Bespokecast Episode 6 — Rob Bartenstein — Now Available on iTunes, GooglePlay, Stitcher and More

We’re happy to announce that the newest episode of Bespokecast is now available to the general public both here and via the various podcast platforms. Be sure to subscribe to Bespokecast on your preferred podcast app to gain access to our full collection of episodes. We’d also love for you to provide a review as well!

We’re happy to announce that the newest episode of Bespokecast is now available to the general public both here and via the various podcast platforms. Be sure to subscribe to Bespokecast on your preferred podcast app to gain access to our full collection of episodes. We’d also love for you to provide a review as well!

In our newest conversation on Bespokecast, we speak with investment advisory industry veteran Rob Bartenstein. Rob is the CEO of Kestra Private Wealth, and he’s also a regular guest on financial networks like CNBC and Fox Business. Kestra is a platform for registered investment advisors. In our conversation, we discuss the current state of the investment advisory industry including the pending Department of Labor fiduciary rule. Rob also discusses his views on the market and the outlook for the economy. We learned a lot talking to Rob and think you will too!

Each new episode of our podcast features a special guest to talk markets with, and Bespoke subscribers receive special access before it’s made available to the general public. If you’d like to try out a Bespoke subscription in order to gain access to these podcasts in advance, you can start a two-week free trial to check out our product. To listen to episode 6 or subscribe to the podcast via iTunes, GooglePlay, OvercastFM, or Stitcher, please click below.

the Bespoke 50 — 2/9/17

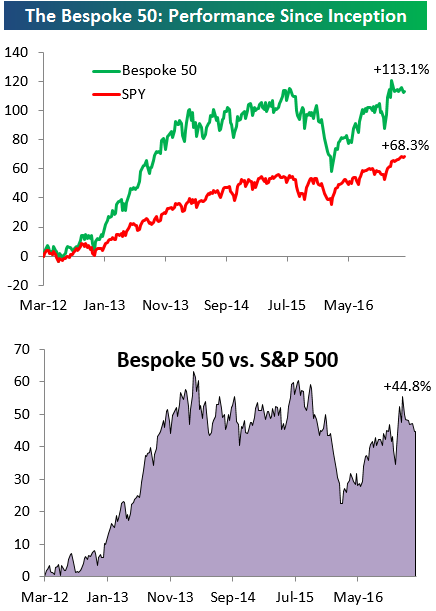

Every Thursday, Bespoke publishes its “Bespoke 50” list of top growth stocks in the Russell 3,000. Our “Bespoke 50” portfolio is made up of the 50 stocks that fit a proprietary growth screen that we created a number of years ago. Since inception in early 2012, the “Bespoke 50” has nearly doubled the performance of the S&P 500. Through today, the “Bespoke 50” is up 113.1% since inception versus the S&P 500’s gain of 68.3%.

To view our “Bespoke 50” list of top growth stocks, sign up for Bespoke Premium ($99/month) at this checkout page and get your first month free. This is a great deal!

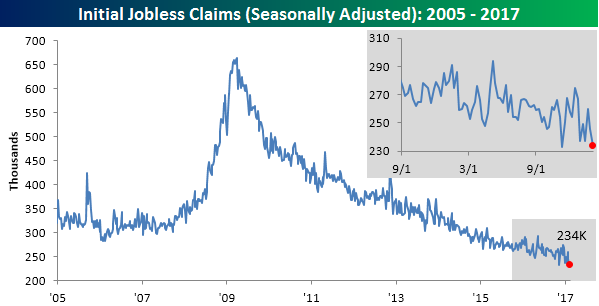

101 Weeks Below 300K

Jobless claims dropped considerably more than expected this week, falling from 246K to 234K and well below consensus expectations for an increase to 249K. This week’s level is the second lowest reading of the current cycle, behind only the 233K reading from early November. It is also the 101st week that claims have been below 300K, which is the longest streak since 1970. It wasn’t too long ago that getting below 300K in weekly claims was considered a milestone. Now, the last time weekly claims were above that level seems like a distant memory.

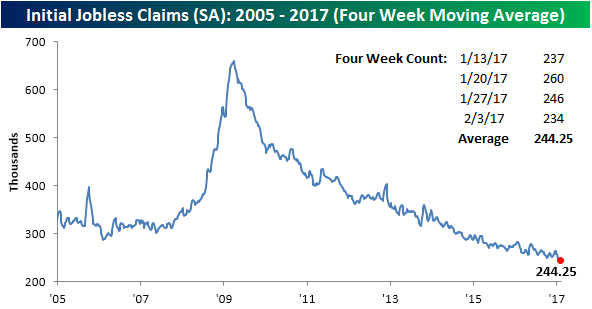

With this week’s big decline, the four-week moving average also went on to make another post-recession low, dropping to 244.25K.

