Technology Shines, Consumer Discretionary Dims

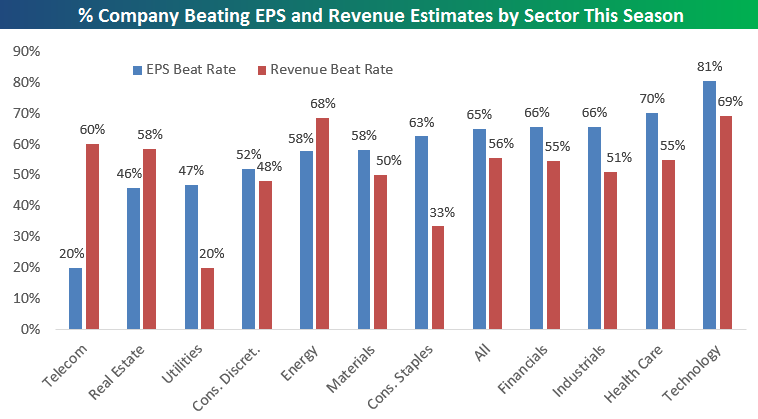

So far this earnings season, 65% of companies have beaten their consensus analyst earnings per share estimates. For top-line revenues, the beat rate is 9 points less at 56%.

Below is a look at the earnings and revenue beat rates by sector. This allows you compare the sector readings to the overall reading in order to see which sectors are outperforming or underperforming.

The Technology sector is knocking it out of the park this season with an 81% earnings beat rate and 69% revenue beat rate. For the earnings beat rate, just three additional sectors have readings above 65% — Health Care, Industrials, and Financials. For revenues, the Energy sector is the only one that really stands out along with Tech for having a high reading.

Consumer stocks are having trouble keeping up this season. The earnings beat rate for Consumer Staples (63%) is slightly below the broad beat rate of 65%, but its revenue beat rate is very low at 33%. For Consumer Discretionary, its earnings beat rate is the fourth worst among all sectors at 52%, and its revenue beat rate of just 48% is the lowest of the cyclical sectors. While the consumer seems flush based on recent sentiment readings, consumer-dependent companies are having a hard time keeping up with analyst expectations this quarter.

ETF Trends: US Indices & Styles – 2/7/16

Gold miners are the best performers over the last week with biotech a close second and Turkey also delivering large 5 day returns. Natural gas, coffee, and telecoms lead the list of largest declines.

Bespoke provides Bespoke Premium and Bespoke Institutional members with a daily ETF Trends report that highlights proprietary trend and timing scores for more than 200 widely followed ETFs across all asset classes. If you’re an ETF investor, this daily report is perfect. Sign up below to access today’s ETF Trends report.

See Bespoke’s full daily ETF Trends report by starting a no-obligation free trial to our premium research. Click here to sign up with just your name and email address.

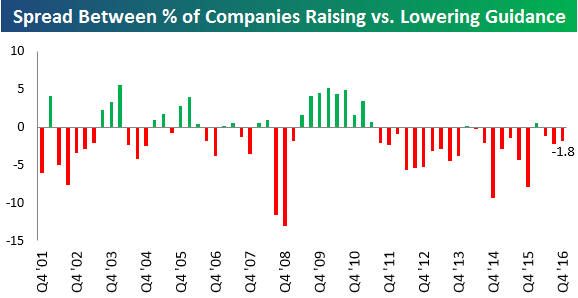

Positive Guidance Spread Doesn’t Last Long

Entering last week, the percentage of companies that had raised forward guidance this earnings season had outnumbered the percentage of companies that had lowered guidance. As we highlighted in this post, a positive guidance spread is not something we’ve seen quite often in recent years, so we took notice.

Well, the fun didn’t last long. After another big batch of earnings reports last week, the guidance spread for this earnings season has flipped negative, meaning more companies have lowered guidance than raised guidance. We thought companies might finally turn a corner in terms of forecasting and sentiment, similar to what we’ve seen in the various consumer sentiment readings since the election last November. There’s still time for the spread to flip back positive before earnings season officially ends in a couple of weeks, but we’re not holding our breath for it.

Bespoke Brunch Reads: 2/4/17

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

The Big Game

Mexican Avocado Group Makes Super Bowl Pitch as Trump Tax Looms by Craig Giammona (Bloomberg)

A brief history of the remarkable positive feedback effect of Mexican avocado imports, which have kicked off a domestic US industry in addition to supply guac for the Super Bowl. [Link]

Super Bowl billions: The big business behind the biggest game of the year by Joe D’Allegro (CNBC)

A rundown of the biggest sponsors, ticket-buyers, investors, and suppliers for the most-watched TV event of the year. [Link; auto-playing video]

Snapchat

Snap’s offer of voteless shares angers big investors by Stephen Foley (FT)

With a detailed S-1 dropping this week, some less-than-palatable details about the $3bn capital raise on public markets planned by Snap Inc began to emerge. [Link; paywall]

