Fixed Income Weekly – 8/16/17

Searching for ways to better understand the fixed income space or looking for actionable ideals in this asset class? Bespoke’s Fixed Income Weekly provides an update on rates and credit every Wednesday. We start off with a fresh piece of analysis driven by what’s in the headlines or driving the market in a given week. We then provide charts of how US Treasury futures and rates are trading, before moving on to a summary of recent fixed income ETF performance, short-term interest rates including money market funds, and a trade idea. We summarize changes and recent developments for a variety of yield curves (UST, bund, Eurodollar, US breakeven inflation and Bespoke’s Global Yield Curve) before finishing with a review of recent UST yield curve changes, spread changes for major credit products and international bonds, and 1 year return profiles for a cross section of the fixed income world.

In this week’s note, we review the spike in corporate credit spreads and vol last week.

Our Fixed Income Weekly helps investors stay on top of fixed income markets and gain new perspective on the developments in interest rates. You can sign up for a Bespoke research trial below to see this week’s report and everything else Bespoke publishes free for the next two weeks!

Click here to start your no-obligation free Bespoke research trial now!

Bespoke’s Global Macro Report — 8/16/17

Bespoke’s Global Macro Dashboard is a high-level summary of 22 major economies from around the world. For each country, we provide charts of local equity market prices, relative performance versus global equities, price to earnings ratios, dividend yields, economic growth, unemployment, retail sales and industrial production growth, inflation, money supply, spot FX performance versus the dollar, policy rate, and ten year local government bond yield interest rates. The report is intended as a tool for both reference and idea generation. It’s clients’ first stop for basic background info on how a given economy is performing, and what issues are driving the narrative for that economy. The dashboard helps you get up to speed on and keep track of the basics for the most important economies around the world, informing starting points for further research and risk management. It’s published weekly every Wednesday at the Bespoke Institutional membership level.

Click here to start a no-obligation two-week free trial to Bespoke Institutional!

The Closer — Quarterly Consumer Data, Retail Sales — 8/15/17

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke Institutional clients, we chart the quarterly data contained in the New York Fed’s Consumer Credit panel, as well as reviewing retail sales today and introducing three new web-based tools for subscribers.

The Closer is one of our most popular reports, and you can sign up for a free trial below to see it!

See today’s post-market Closer and everything else Bespoke publishes by starting a no-obligation 14-day free trial to our research platform!

Bespoke Stock Scores: 8/15/17

Chart of the Day: ROBO

ETF Trends: US Indices & Styles – 8/15/17

Keep Track of Futures Positioning With The Closer

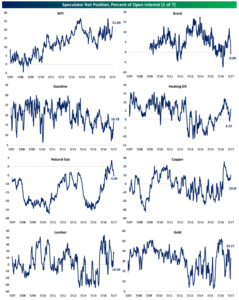

Each Friday in our post-market macro note — The Closer (available to Bespoke Institutional clients), we update tracking of futures market positioning using the CFTC’s Commitment of Traders report. We’ve created a handy table so that clients can analyze the data each week, where we show the net position of traders reporting as speculators relative to the size of the market (percentage of open interest) in a given futures contract.

Speculator shorts are deducted from speculator longs to give a “net” position. To summarize that positioning, the table below shows the current share of open interest (OI) along with the median, average, and ten year percentile. We also show the change over the last 1, 4, 12, and 52 weeks, and show the position relative to the 10-year average in standard deviations in the scatter plot to the right as well as the change over the last 12 weeks. The result is a comprehensive picture of how various asset classes are positioned.

Positioning can be a very helpful contrarian indicator; when financial speculators pile on to a rising price and become an unbalanced long, there’s nobody left to buy and prices are left vulnerable to a correction. This type of positioning is highlighted when the dots in our scatter plot move further and further into the green zone. The opposite is also true for futures markets with falling prices. When the dot in our scatter plot moves further and further left, speculators have become excessively bearish relative to history. While not comprehensive – because they ignore spot markets for financial and physical commodities – the CoT report is definitely a helpful pointer to how the market currently sits.

