Another Week of Sub 250K Jobless Claims

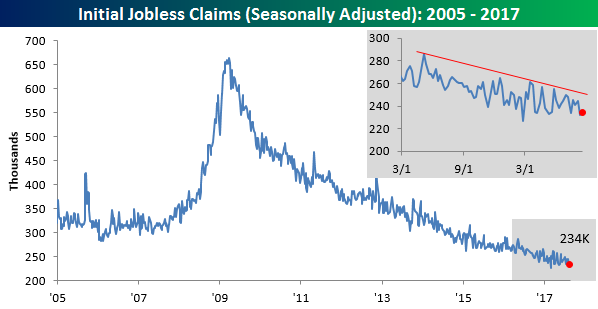

It used to be that a weekly reading for initial jobless claims that came in below 300K was a big deal. Nowadays, sub-300K readings don’t even raise an eyebrow as the new 300K is 250K. In this week’s report, first-time jobless claims came in at 234K compared to estimates of 238K. Not only is that better than expected, but it also marks the 12th straight week that jobless claims have been at or below 250K. It’s hard to overstate just how impressive this trend is.

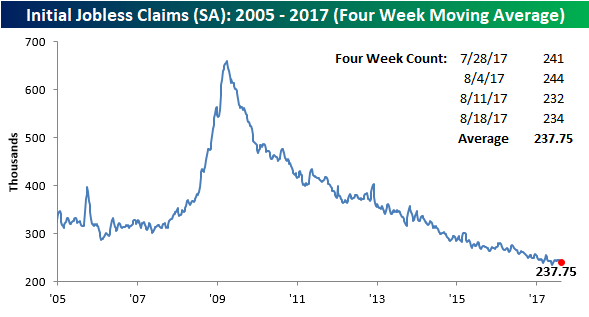

With this week’s second straight sub-240K print, the four-week moving average is also back below 240K and less than 3K from the cycle low of 235.5K made back in mid-May. While the 4-week average is close to a new low, in order to get there next week, we will have to see a print below 232K.

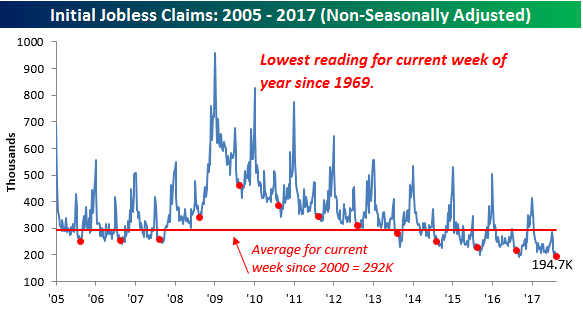

On a non-seasonally adjusted (NSA) basis, jobless claims were just as impressive dropping from 198.3K down to 194.7K. That’s the second straight week below 200K and is nearly 100K below the average level for the current week of the year since 2000. To find a week where the NSA reading for the current week of the year was lower, you have to go back to 1969.

Bulls Fading Into the Fall

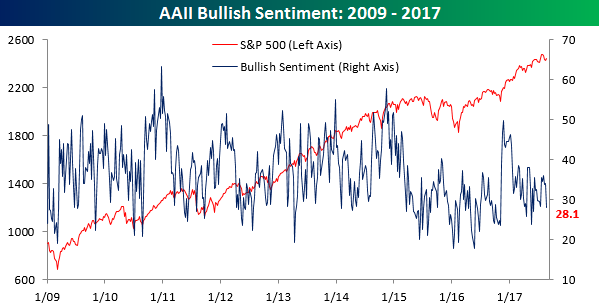

Based on the latest weekly sentiment data from AAII, it appears that investors are growing increasingly concerned about the market as bullish sentiment declined from an already low 34.17% down to 28.1%. That’s the lowest weekly reading since June 1st right before the volatility in the FANG stocks really got going and the largest weekly decline since mid-May. This week’s reading also extends the record streak of weeks below 50% up to 138 weeks!

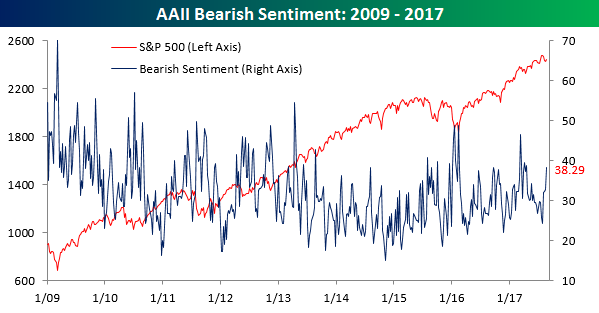

Bearish sentiment has seen an even more pronounced move, rising from 32.8% up to 38.29%. That’s the largest reading for the bearish camp since mid-April. Also outside of a few weeks in the Spring where bearish sentiment spiked higher, you have to go all the way back to early 2016 to find a period where bearish sentiment was higher.