Exclusive: Snap’s secrecy frustrates banks’ pursuit of IPO glory by Lauren Hirsch and Liana B. Baker (Yahoo News/Reuters)

The majority of banks participating in underwriters of the Snap IPO did not have access to the draft S-1 filing before agreeing to help sell shares. [Link]

Trump

Trump and the Power of the Presidency by Katerine Mangu-Ward (Reason)

Expect to hear many arguments like this one in the coming years as libertarians and traditional conservatives alike point to the current President as evidence that the Executive Branch should have its powers more sharply constrained. [Link]

The Data That Turned the World Upside Down by Hannes Grassegger and Mikael Krogerus (Vice Motherboard)

A look at the extremely sophisticated (and evidently effective) ad strategies run by the Trump campaign, including detailed background on the psychological principals applied. [Link]

Uncertainty

The Fed Was Getting More Predictable Until Trump Got Elected by Matthew Boesler (Bloomberg)

Discounting fiscal stimulus, assessing threats to independence, and considering the new path of the dollar: all of these are factors that the Fed didn’t have to deal with but are now critical, driving volatility in interest rate markets up a bit. [Link; auto-playing video]

How Immigration Uncertainty Threatens America’s Tech Dominance by Christopher Mims (WSJ)

Unintended consequences are always a feature of any policy change and in this case, recent events may act as a catalyst on an already present trend: American companies setting up offices outside the US to avoid its immigration system. [Link; paywall]

Fiduciary Rule Is Now in Question. What’s Next for Investors. by Ron Lieber (NYT)

Note: our next episode of Bespokecast, due out early next week to subscribers, features a lengthy discussion of the fiduciary rule with Kestra Financial CEO Rob Bartenstein.

Will advisors have to abide by the Department of Labor edict issued last year or not? [Link; soft paywall]

Endings

The End of Employees by Lauren Weber (WSJ)

One of the most fundamental relationships in our modern social contract are the rights and obligations exchanged by an employer and those they hire. Now, however, that relationship is under threat by arrangements which subcontract all labor to other businesses. [Link; paywall]

Taxi Medallion Prices Are Plummeting, Endangering Loans by Polly Mosendz and Shaien Nasiripour (Bloomberg)

With ridesharing apps sending the price of medallions cratering, once-safe cashflows in major taxi markets now back millions of dollars of debt. [Link]

Obscure Markets

Banks Make Unwanted Risk Lucrative With Bets for Hedge Funds by Alastair Marsh and Donal Griffin (Bloomberg)

Banks are earning impressive fees for trades that transfer default risk to investors via securitization with the explicit goal of reducing capital charges at large banks by lowering risk-weighted assets that capital requirements are calculated against. [Link]

Cocoa Rout Spurs Concern Some Farmers Will Return to Cocaine by Marvin Perez (Bloomberg)

In parts of South America, farmers have a choice between legal cash crops like cocoa and illicit coca leaves. When prices for cocoa crash, some may be more inclined to grow the raw input for cocaine. [Link]

Space

Heisenberg’s Astrophysics Prediction Finally Confirmed After 80 Years by Ethan Siegel (Forbes)

Astrophysics is almost always so far over our heads it’s comical, but this is an interesting story about advances in physics confirming an 80 year old theory about quantum mechanics. [Link; auto-playing video]

Billionaire closer to mining the moon for trillions of dollars in riches by Lori Ioannou (CNBC)

Moon Express has raised $45mm in private capital with the goal of travelling to the moon in late 2017. The goal? Access to the moon’s resources which include a variety of molecules in short or expensive supply from terrestrial producers. [Link; auto-playing video]

Tech

Tesla’s Battery Revolution Just Reached Critical Mass by Tom Randall (Bloomberg)

Three plants in California are going live at almost the same time, together totaling about 15% of globally installed battery capacity and offering the potential for a sea-change in how energy markets work with the potential to store renewable production and release it as needed by the market. [Link]

Dropbox and Slack adapt services for cloud connection by Richard Waters (FT)

Two giants of the new wave of business apps produced in Silicon Valley are introducing new efforts to reduce fragmentation and get entire organizations on the same page. [Link; paywall]

Weather

Betting on Nordic Rain Pays Better Than Average Hedge Fund by Jesper Starn (Bloomberg)

Funds betting on Scandinavian power markets had a volatile year with double-digit returns for some funds versus large declines for competitors amidst a surge in financial power contract trading in the region. [Link]

Fads

Stretching Exercises Are In as the Next Fitness Fad by Joanne Kaufamn (NYT)

A series of businesses designed to relax and lengthen tired muscles are starting to pop up across the country. [Link; soft paywall]