Sign up for a two-week free trial to our Bespoke Institutional package if you’d like access to our weekly futures market positioning data in The Closer.

In our Closer report, we also show 10 year charts of positioning for each market listed above. Below is a sample of one of these chart grids, showing Energy futures positioning along with Copper, Lumber, and Gold.

Sign up for a two-week free trial to our Bespoke Institutional package if you’d like access to our weekly futures market positioning data in The Closer.

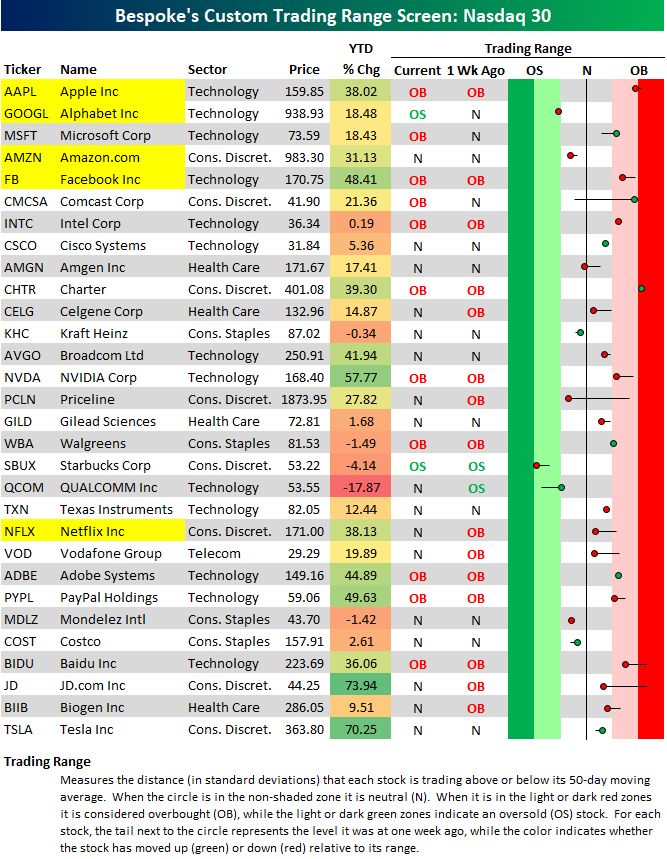

Bespoke’s FAANG+ Trading Range Screen

Below is an updated snapshot of our trading range screen ran on the 30 largest stocks in the Nasdaq 100. The list is sorted by market cap as of the end of Q2, and we’ve highlighted the much-hyped “FAANG” names in yellow. In the trading range section, the “OB” stands for “overbought,” and it happens when a stock trades more than 1 standard deviation above its 50-day moving average (the red zone). The “OS” stands for “oversold,” and that’s when the stock trades more than 1 standard deviation below the 50-day. “N” stands for “neutral,” which means the stock is trading between one standard deviation above and below its 50-day. The black vertical “N” line in the screen represents each stock’s 50-day moving average.

Of the thirty largest Nasdaq 100 stocks, eleven are currently trading in overbought territory, while just two are oversold (GOOGL and SBUX). Apple (AAPL), Comcast (CMCSA) and Charter (CHTR) are the most overbought names in the screen entering Tuesday’s trading day.

Start a 30-day free trial to Bespoke’s Premium service for our most actionable ideas.

The Closer — Toronto Home Prices, Fedspeak, Central Bank Doldrums, CoT Update — 8/14/17

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke Institutional clients, we review Canadian home price data released today, recent FOMC speeches, upcoming central bank meetings, and positioning recaps from the Commitment of Traders report released by the CFTC Friday.

The Closer is one of our most popular reports, and you can sign up for a free trial below to see it!

See today’s post-market Closer and everything else Bespoke publishes by starting a no-obligation 14-day free trial to our research platform!