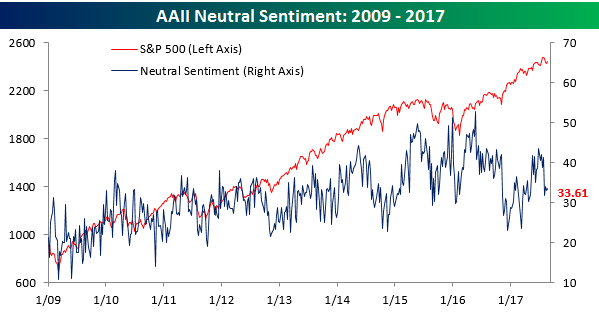

While individuals are increasingly bearish, one-third of investors still can’t make up their mind. While that may sound like a lot, it is actually down considerably from the 40%+ levels it was at just a few weeks ago.

The Closer — Hedging With Yen, Performance Spreads — 8/23/17

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke Institutional clients, we show the positive risk-adjusted return benefits of adding a single currency long to a 60/40 stock-bond portfolio. We also take a look at similar situations when a large spread has built up between the best and worst performing US equity indices. Finally, we review a weak new home sales print today.

The Closer is one of our most popular reports, and you can sign up for a free trial below to see it!

See today’s post-market Closer and everything else Bespoke publishes by starting a no-obligation 14-day free trial to our research platform!

ETF Trends: US Indices & Styles – 8/23/17

Chart of the Day: Amazon Survivors vs Mortals

Alibaba (BABA) Catching Back Up to Amazon.com (AMZN)

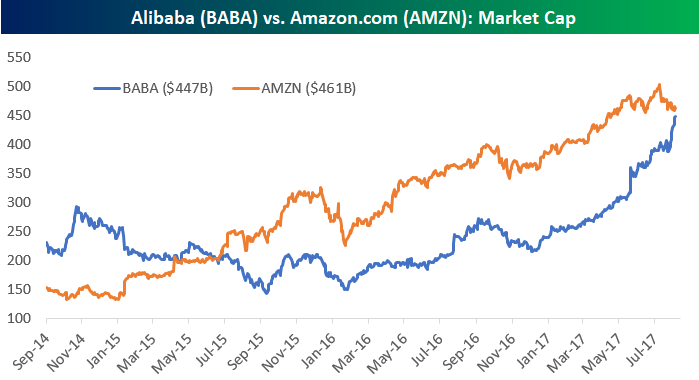

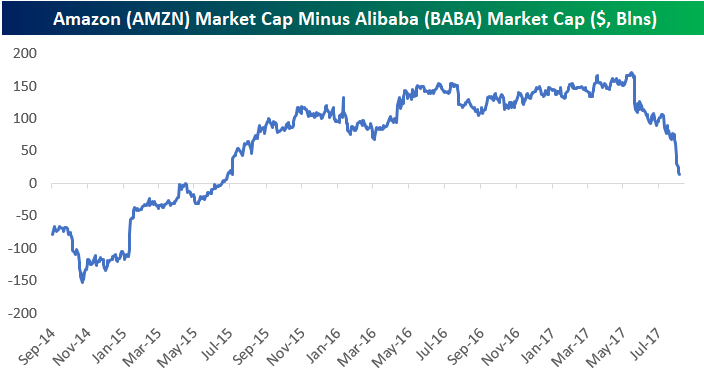

Below is a chart of the historical market caps for Alibaba (the Chinese version of Amazon) and Amazon.com (AMZN). As shown, Alibaba (BABA) actually had a higher market cap that Amazon.com (AMZN) for quite some time just after BABA IPOd back in late 2014. Once AMZN’s market cap crossed above BABA’s in mid-2015, however, AMZN opened up a wide lead for a two-year period.

BABA has been on an absolute tear lately, though, and its market cap has ballooned from $220 billion up to $447 billion since the start of the year. While AMZN’s market cap has risen more than $100 billion this year as well, BABA has pulled to within $14 billion of AMZN at this point. Another decent-sized down day for AMZN accompanied by a gain in BABA would see these market caps cross yet again.