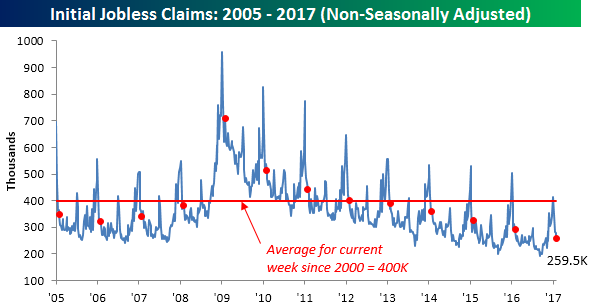

On a non-seasonally adjusted basis, claims declined from 278.6K down to 259.5K. That’s more than 140K below the average for the current week of the year going back to 2000 and is the lowest reading for the current week of the year since 1969.

The Closer — Vol Stays Low — 2/8/17

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke Institutional clients, we take a look at declining volatility and recap EIA data on the petroleum market.

The Closer is one of our most popular reports, and you can see it and everything else Bespoke publishes by starting a no-obligation 14-day free trial to our research!

Earnings Season Triple Plays — 2/8/17

Here at Bespoke, our job is to identify winners and losers, and one of the ways we try to find earnings-season winners is through our list of “triple plays.”

Long-term Bespoke subscribers know how much we like triple plays, but for those that haven’t heard of the term, we came up with it back in the mid-2000s for companies that beat analyst earnings estimates, beat analyst revenue estimates and also raise guidance. Investopedia.com is one of the best online resources for financial markets education, and they’ve actually given us credit for coining the “triple play” term on their website. We consider triple play stocks to be the cream of the crop of earnings season, and we are constantly finding new long-term buy opportunities from this basket of names each quarter.

There have been a total of 40 “triple plays” so far this season out of roughly 1,000 earnings reports. Throughout earnings season, Bespoke sends Premium and Institutional members its “Earnings Triple Plays Report.” The report keeps a running tally of recent triple plays, and it also provides a list of “Top Triple Plays.” We’ve just published our first Earnings Triple Plays Report for this earnings season, featuring a list of the 40 stocks that have registered triple plays this earnings season plus the 12 that we’ve identified as having the most attractive chart patterns. Learn how to see the stocks below!

See our Top Earnings Season Triple Plays by signing up for a monthly Bespoke Premium membership now. Click this link for a 14-day free trial.

Chart of the Day: Peru-sing a Breakout in the Financial Sector

Crude Oil Inventories Surge

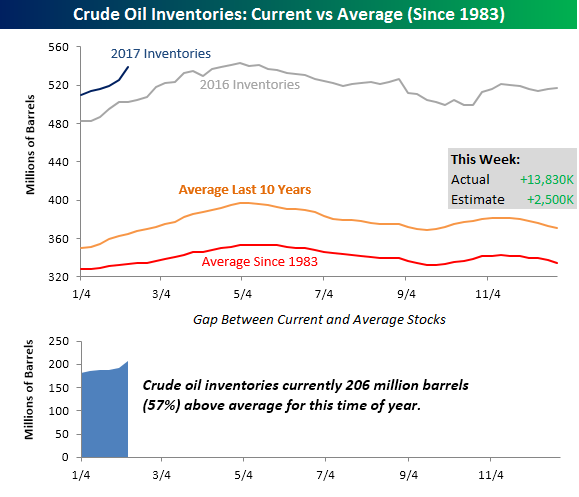

Crude oil inventories saw a much larger than expected increase in the latest week, surging by 13.83 million barrels compared to the consensus forecast of a 2.5 million barrel build in stockpiles. This week’s increase represents the second largest weekly build in stockpiles going all the way back to 1983. The only week in the last 34 years that saw a larger weekly increase in inventories was last October when stockpiles increased by 14.42 million barrels. The key difference between last October and this week’s build in stockpiles is that back in October, the weekly build followed several drawdowns in the prior week, including the second-largest single week decline on record whereas this week’s build followed four prior weeks where inventories also increased.

The chart below compares weekly crude oil inventories in 2017 to weekly levels in 2016, as well as the ten-year average and the average going back to 1983. Needless to say, inventory levels are way above average. In fact, this week’s level of just under 540 million barrels is the fifth highest weekly reading since at least 1983, and that puts total stockpiles 206 million (57%) above their historical average for this time of year.

