Days February 2017

Bespoke Summary of Economic Indicators: 1/31/17

A Confidence Boost For the Forgotten Man

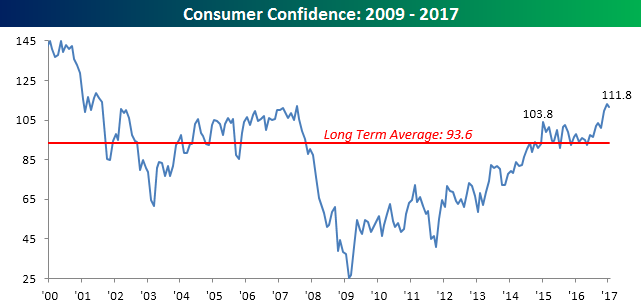

Consumer Confidence for the month of January was released earlier today, and after hitting the highest level in over a decade last month (August 2001), sentiment saw a slightly larger than expected pullback. While economists were forecasting the headline reading to come in at 112.8, the actual reading printed at 111.8. As shown in the chart below, though, this month’s decline barely registers relative to the move we have seen in the past few months, and sentiment remains comfortably above its historical average of 93.6 dating back to 2000.

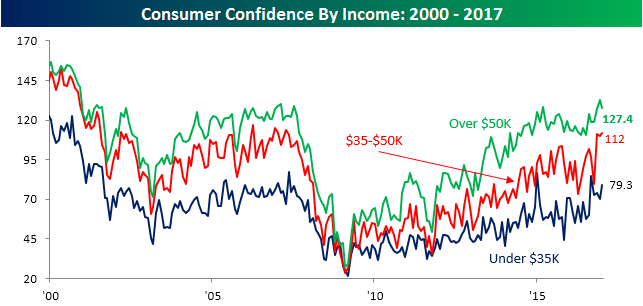

What really stood out in this month’s report is how confidence varied by income level. As shown in the chart, for all three income levels, sentiment surged post-election. However, the only income level where sentiment hit a new high was in the middle-income level of consumers with incomes of $35K to $50K. Among many political scientists, this is the heart of President Trump’s base and consists of the “Forgotten Man” among the US population. The term “Forgotten Man” was first coined in an essay by William Graham Sumner. In a nutshell, when the rich see an injustice from which the poor are suffering, it is often the people in the middle who bare the burden of the remedying of the situation. Trump took this theme and campaigned on the idea that while traditional Republicans were the party of the rich and Democrats were increasingly focused on catering to lower income Americans, no one was fighting for the middle class. Given the results of the election, it only makes sense that confidence among this group has seen the biggest improvement since Trump. Whether their confidence continues remains to be seen, but for now, the “Forgotten Man” is still with Trump.

Chart of the Day: February Sector Performance

Bespoke Stock Scores: 1/31/17

ETF Trends: Hedge – 1/31/17

4 emerging markets top the list of the best performing ETFs over the past week with the USD making new lows intraday today. Russia and Hong Kong are also high on the list of best performers along with semis, MLPs, and financials. Poor performers include Italy, South Africa, Energy companies, Metals, and REITs.

Bespoke provides Bespoke Premium and Bespoke Institutional members with a daily ETF Trends report that highlights proprietary trend and timing scores for more than 200 widely followed ETFs across all asset classes. If you’re an ETF investor, this daily report is perfect. Sign up below to access today’s ETF Trends report.

See Bespoke’s full daily ETF Trends report by starting a no-obligation free trial to our premium research. Click here to sign up with just your name and email address.