Fixed Income Weekly – 8/23/17

Searching for ways to better understand the fixed income space or looking for actionable ideals in this asset class? Bespoke’s Fixed Income Weekly provides an update on rates and credit every Wednesday. We start off with a fresh piece of analysis driven by what’s in the headlines or driving the market in a given week. We then provide charts of how US Treasury futures and rates are trading, before moving on to a summary of recent fixed income ETF performance, short-term interest rates including money market funds, and a trade idea. We summarize changes and recent developments for a variety of yield curves (UST, bund, Eurodollar, US breakeven inflation and Bespoke’s Global Yield Curve) before finishing with a review of recent UST yield curve changes, spread changes for major credit products and international bonds, and 1 year return profiles for a cross section of the fixed income world.

In this week’s note, we take a look at Energy’s impact on the high yield market.

Our Fixed Income Weekly helps investors stay on top of fixed income markets and gain new perspective on the developments in interest rates. You can sign up for a Bespoke research trial below to see this week’s report and everything else Bespoke publishes free for the next two weeks!

Click here to start your no-obligation free Bespoke research trial now!

Bespoke’s Global Macro Dashboard — 8/23/17

Bespoke’s Global Macro Dashboard is a high-level summary of 22 major economies from around the world. For each country, we provide charts of local equity market prices, relative performance versus global equities, price to earnings ratios, dividend yields, economic growth, unemployment, retail sales and industrial production growth, inflation, money supply, spot FX performance versus the dollar, policy rate, and ten year local government bond yield interest rates. The report is intended as a tool for both reference and idea generation. It’s clients’ first stop for basic background info on how a given economy is performing, and what issues are driving the narrative for that economy. The dashboard helps you get up to speed on and keep track of the basics for the most important economies around the world, informing starting points for further research and risk management. It’s published weekly every Wednesday at the Bespoke Institutional membership level.

Click here to start a no-obligation two-week free trial to Bespoke Institutional!

Breadth Still Not Great

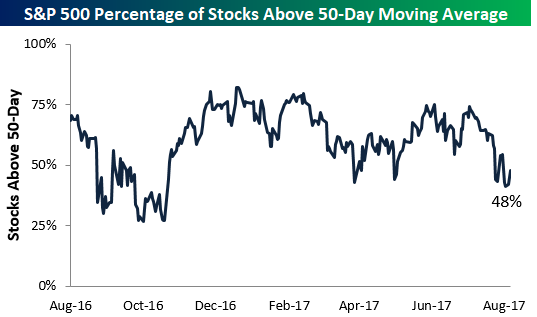

The S&P 500 re-took its 50-day moving average yesterday, but unfortunately it did so without more than half of its index members closing above their 50-days as well. As shown below, only 48% of stocks in the S&P are currently above their 50-day moving averages. Bulls would like to see a much stronger reading than that based on where the S&P is currently trading.

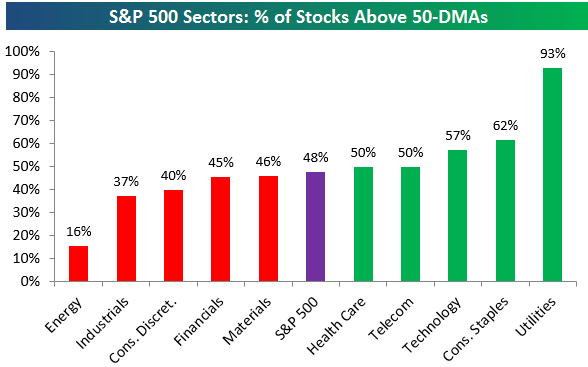

Below is a look at the percentage of stocks above their 50-day moving averages by sector. As shown, five cyclical sectors have breadth readings that are weaker than the 48% reading for the broad S&P 500. Energy is all the way down at 16%, while Industrials and Consumer Discretionary are at 40% or less. The two sectors with the strongest breadth levels are both defensive in nature — Utilities and Consumer Staples. We’d prefer to see the script flipped with cyclicals leading and defensives lagging.

The Closer — Large Cap Technicals, Mexican Growth, and Canadian Retail — 8/22/17

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke Institutional clients, we review the technical picture for the S&P 500, recap major North American data releases today, and preview tomorrow’s data schedule.

The Closer is one of our most popular reports, and you can sign up for a free trial below to see it!

See today’s post-market Closer and everything else Bespoke publishes by starting a no-obligation 14-day free trial to our research platform!