The Buck

Why the Dollar Is Likely to Fall This Year by Kopin Tan

Contrarians on the strength of the dollar (which rocketed higher post-election) have been right so far this year as the USD has fallen broadly. Is more in store? This story features a nice shout-out to our work on the impact the dollar has for US equity markets. [a href=”http://www.barrons.com/articles/why-the-dollar-is-likely-to-fall-this-year-1486189556?mod=BOL_hp_we_columns” target=”_blank”>Link]

Whoops

This trader bets it all on Apple getting crushed after earnings by Shawn Langlois (MarketWatch)

A Canadian was on the wrong side of Apple’s earnings this week, the last in a series of disastrous trades which have evaporated an inheritance that once counted in the 7 figures range. [Link]

Trade

Trade flows between the US, UK and EU27: what goes where? by Filippo Biondi and Robert Kalcik (Bruegel)

An interesting look at three-way trade flows between America, the UK, and the European Union. [Link]

Have a great Sunday!

Bespoke’s Quick-View Chart Book — 2/4/17

The Bespoke Report — Financials to the Rescue — 2/3/17

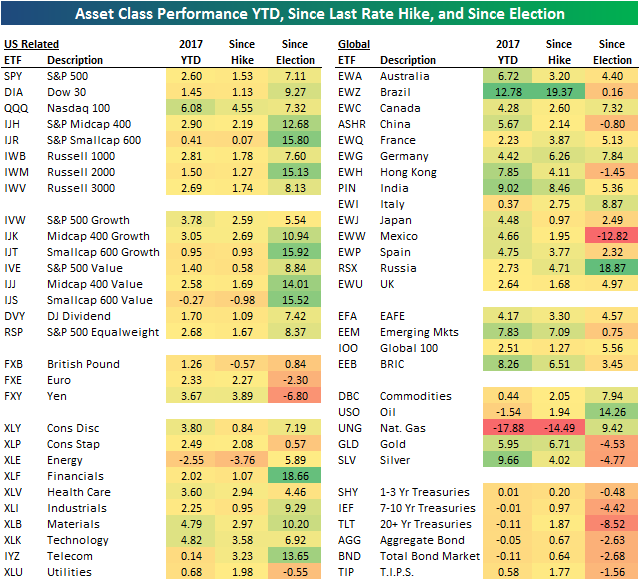

The screen below is one of many graphics included in our just-published Bespoke Report newsletter (included weekly with all of our membership packages). It shows the recent performance of various asset classes using our key ETF matrix.

If you’d like to read our thoughts on recent performance plus the rest of this week’s Bespoke Report newsletter, take advantage of our one-month Bespoke Premium free trial offer that includes our 2017 Outlook Report. Sign up now at this page.

Have a great weekend!

The Closer 2/3/17 – End of Week Charts

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke clients, we recap weekly price action in major asset classes, update economic surprise index data for major economies, chart the weekly Commitment of Traders report from the CFTC, and provide our normal nightly update on ETF performance, volume and price movers, and the Bespoke Market Timing Model.

The Closer is one of our most popular reports, and you can sign up for a trial below to see it and everything else Bespoke publishes free for the next two weeks!

Click here to start your no-obligation free Bespoke research trial now!

ETF Trends: Fixed Income, Currencies, and Commodities – 2/3/17

Turkey is up double-digits for US-based investors over the past week while gold miners, biotechs, and a number of EM countries have rallied. Sweden is also riding currency tailwinds. Natural gas continues to plunge while an esoteric range of US equity ETFs have undeperformed: steel, telecoms, transports, energy, and homebuilders.

Bespoke provides Bespoke Premium and Bespoke Institutional members with a daily ETF Trends report that highlights proprietary trend and timing scores for more than 200 widely followed ETFs across all asset classes. If you’re an ETF investor, this daily report is perfect. Sign up below to access today’s ETF Trends report.

See Bespoke’s full daily ETF Trends report by starting a no-obligation free trial to our premium research. Click here to sign up with just your name and email address.

The Closer 2/2/17 – Comfort And Productivity

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke Institutional clients, we update our tracking of differing consumer comfort across demographics, as well as updating labor productivity figures released today by the BLS.

The Closer is one of our most popular reports, and you can see it and everything else Bespoke publishes by starting a no-obligation 14-day free trial to our research!

ETF Trends: International – 2/2/17

Turkey has surged over the last few days as the country’s beaten-down equity and foreign exchange markets have gotten a breather. The same goes for biotechs and pharma, receiving positive comments from the Trump Administration this week, while Mexico has also rallied notably. Energy companies continue to top the worst performers list with Banks and homebuilders also declining.

Bespoke provides Bespoke Premium and Bespoke Institutional members with a daily ETF Trends report that highlights proprietary trend and timing scores for more than 200 widely followed ETFs across all asset classes. If you’re an ETF investor, this daily report is perfect. Sign up below to access today’s ETF Trends report.

See Bespoke’s full daily ETF Trends report by starting a no-obligation free trial to our premium research. Click here to sign up with just your name and email address.