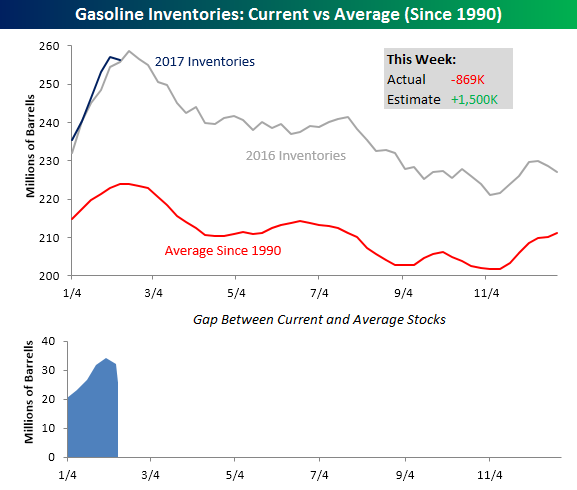

While crude oil inventories spiked this week, gasoline stockpiles saw an unexpected decline after five straight weeks of large builds. While traders were expecting a build in inventories of 1.5 million barrels, stockpiles actually declined by 839K. Like crude oil, as shown in the chart below, gasoline stockpiles are well above their historical average, but not to nearly the same degree. Additionally, at this point inventory trends seem to be following last year’s trends pretty closely.

Interesting Trends in Gas Prices

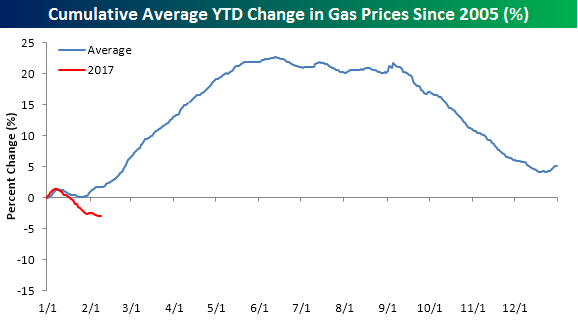

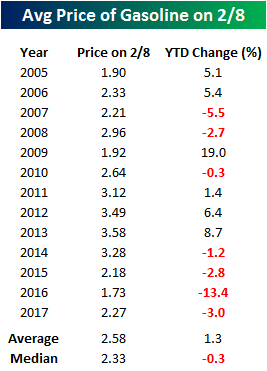

Summer driving season is still a long ways off, but we are seeing some really interesting trends unfold in terms of gas prices. According to AAA, the national average price of a gallon of gas currently stands at $2.27, which is down about 3% from where prices were at the end of 2016. As shown in the table to the right, this year’s decline is much weaker than the average YTD change of +1.3% at this time of year, and going back to 2005, there have only been two other years (2007 and 2016) where the national average price saw a larger YTD decline at this time of year.

Summer driving season is still a long ways off, but we are seeing some really interesting trends unfold in terms of gas prices. According to AAA, the national average price of a gallon of gas currently stands at $2.27, which is down about 3% from where prices were at the end of 2016. As shown in the table to the right, this year’s decline is much weaker than the average YTD change of +1.3% at this time of year, and going back to 2005, there have only been two other years (2007 and 2016) where the national average price saw a larger YTD decline at this time of year.

The chart below compares this year’s move lower in gas prices to a composite of the average YTD change going back to 2005. It’s not uncommon for prices to start the year off on a weak note in January. Once February begins we see a steady move higher until the start of the Summer driving season around Memorial Day when they typically reach their peak for the year. If history is any guide, prices should start to rebound in the weeks and months ahead. It’s certainly not guaranteed, but it is the ‘typical’ pattern.

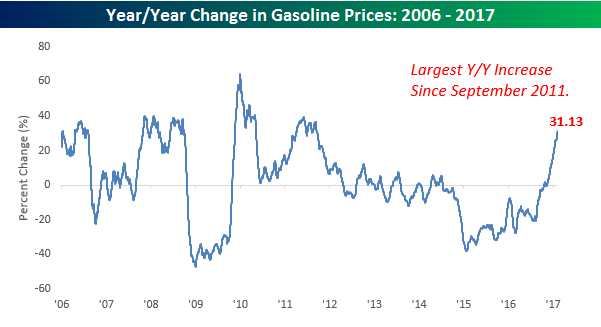

Rather than focusing on absolute price levels, when thinking about gas prices, it is often helpful to compare current levels to where they were a year ago. When prices are down significantly versus the same time last year, consumers may feel more flush, whereas higher prices may force the consumer to reign in spending elsewhere. On this front, even though gas prices are down on the year, because energy prices, and by extension gas prices, were so depressed at this time last year, the y/y change in gas prices has recently surged. As shown in the chart below, prices at the pump are currently more than 30% higher than they were at this time last year. To find a larger y/y increase in prices at the pump you have to go back more than five years to September 2011.

Bespoke CNBC Appearance (2/8/17)

The Closer 2/7/17 – Trade, Openings, Credit

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke Institutional clients, we recap US trade data reported today along with the Job Openings and Labor Turnover Survey and consumer credit reported by the Federal Reserve.

The Closer is one of our most popular reports, and you can see it and everything else Bespoke publishes by starting a no-obligation 14-day free trial to our research!